House Insurance Cheapest

Securing affordable house insurance is a crucial aspect of homeownership, and it can be a complex and often confusing process. With a wide range of options available, finding the cheapest house insurance that suits your specific needs can be a daunting task. However, with the right knowledge and strategies, you can navigate the market and secure a policy that offers both comprehensive coverage and cost-effectiveness.

Understanding House Insurance Costs

The cost of house insurance can vary significantly depending on several factors. Understanding these factors is essential to identify the cheapest options available. Here are some key considerations:

-

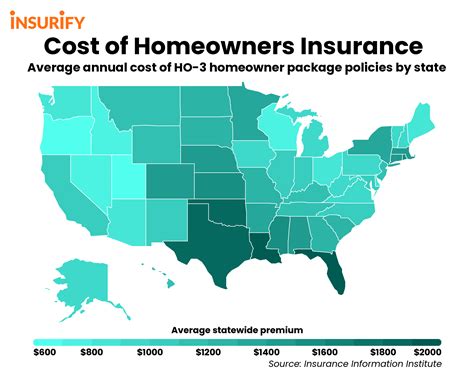

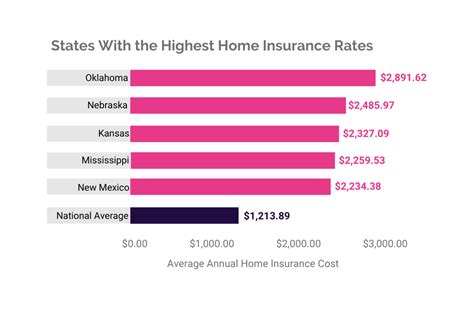

Location: Insurance rates can differ based on where you live. Factors like crime rates, natural disaster risks, and even local construction costs can impact premiums.

-

Coverage Types: House insurance typically includes coverage for the structure of your home, personal belongings, liability, and additional living expenses in case of a disaster. The extent of coverage you choose will affect the overall cost.

-

Deductibles: Opting for a higher deductible (the amount you pay out of pocket before the insurance kicks in) can lead to lower premiums. However, this means you'll have to pay more in the event of a claim.

-

Discounts: Many insurance providers offer discounts for various reasons. These could include bundling multiple policies (e.g., home and auto insurance), having safety features in your home, or being a loyal customer for a certain number of years.

-

Credit Score: Believe it or not, your credit score can influence your insurance rates. Insurers often use credit-based insurance scores to assess risk, so maintaining a good credit score can lead to lower premiums.

Strategies for Finding the Cheapest House Insurance

Now that we’ve covered the fundamental cost factors, let’s delve into some strategies to help you find the cheapest house insurance:

Shop Around and Compare Quotes

One of the most effective ways to find cheap house insurance is to compare quotes from multiple providers. Each insurer has its own unique pricing structure and policies, so getting quotes from a variety of sources can help you identify the best deal. Online comparison tools can be a great starting point, but it’s also beneficial to reach out to individual insurance companies or brokers to get personalized quotes.

| Insurance Provider | Average Annual Premium |

|---|---|

| Company A | $1,200 |

| Company B | $1,350 |

| Company C | $1,150 |

| Company D | $1,400 |

Note: The above table provides a simplified example of average annual premiums from different providers. Actual quotes will vary based on individual circumstances and the coverage selected.

Bundle Policies

If you have multiple insurance needs, such as home and auto insurance, consider bundling your policies with the same insurer. Many providers offer significant discounts when you combine different types of insurance, which can lead to substantial savings.

Increase Your Deductible

As mentioned earlier, opting for a higher deductible can lower your premiums. However, it’s essential to ensure that the increased deductible amount is manageable in case you need to file a claim. It’s a delicate balance between saving on premiums and being able to afford the deductible if the need arises.

Improve Your Home’s Safety

Installing safety features like smoke detectors, fire extinguishers, and security systems can make your home less risky in the eyes of insurers. These improvements not only enhance your home’s security but can also lead to insurance discounts.

