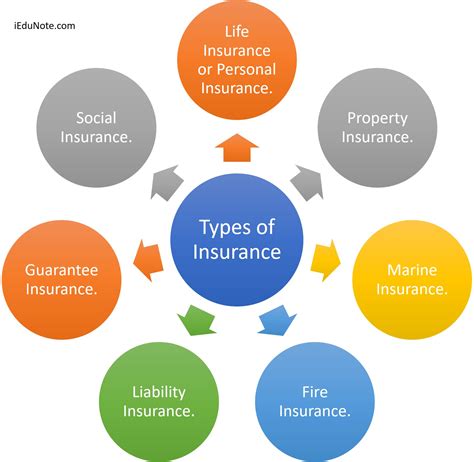

What Are The Different Types Of Insurance

Insurance is an essential financial tool that provides individuals and businesses with protection against various risks and unforeseen circumstances. It plays a crucial role in safeguarding our assets, health, and overall well-being. With numerous types of insurance available, it's important to understand the specific needs and coverage options tailored to different aspects of our lives. In this comprehensive article, we will delve into the various types of insurance, exploring their unique features, benefits, and how they contribute to financial security.

The Diverse World of Insurance Coverage

The insurance industry offers a wide array of policies to address the diverse needs of individuals and organizations. From protecting our health to securing our property and even mitigating business risks, insurance provides a safety net in an unpredictable world. Let’s explore the key types of insurance and their significance.

Health Insurance: Nurturing Well-being and Financial Peace of Mind

Health insurance is arguably one of the most critical types of insurance, especially in today’s healthcare landscape. It provides coverage for medical expenses, ensuring that individuals can access necessary healthcare services without incurring excessive financial burdens. With rising healthcare costs, health insurance plays a vital role in maintaining financial stability and promoting overall well-being.

Key features of health insurance include coverage for hospital stays, outpatient services, prescription medications, and sometimes even preventive care. Different plans offer varying levels of coverage, deductibles, and out-of-pocket expenses. Understanding the specific needs of an individual or family is essential when choosing a health insurance plan.

Life Insurance: Securing Your Loved Ones’ Future

Life insurance is designed to provide financial protection to beneficiaries in the event of the policyholder’s death. It serves as a safety net for families, ensuring they have the means to cover funeral expenses, pay off debts, and maintain their standard of living. Life insurance policies come in various forms, catering to different needs and financial goals.

Term life insurance offers coverage for a specified period, often providing high coverage amounts at relatively low premiums. Permanent life insurance, on the other hand, offers lifelong coverage and accumulates cash value over time, making it a popular choice for long-term financial planning and wealth accumulation.

Auto Insurance: Protecting Your Wheels and Wallet

Auto insurance is a legal requirement in many regions and a vital protection for vehicle owners. It provides coverage for damages and liabilities arising from accidents, theft, or other mishaps involving vehicles. Auto insurance policies typically include liability coverage, collision coverage, and comprehensive coverage, offering a well-rounded protection plan for car owners.

Liability coverage is essential as it safeguards policyholders from financial losses resulting from accidents they cause. Collision coverage covers damages to the insured vehicle, while comprehensive coverage provides protection against non-collision-related incidents, such as vandalism, natural disasters, or animal collisions.

Homeowners Insurance: Shielding Your Castle

Homeowners insurance is specifically designed to protect homeowners from financial losses associated with their properties. It covers damages to the home and its contents, as well as liabilities arising from accidents on the property. This type of insurance is crucial for safeguarding one’s largest investment—their home.

Homeowners insurance policies typically include coverage for structural damage, personal belongings, and liability. Additionally, they may offer optional endorsements to cover specific risks, such as flood or earthquake damage. Understanding the unique risks associated with one’s geographical location is essential when choosing a homeowners insurance policy.

Business Insurance: Mitigating Risks and Fostering Growth

Businesses, regardless of their size, face various risks that can impact their operations and financial stability. Business insurance provides protection against these risks, allowing companies to focus on growth and innovation without constant worry. From liability insurance to property insurance, business owners have a range of coverage options tailored to their specific needs.

Liability insurance protects businesses from financial losses arising from accidents or injuries caused to others on their premises or due to their products or services. Property insurance covers physical assets, including buildings, equipment, and inventory, providing a safety net against losses from theft, fire, or natural disasters. Other types of business insurance, such as professional liability insurance and workers’ compensation insurance, address specific risks associated with different industries.

Travel Insurance: Peace of Mind on the Road

Travel insurance is a valuable addition to any travel itinerary, offering protection against unforeseen circumstances while on the move. It covers a range of situations, including trip cancellations, medical emergencies, lost luggage, and travel delays. With the unpredictability of travel, having travel insurance provides peace of mind and financial security.

