Form 1095 Health Insurance

The Form 1095 is a crucial document for individuals and families in the United States, as it serves as proof of health insurance coverage. This form is an essential part of the Affordable Care Act (ACA) and plays a significant role in ensuring that Americans have access to healthcare and meet their tax obligations. In this comprehensive guide, we will delve into the world of Form 1095, exploring its purpose, types, filing requirements, and the impact it has on individuals' lives.

Understanding Form 1095: A Comprehensive Overview

Form 1095 is a tax form issued by health insurance providers or employers to individuals who have enrolled in a qualified health plan. It is designed to verify an individual’s health insurance coverage for a specific tax year and is a key component in the implementation of the Affordable Care Act. The form provides critical information to the Internal Revenue Service (IRS) and helps enforce the Individual Shared Responsibility Provision, commonly known as the individual mandate.

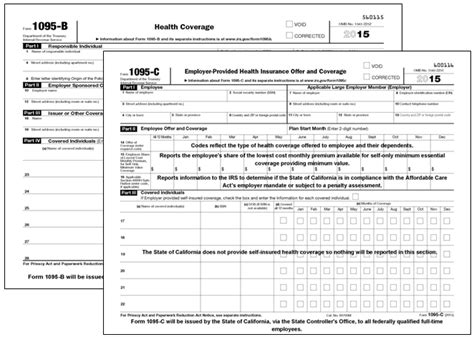

There are three types of Form 1095: 1095-A, 1095-B, and 1095-C. Each type serves a distinct purpose and is relevant to different groups of people. Understanding these variations is crucial for individuals to navigate the healthcare system and comply with tax regulations effectively.

Types of Form 1095

Form 1095-A: This form is provided to individuals who enroll in a health insurance marketplace plan. It is issued by the Health Insurance Marketplace and contains essential details about the plan, including the policy holder’s name, coverage period, and the premiums paid. Form 1095-A is a critical document for individuals seeking premium tax credits or cost-sharing reductions, as it verifies their eligibility for these benefits.

Form 1095-B: Issued by employers or government-sponsored health plans, this form confirms that an individual has minimum essential coverage. It includes information such as the policy holder's name, coverage dates, and the name of the insurance provider. Form 1095-B is typically provided to employees who receive healthcare coverage through their employer.

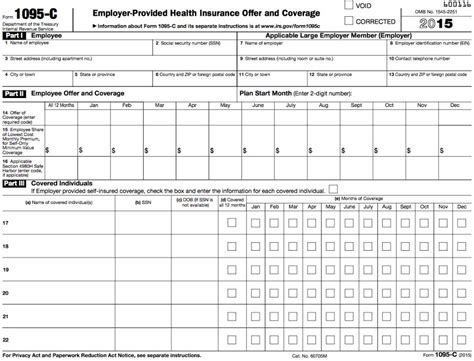

Form 1095-C: This form is specifically designed for employers with more than 50 full-time employees. It details the employer's offer of health insurance coverage and is a way for the IRS to enforce the employer mandate. Form 1095-C includes information about the employer, the employee, and the coverage options provided.

Filing Requirements and Deadlines

The filing requirements for Form 1095 vary depending on the type of form and the issuer. In general, health insurance providers and employers are responsible for furnishing these forms to individuals by a certain deadline. This deadline is typically set by the IRS and can vary from year to year.

For individuals, receiving Form 1095 is an important step in preparing their tax returns. It is essential to keep these forms organized and readily accessible, as they are required when filing taxes. Failure to provide accurate information on tax returns regarding health insurance coverage can result in penalties or complications during the tax filing process.

Impact on Individuals

Form 1095 has a significant impact on individuals’ lives, particularly in relation to healthcare access and financial obligations. Here are some key ways in which Form 1095 affects individuals:

- Healthcare Coverage Verification: Form 1095 serves as proof of health insurance coverage, which is essential for individuals to access medical services without incurring substantial out-of-pocket costs. It ensures that individuals are not subject to the individual mandate penalty, which applies to those without minimum essential coverage.

- Premium Tax Credits: For individuals who qualify for premium tax credits, Form 1095-A is a vital document. It helps determine the amount of tax credit an individual is eligible for, reducing the cost of their health insurance premiums.

- Cost-Sharing Reductions: Similarly, Form 1095-A is used to verify eligibility for cost-sharing reductions. These reductions lower the out-of-pocket costs, such as deductibles and copayments, for individuals with low to moderate incomes.

