Which Medical Insurance Is Best

Choosing the right medical insurance can be a daunting task, as it involves navigating through various options, understanding complex policies, and ensuring adequate coverage for your specific healthcare needs. With the multitude of insurance providers and plans available, it is crucial to make an informed decision to safeguard your health and financial well-being.

Understanding Medical Insurance Plans

Medical insurance, also known as health insurance, is a vital component of modern healthcare systems. It provides financial protection against the high costs of medical treatments, hospital stays, and other healthcare services. The insurance market offers a wide range of plans, each designed to cater to different demographics, budgets, and health requirements.

The primary goal of medical insurance is to provide individuals and families with access to quality healthcare services without incurring excessive out-of-pocket expenses. By paying regular premiums, policyholders gain peace of mind, knowing that their healthcare needs are covered should any unforeseen medical issues arise.

Key Factors to Consider When Choosing Medical Insurance

When evaluating medical insurance options, several critical factors come into play. Understanding these factors will help you make an informed decision that aligns with your unique circumstances.

Coverage and Benefits

The scope of coverage is perhaps the most crucial aspect of any medical insurance plan. It determines the range of medical services, treatments, and procedures that are covered under the policy. Common coverage categories include hospitalization, outpatient care, prescription drugs, preventive care, and specialist consultations.

While some plans offer comprehensive coverage, others may have limitations or exclusions. It is essential to review the policy's benefits schedule to understand what is covered and at what level. Pay close attention to any restrictions or waiting periods, as these can impact your access to certain services.

Premiums and Deductibles

The cost of medical insurance is a significant consideration. Premiums are the regular payments you make to maintain your insurance coverage. They can vary widely depending on the insurer, the plan’s features, and your personal circumstances (such as age, location, and health status).

Additionally, deductibles play a role in determining your out-of-pocket expenses. A deductible is the amount you must pay out of your own pocket before the insurance coverage kicks in. Higher deductibles often correspond to lower premiums, so it's a trade-off to consider. Understanding the premium and deductible structure is crucial to managing your healthcare expenses effectively.

Network of Providers

Most medical insurance plans operate within a network of healthcare providers. This network includes hospitals, clinics, doctors, and other healthcare professionals. Being aware of the providers within your insurance network is essential, as it can impact your access to care and the cost of services.

Some plans offer broader networks, providing you with more flexibility in choosing your healthcare providers. On the other hand, narrower networks may limit your options but often result in lower costs. Consider your preferred healthcare facilities and specialists to ensure they are included in the insurance network you choose.

Pre-Existing Conditions

If you have a pre-existing medical condition, it is vital to understand how it will be treated under the insurance plan. Some insurers may impose waiting periods or exclusions for certain pre-existing conditions, while others may provide full coverage from the start. Transparency about pre-existing condition coverage is essential to avoid surprises and ensure you receive the necessary care.

Additional Benefits and Perks

Beyond the basic coverage, many medical insurance plans offer additional benefits and perks. These can include dental and vision coverage, mental health services, wellness programs, and travel insurance. While these add-ons may not be essential, they can enhance your overall healthcare experience and provide extra value for your money.

Popular Medical Insurance Providers and Their Plans

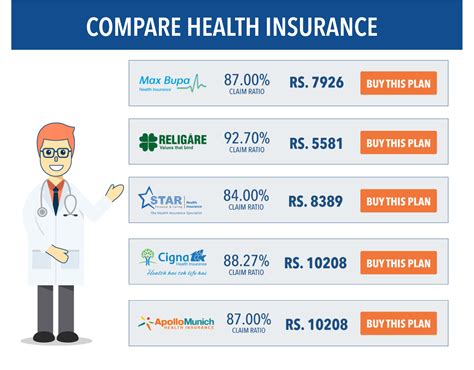

The medical insurance market is highly competitive, with numerous providers offering a diverse range of plans. Here’s an overview of some popular insurance companies and their notable plans, along with key features to help you evaluate their offerings:

Provider 1: ABC Health Insurance

ABC Health Insurance is renowned for its comprehensive coverage and customer-centric approach. Their flagship plan, ABC Platinum, offers an extensive benefits package, including:

- Full coverage for hospitalization and surgical procedures.

- Prescription drug coverage with a wide range of approved medications.

- Specialist consultations with no referral requirements.

- Wellness programs and preventive care incentives.

- 24⁄7 access to telemedicine services.

ABC Health Insurance also boasts a vast network of providers, ensuring you have access to top-quality healthcare across the country.

Provider 2: XYZ Medical Group

XYZ Medical Group specializes in offering tailored insurance solutions for specific demographics. Their Young Adult Plan is designed to cater to the unique needs of young adults, providing:

- Affordable premiums with a focus on budget-friendly coverage.

