Health Insurance Cigna

In the vast landscape of health insurance providers, Cigna stands as a prominent player, offering a comprehensive suite of healthcare coverage options. With a rich history spanning decades, Cigna has evolved to meet the diverse needs of individuals, families, and businesses, making it a trusted name in the industry. This article aims to delve into the world of Cigna health insurance, exploring its key features, benefits, and the impact it has on policyholders' well-being.

A Journey into Cigna’s Healthcare Ecosystem

Cigna’s journey began over a century ago, with a commitment to providing accessible and affordable healthcare solutions. Today, the company has grown into a global health service company, serving millions of customers across the United States and various international markets. Its comprehensive approach to healthcare coverage sets it apart, offering a range of plans designed to cater to different lifestyles, budgets, and health requirements.

Cigna’s Plan Options: A Spectrum of Coverage

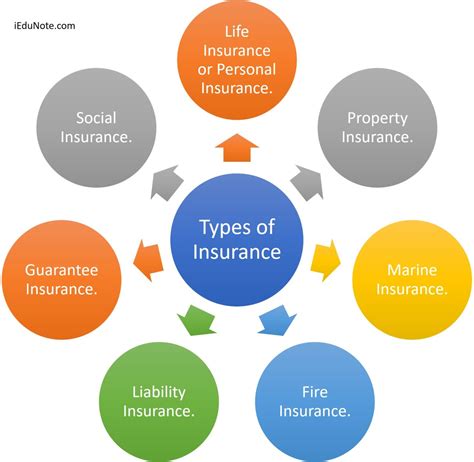

Cigna understands that one-size-fits-all approaches to health insurance are impractical. Thus, they have crafted a diverse portfolio of plans to suit various needs. From individual health insurance plans tailored to personal healthcare requirements to family health insurance options that offer comprehensive coverage for entire households, Cigna ensures no one is left out.

For businesses, Cigna provides group health insurance plans, which offer cost-effective solutions while promoting employee well-being. These plans can be customized to align with the unique needs of each organization, ensuring a healthy and productive workforce.

Additionally, Cigna recognizes the importance of specialized care. Their Medicare plans cater specifically to seniors and individuals with disabilities, providing the extra layer of support needed during these stages of life. Furthermore, dental and vision insurance plans ensure that policyholders' oral and visual health are not overlooked, completing the comprehensive healthcare package.

| Plan Category | Key Features |

|---|---|

| Individual Health Insurance | Tailored coverage for individuals, including preventive care and specialist access. |

| Family Health Insurance | Comprehensive plans covering entire families, with options for customizable benefits. |

| Group Health Insurance | Cost-effective solutions for businesses, promoting employee health and productivity. |

| Medicare Plans | Specialized coverage for seniors and individuals with disabilities, offering enhanced benefits. |

| Dental and Vision Insurance | Plans focusing on oral and visual health, ensuring comprehensive healthcare. |

The Benefits of Choosing Cigna

Cigna’s commitment to its policyholders goes beyond providing insurance coverage. The company is dedicated to promoting overall well-being, offering a range of benefits that extend beyond traditional healthcare.

One of the standout features of Cigna's plans is the access to a vast network of healthcare providers. With a comprehensive network, policyholders can choose from a wide range of doctors, specialists, and hospitals, ensuring they receive the best possible care. This network extends across the nation, providing convenience and peace of mind.

Cigna also prioritizes preventive care. Their plans often include coverage for annual check-ups, vaccinations, and screening tests, encouraging policyholders to take a proactive approach to their health. By focusing on prevention, Cigna aims to reduce the incidence of serious health issues and promote a healthier population.

Furthermore, Cigna understands the financial burden that unexpected medical expenses can impose. As such, their plans often include cost-saving features like discounted rates for certain services, out-of-pocket maximums, and flexible payment options. These features help policyholders manage their healthcare costs effectively.

Cigna’s Impact on Policyholders’ Lives

Cigna’s health insurance plans have a profound impact on the lives of its policyholders. By providing comprehensive coverage, Cigna ensures that individuals and families can access the healthcare they need without financial strain. This peace of mind allows policyholders to focus on their well-being and overall quality of life.

For businesses, Cigna's group health insurance plans foster a culture of health and wellness within the workplace. Employees can access the care they need, leading to improved productivity and morale. Moreover, Cigna's focus on preventive care can help reduce absenteeism and promote a healthier, more engaged workforce.

Real-Life Success Stories

Cigna’s impact is best illustrated through the stories of its policyholders. Take, for instance, the story of Sarah, a young professional with Cigna’s individual health insurance plan. After a minor accident, Sarah required specialized care and physical therapy. With Cigna’s coverage, she was able to access the necessary treatments without worrying about the financial burden. This allowed her to focus on her recovery and get back to her active lifestyle.

On the other hand, John, a small business owner, chose Cigna's group health insurance plan for his employees. Not only did this plan provide comprehensive coverage, but it also offered discounts on wellness programs and stress management resources. John's employees appreciated the benefits, leading to a happier and more productive workplace.

These stories highlight how Cigna's health insurance plans make a tangible difference in people's lives, providing the support and coverage needed to navigate the complexities of healthcare.

The Future of Cigna’s Health Insurance

As the healthcare landscape continues to evolve, Cigna remains committed to innovation and adaptability. The company is continually researching and developing new strategies to enhance its health insurance offerings, ensuring they remain relevant and beneficial to policyholders.

Cigna's future initiatives include a focus on digital health solutions. The company is investing in telemedicine and virtual healthcare services, providing policyholders with convenient access to medical advice and treatment from the comfort of their homes. This not only improves accessibility but also reduces costs and waiting times.

Additionally, Cigna is exploring partnerships with leading healthcare providers and technology companies to enhance its network of services. By collaborating with experts in various fields, Cigna aims to offer its policyholders the best possible care, ensuring they receive the latest advancements in healthcare.

Conclusion

Cigna’s health insurance plans are more than just coverage; they are a commitment to the well-being of individuals, families, and businesses. With a diverse range of plans, comprehensive benefits, and a focus on preventive care, Cigna is dedicated to making healthcare accessible and affordable. As the company continues to innovate and adapt, its impact on the healthcare industry and the lives of its policyholders is set to grow, making it a trusted partner in health and wellness.

How do I choose the right Cigna health insurance plan for my needs?

+Choosing the right Cigna plan depends on your specific needs. Consider factors like your health status, the number of people covered, and your budget. Cigna offers a range of plans, including individual, family, and group options, each with customizable benefits. Review the plan details, compare coverage, and consult with a Cigna representative to find the best fit.

What is included in Cigna’s preventive care coverage?

+Cigna’s preventive care coverage typically includes annual check-ups, vaccinations, screening tests, and wellness programs. These services are designed to promote early detection and prevention of health issues. The specific services covered may vary depending on the plan chosen, so it’s important to review the plan details to understand the extent of coverage.

How can I access Cigna’s network of healthcare providers?

+Cigna provides its policyholders with access to a vast network of healthcare providers, including doctors, specialists, and hospitals. You can find in-network providers by using Cigna’s online provider search tool or by contacting Cigna’s customer service. Choosing in-network providers can result in lower out-of-pocket costs and ensure a smoother claims process.