Full Coverage Dental Insurance Texas

Dental health is a crucial aspect of overall well-being, and having adequate dental insurance coverage is essential for maintaining optimal oral health. In the state of Texas, numerous insurance plans and providers offer a range of options to cater to diverse needs. This comprehensive guide will delve into the world of Full Coverage Dental Insurance in Texas, providing an in-depth analysis of the benefits, costs, and considerations to help residents make informed decisions about their dental care.

Understanding Full Coverage Dental Insurance

Full coverage dental insurance in Texas is designed to provide extensive protection for a wide range of dental procedures, from preventive care to major restorative treatments. Unlike basic dental plans, which often have limitations and exclusions, full coverage plans aim to minimize out-of-pocket expenses and ensure that individuals have access to necessary dental services without financial strain.

Benefits of Full Coverage Dental Insurance

The advantages of opting for full coverage dental insurance are substantial. Firstly, it promotes proactive dental care by covering a comprehensive array of preventive services, such as regular check-ups, cleanings, fluoride treatments, and sealants, which are vital for maintaining healthy teeth and gums. By encouraging routine visits, these plans can help detect and address potential issues early on, potentially saving individuals from more complex and costly procedures down the line.

Secondly, full coverage dental insurance provides peace of mind by offering extensive protection for more extensive procedures. This includes restorative treatments like fillings, root canals, crowns, and bridges, as well as periodontal treatments for gum disease. Additionally, many plans cover orthodontic care, which can be a significant benefit for those requiring braces or other orthodontic appliances.

Lastly, full coverage plans often include dental emergencies, ensuring that unexpected dental issues, such as severe toothaches or injuries, are covered. This aspect is particularly valuable, as dental emergencies can be both painful and costly without insurance.

Costs and Coverage

The cost of full coverage dental insurance in Texas can vary significantly depending on the chosen plan, the insurer, and the individual’s or family’s specific needs. Typically, these plans have higher monthly premiums compared to basic dental insurance, reflecting the extensive coverage they provide. However, the potential savings on dental procedures and the peace of mind they offer can make them a worthwhile investment.

Coverage limits and deductibles are important considerations. Some plans may have annual maximums on the amount they will pay out for certain procedures, while others may have lower deductibles, requiring a smaller out-of-pocket payment before coverage kicks in. It's crucial to review these details thoroughly to ensure the plan aligns with one's anticipated dental needs.

Moreover, the choice of dental provider network can impact costs. Preferred Provider Organization (PPO) plans offer flexibility in choosing dentists, both in and out of network, while Health Maintenance Organization (HMO) plans typically require the use of in-network dentists to receive full coverage benefits. Understanding the network and provider options is essential for making informed decisions about dental care.

Popular Full Coverage Dental Insurance Plans in Texas

Texas boasts a competitive market for dental insurance, with numerous reputable providers offering a range of full coverage plans. Here’s an overview of some of the popular options available:

Delta Dental of Texas

Delta Dental is one of the leading dental insurance providers in the United States and offers a variety of plans tailored to different needs. Their Delta Dental PPO plans in Texas provide extensive coverage for a wide range of dental services, including preventive, basic, and major procedures. With a large network of participating dentists, individuals can choose from a broad selection of dental providers.

Delta Dental's plans often include features like no waiting periods for certain procedures, discounted rates with in-network dentists, and optional orthodontic coverage for an additional fee. Their DeltaCare USA plan, a type of HMO, offers comprehensive coverage with set copayments for services, making it a cost-effective option for those seeking full coverage.

United Concordia Dental

United Concordia Dental is another prominent player in the Texas dental insurance market. Their Concordia Advantage Plus PPO plan offers a robust package of benefits, including 100% coverage for preventive care, 80% coverage for basic procedures, and 50% coverage for major treatments. The plan also provides prescription savings and dental injury coverage, making it a comprehensive choice.

United Concordia's plans often feature low out-of-pocket costs, with many procedures requiring only a small copayment. Additionally, their network includes dental specialists, ensuring that individuals can access the specific care they need.

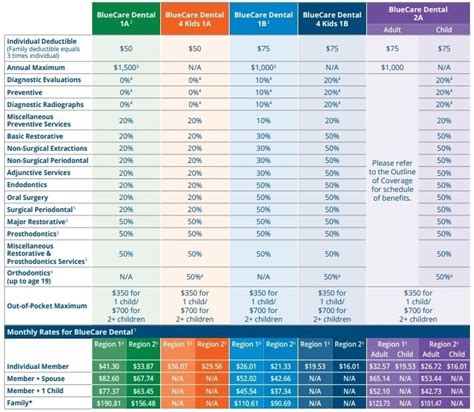

BlueCross BlueShield of Texas

BlueCross BlueShield, a well-known health insurance provider, also offers dental insurance plans in Texas. Their Blue Dental PPO plans provide full coverage for preventive care, partial coverage for basic and major procedures, and optional orthodontic coverage. With a vast network of providers, individuals can easily find an in-network dentist to maximize their benefits.

