Health Insurance Individual Plan

In today's dynamic healthcare landscape, understanding your insurance options is crucial. This comprehensive guide will delve into the intricacies of individual health insurance plans, offering a detailed breakdown of what they entail, their benefits, and how they can provide peace of mind for your healthcare needs.

Unveiling the Individual Health Insurance Plan

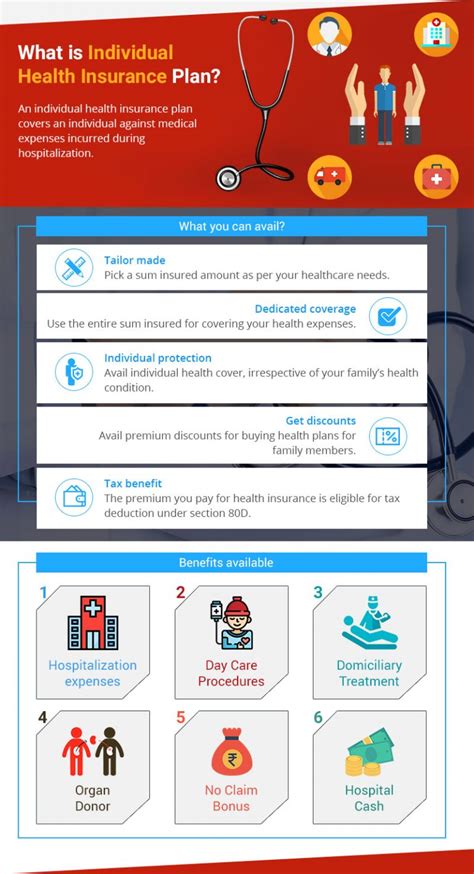

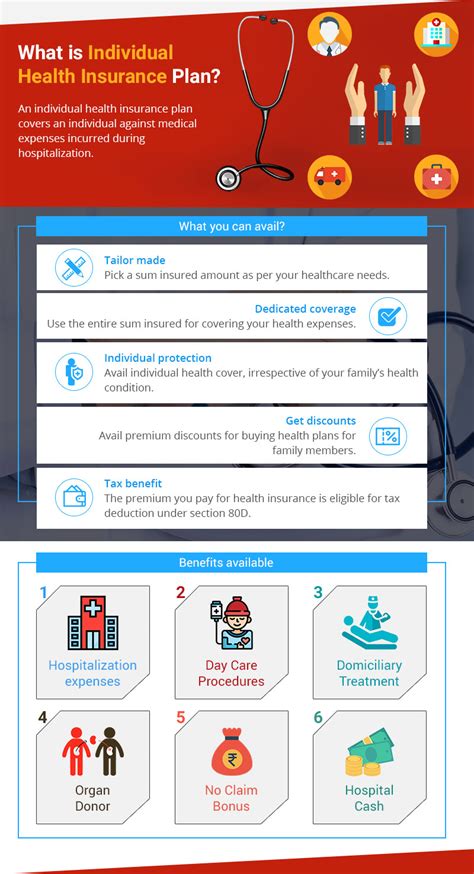

An individual health insurance plan is a personalized policy designed for people who are not covered under a group plan, such as those offered by employers. It's tailored to meet the unique needs of an individual, providing coverage for medical expenses and often offering additional benefits.

These plans play a vital role in ensuring that individuals and their families have access to necessary medical care, without the financial burden of paying out-of-pocket for expensive treatments or procedures. With a range of options available, it's essential to understand the specifics of these plans to make an informed decision.

Key Features and Benefits

Individual health insurance plans offer a myriad of features that cater to diverse healthcare requirements. Here's an overview of some of the key benefits:

- Comprehensive Coverage: These plans typically cover a wide range of medical services, including doctor visits, hospital stays, prescription medications, and often preventive care. Some even offer coverage for mental health services and substance abuse treatment.

- Customizable Options: Insurers provide various plan types, allowing individuals to choose coverage that suits their specific needs and budget. This flexibility ensures that everyone can find a plan that aligns with their healthcare priorities.

- Pre-Existing Condition Coverage: A significant advantage of individual plans is that they cannot discriminate based on pre-existing conditions. This means that regardless of your health history, you have the right to purchase a plan and receive coverage for your condition.

- Portability: Unlike group plans that are tied to employment, individual plans are portable. This means you can keep your coverage even if you change jobs, get married, or move to a different state.

