Free Pump Through Insurance

Welcome to an insightful exploration of free pump-through insurance, a financial concept designed to offer unique protection for individuals and businesses alike. In an era where unexpected expenses can arise from any corner, the concept of pump-through insurance has gained traction as a viable solution to mitigate financial risks associated with pump systems and equipment.

This comprehensive guide aims to delve into the intricacies of this insurance type, shedding light on its functionality, benefits, and potential drawbacks. By understanding the mechanics of pump-through insurance, readers will be equipped with the knowledge to make informed decisions regarding their financial and operational strategies.

With a focus on providing an expert-level analysis, this article will navigate through the key aspects of free pump-through insurance, offering a detailed examination of its features, real-world applications, and the underlying mechanisms that make it a compelling option for many.

Understanding Pump-Through Insurance

Pump-through insurance, a specialized form of coverage, is tailored to address the unique needs of industries heavily reliant on pump systems. These systems, integral to various sectors such as manufacturing, agriculture, and wastewater management, are susceptible to unexpected breakdowns and failures.

The primary objective of pump-through insurance is to provide financial support during such unforeseen events. By covering the costs associated with repairs, maintenance, and potential downtime, this insurance type aims to minimize the financial impact of pump-related incidents.

The concept of "free" pump-through insurance further adds an attractive layer, suggesting that the coverage is provided without direct cost to the policyholder. This notion, however, often comes with nuances and conditions that require a deeper understanding.

Key Features of Pump-Through Insurance

-

Comprehensive Coverage: Pump-through insurance policies typically offer a wide range of coverage, including repair and replacement of pump components, emergency services, and even coverage for potential environmental damage caused by pump failures.

-

Business Continuity: A significant benefit of this insurance type is its ability to ensure business continuity. By providing rapid response and financial support, businesses can minimize downtime and maintain their operational efficiency.

-

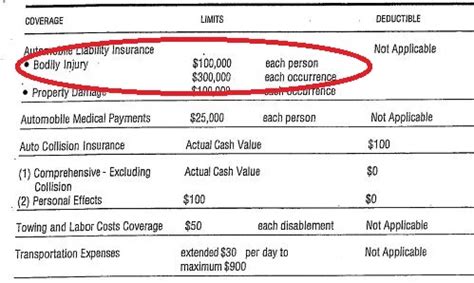

Customizable Policies: Recognizing the diverse needs of different industries, pump-through insurance policies are often highly customizable. Policyholders can tailor coverage limits, deductibles, and specific inclusions to align with their unique requirements.

How Pump-Through Insurance Works

The operational mechanics of pump-through insurance involve a comprehensive risk assessment process. Insurance providers evaluate the specific risks associated with the policyholder’s pump systems, considering factors such as system age, maintenance history, and environmental conditions.

Based on this assessment, a tailored insurance policy is crafted, outlining the scope of coverage, conditions, and any exclusions. The policy will specify the procedures to be followed in the event of a pump-related incident, including notification protocols and claim submission processes.

When a covered event occurs, the policyholder can initiate a claim, triggering the insurance provider's response. This response typically involves a swift assessment of the incident, followed by the deployment of resources to address the issue. The financial support provided may cover the costs of repairs, temporary replacements, or even lost revenue during the downtime.

| Pump-Through Insurance Benefits | Real-World Applications |

|---|---|

| Financial Protection: Mitigates the financial burden of pump failures. | Agricultural businesses can insure irrigation pumps, ensuring continued crop production despite pump malfunctions. |

| Rapid Response: Provides swift action to minimize downtime. | Manufacturing plants can secure coverage for critical pumps, allowing for quick repairs to maintain production schedules. |

| Customized Coverage: Tailored to specific industry needs. | Wastewater treatment facilities can insure pumps with specialized coverage for environmental damage. |

The Advantages of Free Pump-Through Insurance

The allure of “free” pump-through insurance lies in its potential to offer substantial financial protection without a direct cost. While the term “free” may require clarification, the benefits it presents are indeed noteworthy.

Financial Savings

By providing coverage without a direct premium payment, free pump-through insurance eliminates a significant financial burden for businesses. This is particularly advantageous for smaller enterprises or startups with limited financial resources.

The absence of premium costs allows businesses to redirect their financial focus towards other operational necessities, ensuring a more robust and flexible financial strategy.

Risk Mitigation

Pump-related incidents can result in costly repairs, replacement parts, and potential legal liabilities. Free pump-through insurance acts as a protective shield, absorbing these financial risks and minimizing the potential for catastrophic losses.

By mitigating these risks, businesses can operate with a greater sense of financial security, knowing that they are safeguarded against the unpredictable nature of pump system failures.

Business Continuity

One of the most significant advantages of free pump-through insurance is its contribution to maintaining business continuity. In the event of a pump failure, the insurance coverage ensures that the necessary resources are readily available to address the issue promptly.

This rapid response capability minimizes downtime, allowing businesses to quickly resume operations and prevent potential revenue losses. By keeping operations running smoothly, free pump-through insurance can be a critical factor in a business's long-term success and sustainability.

