Good Dental Insurance Plans

Choosing the right dental insurance plan is crucial for maintaining optimal oral health and ensuring financial protection when it comes to dental care. With a myriad of options available, it can be challenging to navigate the complexities of dental insurance. In this comprehensive guide, we will delve into the key factors to consider, explore different types of plans, and provide valuable insights to help you make an informed decision.

Understanding Dental Insurance

Dental insurance is a type of health coverage specifically designed to offset the costs associated with dental procedures and treatments. It plays a vital role in promoting regular dental check-ups, preventative care, and necessary treatments, ultimately leading to improved oral health and overall well-being.

Unlike medical insurance, dental insurance often operates on a different structure. It typically follows a percentage-based reimbursement model, where the insurance company covers a certain percentage of the treatment cost, while the policyholder is responsible for the remaining amount. Understanding this reimbursement structure is essential when evaluating dental insurance plans.

Key Factors to Consider

When evaluating dental insurance plans, several critical factors come into play. Here are some key considerations to guide your decision-making process:

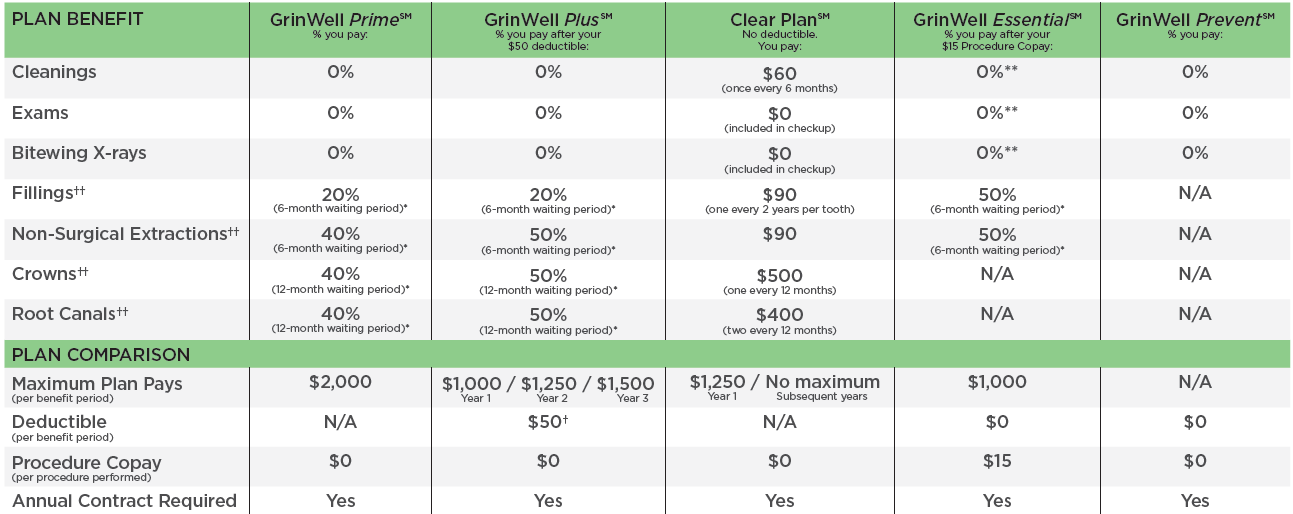

Coverage and Benefits

Examine the scope of coverage offered by the plan. Look for plans that provide comprehensive coverage for a wide range of dental services, including preventative care, basic procedures, and major treatments. Consider the percentage of coverage for each category, as this will impact your out-of-pocket expenses.

Additionally, assess the annual maximum benefit limits. This refers to the maximum amount the insurance company will reimburse for dental services within a calendar year. Choose a plan with a higher annual maximum to ensure adequate coverage for unexpected or extensive dental treatments.

| Plan Type | Annual Maximum Benefit |

|---|---|

| Basic Plan | $1,000 |

| Enhanced Plan | $2,000 |

| Premium Plan | $5,000 |

Network of Providers

Dental insurance plans often operate within a network of preferred providers. It is crucial to consider the network’s size and accessibility. Ensure that the plan includes a sufficient number of dental professionals in your area, allowing you to choose from a variety of qualified dentists.

Evaluate the plan's network restrictions. Some plans may require you to visit in-network providers exclusively, while others offer more flexibility with out-of-network options. Consider your preference and the availability of preferred dentists when making your choice.

