Geico Car Insurance Prices

GEICO, the well-known insurance company, offers car insurance policies that are renowned for their competitive pricing and extensive coverage options. With a commitment to providing affordable and reliable auto insurance, GEICO has become a popular choice for many drivers across the United States. In this comprehensive guide, we will delve into the factors influencing GEICO car insurance prices, explore the range of coverage options, and provide valuable insights to help you make informed decisions when considering GEICO as your insurance provider.

Understanding GEICO Car Insurance Prices

GEICO’s car insurance prices are influenced by a variety of factors, each playing a crucial role in determining the overall cost of your policy. These factors include your personal information, driving history, vehicle details, and the coverage options you choose. By understanding how these elements impact your premium, you can make strategic choices to potentially reduce your insurance costs.

Personal Information and Driving History

Your personal details, such as age, gender, and marital status, are taken into account when calculating your car insurance premium. Additionally, your driving history, including any accidents, violations, or claims, significantly affects the price. A clean driving record with no recent accidents or traffic violations typically results in lower insurance rates. GEICO offers a Safe Driver Discount to reward drivers with a good driving history, encouraging safe and responsible driving practices.

Furthermore, your credit score can also influence your insurance premium. GEICO, like many insurance companies, may consider your credit-based insurance score when determining your rates. Maintaining a good credit history can potentially lead to lower insurance costs.

Vehicle Details and Coverage Options

The type of vehicle you drive and its usage are important factors in determining your car insurance price. GEICO takes into account the make, model, year, and value of your vehicle, as well as its safety features and potential risk factors. Vehicles with advanced safety technologies, such as anti-lock brakes or collision avoidance systems, may be eligible for discounts.

GEICO offers a wide range of coverage options to tailor your policy to your specific needs. These include:

- Liability Coverage: This basic coverage is required by law and protects you against financial losses if you are found at fault in an accident. It covers bodily injury and property damage claims made against you.

- Collision Coverage: This optional coverage pays for repairs or replacements if your vehicle is damaged in a collision, regardless of fault.

- Comprehensive Coverage: Comprehensive coverage protects against non-collision incidents, such as theft, vandalism, fire, or natural disasters. It provides financial protection for your vehicle in a wide range of situations.

- Uninsured/Underinsured Motorist Coverage: This coverage safeguards you against financial losses if you are involved in an accident with a driver who does not have adequate insurance.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage helps cover medical expenses for you and your passengers after an accident, regardless of fault.

- Roadside Assistance: GEICO offers optional roadside assistance plans that provide emergency services such as towing, flat tire changes, and battery jumps.

Factors Influencing GEICO Car Insurance Prices

In addition to the factors mentioned above, several other elements can impact the cost of your GEICO car insurance policy. Understanding these factors can help you make informed decisions and potentially save on your insurance premiums.

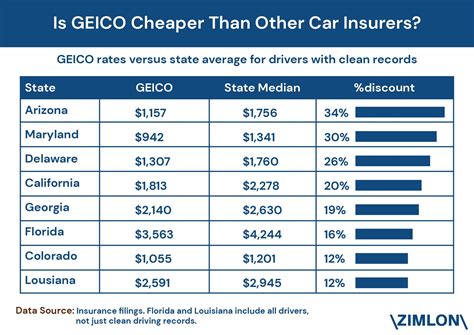

Geographic Location

Your geographic location plays a significant role in determining your insurance rates. Factors such as the cost of living, traffic density, crime rates, and weather conditions in your area can influence your premium. GEICO takes into account these regional variations to ensure fair pricing.

Discounts and Savings

GEICO offers a variety of discounts to help customers save on their car insurance premiums. Some of the notable discounts include:

- Military Discount: GEICO provides exclusive discounts for active-duty military personnel, veterans, and their families.

- Good Student Discount: If you are a full-time student with a good academic record, you may be eligible for this discount.

- Multi-Policy Discount: Combining your auto insurance with other GEICO policies, such as homeowners or renters insurance, can result in additional savings.

- Bundling Discounts: Bundling your car insurance with other GEICO policies, such as motorcycle or RV insurance, can lead to significant discounts.

- Safe Driver Discount: As mentioned earlier, maintaining a clean driving record can earn you a discount on your insurance premium.

Payment Options and Frequency

The payment method and frequency you choose can also impact your insurance premium. GEICO offers flexible payment options, including monthly, quarterly, or annual payments. While paying annually may result in a slight discount, it is important to consider your financial situation and choose the payment option that best suits your needs.

Performance and Customer Satisfaction

GEICO has consistently received positive reviews and recognition for its excellent customer service and claim handling. The company’s dedication to providing prompt and efficient service has earned it a strong reputation in the insurance industry. GEICO’s customer satisfaction ratings are consistently high, with many customers praising the company’s easy-to-use online platform, responsive customer support, and streamlined claims process.

