Geico Car Insurance Estimate

When it comes to car insurance, choosing the right provider is crucial to ensure you receive the coverage and benefits you need. In the vast landscape of insurance companies, GEICO stands out as a well-known and trusted name. This article delves into the process of obtaining a GEICO car insurance estimate, exploring the factors that influence premiums, the coverage options available, and the steps to secure the best rates for your vehicle.

Understanding GEICO’s Car Insurance Estimate Process

GEICO, an acronym for Government Employees Insurance Company, has been a prominent player in the insurance industry since its inception in 1936. Tailoring its services to cater to the unique needs of government employees, the company has since expanded its reach to offer comprehensive coverage to a diverse range of customers. GEICO’s commitment to providing accessible and affordable insurance has solidified its position as one of the leading providers in the market.

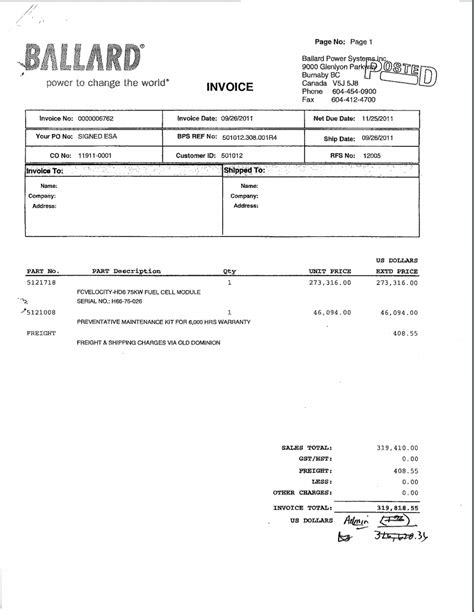

Obtaining a GEICO car insurance estimate is a straightforward process, designed to be user-friendly and efficient. The company's online platform allows prospective customers to input their details and receive a personalized quote within minutes. This digital interface not only saves time but also ensures that customers have a clear understanding of the coverage and costs associated with their specific needs.

Factors Influencing GEICO’s Car Insurance Premiums

Several key factors influence the premium rates offered by GEICO. These include the type of vehicle insured, the driver’s age and driving record, the geographical location, and the coverage limits selected. For instance, a newer, high-performance car may attract higher premiums compared to an older, more economical vehicle. Similarly, drivers with a clean record and extensive experience may benefit from more competitive rates.

GEICO's pricing structure also takes into account the driver's history of accidents and claims. While a single minor accident may not significantly impact premiums, a pattern of frequent claims or serious incidents could lead to higher rates. The company's comprehensive risk assessment process ensures that premiums are fair and reflective of the individual's driving profile.

Furthermore, the geographical location plays a significant role in determining insurance rates. Areas with a higher incidence of accidents, theft, or natural disasters may result in elevated premiums. GEICO's data-driven approach allows them to analyze regional trends and adjust premiums accordingly, ensuring that customers are not overcharged for their coverage.

Coverage Options Available with GEICO

GEICO offers a comprehensive range of coverage options to cater to the diverse needs of its customers. These include:

- Liability Coverage: This fundamental coverage protects the insured against bodily injury and property damage claims made by others in the event of an accident caused by the policyholder.

- Collision Coverage: In the event of an accident, collision coverage pays for the repair or replacement of the insured vehicle, regardless of who is at fault.

- Comprehensive Coverage: This option provides protection against damages caused by non-collision incidents such as theft, vandalism, natural disasters, or collisions with animals.

- Uninsured/Underinsured Motorist Coverage: This coverage safeguards the insured in the event of an accident with a driver who either does not have insurance or does not have sufficient coverage to compensate for the damages caused.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage pays for medical expenses incurred by the policyholder and their passengers after an accident, regardless of fault.

- Rental Car Coverage: GEICO offers rental car coverage to provide temporary transportation in the event that the insured vehicle is being repaired or is unavailable due to an insured loss.