- Tax Compliance: By requiring individuals to report their health insurance coverage on their tax returns, Form 1095 helps enforce tax compliance. It ensures that individuals are aware of their tax obligations and prevents tax evasion related to healthcare coverage.

Real-World Scenarios and Examples

To illustrate the importance and impact of Form 1095, let’s consider a few real-world scenarios:

Scenario 1: John’s Marketplace Plan

John, a self-employed individual, purchased a health insurance plan through the Health Insurance Marketplace. He received Form 1095-A from his insurance provider, which detailed his coverage period, premiums paid, and the amount of premium tax credit he was eligible for. With this information, John was able to claim the tax credit on his tax return, reducing his overall tax liability.

Scenario 2: Emma’s Employer-Sponsored Coverage

Emma works for a large corporation that offers health insurance benefits to its employees. Her employer provided her with Form 1095-B, confirming that she had minimum essential coverage throughout the year. This form helped Emma verify her healthcare coverage and ensure that she was in compliance with the individual mandate.

Scenario 3: Mike’s Small Business

Mike owns a small business with 15 full-time employees. He is required to provide health insurance coverage to his employees or face penalties under the employer mandate. To comply with this requirement, Mike offers a group health insurance plan and furnishes his employees with Form 1095-C. This form details the coverage options he provided and helps the IRS enforce the employer mandate.

Navigating the Healthcare System with Form 1095

Understanding and utilizing Form 1095 effectively is crucial for individuals to navigate the complex healthcare system and comply with tax regulations. Here are some key tips and insights to keep in mind:

- Keep Your Forms Organized: Treat Form 1095 as an essential tax document and store it securely with other important financial records. Having easy access to these forms can simplify the tax filing process and ensure accurate reporting.

- Understand Your Coverage: Carefully review your Form 1095 to ensure that the information is accurate and reflects your actual coverage. If there are any discrepancies, contact your insurance provider or employer to resolve them promptly.

- Take Advantage of Tax Benefits: If you qualify for premium tax credits or cost-sharing reductions, use Form 1095-A to claim these benefits on your tax return. These credits can significantly reduce the cost of your health insurance premiums, making healthcare more affordable.

- Stay Informed about Deadlines: Be aware of the filing deadlines for Form 1095 and plan accordingly. Missing these deadlines can result in penalties or complications, so it's essential to stay organized and meet the required timelines.

| Form Type | Issuer | Purpose |

|---|---|---|

| 1095-A | Health Insurance Marketplace | Verifies eligibility for premium tax credits and cost-sharing reductions |

| 1095-B | Employers or Government-Sponsored Plans | Confirms minimum essential coverage |

| 1095-C | Employers with 50+ Full-Time Employees | Details employer-provided coverage options |

Frequently Asked Questions

What happens if I don’t receive Form 1095 by the deadline?

+If you don’t receive Form 1095 by the deadline, it’s important to contact your insurance provider or employer promptly. They may be able to provide you with a replacement form or assist you in obtaining the necessary information. Keep in mind that you may still need to file your taxes on time, even if you don’t have the form yet.

Can I claim a premium tax credit if I receive Form 1095-B or Form 1095-C?

+No, premium tax credits are only available to individuals who receive Form 1095-A. Forms 1095-B and 1095-C are used to verify minimum essential coverage and do not provide eligibility for premium tax credits. If you believe you are eligible for a premium tax credit, you should contact the Health Insurance Marketplace for further guidance.

What should I do if the information on my Form 1095 is incorrect?

+If you notice any discrepancies or errors on your Form 1095, it’s crucial to contact the issuer (insurance provider or employer) immediately. They can help correct the information and provide you with an updated form if necessary. Accurate information is essential for tax compliance and healthcare coverage verification.

Can I use Form 1095 to apply for Medicaid or other government assistance programs?

+Form 1095 can be a helpful document when applying for certain government assistance programs, such as Medicaid or the Children’s Health Insurance Program (CHIP). However, the specific requirements and eligibility criteria may vary by program and state. It’s recommended to review the application guidelines and consult with the relevant government agency for accurate information.

Form 1095 is a powerful tool that empowers individuals to take control of their healthcare and financial well-being. By understanding its purpose and effectively utilizing the information it provides, individuals can navigate the healthcare system and tax obligations with confidence. Stay informed, stay organized, and ensure that you have the necessary documentation to access the healthcare coverage you need and deserve.