- Tax Benefits: Depending on your income and family size, you might be eligible for tax credits and subsidies to help offset the cost of your premium. These credits can significantly reduce your monthly payments, making healthcare more affordable.

Understanding Plan Types

Individual health insurance plans come in various types, each with its own set of characteristics and coverage options. The two primary types are:

Managed Care Plans

Managed care plans are designed to control healthcare costs while ensuring quality care. They typically involve a network of healthcare providers, and members must choose a primary care physician (PCP) who coordinates their care. There are two main subtypes of managed care plans:

- Health Maintenance Organizations (HMOs): HMOs require members to select a PCP within their network. Referrals are typically needed to see specialists, and services outside the network are often not covered. HMOs generally have lower out-of-pocket costs but may limit your choice of providers.

- Preferred Provider Organizations (PPOs): PPOs offer more flexibility than HMOs. Members can choose any in-network provider without a referral, but out-of-network services are also covered, albeit at a higher cost. PPOs provide a broader range of provider choices but may have higher out-of-pocket expenses.

Fee-for-Service Plans

Fee-for-service plans, also known as indemnity plans, offer the most flexibility in terms of provider choice. Members can visit any doctor or hospital they wish, without needing referrals or pre-authorizations. However, this freedom often comes with higher out-of-pocket costs.

These plans typically involve a deductible, which is the amount you pay out-of-pocket before your insurance kicks in. After meeting the deductible, the plan covers a percentage of your medical expenses, while you pay the rest.

| Plan Type | Key Features |

|---|---|

| Managed Care Plans | Network of providers, coordinated care, lower out-of-pocket costs |

| HMOs | Primary care physician, referrals needed, limited provider choice |

| PPOs | Flexibility in provider choice, higher out-of-pocket costs |

| Fee-for-Service Plans | Flexibility in provider choice, higher out-of-pocket costs, deductible and coinsurance |

Cost and Coverage Considerations

When selecting an individual health insurance plan, it's crucial to consider the balance between cost and coverage. Here are some factors to keep in mind:

- Premium: This is the amount you pay monthly to maintain your coverage. Premiums can vary based on factors like age, location, and the type of plan you choose.

- Deductible: The deductible is the amount you pay out-of-pocket before your insurance starts covering costs. Higher deductibles often mean lower premiums, and vice versa.

- Coinsurance: After meeting your deductible, you may still be responsible for a percentage of the cost of covered services. This is known as coinsurance. For instance, if your plan has an 80/20 coinsurance, you pay 20% of the cost, and your insurance covers the remaining 80%.

- Out-of-Pocket Maximum: This is the maximum amount you'll pay in a year for covered services. Once you reach this limit, your insurance covers 100% of the cost for covered services for the rest of the year.

Choosing the Right Plan

Selecting the right individual health insurance plan involves careful consideration of your healthcare needs and financial situation. Here's a step-by-step guide to help you make an informed decision:

- Assess Your Healthcare Needs: Consider your current and potential future healthcare requirements. Do you have any ongoing medical conditions? Do you anticipate needing specialized care? Understanding your needs will help you choose a plan with appropriate coverage.

- Compare Plans: Research and compare different plan options. Look at the coverage details, including what's included and excluded. Consider the network of providers and whether your preferred doctors and hospitals are in-network.

- Evaluate Costs: Compare the premiums, deductibles, and out-of-pocket maximums for each plan. Remember that a plan with a lower premium might have a higher deductible, so consider your ability to pay out-of-pocket costs.

- Check for Subsidies: If your income qualifies, you may be eligible for tax credits or subsidies to reduce your premium costs. Check the government's healthcare marketplace to see if you're eligible for these benefits.

- Read the Fine Print: Carefully review the plan's summary of benefits and coverage. This document outlines what's covered, any limitations or exclusions, and the process for filing claims. Understanding these details can prevent surprises down the line.

Navigating the Application Process

The application process for individual health insurance plans can vary depending on the insurer and the state you reside in. However, there are some common steps involved:

- Gather Necessary Information: Before starting your application, ensure you have all the required documents and information. This typically includes your personal details, income information, and details about any existing health conditions.

- Choose Your Plan: Select the plan that best suits your needs and budget. Consider the coverage, network of providers, and any additional benefits offered.

- Complete the Application: Fill out the application form accurately and completely. Be sure to provide all the required details and documentation.

