Health Insurance California Quote

In the bustling state of California, the health insurance landscape is as diverse as its population. From the sunny beaches of Los Angeles to the bustling streets of San Francisco, residents seek affordable and comprehensive healthcare coverage. Understanding the intricacies of health insurance quotes in California is essential for individuals and families aiming to secure adequate medical protection.

Navigating the California Health Insurance Market

California boasts one of the largest and most diverse health insurance markets in the nation. With a wide range of providers and plans available, finding the right coverage can be both an opportunity and a challenge. This comprehensive guide aims to unravel the complexities of health insurance quotes in the Golden State, empowering residents to make informed decisions about their healthcare.

The Importance of Personalized Quotes

When it comes to health insurance, a one-size-fits-all approach rarely suffices. Each individual or family has unique healthcare needs, and understanding these needs is crucial for obtaining accurate quotes. Factors such as age, gender, location, and medical history significantly influence the cost and coverage of health insurance plans. Obtaining personalized quotes ensures that Californians receive tailored recommendations, helping them secure the best value for their healthcare investment.

Understanding Health Insurance Plans

California offers a multitude of health insurance plans, each with its own set of features and benefits. Here’s a breakdown of some common plan types:

- PPO (Preferred Provider Organization): PPO plans provide flexibility, allowing individuals to choose their healthcare providers without a referral. They often have a network of preferred providers, offering discounted rates.

- HMO (Health Maintenance Organization): HMOs typically require members to select a primary care physician and obtain referrals for specialist care. While they may have more limited provider networks, HMO plans are often more cost-effective.

- EPO (Exclusive Provider Organization): EPO plans are similar to PPOs but with a more restricted network of providers. They offer lower premiums but require members to stay within the network for coverage.

- POS (Point of Service): POS plans combine elements of both PPOs and HMOs. Members can choose between in-network and out-of-network providers, but costs may vary depending on their choice.

The right plan type depends on individual preferences and healthcare needs. Understanding the differences between these plans is essential for making an informed decision.

Factors Influencing Health Insurance Quotes

Several key factors impact the cost and availability of health insurance quotes in California:

- Age: Younger individuals generally receive lower premiums, while older adults may face higher costs due to increased healthcare needs.

- Tobacco Use: Smokers and tobacco users often pay higher premiums, as their health risks are considered higher.

- Location: Health insurance rates can vary significantly between different regions of California. Urban areas may have higher costs due to the concentration of healthcare facilities.

- Medical History: Pre-existing conditions and past medical treatments can impact insurance quotes. Some plans offer coverage for pre-existing conditions, while others may have waiting periods or exclusions.

- Family Size: Health insurance quotes for families consider the number of dependents and their ages. Family plans often provide cost-effective coverage for multiple individuals.

Being aware of these factors and how they influence quotes is crucial for Californians seeking affordable and comprehensive healthcare coverage.

The Role of Technology in Health Insurance Quotes

In today’s digital age, technology has revolutionized the way Californians access health insurance quotes. Online platforms and comparison tools have made it easier than ever to compare plans, providers, and prices. These digital resources offer a convenient and efficient way to explore various options, empowering individuals to make informed choices.

Online Health Insurance Portals

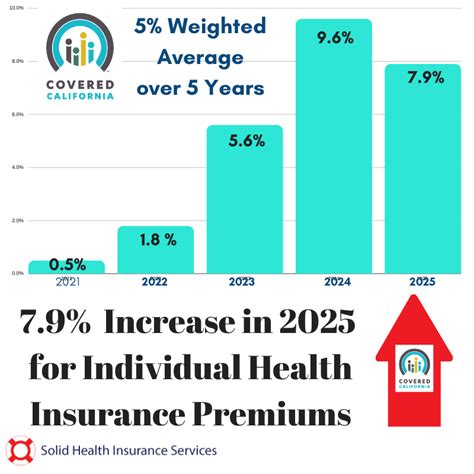

Numerous online platforms and websites specialize in providing health insurance quotes. These portals allow users to input their personal information and preferences, generating a list of tailored plan options. Some popular platforms include eHealthInsurance, HealthCare.gov, and Covered California, the state’s official marketplace.