Maintain a Good Credit Score

As insurance companies often use credit-based insurance scores, maintaining a strong credit history can lead to lower premiums. Regularly check your credit report and work on improving your score if needed. Simple steps like paying bills on time and reducing credit card balances can positively impact your credit score.

Consider Alternative Insurance Options

Traditional insurance companies aren’t the only option. There are alternative insurance providers, such as peer-to-peer insurance platforms and insurance startups, that offer innovative coverage options at competitive rates. Exploring these alternatives could uncover cheaper insurance options.

Evaluating Cheapest House Insurance Options

While cost is a significant factor, it’s not the only consideration when choosing house insurance. You must also ensure that the policy provides adequate coverage for your needs. Here’s what to look for when evaluating the cheapest house insurance options:

-

Coverage Limits: Ensure the policy covers the full replacement cost of your home and belongings. Underinsured properties can lead to financial hardship in the event of a claim.

-

Exclusions and Limitations: Carefully review the policy to understand what's not covered. Some common exclusions include flood damage, earthquake damage, and certain types of water damage.

-

Claims Process: Research the insurer's claims process and reputation for prompt and fair settlements. Look for customer reviews and ratings to get an idea of the company's performance in this regard.

-

Additional Benefits: Some insurers offer extra perks like identity theft protection, credit monitoring, or temporary living expenses beyond the standard coverage limits. These can be valuable additions to your policy.

Case Study: Finding Affordable Coverage

Let’s consider a real-world example to illustrate the process of finding cheap house insurance. Meet Sarah, a homeowner looking to insure her newly purchased home. Sarah’s goal is to find comprehensive coverage at an affordable price.

Sarah starts by getting quotes from traditional insurance companies. She compares the premiums and coverage options offered by each provider. She also reaches out to local brokers who can provide personalized recommendations based on her specific needs.

After gathering quotes, Sarah discovers that while some companies offer lower premiums, they have higher deductibles or lack certain coverage options she requires. She also explores alternative insurance providers, discovering a peer-to-peer insurance platform that offers a competitive rate with no hidden fees and a straightforward claims process.

Ultimately, Sarah chooses a policy that provides comprehensive coverage, a manageable deductible, and a reputable claims process. By carefully evaluating her options, she finds an affordable house insurance policy that suits her needs without compromising on quality.

Future Trends in House Insurance

The house insurance landscape is evolving, and several trends are shaping the industry. These trends can impact the cost and availability of insurance in the future. Here are a few to watch out for:

-

Telematics: Telematics devices and apps are being used to monitor driving behavior, which can influence auto insurance rates. This technology could extend to home insurance, with devices monitoring home safety and security, potentially leading to lower premiums for responsible homeowners.

-

Digital Transformation: The insurance industry is embracing digital technologies, making it easier for customers to access and manage their policies online. This shift could lead to more efficient processes and potentially lower costs.

-

Data-Driven Underwriting: Insurers are increasingly using advanced data analytics to assess risk and price policies. This data-driven approach could lead to more accurate pricing, benefiting those who present lower risks.

-

Climate Change Impact: With increasing concerns about climate change, the frequency and severity of natural disasters are expected to rise. This could lead to higher insurance premiums, especially in areas vulnerable to such events.

💡 It's essential to stay informed about these trends and their potential impact on your insurance needs. Regularly reviewing your policy and keeping up with industry developments can help you make informed decisions about your house insurance.

FAQs

How often should I review my house insurance policy?

+It’s recommended to review your policy annually or whenever you experience significant life changes, such as renovations, adding family members, or relocating. Regular reviews ensure your coverage remains adequate and cost-effective.

Can I negotiate house insurance rates?

+While insurance rates are primarily based on calculated risk assessments, it doesn’t hurt to inquire about potential discounts or negotiate with your insurer. Sometimes, providers may be willing to offer better rates to retain loyal customers.

What factors can cause my house insurance rates to increase unexpectedly?

+Unexpected rate increases can be due to various factors, including changes in your location’s risk profile (e.g., increased crime rates or natural disaster risks), updates to your home’s value or contents, or changes in the insurance market.