GEICO's performance in handling claims is a key factor in its success. The company utilizes advanced technology and a well-organized claims management system to ensure a swift and fair resolution process. Customers appreciate the convenience of filing claims online or through the GEICO mobile app, as well as the availability of dedicated claims representatives who provide personalized assistance throughout the claims process.

Furthermore, GEICO's comprehensive coverage options and competitive pricing have contributed to its strong market position. The company offers a wide range of coverage choices, allowing customers to customize their policies to meet their specific needs. Whether it's liability coverage, collision coverage, comprehensive coverage, or additional protections like roadside assistance, GEICO provides comprehensive solutions to protect drivers and their vehicles.

GEICO's commitment to innovation and technological advancements has also played a significant role in its success. The company has embraced digital transformation, leveraging technology to enhance the customer experience. From online policy management and quote comparisons to seamless digital claim submissions, GEICO has made it easier and more convenient for customers to interact with their insurance provider.

Additionally, GEICO's focus on customer education and awareness has helped empower customers to make informed decisions about their insurance coverage. The company provides a wealth of resources and tools, including educational articles, videos, and interactive tools, to help customers understand their insurance options and make choices that align with their needs and budget.

Overall, GEICO's exceptional customer service, efficient claim handling, competitive pricing, and commitment to innovation have contributed to its strong performance and customer satisfaction. The company's dedication to providing quality insurance products and an exceptional customer experience has made it a trusted choice for millions of drivers across the United States.

Future Outlook and Industry Trends

As the insurance industry continues to evolve, GEICO remains committed to staying at the forefront of technological advancements and consumer trends. The company is actively exploring innovative solutions, such as usage-based insurance and telematics, to offer even more personalized and cost-effective coverage options to its customers.

Usage-based insurance, also known as pay-as-you-drive or pay-per-mile insurance, is an emerging trend in the industry. GEICO is exploring ways to leverage telematics technology, which uses data collected from vehicles to analyze driving behavior and offer personalized insurance rates based on actual usage. This approach has the potential to provide significant savings for safe and low-mileage drivers.

Additionally, GEICO is investing in enhancing its digital capabilities and improving the overall customer experience. The company aims to further streamline its online platforms and mobile apps, making it easier for customers to manage their policies, file claims, and access real-time information. By embracing digital transformation, GEICO aims to meet the evolving needs and expectations of its customers in an increasingly digital world.

Furthermore, GEICO recognizes the importance of environmental sustainability and is actively working towards reducing its carbon footprint. The company is exploring sustainable practices and initiatives, such as encouraging electric vehicle adoption and offering discounts for eco-friendly driving behaviors. By aligning with sustainable trends, GEICO aims to contribute to a greener and more environmentally conscious future.

In conclusion, GEICO's car insurance prices are influenced by a multitude of factors, including personal information, driving history, vehicle details, and coverage options. By understanding these factors and taking advantage of the various discounts and savings opportunities offered by GEICO, you can potentially reduce your insurance costs. GEICO's commitment to customer satisfaction, performance, and innovation positions it as a reliable and trusted insurance provider, ensuring a positive experience for its customers.

How can I get a quote for GEICO car insurance?

+To get a quote for GEICO car insurance, you can visit their official website or contact their customer service representatives. You’ll be guided through a series of questions to provide the necessary information, such as your personal details, vehicle information, and coverage preferences. GEICO offers convenient online tools and resources to help you obtain a personalized quote quickly and easily.

What factors determine my GEICO car insurance premium?

+Several factors influence your GEICO car insurance premium, including your personal information (age, gender, marital status), driving history (accidents, violations), vehicle details (make, model, year), and the coverage options you choose. Your geographic location, credit score, and any applicable discounts can also impact your premium.

Does GEICO offer any discounts on car insurance premiums?

+Yes, GEICO offers a range of discounts to help customers save on their car insurance premiums. These include discounts for safe driving, good academic performance, military service, bundling multiple policies, and more. It’s worth exploring these discounts to potentially lower your insurance costs.

How does GEICO’s claim handling process work?

+GEICO has a streamlined claim handling process that aims to provide efficient and timely resolutions. You can file a claim online, through the GEICO mobile app, or by contacting their customer service representatives. GEICO’s dedicated claims team will guide you through the process, assess the damage, and work towards a fair and prompt settlement.

Can I customize my GEICO car insurance policy?

+Absolutely! GEICO offers a wide range of coverage options to tailor your policy to your specific needs. You can choose from liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, medical payments coverage, and optional add-ons like roadside assistance. By selecting the coverage that aligns with your preferences and budget, you can create a personalized insurance plan.