Health Insurance Las Vegas

Welcome to this in-depth exploration of health insurance options in the vibrant city of Las Vegas. In this comprehensive guide, we will delve into the unique healthcare landscape of this dynamic metropolis, providing you with valuable insights, expert advice, and actionable tips to navigate the world of health insurance with confidence.

Unveiling the Health Insurance Scene in Las Vegas

Las Vegas, known for its dazzling nightlife and entertainment, also boasts a diverse and robust healthcare system. With a population of over 2 million, the city offers a wide range of insurance plans to cater to its residents’ varying needs. From comprehensive coverage to specialized policies, understanding the options is key to making informed decisions.

The Importance of Health Insurance in Las Vegas

In a city where residents and visitors alike enjoy an active lifestyle, the importance of health insurance cannot be overstated. Whether it’s seeking medical attention after a hiking adventure in Red Rock Canyon or accessing specialized care for unique health conditions, having the right insurance plan ensures financial protection and peace of mind.

Let's dive into the key aspects of health insurance in Las Vegas, exploring the plans, providers, and considerations that make this city's healthcare scene unique.

Understanding Las Vegas Health Insurance Plans

Health insurance plans in Las Vegas come in various forms, each designed to cater to different demographics and needs. Here’s an overview of the most common types of plans available:

Individual and Family Plans

These plans are tailored for individuals and families, offering flexible coverage options. Whether you’re a solo adventurer or a growing family, individual and family plans provide customizable benefits to suit your specific healthcare requirements. With a range of deductibles, copays, and coverage limits, you can find a plan that aligns with your budget and health needs.

Employer-Sponsored Group Plans

Many residents of Las Vegas benefit from employer-sponsored health insurance plans. These group plans offer comprehensive coverage at a reduced cost, as the employer often contributes to the premium. Group plans typically include a variety of benefits, such as dental, vision, and prescription drug coverage, making them an attractive option for employees.

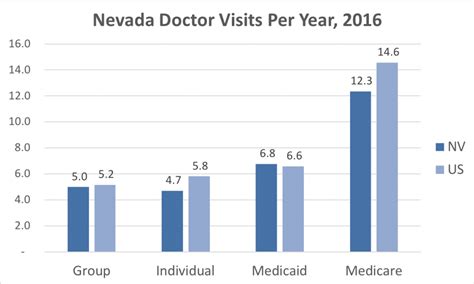

Medicare and Medicaid Options

For seniors and individuals with low incomes, Medicare and Medicaid play a crucial role in Las Vegas’ healthcare system. Medicare, a federal program, provides health coverage for seniors aged 65 and older, while Medicaid assists low-income individuals and families. Understanding the eligibility criteria and benefits of these programs is essential for those seeking affordable healthcare options.

| Plan Type | Key Features |

|---|---|

| Individual/Family Plans | Customizable coverage, flexible deductibles, copays, and limits |

| Employer-Sponsored Group Plans | Reduced premiums, comprehensive benefits, including dental and vision |

| Medicare | Federal health coverage for seniors, including Part A (hospital insurance) and Part B (medical insurance) |

| Medicaid | Assists low-income individuals and families, covering essential medical services |

Key Considerations for Choosing Health Insurance in Las Vegas

When selecting a health insurance plan in Las Vegas, several factors come into play. Here are some key considerations to keep in mind:

Network of Providers

Health insurance plans often have networks of preferred providers, including hospitals, clinics, and specialists. It’s essential to ensure that your chosen plan includes a network of providers that aligns with your healthcare needs. Whether you have a preferred hospital or a trusted specialist, verifying their inclusion in the plan’s network is crucial.

Coverage Limits and Out-of-Pocket Costs

Understanding the coverage limits and out-of-pocket costs of a plan is vital. Consider your anticipated healthcare expenses and choose a plan with suitable deductibles, copays, and maximum out-of-pocket expenses. Plans with lower deductibles may have higher premiums, so finding the right balance for your budget is key.

Specialized Coverage

Las Vegas’ diverse population often requires specialized coverage for unique health conditions. From mental health services to substance abuse treatment, ensure your plan offers the necessary coverage for your specific needs. Some plans may include additional benefits, such as wellness programs or alternative therapy coverage, which can further enhance your healthcare experience.

Prescription Drug Coverage

Prescription medications can be a significant expense, so it’s crucial to select a plan with comprehensive prescription drug coverage. Verify the plan’s formulary, which lists the covered medications and their associated costs. Plans with preferred drug lists (PDLs) may offer discounted rates for specific medications, helping you manage your prescription costs effectively.