BlueCross BlueShield's plans often emphasize customization, allowing individuals to choose the level of coverage that suits their needs and budget. Additionally, their plans may include dental wellness programs and discounts on certain procedures, further enhancing the value of their dental insurance offerings.

| Insurance Provider | Plan Name | Key Benefits |

|---|---|---|

| Delta Dental of Texas | Delta Dental PPO | Extensive coverage, large network, no waiting periods |

| United Concordia Dental | Concordia Advantage Plus PPO | High coverage percentages, low out-of-pocket costs, specialist access |

| BlueCross BlueShield of Texas | Blue Dental PPO | Full preventive coverage, customization options, dental wellness programs |

Choosing the Right Full Coverage Dental Insurance

Selecting the ideal full coverage dental insurance plan requires careful consideration of several factors. Firstly, individuals should assess their current and anticipated dental needs. This includes evaluating the frequency of dental visits, the likelihood of requiring more extensive procedures, and any specific concerns or conditions they may have.

Secondly, the cost of the plan is a critical factor. While full coverage plans offer extensive benefits, they typically come with higher premiums. It's important to balance the cost of the plan with one's budget and the potential savings it offers on dental procedures.

The choice of dental provider network is another significant consideration. Depending on personal preferences and the availability of preferred dentists, individuals may lean towards PPO plans with more flexibility or HMO plans with set copayments and potentially lower costs. It's crucial to review the network and ensure that it includes the desired dentists or specialists.

Additionally, individuals should pay attention to additional features offered by the plans. This can include optional orthodontic coverage, prescription savings, or dental wellness programs. These features can enhance the overall value and convenience of the insurance plan.

Tips for Selecting a Plan

- Compare Plans: Research and compare multiple plans from different providers to find the best fit for your needs and budget.

- Read the Fine Print: Carefully review the plan’s coverage details, including exclusions and limitations, to ensure it aligns with your expectations.

- Consider Network Flexibility: Decide whether you prefer the flexibility of a PPO plan or the potential cost savings of an HMO plan.

- Check Provider Ratings: Look up the ratings and reviews of the insurance provider to assess their reputation and customer satisfaction.

- Discuss with Your Dentist: Consult with your dentist to understand their recommendations and preferences for insurance plans.

Performance and Satisfaction

The performance and satisfaction associated with full coverage dental insurance plans in Texas are generally positive. Many individuals and families find that the comprehensive coverage and peace of mind offered by these plans are well worth the investment. By encouraging regular dental visits and providing access to necessary treatments, full coverage plans can play a significant role in maintaining good oral health.

Satisfaction surveys and customer reviews often highlight the benefits of full coverage plans, including the ability to manage dental costs effectively and the freedom to choose from a wide range of dental providers. Additionally, the convenience of having most or all dental procedures covered under one plan is highly appreciated by those who have experienced the stress of managing multiple insurance policies or paying out-of-pocket for extensive treatments.

Future Implications and Considerations

As the landscape of healthcare and insurance continues to evolve, it’s important to stay informed about potential changes that may impact full coverage dental insurance plans in Texas. Here are some key considerations for the future:

Policy Changes and Updates

Insurance providers may introduce new plans, modify existing ones, or adjust their coverage and costs based on market trends and regulatory changes. Staying updated on these shifts can help individuals make informed decisions when it’s time to renew or switch plans.

Advancements in Dental Technology

The field of dentistry is constantly evolving, with new technologies and treatments becoming available. Full coverage dental insurance plans may need to adapt to incorporate these advancements, ensuring that individuals have access to the latest and most effective treatments.

Economic and Healthcare Trends

Economic fluctuations and changes in healthcare policies can impact the cost and availability of full coverage dental insurance. Monitoring these trends can provide insights into potential changes in the market and help individuals plan for the future.

Preventive Care and Oral Health Education

A key aspect of full coverage dental insurance is promoting preventive care. As awareness of the importance of oral health grows, insurance providers may place even greater emphasis on preventive services and oral health education. This can lead to more comprehensive coverage for preventive procedures and initiatives aimed at improving overall oral health.

Conclusion

Full coverage dental insurance in Texas offers a robust solution for individuals and families seeking comprehensive protection for their dental health. By understanding the benefits, costs, and considerations associated with these plans, residents can make informed decisions to ensure they receive the care they need without financial strain. As the dental insurance landscape continues to evolve, staying informed and proactive is key to maintaining optimal oral health and overall well-being.

What is considered full coverage dental insurance in Texas?

+

Full coverage dental insurance in Texas typically refers to plans that offer extensive coverage for a wide range of dental procedures, including preventive, basic, and major treatments. These plans aim to minimize out-of-pocket expenses and provide peace of mind by covering most dental needs.

How much does full coverage dental insurance cost in Texas?

+

The cost of full coverage dental insurance in Texas can vary significantly depending on the plan, provider, and individual needs. Monthly premiums can range from around 30 to over 100, with higher premiums reflecting more comprehensive coverage. It’s important to review and compare plans to find the best fit for your budget.

What are some popular full coverage dental insurance providers in Texas?

+

Some well-known providers offering full coverage dental insurance plans in Texas include Delta Dental of Texas, United Concordia Dental, and BlueCross BlueShield of Texas. These providers offer a range of plans with varying benefits and costs to suit different needs.

What factors should I consider when choosing a full coverage dental insurance plan?

+

When selecting a full coverage dental insurance plan, consider your current and anticipated dental needs, the cost of the plan, the choice of dental provider network, and any additional features or benefits offered. It’s essential to find a plan that aligns with your budget and provides the coverage you require.