- Wait for Approval: Once you've submitted your application, the insurer will review it. This process can take a few days to a few weeks, depending on the insurer and the complexity of your application.

- Pay Your Premium: If your application is approved, you'll receive information about your coverage and how to pay your premium. It's important to make timely payments to ensure your coverage remains active.

Understanding Your Coverage

Once you've selected and enrolled in an individual health insurance plan, it's crucial to understand your coverage and how to utilize it effectively. Here's a breakdown of what you need to know:

Understanding Your Policy

Your insurance policy is a contract between you and the insurer. It outlines your rights and responsibilities, as well as the benefits and limitations of your coverage. Here are some key terms to familiarize yourself with:

- Policy Number: This unique identifier is used for all communications and transactions with your insurer. Keep it handy and share it when filing claims or making inquiries.

- Coverage Period: Your policy will specify the dates it's in effect. Most policies are for a year, but some may have shorter or longer coverage periods.

- Benefit Schedule: This document outlines the specific benefits and services covered by your plan. It details the amount or percentage of costs covered for different services, as well as any exclusions or limitations.

- Exclusions and Limitations: These are services or conditions that are not covered by your plan. It's essential to review these carefully to understand what's not included in your coverage.

Using Your Coverage

Understanding how to use your coverage effectively can help you maximize the benefits of your individual health insurance plan. Here are some tips:

- Choose In-Network Providers: If you have a managed care plan, using in-network providers can save you money. These providers have negotiated rates with your insurer, so services are typically covered at a lower cost.

- Understand Your Copayments: Copayments, or copays, are fixed amounts you pay for covered services. For instance, you might have a $20 copay for a doctor's visit. Knowing these amounts can help you budget for healthcare expenses.

- File Claims: If you receive services that aren't automatically billed to your insurer, you'll need to file a claim to be reimbursed. This typically involves filling out a claim form and providing receipts or other documentation.

- Appeal Denied Claims: If a claim is denied, you have the right to appeal. The appeals process varies by insurer, but typically involves submitting additional information or documentation to support your claim.

Maximizing Your Benefits

Individual health insurance plans offer a range of benefits beyond basic medical coverage. Here's how you can make the most of these additional perks:

Preventive Care

Many individual health insurance plans cover preventive care services, such as annual check-ups, screenings, and immunizations, at no cost to you. Taking advantage of these services can help catch potential health issues early, when they're often more treatable.

Wellness Programs

Some insurers offer wellness programs designed to promote healthy lifestyles. These programs may provide discounts on gym memberships, weight loss programs, or smoking cessation aids. Participating in these programs can not only improve your health but also potentially lower your insurance costs.

Telehealth Services

Telehealth services allow you to connect with healthcare providers remotely, often through video calls or phone consultations. Many individual health insurance plans cover telehealth services, making it more convenient and affordable to access medical advice and treatment.

Chronic Condition Management

If you have a chronic condition, your insurance plan may offer special programs to help manage your condition. These programs can provide additional support, resources, and guidance to help you better manage your health.

Frequently Asked Questions

What is the difference between an individual health insurance plan and a group plan?

+Individual plans are designed for people who are not covered under a group plan, such as those offered by employers. They are personalized to meet the unique needs of an individual, while group plans are often standardized and offer limited customization.

Are individual health insurance plans more expensive than group plans?

+The cost of an individual plan can vary widely based on factors like age, location, and the type of plan chosen. While group plans may offer some advantages in terms of cost, individual plans provide flexibility and the ability to choose a plan that best suits your needs.

Can I switch my individual health insurance plan during the year?

+In most cases, you can only switch your individual plan during the open enrollment period, which typically occurs once a year. However, if you experience a qualifying life event, such as a move, job loss, or marriage, you may be eligible for a special enrollment period.

What happens if I miss a premium payment for my individual health insurance plan?

+If you miss a premium payment, your coverage may be canceled. It's important to ensure timely payments to maintain uninterrupted coverage. If you're facing financial difficulties, contact your insurer to discuss potential options.

In conclusion, individual health insurance plans offer a personalized and flexible approach to healthcare coverage. By understanding the various plan types, coverage options, and cost considerations, you can make an informed decision that meets your unique needs. Remember, healthcare is a vital aspect of your well-being, and having the right insurance plan can provide peace of mind and access to quality care when you need it most.