Premiums and Costs

Dental insurance plans come with varying premium costs. Evaluate the monthly or annual premiums associated with each plan. Remember that lower premiums may indicate a more restrictive plan with limited coverage and benefits.

Consider your budget and assess the value proposition of each plan. While it is tempting to opt for the lowest-cost plan, ensure that it aligns with your dental care needs and provides adequate coverage for the procedures you anticipate requiring.

Deductibles and Co-Pays

Deductibles and co-pays are additional costs you may incur when utilizing your dental insurance plan. Deductibles represent the amount you must pay out of pocket before the insurance coverage kicks in, while co-pays are the fixed amounts you pay for each dental visit or procedure.

Evaluate the deductibles and co-pays associated with each plan. Compare these costs across different plans to determine which option offers the most favorable financial arrangement for your specific dental care requirements.

Types of Dental Insurance Plans

Dental insurance plans can be categorized into several types, each with its own set of features and benefits. Understanding the different plan types will help you make an informed choice based on your individual needs.

Indemnity Plans

Indemnity plans, also known as fee-for-service plans, offer the most flexibility in terms of provider choice. With this type of plan, you can visit any licensed dentist, whether in-network or out-of-network. The insurance company will reimburse you based on a predetermined fee schedule.

While indemnity plans provide freedom of choice, they may come with higher premiums and out-of-pocket costs. It is essential to carefully assess your dental needs and budget before opting for an indemnity plan.

Preferred Provider Organization (PPO) Plans

PPO plans offer a balance between flexibility and cost-effectiveness. These plans have a network of preferred providers, and you have the option to visit either in-network or out-of-network dentists.

With PPO plans, you typically receive higher reimbursement rates and lower out-of-pocket costs when utilizing in-network providers. However, you still have the flexibility to visit out-of-network dentists if needed, although at a slightly reduced reimbursement rate.

Health Maintenance Organization (HMO) Plans

HMO plans operate within a network of contracted dentists. These plans typically have lower premiums and out-of-pocket costs compared to other plan types. However, the trade-off is a more restricted network of providers.

With an HMO plan, you must choose a primary dentist within the network and obtain referrals for specialty treatments. While HMO plans may be more affordable, they may not offer the same level of flexibility in terms of provider choice.

Discount Dental Plans

Discount dental plans, also known as dental savings plans, are an alternative to traditional insurance plans. These plans offer discounted rates on dental services through a network of participating dentists.

Discount dental plans do not provide insurance coverage or reimbursement. Instead, they offer predetermined discounts on various dental procedures. While these plans may be suitable for those seeking affordable dental care, they may not cover all necessary treatments or provide comprehensive coverage.

Selecting the Right Plan

Choosing the right dental insurance plan requires a thoughtful evaluation of your unique needs and circumstances. Consider the following steps to make an informed decision:

- Assess your dental health status and the type of dental care you anticipate requiring in the near future.

- Determine your budget and the level of coverage you can afford.

- Evaluate the network of providers and ensure they align with your preferences and geographical location.

- Compare plans based on coverage, benefits, premiums, deductibles, and co-pays.

- Read the plan details and exclusions carefully to understand what is and isn't covered.

- Consider the flexibility and restrictions associated with each plan type.

- Seek advice from dental professionals or insurance brokers who can provide expert guidance.

Remember, the right dental insurance plan should offer adequate coverage, fit within your budget, and align with your dental care needs. It is essential to thoroughly research and compare options to make an informed choice.

Conclusion

Dental insurance plays a vital role in maintaining optimal oral health and financial well-being. By understanding the key factors to consider, evaluating different plan types, and following a structured decision-making process, you can select a dental insurance plan that best suits your needs. Remember to regularly review and reassess your plan to ensure it continues to meet your changing dental care requirements.

How do I know if a dental insurance plan is right for me?

+Evaluating a dental insurance plan’s suitability involves assessing your dental health needs, budget, and preferences. Consider the coverage, benefits, and cost of the plan, ensuring it aligns with your anticipated dental care requirements.

Can I use my dental insurance plan outside of my network?

+It depends on the type of plan you have. Some plans, like indemnity plans, offer flexibility and allow you to visit out-of-network dentists. However, PPO and HMO plans may have restrictions and lower reimbursement rates for out-of-network providers.

What happens if I exceed my annual maximum benefit limit?

+If you exceed the annual maximum benefit limit, you will be responsible for paying the full cost of any additional dental treatments out of pocket. It is essential to choose a plan with an adequate annual maximum to avoid unexpected expenses.