Additionally, GEICO provides optional coverage enhancements such as Emergency Roadside Service, Mechanical Breakdown Insurance, and Custom Parts and Equipment coverage, allowing customers to tailor their policy to their specific needs and preferences.

| Coverage Type | Description |

|---|---|

| Liability Coverage | Protects against bodily injury and property damage claims made by others. |

| Collision Coverage | Covers repair or replacement costs for insured vehicle in case of an accident. |

| Comprehensive Coverage | Protects against non-collision incidents like theft, vandalism, and natural disasters. |

| Uninsured/Underinsured Motorist Coverage | Provides coverage when involved in an accident with an uninsured or underinsured driver. |

| Medical Payments Coverage (PIP) | Covers medical expenses for the policyholder and passengers after an accident. |

| Rental Car Coverage | Offers temporary transportation solutions during vehicle repairs or unavailability. |

Securing the Best GEICO Car Insurance Rates

To secure the most competitive rates for your car insurance, there are several strategies you can employ. Firstly, consider the discounts offered by GEICO. The company provides a range of discounts, including those for safe driving, multi-policy bundles, and military service. By taking advantage of these discounts, you can significantly reduce your premium costs.

Additionally, GEICO offers a usage-based insurance program called DriveEasy. This program uses a small device installed in your vehicle to track your driving behavior, including miles driven, time of day, and braking habits. By participating in this program, you can potentially receive discounts based on your safe driving habits. However, it's important to note that this program may not be available in all states or for all drivers.

Another way to secure better rates is by adjusting your coverage limits. While it's essential to have adequate coverage, you may be able to save by opting for higher deductibles or adjusting the limits of certain coverages. It's recommended to review your coverage limits regularly to ensure you have the right balance between protection and affordability.

Furthermore, maintaining a clean driving record is crucial for obtaining the best rates. GEICO, like most insurance companies, rewards safe driving by offering discounts for accident-free periods. By avoiding accidents and traffic violations, you can significantly impact your premium costs over time.

Comparison with Other Insurance Providers

When evaluating car insurance options, it’s beneficial to compare GEICO’s rates and coverage with other leading providers in the market. While GEICO boasts a strong reputation for competitive pricing and comprehensive coverage, other companies may offer unique benefits or specialized services that align with your specific needs.

For instance, some providers may excel in offering additional perks such as accident forgiveness, vanishing deductibles, or roadside assistance programs. Others may have a more extensive network of repair shops or provide more flexible payment options. By comparing multiple quotes and understanding the unique features of each provider, you can make an informed decision that best suits your requirements.

It's also essential to consider the customer service and claims process of different insurance companies. While rates and coverage are crucial factors, the support and assistance you receive during the claims process can significantly impact your overall experience. Researching customer reviews and ratings can provide valuable insights into the level of service and satisfaction offered by various providers.