Navigating the Las Vegas Health Insurance Market

With a vast array of health insurance options available, navigating the Las Vegas market can be overwhelming. Here are some tips to simplify the process:

Compare Plans

Utilize online comparison tools and insurance brokerages to evaluate different plans. Compare premiums, deductibles, coverage limits, and provider networks to find the plan that best suits your needs and budget. Don’t hesitate to reach out to insurance providers or brokers for personalized advice and recommendations.

Consider Your Healthcare Needs

Assess your current and anticipated healthcare needs. If you have ongoing medical conditions or require specialized treatments, ensure your plan covers these services adequately. For those with a history of chronic illnesses or injuries, plans with lower deductibles and comprehensive benefits may be more suitable.

Explore Employer Benefits

If you’re employed, take advantage of employer-sponsored group plans. These plans often offer competitive rates and comprehensive benefits. Understand the enrollment periods and eligibility criteria to ensure you don’t miss out on this valuable opportunity.

Seek Professional Advice

Health insurance can be complex, and it’s beneficial to seek guidance from professionals. Insurance brokers and financial advisors can provide personalized recommendations based on your specific circumstances. They can help you navigate the nuances of different plans and ensure you make an informed decision.

The Future of Health Insurance in Las Vegas

The healthcare landscape in Las Vegas is evolving, with new initiatives and innovations shaping the future of health insurance. Here’s a glimpse into what lies ahead:

Telehealth Services

Telehealth services have gained popularity, especially in the wake of the COVID-19 pandemic. Las Vegas is embracing this trend, with many insurance plans now covering virtual healthcare consultations. Telehealth offers convenient access to medical advice, reducing the need for in-person visits and providing efficient healthcare solutions.

Preventive Care Initiatives

Health insurance providers in Las Vegas are focusing on preventive care to promote overall wellness. Many plans now include coverage for preventive services, such as vaccinations, screenings, and wellness programs. By encouraging preventive care, insurance companies aim to reduce the burden of chronic diseases and improve the overall health of the community.

Personalized Medicine

The field of personalized medicine is gaining traction, and Las Vegas is no exception. Insurance plans are beginning to incorporate genetic testing and precision medicine into their coverage. This approach allows for tailored treatment plans based on an individual’s unique genetic makeup, leading to more effective and efficient healthcare.

Health Insurance Innovation

Las Vegas is a hub of innovation, and this spirit extends to the healthcare industry. Insurance providers are exploring new technologies and business models to enhance the customer experience. From digital health platforms to innovative payment models, the future of health insurance in Las Vegas promises increased accessibility, efficiency, and customization.

Conclusion

Health insurance in Las Vegas offers a wide range of options to cater to the diverse needs of its residents. By understanding the different plan types, key considerations, and future trends, you can make informed decisions to protect your health and financial well-being. Remember, the right health insurance plan is an investment in your future, providing security and peace of mind in the face of unexpected medical challenges.

FAQ

What is the average cost of health insurance in Las Vegas?

+The cost of health insurance in Las Vegas can vary significantly based on factors such as age, plan type, and coverage limits. On average, individuals can expect to pay between 300 to 800 per month for an individual plan, while family plans may range from 800 to 2,000 per month. It’s important to compare plans and consider your specific needs to find the most cost-effective option.

Are there any discounts or subsidies available for health insurance in Las Vegas?

+Yes, several discounts and subsidies are available to make health insurance more affordable. Low-income individuals and families may qualify for Medicaid or receive subsidies through the Affordable Care Act (ACA) marketplace. Additionally, some insurance providers offer discounts for healthy lifestyle choices, such as fitness tracking or participation in wellness programs.

Can I switch health insurance plans during the year in Las Vegas?

+In most cases, you can switch health insurance plans during the year in Las Vegas. However, it’s important to understand the open enrollment periods and any special enrollment periods that may apply. Open enrollment typically occurs annually, allowing you to review and change plans. Special enrollment periods may be available due to life events, such as marriage, divorce, or loss of other coverage.

What happens if I need emergency medical care while traveling outside of Las Vegas with my health insurance plan?

+Most health insurance plans in Las Vegas provide some level of coverage for emergency medical care while traveling. However, it’s crucial to review your plan’s details, including any out-of-network provisions and emergency travel benefits. Some plans may require pre-authorization for emergency care outside of your network, so it’s essential to understand your plan’s specific requirements.

How can I find a healthcare provider that accepts my health insurance plan in Las Vegas?

+Finding a healthcare provider that accepts your insurance plan is straightforward. Most insurance providers offer online directories or tools to search for in-network providers. You can also contact your insurance company’s customer service to verify which providers are included in your plan’s network. Additionally, many healthcare facilities and practices list the insurance plans they accept on their websites.