Full Coverage Insurance Cheap

Full coverage insurance is a comprehensive type of policy that provides a high level of protection for vehicle owners. It typically includes a combination of liability, collision, and comprehensive coverage, offering financial protection in various scenarios. While full coverage insurance is often associated with higher premiums, there are strategies and factors that can make it more affordable. In this article, we delve into the world of full coverage auto insurance, exploring its benefits, the key factors influencing its cost, and practical tips to secure the best rates without compromising on essential protection.

Understanding Full Coverage Insurance

Full coverage insurance, often referred to as comprehensive auto insurance, is designed to offer extensive protection for vehicle owners. It combines multiple types of coverage, including liability, collision, and comprehensive coverage, to address a wide range of potential risks and damages.

Liability Coverage

Liability coverage is a fundamental component of full coverage insurance. It provides protection in the event that you are found at fault for an accident. This coverage pays for the damages and injuries sustained by others involved in the accident, including medical expenses, property damage, and legal fees. It is essential to have adequate liability coverage to protect your assets and avoid financial strain in the event of an at-fault accident.

Collision Coverage

Collision coverage is another crucial aspect of full coverage insurance. It covers the cost of repairing or replacing your vehicle if it is damaged in an accident, regardless of fault. This coverage is particularly valuable for newer or more expensive vehicles, as it ensures that you are not left with a substantial financial burden in the event of an accident. Collision coverage typically comes with a deductible, which is the amount you pay out of pocket before the insurance kicks in.

Comprehensive Coverage

Comprehensive coverage is the final piece of the full coverage insurance puzzle. It provides protection against damages caused by events other than collisions, such as theft, vandalism, natural disasters, or damage caused by animals. Comprehensive coverage can offer peace of mind, knowing that your vehicle is protected against a wide range of unforeseen circumstances.

Factors Affecting Full Coverage Insurance Costs

The cost of full coverage insurance can vary significantly depending on several factors. Understanding these factors can help you make informed decisions and potentially lower your insurance premiums.

Vehicle Type and Age

The type and age of your vehicle play a significant role in determining the cost of full coverage insurance. Generally, newer and more expensive vehicles carry higher insurance premiums due to their higher replacement and repair costs. Additionally, certain vehicle models may have a higher likelihood of being involved in accidents or being targeted by thieves, which can also impact insurance rates.

| Vehicle Type | Average Annual Premium |

|---|---|

| Luxury Car | $2,500 - $3,000 |

| Sports Car | $2,000 - $2,500 |

| Sedan | $1,500 - $2,000 |

| SUV | $1,200 - $1,800 |

Driving History and Claims

Your driving history and claims record are key factors in determining your insurance rates. Insurance companies carefully assess your driving behavior and past claims to assess the risk they are taking on. A clean driving record with no at-fault accidents or traffic violations can lead to lower insurance premiums. Conversely, a history of accidents or claims can significantly increase your rates, as it indicates a higher risk of future incidents.

Location and Usage

The location where you reside and the usage of your vehicle can also impact the cost of full coverage insurance. Insurance rates can vary widely based on geographical factors, such as the population density, crime rates, and accident statistics in your area. Additionally, the purpose for which you use your vehicle, whether for commuting, business, or pleasure, can influence your insurance premiums. Higher mileage and more frequent usage may result in increased rates.

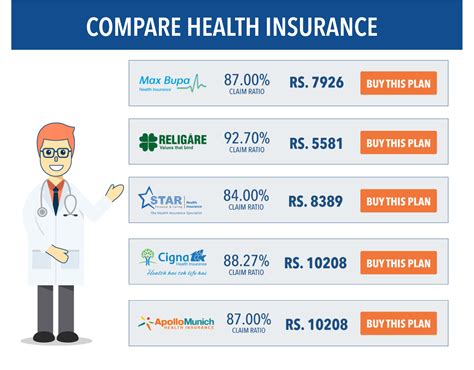

Insurance Provider and Coverage Options

The insurance provider you choose and the specific coverage options you select can greatly affect the cost of your full coverage insurance. Different insurance companies offer varying rates and discounts, so it’s essential to shop around and compare quotes. Additionally, the coverage limits and deductibles you choose can significantly impact your premiums. Higher coverage limits and lower deductibles typically result in higher premiums, while opting for lower limits and higher deductibles can reduce your costs.

Tips to Secure Cheap Full Coverage Insurance

While full coverage insurance may be more expensive than basic liability coverage, there are strategies you can employ to make it more affordable.

Shop Around and Compare Quotes

One of the most effective ways to find cheap full coverage insurance is to compare quotes from multiple insurance providers. Insurance rates can vary significantly between companies, so obtaining quotes from at least three different insurers is advisable. Online comparison tools and insurance brokers can simplify this process, allowing you to quickly assess the available options and identify the most competitive rates.

