Get Vision Insurance

Vision insurance is an essential aspect of comprehensive healthcare, ensuring that individuals have access to necessary eye care services and treatments. In today's fast-paced world, maintaining optimal eye health is crucial, especially with the increasing reliance on digital screens and the potential risks associated with various eye conditions. Obtaining vision insurance not only provides peace of mind but also empowers individuals to take control of their visual well-being and ensure they receive the necessary care when needed.

Understanding Vision Insurance

Vision insurance, often referred to as ophthalmic insurance, is a specialized type of health coverage designed to offset the costs of routine eye exams, prescription eyeglasses, contact lenses, and sometimes even vision correction procedures like LASIK. It is distinct from traditional health insurance, which primarily focuses on medical and surgical treatments for the body. Vision insurance aims to make eye care services more accessible and affordable for individuals and families, ensuring that regular eye check-ups and necessary vision corrections are within reach.

Key Benefits of Vision Insurance

The benefits of vision insurance are multifaceted and cater to a range of eye care needs. Here’s an overview of the key advantages:

- Routine Eye Exams: Vision insurance typically covers annual comprehensive eye exams, which are vital for detecting and managing eye conditions such as nearsightedness, farsightedness, astigmatism, and presbyopia. These exams also play a crucial role in identifying more serious eye diseases like glaucoma, cataracts, and macular degeneration in their early stages, enabling prompt treatment.

- Prescription Eyeglasses and Contact Lenses: Vision insurance plans often include allowances for purchasing prescription eyewear, whether it’s eyeglasses or contact lenses. This coverage ensures that individuals can afford the corrective lenses they need to see clearly and comfortably.

- Vision Correction Procedures: Some vision insurance plans offer coverage for refractive surgeries like LASIK or PRK. These procedures can significantly reduce or even eliminate the need for corrective lenses, providing a more permanent solution for vision correction.

- Specialty Care: Depending on the plan, vision insurance may cover visits to ophthalmologists or optometrists who specialize in specific eye conditions, such as pediatric ophthalmology, retinal diseases, or corneal disorders. This specialized care ensures that individuals receive expert treatment for their unique eye health needs.

Selecting the Right Vision Insurance Plan

When choosing a vision insurance plan, it’s essential to consider various factors to ensure the plan aligns with your specific eye care needs and preferences. Here are some key considerations:

Plan Coverage and Benefits

Review the plan’s coverage and benefits to understand what is included and excluded. Look for plans that offer comprehensive coverage for routine eye exams, prescription lenses, and, if desired, vision correction procedures. Ensure the plan includes a sufficient allowance for eyewear or contact lenses to cover your needs.

| Plan Type | Coverage | Eyewear Allowance | Vision Correction |

|---|---|---|---|

| Basic | Annual eye exams | $100-$200 | No coverage |

| Standard | Eye exams, lenses | $200-$300 | Discounts available |

| Premium | Comprehensive care | $300+$ | Full coverage |

Network of Providers

Vision insurance plans typically have networks of preferred providers, including ophthalmologists, optometrists, and optical shops. Ensure that the plan’s network includes providers in your area who are convenient for you to visit. Check if your preferred eye doctor or optical store is in-network to maximize your coverage.

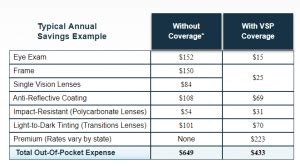

Cost and Premiums

Consider the cost of the vision insurance plan, including the monthly premiums and any additional out-of-pocket expenses. Evaluate whether the plan’s benefits and coverage justify the cost, especially if you anticipate needing frequent eye exams or prescription eyewear.

Plan Flexibility and Customization

Some vision insurance plans offer flexibility and customization options, allowing you to tailor the plan to your specific needs. For example, you might be able to choose a higher eyewear allowance or add coverage for specific vision correction procedures. Consider your long-term eye care goals and select a plan that provides the necessary flexibility.

Enrolling in Vision Insurance

Enrolling in vision insurance is a straightforward process, and there are several avenues you can explore:

Through Your Employer

Many employers offer vision insurance as part of their benefits package. Check with your human resources department to see if such coverage is available. Enrolling through your employer often provides cost-effective options and may offer additional benefits, such as discounted rates or family coverage.

Individual Market

If your employer doesn’t offer vision insurance or you’re self-employed, you can purchase a plan on the individual market. Compare different providers and plans to find one that suits your needs and budget. Consider using online marketplaces or insurance brokers to explore your options.