- Comprehensive coverage for common young adult health concerns, such as mental health services and reproductive health.

- A dedicated network of providers experienced in treating young adults.

- Flexible payment options and student discounts.

XYZ Medical Group’s plans often include additional benefits like travel insurance and access to exclusive wellness events.

Provider 3: MedPro Insurance

MedPro Insurance is known for its innovative approach to healthcare coverage. Their MedPro Advantage plan offers:

- A unique shared savings model, where policyholders can benefit from cost savings when utilizing in-network providers.

- Robust telemedicine services, with virtual consultations available for a wide range of specialties.

- Wellness incentives and discounts on fitness-related purchases.

- Coverage for alternative therapies and holistic medicine.

MedPro Insurance’s plans often appeal to individuals seeking a more personalized and modern healthcare experience.

Provider 4: HealthGuard Insurance

HealthGuard Insurance focuses on providing robust coverage for families. Their Family Guardian plan offers:

- Coverage for all family members, including children and elderly dependents.

- Pediatric-specific benefits, such as coverage for immunizations, check-ups, and specialized pediatric treatments.

- Maternity and newborn care, with comprehensive coverage for pregnancy-related expenses.

- A dedicated family support line for non-medical queries and guidance.

HealthGuard Insurance understands the unique healthcare needs of families and aims to provide a comprehensive safety net.

Comparative Analysis: Finding the Best Fit

When comparing medical insurance plans, it’s essential to assess how well each plan aligns with your specific needs. Consider the following aspects to make an informed decision:

Your Current and Anticipated Healthcare Needs

Evaluate your current health status and any ongoing medical conditions. Consider any specialized treatments or medications you require. Additionally, think about any future healthcare needs you may anticipate, such as planned surgeries or chronic condition management.

Cost-Benefit Analysis

Perform a thorough analysis of the premiums, deductibles, and out-of-pocket expenses associated with each plan. Calculate the potential costs based on your healthcare utilization and compare them across different plans. Remember that the cheapest plan may not always provide the best value if it has limited coverage.

Network Flexibility

Assess your preference for flexibility in choosing healthcare providers. If you have established relationships with specific doctors or hospitals, ensure they are included in the insurance network. Conversely, if you value the freedom to choose from a wide range of providers, opt for plans with broader networks.

Pre-Existing Condition Considerations

If you have pre-existing conditions, carefully review the policies’ approach to such conditions. Some insurers may require waiting periods or have exclusions, while others may provide coverage from the outset. Ensure that the plan you choose aligns with your health requirements and provides the necessary support.

Additional Benefits and Convenience

Consider the added value provided by each plan’s additional benefits and perks. Telemedicine services, wellness programs, and travel insurance can enhance your overall healthcare experience and provide peace of mind. Assess which benefits are most relevant to your lifestyle and health goals.

Expert Insights and Industry Trends

Staying informed about industry trends and expert insights can further guide your decision-making process. Here are some key observations from industry experts:

Conclusion: Making an Informed Choice

Choosing the best medical insurance plan is a critical decision that impacts your health and financial security. By understanding the key factors, evaluating popular providers, and staying informed about industry trends, you can make a well-informed choice that suits your unique needs.

Remember, the "best" medical insurance plan is the one that provides comprehensive coverage, aligns with your healthcare requirements, and offers value for your money. Take the time to research, compare, and seek expert advice to ensure you select a plan that gives you the peace of mind and access to quality healthcare you deserve.

What is the average cost of medical insurance premiums?

+The average cost of medical insurance premiums varies widely based on factors such as age, location, and the scope of coverage. As of [latest data available], the average annual premium for an individual plan ranges from [lower end] to [higher end], while family plans can cost between [lower end] and [higher end].

How do I know if a plan covers my specific healthcare needs?

+To ensure a plan covers your specific needs, carefully review the policy’s benefits schedule. Pay attention to any exclusions or limitations, especially if you have pre-existing conditions or require specialized treatments. Contact the insurer directly if you have questions or need clarification.

Are there any government-sponsored medical insurance programs?

+Yes, many countries offer government-sponsored medical insurance programs to provide coverage for specific demographics or income levels. Examples include Medicare, Medicaid, and the Affordable Care Act (ACA) in the United States. These programs aim to ensure access to healthcare for vulnerable populations.

What is the process for switching medical insurance plans?

+Switching medical insurance plans typically involves a few steps. First, research and compare different plans to find one that better suits your needs. Contact the new insurer to initiate the application process. They will guide you through the enrollment process, which may include providing personal and medical information. Ensure you understand the coverage gaps and any potential waiting periods during the transition.