Trip cancellation coverage ensures that travelers can recover some or all of their prepaid expenses if they need to cancel their trip due to unforeseen events. Medical emergency coverage provides access to healthcare services and covers associated costs, ensuring travelers can receive necessary medical attention without incurring excessive expenses.

Pet Insurance: Caring for Fido’s Health

Pet insurance is gaining popularity among pet owners who want to ensure their furry friends receive the best medical care without financial strain. Similar to health insurance for humans, pet insurance covers veterinary expenses, providing peace of mind for pet owners. It helps cover the costs of unexpected illnesses, injuries, or even routine check-ups, ensuring pets receive timely and comprehensive care.

Pet insurance policies vary in coverage and premiums, with some offering accident-only coverage while others provide more comprehensive plans. Understanding the specific needs of one’s pet and the typical veterinary expenses in their region is crucial when selecting a pet insurance policy.

Long-Term Care Insurance: Planning for the Future

Long-term care insurance is designed to provide financial support for individuals who require extended care due to chronic illnesses, disabilities, or aging. It covers the costs of assisted living facilities, nursing homes, or in-home care, ensuring individuals can receive the care they need without depleting their savings or relying solely on government assistance.

Long-term care insurance policies typically have specific eligibility criteria and coverage limits. They may also offer additional benefits, such as coverage for respite care or care management services. Planning for long-term care insurance is an important step towards ensuring financial stability and maintaining independence as one ages.

Dental Insurance: Bright Smiles, Healthy Mouths

Dental insurance is a specialized type of insurance that focuses on covering the costs of dental care. It provides financial assistance for routine dental check-ups, cleanings, fillings, and even more complex procedures like root canals or dental implants. With the rising costs of dental treatments, dental insurance helps individuals maintain good oral health without breaking the bank.

Dental insurance plans vary in their coverage, with some offering comprehensive coverage for a wide range of procedures while others focus on basic preventive care. Understanding one’s dental needs and the typical costs associated with dental treatments is essential when selecting a dental insurance plan.

Umbrella Insurance: Extra Protection for Peace of Mind

Umbrella insurance is an additional layer of liability protection that goes beyond the limits of traditional insurance policies. It provides coverage for claims and lawsuits that exceed the limits of an individual’s existing insurance policies, offering a safety net against catastrophic financial losses.

Umbrella insurance policies are especially beneficial for individuals with significant assets or high-risk occupations. They provide an extra layer of protection against personal liability claims, ensuring that individuals can maintain their financial stability even in the face of unexpected legal challenges.

Specialized Insurance: Tailored Protection for Unique Needs

In addition to the aforementioned types of insurance, there are numerous specialized insurance policies designed to address specific needs. These include insurance for fine art, jewelry, collectibles, and even cyber risks. Specialized insurance policies cater to individuals with unique assets or specific risks associated with their professions or hobbies.

For example, fine art insurance provides coverage for valuable artwork, ensuring it is protected against damage, theft, or loss. Similarly, jewelry insurance covers the replacement or repair of valuable jewelry items, providing peace of mind for individuals who own precious heirlooms or investment pieces.

Navigating the Insurance Landscape

The world of insurance is vast and diverse, offering protection and peace of mind for various aspects of our lives. Whether it’s safeguarding our health, protecting our homes and businesses, or providing financial support during unexpected events, insurance plays a crucial role in our financial well-being.

When navigating the insurance landscape, it’s essential to understand our specific needs and the unique risks we face. Consulting with insurance professionals and thoroughly researching different coverage options can help us make informed decisions and choose policies that provide the right balance of protection and affordability. By staying informed and proactive, we can ensure we have the necessary insurance coverage to face life’s challenges with confidence and security.

What is the purpose of insurance, and how does it benefit individuals and businesses?

+Insurance serves as a financial safety net, protecting individuals and businesses from potential losses due to unforeseen circumstances. It provides peace of mind by offering coverage for various risks, ensuring financial stability and continuity.

How does health insurance work, and what are its key benefits?

+Health insurance covers medical expenses, ensuring access to healthcare services without excessive financial burden. It provides coverage for hospital stays, outpatient services, medications, and preventive care, promoting overall well-being and financial stability.

What are the main types of life insurance, and how do they differ?

+Life insurance includes term life insurance, offering coverage for a specified period, and permanent life insurance, providing lifelong coverage with cash value accumulation. Term life insurance offers high coverage at low premiums, while permanent life insurance is suitable for long-term financial planning.