These portals often provide detailed plan summaries, highlighting key features such as deductibles, copays, and provider networks. Users can compare multiple plans side by side, ensuring they make the best decision for their healthcare needs.

Mobile Apps for Health Insurance Quotes

For those on the go, mobile apps offer a convenient way to access health insurance quotes. Several reputable insurance providers and comparison platforms have developed user-friendly apps, making it possible to obtain quotes and manage healthcare plans from the palm of your hand.

These apps often provide additional features, such as secure storage of insurance cards, claim tracking, and access to a network of preferred providers. They can be a valuable tool for staying organized and informed about your health insurance coverage.

Comparing Quotes and Making Informed Decisions

When comparing health insurance quotes, it’s essential to look beyond the premium costs. Consider the following factors to make an informed decision:

- Deductibles and Out-of-Pocket Costs: Understand the annual deductibles and any additional out-of-pocket expenses, such as copays and coinsurance.

- Provider Networks: Ensure that your preferred healthcare providers are included in the plan’s network. Out-of-network care can be costly.

- Coverage Limits: Review the plan’s coverage limits for various services, including prescription drugs, mental health care, and specialty treatments.

- Additional Benefits: Some plans offer extra benefits, such as vision or dental coverage, which can be valuable additions to your healthcare package.

By thoroughly evaluating these aspects, Californians can select a health insurance plan that aligns with their healthcare needs and budget.

The Future of Health Insurance in California

The health insurance landscape in California is continually evolving, driven by technological advancements, policy changes, and the state’s commitment to accessible healthcare. As the population’s needs and preferences shift, so too will the insurance market, offering innovative solutions to meet these demands.

Telehealth and Virtual Care

The rise of telehealth services has transformed the way Californians access healthcare. Virtual appointments and remote monitoring have become increasingly popular, especially in light of recent global health challenges. As technology advances, telehealth is expected to play a more integral role in health insurance plans, offering convenient and cost-effective care options.

Focus on Preventive Care

California is known for its emphasis on preventive care, aiming to keep residents healthy and reduce the need for costly treatments. Many health insurance plans in the state already offer incentives and discounts for preventive services, such as annual check-ups, immunizations, and screenings. This trend is likely to continue, with a growing focus on wellness and early intervention.

Integration of Wearable Technology

Wearable technology, such as fitness trackers and health monitoring devices, has the potential to revolutionize healthcare. In the future, health insurance plans may increasingly integrate these devices, offering incentives for individuals who actively monitor and improve their health. This could lead to personalized insurance plans based on individual health data, promoting a proactive approach to wellness.

Frequently Asked Questions

How do I know if I’m eligible for government-subsidized health insurance in California?

+

Eligibility for government-subsidized health insurance, such as Medicaid or Covered California, depends on various factors, including income, family size, and citizenship status. You can visit Covered California’s website or consult with a healthcare navigator to determine your eligibility and explore available options.

Are there any discounts or incentives available for purchasing health insurance in California?

+

Yes, California offers various discounts and incentives to encourage residents to purchase health insurance. These may include premium tax credits, cost-sharing reductions, and enrollment incentives. It’s recommended to research these options and apply for any benefits you may be eligible for.

What happens if I don’t have health insurance in California?

+

In California, individuals without health insurance may face penalties, known as the Individual Mandate Penalty. Additionally, lacking insurance can result in significant financial burdens if unexpected medical emergencies arise. It’s important to explore available options and obtain coverage to avoid these consequences.

Can I switch health insurance plans during the year in California?

+

In California, you can switch health insurance plans outside of the annual Open Enrollment period if you experience a Qualifying Life Event (QLE). Examples of QLEs include marriage, divorce, birth or adoption of a child, or loss of existing coverage. You can explore your options and make changes accordingly.

How can I find a reputable health insurance provider in California?

+

To find a reputable health insurance provider in California, consider researching and comparing multiple providers based on their reputation, customer reviews, financial stability, and coverage options. You can utilize online resources, consult with healthcare professionals, and seek recommendations from trusted sources to make an informed choice.