Increase Your Deductible

Increasing your deductible, which is the amount you pay out of pocket before your insurance coverage kicks in, can significantly reduce your insurance premiums. While this approach requires you to shoulder a larger financial burden in the event of a claim, it can lead to substantial savings on your insurance policy. It’s important to choose a deductible amount that you are comfortable with and can afford in the event of an accident.

Maintain a Clean Driving Record

A clean driving record is crucial when it comes to securing cheap full coverage insurance. Insurance companies offer discounts and lower rates to drivers with a history of safe driving. Avoiding traffic violations, at-fault accidents, and claims can significantly improve your chances of obtaining affordable insurance. If you have a less-than-perfect driving record, consider taking a defensive driving course, as it may help reduce your insurance premiums.

Explore Discounts and Bundles

Insurance companies often offer a range of discounts to attract and retain customers. Common discounts include multi-policy discounts (bundling your auto insurance with other policies like home or renters insurance), safe driver discounts, good student discounts, and loyalty discounts. Additionally, some insurers provide discounts for vehicles equipped with safety features or for belonging to certain professional organizations. Be sure to inquire about available discounts when obtaining quotes and consider how you can qualify for these savings.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is an innovative approach to auto insurance that uses technology to track your driving behavior. Insurance providers install a device in your vehicle or use an app on your smartphone to monitor factors such as mileage, driving speed, and braking habits. By analyzing your driving data, insurance companies can offer personalized premiums based on your actual driving behavior. This approach can benefit safe drivers, as it provides an opportunity to prove their low-risk driving habits and potentially secure lower insurance rates.

Future Trends and Considerations

The auto insurance industry is continuously evolving, and several trends and considerations are shaping the future of full coverage insurance.

Advancements in Vehicle Technology

Advancements in vehicle technology, such as autonomous driving features and advanced safety systems, are influencing the cost and availability of full coverage insurance. Vehicles equipped with advanced safety features, such as automatic emergency braking or lane departure warning systems, may be eligible for insurance discounts. Additionally, as autonomous driving technology becomes more prevalent, insurance providers may need to adjust their coverage and pricing models to accommodate the changing landscape.

Increased Focus on Personalized Insurance

The insurance industry is moving towards a more personalized approach, leveraging data and technology to offer tailored insurance solutions. Usage-based insurance and telematics are examples of this trend, as they allow insurers to assess individual driving behavior and offer premiums based on actual risk. This shift towards personalized insurance can benefit safe drivers, as it recognizes and rewards their low-risk driving habits.

Expanding Coverage Options

Insurance providers are continually expanding their coverage options to meet the evolving needs of vehicle owners. Full coverage insurance policies may include additional benefits and services, such as rental car coverage, gap insurance, or roadside assistance. These add-ons can provide greater peace of mind and enhance the overall insurance experience.

Digital Transformation and Online Services

The digital transformation of the insurance industry is streamlining processes and enhancing the customer experience. Online platforms and mobile apps allow policyholders to manage their insurance policies, file claims, and access policy information conveniently. Additionally, the use of artificial intelligence and machine learning is improving fraud detection and claim processing, leading to more efficient and accurate insurance services.

Conclusion

Full coverage insurance is a vital component of financial protection for vehicle owners, offering comprehensive coverage against a wide range of risks and damages. While it may be more expensive than basic liability coverage, there are strategies and factors that can make it more affordable. By understanding the key components of full coverage insurance, the factors influencing its cost, and implementing cost-saving tips, you can secure the best rates without compromising on essential protection.

What is the average cost of full coverage insurance?

+The average cost of full coverage insurance can vary widely based on factors such as vehicle type, age, driving history, location, and coverage options. On average, full coverage insurance premiums range from 1,200 to 3,000 per year. However, it’s important to note that individual rates can be significantly higher or lower depending on your specific circumstances.

Can I get full coverage insurance for an older vehicle?

+Yes, full coverage insurance is available for older vehicles. However, the cost of insurance may be lower for older vehicles compared to newer ones. This is because older vehicles generally have lower replacement and repair costs, resulting in potentially lower insurance premiums. It’s important to carefully assess the value of your older vehicle and choose coverage limits that align with its actual worth.

Are there any alternatives to full coverage insurance for cost-conscious drivers?

+Yes, there are alternative insurance options for drivers who want to save on costs. Basic liability insurance provides coverage for damages and injuries you cause to others but does not cover your own vehicle. This option is suitable for older or less valuable vehicles. Additionally, state-minimum liability insurance covers the legal requirements but may not provide sufficient protection. It’s important to carefully assess your needs and budget when choosing an insurance option.