Medicaid and Medicare

Medicaid and Medicare, the government-run health insurance programs, may provide some level of vision coverage. Check with your state’s Medicaid program or Medicare to understand the specific vision benefits offered. While these programs might not cover all eye care needs, they can be a valuable resource for individuals with limited financial means.

Discount Programs

Discount vision programs, often referred to as vision discount plans, are an alternative to traditional insurance. These plans provide access to discounted eye care services and products without the need for insurance coverage. While they don’t provide the same level of financial protection as insurance, they can be a cost-effective option for individuals who anticipate minimal eye care needs.

Maximizing Your Vision Insurance Benefits

Once you’ve enrolled in a vision insurance plan, it’s essential to understand how to make the most of your benefits:

Understanding Your Plan

Familiarize yourself with the specifics of your vision insurance plan, including coverage limits, exclusions, and any waiting periods. This knowledge will help you make informed decisions about your eye care and avoid unexpected expenses.

Choosing an In-Network Provider

Whenever possible, choose an eye doctor or optical shop that is in-network with your vision insurance plan. This ensures that you receive the maximum coverage and avoid higher out-of-pocket costs. If you have a preferred provider who is not in-network, consider the financial implications and decide whether it’s worth the additional expense.

Using Your Benefits Wisely

Make the most of your vision insurance benefits by utilizing them as intended. Schedule regular eye exams, especially if you have a history of eye problems or wear corrective lenses. Take advantage of any discounts or allowances for prescription eyewear to ensure you have the most up-to-date and comfortable vision correction solutions.

Understanding Out-of-Pocket Costs

Be aware of any out-of-pocket costs associated with your vision insurance plan, such as copays, deductibles, or coinsurance. These costs can vary depending on the type of service or product, so it’s essential to clarify these expenses with your provider before receiving treatment or purchasing eyewear.

The Future of Vision Insurance

The vision insurance industry is evolving to meet the changing needs of individuals and the advancements in eye care technology. Here’s a glimpse into the future of vision insurance:

Integration with Telehealth

Telehealth services are increasingly being integrated into vision care, allowing individuals to consult with eye care professionals remotely. This development is expected to continue, offering greater convenience and accessibility for routine eye exams and follow-up appointments.

Enhanced Coverage for Specialty Care

As the field of ophthalmology advances, vision insurance plans are likely to expand their coverage for specialty care. This includes increased access to advanced treatments for retinal diseases, glaucoma, and other complex eye conditions. Such enhancements will ensure that individuals receive the latest and most effective treatments.

Focus on Preventative Care

Vision insurance providers are recognizing the importance of preventative eye care in maintaining overall health. Expect to see more emphasis on comprehensive eye exams and early detection of eye diseases, with plans offering incentives or reduced costs for regular check-ups.

Technology-Driven Solutions

Advancements in technology, such as artificial intelligence and digital eye-tracking systems, are revolutionizing eye care. Vision insurance plans are likely to incorporate these innovations, offering more precise diagnoses and personalized treatment plans. This shift towards technology-driven solutions will enhance the efficiency and accuracy of eye care services.

Partnerships with Eye Care Brands

Vision insurance companies are forming partnerships with leading eye care brands and manufacturers to provide exclusive discounts and benefits to their members. These partnerships will likely expand, offering a wider range of high-quality eyewear and contact lens options at discounted rates.

Conclusion

Vision insurance is an invaluable tool for maintaining optimal eye health and ensuring access to necessary eye care services. By understanding the benefits and selecting the right plan, individuals can take control of their visual well-being and enjoy the clarity and comfort that comes with healthy eyes. As the field of ophthalmology advances, vision insurance will continue to evolve, offering even more comprehensive coverage and innovative solutions to meet the diverse needs of individuals.

Can I enroll in vision insurance at any time of the year?

+Vision insurance enrollment typically follows the same guidelines as health insurance, with open enrollment periods occurring annually. However, some special enrollment periods may be available due to life events like losing other insurance coverage or moving to a new area. Check with your insurance provider for specific enrollment guidelines.

Are there any age restrictions for vision insurance coverage?

+Vision insurance coverage is available to individuals of all ages. Many plans cover children and seniors, recognizing the unique eye care needs of these populations. However, specific plan features and coverage may vary based on age, so it’s essential to review the plan details thoroughly.

How often should I schedule an eye exam with vision insurance coverage?

+The frequency of eye exams depends on your age, eye health, and any specific vision issues you may have. In general, adults should aim for an eye exam every one to two years, while children and individuals with certain eye conditions may require more frequent exams. Consult with your eye doctor to determine the appropriate schedule for your needs.