The Future of GEICO’s Car Insurance Estimates

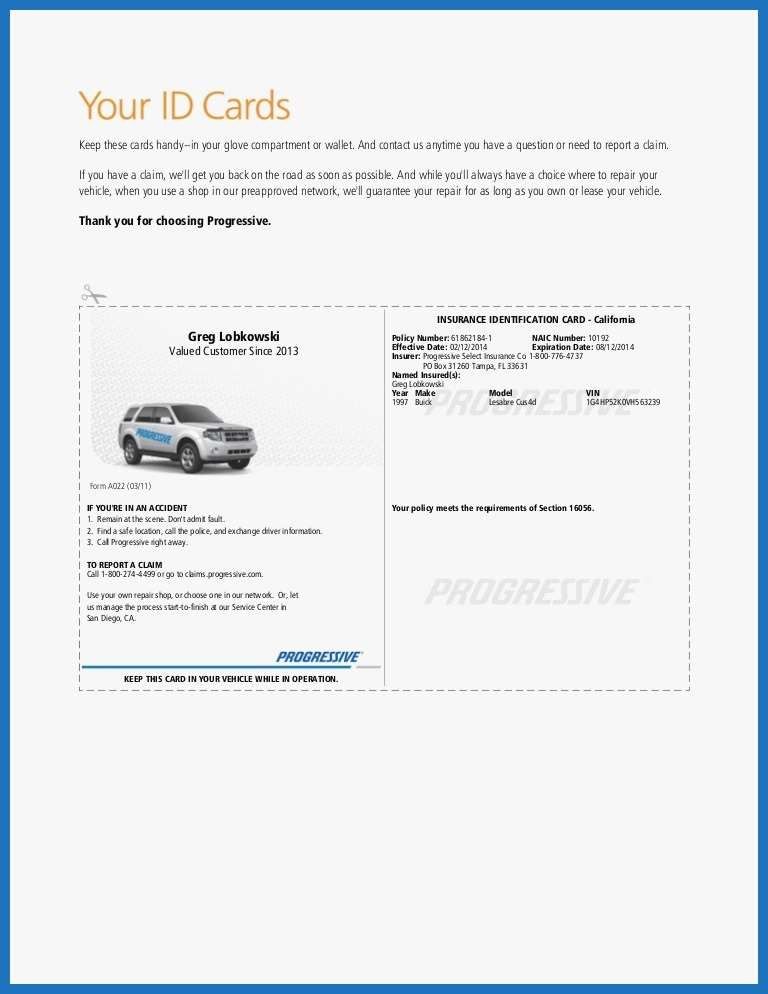

As the insurance industry continues to evolve, GEICO remains at the forefront of innovation, leveraging technology to enhance its services and improve the customer experience. The company’s commitment to digital transformation is evident in its mobile app, which allows customers to manage their policies, file claims, and access important documents on the go.

Furthermore, GEICO is exploring the potential of artificial intelligence and machine learning to streamline the insurance estimate process. By analyzing vast amounts of data, these technologies can provide more accurate and personalized quotes, taking into account individual driving habits and risk profiles. This level of customization not only benefits customers but also helps GEICO offer competitive rates and tailored coverage options.

In addition to technological advancements, GEICO is dedicated to promoting road safety and reducing accidents. The company actively supports various initiatives and programs aimed at educating drivers and improving driving behavior. By investing in these efforts, GEICO not only contributes to safer roads but also fosters a culture of responsible driving, which ultimately benefits its customers through potential premium reductions.

The Impact of Emerging Technologies on Car Insurance

The emergence of autonomous vehicles and advanced driver-assistance systems is set to revolutionize the car insurance industry. As these technologies become more prevalent, the traditional risk assessment models used by insurance companies will need to adapt. GEICO, recognizing this paradigm shift, is actively researching and developing strategies to incorporate these technological advancements into its underwriting processes.

With autonomous vehicles, the risk of accidents caused by human error is significantly reduced. This shift in risk profile could lead to a reevaluation of insurance premiums, potentially resulting in lower costs for policyholders. GEICO, being at the forefront of innovation, is well-positioned to navigate these changes and offer competitive rates for this emerging technology.

Additionally, the integration of telematics and connected car technologies provides GEICO with an opportunity to offer more dynamic and personalized insurance plans. By collecting real-time data on driving behavior and vehicle performance, GEICO can provide usage-based insurance options that reward safe driving and offer customers more control over their premiums. This data-driven approach not only benefits the company but also empowers customers to make informed decisions about their coverage and driving habits.

Conclusion: Navigating the World of Car Insurance with GEICO

Obtaining a GEICO car insurance estimate is a crucial step in securing comprehensive and affordable coverage for your vehicle. By understanding the factors that influence premiums, exploring the range of coverage options, and employing strategies to secure the best rates, you can make an informed decision that aligns with your specific needs and budget.

As the insurance landscape continues to evolve, GEICO's commitment to innovation and customer satisfaction positions it as a trusted partner in the world of car insurance. With its digital-first approach, emphasis on road safety, and dedication to staying ahead of industry trends, GEICO is well-equipped to provide its customers with the coverage and support they need, now and in the future.

How long does it take to receive a GEICO car insurance estimate?

+GEICO’s online platform allows for a quick and efficient estimate process. Typically, you can receive a personalized quote within minutes after providing your details.

Can I customize my GEICO car insurance policy to fit my specific needs?

+Absolutely! GEICO offers a wide range of coverage options and additional perks, allowing you to tailor your policy to your unique requirements.

Are there any discounts available with GEICO car insurance?

+Yes, GEICO provides various discounts for safe driving, multi-policy bundles, and military service, among others. These discounts can significantly reduce your premium costs.

What factors influence GEICO’s car insurance premiums the most?

+The main factors include the type of vehicle, the driver’s age and driving record, geographical location, and the coverage limits selected. Each of these elements plays a significant role in determining your premium.

How can I secure the best rates for my GEICO car insurance policy?

+To secure the best rates, consider taking advantage of GEICO’s discounts, participating in their usage-based insurance program (if available), adjusting your coverage limits, and maintaining a clean driving record.