Potential Drawbacks and Considerations

While free pump-through insurance presents an attractive proposition, it is essential to consider the nuances and potential limitations associated with this type of coverage.

Limited Coverage

One of the primary drawbacks of free pump-through insurance is the potential for limited coverage. In order to offer this insurance at no direct cost, providers may impose restrictions on the scope of coverage.

This could include lower coverage limits, stricter definitions of covered incidents, or the exclusion of certain types of pump failures. Policyholders should carefully review the terms and conditions to ensure that the coverage aligns with their specific needs and potential risks.

Conditions and Exclusions

Insurance policies, including free pump-through insurance, often come with a range of conditions and exclusions. These may include requirements for regular maintenance, specific guidelines for incident reporting, or exclusions for certain types of damage.

Understanding these conditions and exclusions is crucial to avoid any surprises when making a claim. Policyholders should thoroughly review the policy documentation and seek clarification from their insurance provider to ensure they are aware of all the terms and potential limitations.

Claim Processes and Turnaround Times

The efficiency of the claim process is a critical factor in the effectiveness of pump-through insurance. Delays in claim processing or long turnaround times for repairs can negate the benefits of the insurance, particularly in time-sensitive industries.

Policyholders should inquire about the typical claim process and turnaround times, ensuring that the insurance provider can deliver a swift and effective response when needed. A slow or cumbersome claim process may undermine the very purpose of having pump-through insurance in the first place.

Case Studies: Real-World Applications

Agricultural Sector

In the agricultural industry, pump systems are integral to irrigation processes, ensuring the timely delivery of water to crops. A failure in these systems can lead to significant crop losses and financial setbacks.

Free pump-through insurance in this sector can provide a safety net, covering the costs of repairs and potential crop damage. By offering financial protection, this insurance type allows farmers to focus on their core business without the added worry of pump-related incidents.

Manufacturing Plants

Manufacturing plants often rely on intricate pump systems for various processes, from material transportation to wastewater management. A pump failure can disrupt production lines, leading to costly downtime and potential losses.

With free pump-through insurance, manufacturing businesses can insure their critical pump systems, ensuring rapid response and financial support in the event of a failure. This allows them to maintain their production schedules and minimize the impact on their overall operations.

Wastewater Treatment Facilities

Wastewater treatment facilities utilize pumps for various processes, including the transport and treatment of wastewater. Failures in these systems can result in environmental damage and legal liabilities.

Specialized free pump-through insurance for wastewater treatment facilities can offer coverage for both the repair or replacement of pumps and potential environmental damage. This comprehensive coverage provides a vital layer of protection for these critical infrastructure systems.

The Future of Pump-Through Insurance

As technology advances and industries evolve, the landscape of pump-through insurance is also expected to undergo transformations. The integration of smart technologies and predictive maintenance strategies may play a significant role in shaping the future of this insurance type.

Integration of Smart Technologies

The increasing adoption of smart technologies in pump systems offers an opportunity for more precise risk assessment and management. Smart sensors and predictive analytics can provide real-time data on pump performance, enabling insurance providers to offer more tailored and efficient coverage.

By leveraging these technologies, insurance providers can identify potential issues before they lead to costly failures, allowing for proactive maintenance and reduced risks.

Embracing Predictive Maintenance

Predictive maintenance strategies, which use data analytics to predict when equipment is likely to fail, can be a game-changer for pump-through insurance. By identifying potential issues early on, businesses can schedule maintenance activities proactively, reducing the likelihood of unexpected failures.

This shift towards predictive maintenance not only benefits businesses by minimizing downtime but also provides insurance providers with a more stable and predictable risk profile, potentially leading to more affordable and accessible coverage options.

Industry Collaboration and Standardization

The future of pump-through insurance may also involve increased collaboration between insurance providers, pump manufacturers, and industry associations. This collaboration could lead to the development of standardized policies and procedures, making it easier for businesses to understand and access this type of insurance.

By working together, these stakeholders can create a more unified approach to pump-through insurance, ensuring that the coverage provided is relevant, accessible, and effective for the industries that rely on pump systems.

How does free pump-through insurance differ from traditional insurance policies?

+Free pump-through insurance differs from traditional policies in its specific focus on pump systems and its potential to be offered without direct cost. While traditional insurance policies often cover a broad range of risks, pump-through insurance is tailored to address the unique needs of industries reliant on pump systems.

What are the potential limitations of free pump-through insurance?

+Potential limitations of free pump-through insurance may include limited coverage, strict conditions and exclusions, and potential delays in claim processing. It's essential for policyholders to carefully review the terms and conditions to ensure they understand the scope of coverage and any potential limitations.

How can businesses ensure they get the most out of their pump-through insurance coverage?

+Businesses can maximize the benefits of their pump-through insurance by staying informed about the coverage limits and conditions. Regularly reviewing and updating their insurance policies to reflect any changes in their operations or pump systems is also crucial. Additionally, maintaining open communication with their insurance provider can ensure a smooth claim process when needed.