How Much Should Car Insurance Be

Car insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind for drivers. However, the cost of car insurance can vary significantly depending on various factors. Understanding these factors and knowing the average rates can help you determine how much you should expect to pay for car insurance. In this comprehensive guide, we will delve into the world of car insurance costs, exploring the key determinants, providing real-world examples, and offering insights to ensure you get the right coverage at a fair price.

Factors Influencing Car Insurance Costs

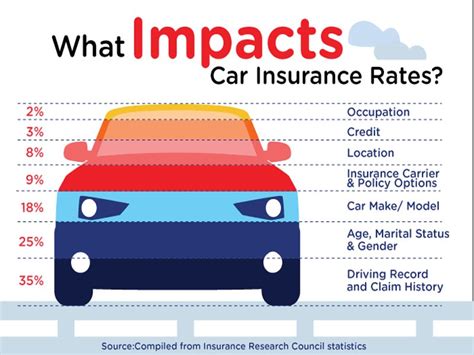

The price of car insurance is influenced by a multitude of factors, each playing a unique role in determining the overall premium. Let’s explore these factors and understand how they impact the cost of your policy.

Driver Profile and History

Your personal information and driving record are among the most critical factors that insurance companies consider. Age, gender, driving experience, and the number of years you’ve held a license all come into play. For instance, younger drivers, particularly those under 25, often face higher premiums due to their lack of experience on the road. Additionally, a clean driving record with no accidents or traffic violations can lead to more affordable rates, as it indicates a lower risk profile.

Here's a real-world example: Let's consider two drivers - Sarah, a 22-year-old with a clean driving record, and John, a 35-year-old with a history of speeding tickets. Despite their different ages, Sarah's premium might be lower than John's due to her pristine driving history, demonstrating a lower risk of claims.

Vehicle Type and Usage

The make, model, and age of your vehicle can significantly impact your insurance costs. Generally, newer and more expensive cars tend to attract higher premiums, as they are costlier to repair or replace. Additionally, the purpose for which you use your vehicle matters. If you primarily drive for personal use, your rates will likely be lower compared to those who use their vehicles for business purposes or as part of their occupation.

For instance, a sports car enthusiast who owns a high-performance vehicle might expect to pay a premium due to the vehicle's higher repair costs and potential for speeding-related incidents. On the other hand, a retiree using their car solely for leisure trips could enjoy more affordable rates.

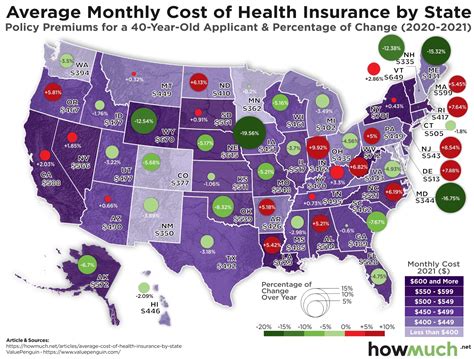

Location and Driving Conditions

Where you live and drive plays a crucial role in determining your insurance rates. Insurance companies consider factors like traffic density, crime rates, and weather conditions when setting premiums. Areas with higher rates of car theft or accidents will generally have higher insurance costs. Similarly, regions with harsh winters or frequent natural disasters may also see increased premiums due to the potential for weather-related claims.

Imagine comparing insurance rates in a rural town with low traffic and a low crime rate to those in a bustling city with heavy congestion and a higher incidence of car theft. The urban area would likely result in higher insurance premiums.

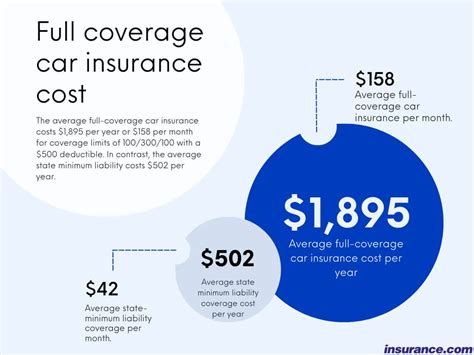

Coverage Options and Deductibles

The type and extent of coverage you choose directly impact your insurance costs. Comprehensive and collision coverage, which provide protection for your vehicle against various risks, can add to your premium. On the other hand, increasing your deductible, which is the amount you pay out of pocket before your insurance kicks in, can lower your premium. It’s a trade-off between upfront costs and potential future savings.

For example, if you opt for a higher deductible, say $1,000 instead of $500, you might see a reduction in your monthly premium, but you'll need to be prepared to pay a larger sum if you file a claim.

Claims History and Credit Score

Your insurance history and credit score are other factors that insurance companies consider. A history of multiple claims, even if not at fault, can signal a higher risk and lead to increased premiums. Additionally, a good credit score is often correlated with lower insurance costs, as it is seen as an indicator of financial responsibility.

Consider a driver with a history of frequent claims, even if they were not at fault. Their insurance provider might view them as a higher risk and adjust their premiums accordingly.

Average Car Insurance Costs and Real-World Examples

Now that we’ve explored the factors influencing car insurance costs, let’s take a look at some real-world examples and average rates to provide a clearer picture of what you might expect to pay.

| Driver Profile | Average Annual Premium |

|---|---|

| 25-year-old male with a clean record, driving a 2018 sedan for personal use in a suburban area | $1,200 |

| 30-year-old female with a minor speeding violation, driving a 2015 SUV for work in an urban area | $1,500 |

| 45-year-old male with a perfect driving record, driving a 2020 luxury sedan for business in a rural area | $1,800 |

| 60-year-old female with a history of minor accidents, driving a 2012 compact car for personal use in a high-crime area | $2,200 |

These examples illustrate how different driver profiles can lead to varying insurance costs. It's important to note that these are average estimates, and your actual premium could be higher or lower based on your unique circumstances.

Strategies to Lower Your Car Insurance Costs

While the cost of car insurance is influenced by numerous factors, there are strategies you can employ to potentially reduce your premiums and ensure you’re getting the best value for your money.

Shop Around and Compare Quotes

Insurance rates can vary significantly between providers, so it’s essential to shop around and compare quotes. Requesting quotes from multiple insurance companies allows you to identify the most competitive rates for your specific needs. Online quote comparison tools can be particularly useful for this purpose, providing a convenient way to assess different options.

Bundle Policies

If you have multiple insurance needs, such as home and auto insurance, consider bundling your policies with the same provider. Many insurance companies offer discounts when you combine multiple policies, as it simplifies their administrative processes and reduces the risk of policy cancellations.

Maintain a Good Driving Record

A clean driving record is one of the most effective ways to keep your insurance costs down. Avoid traffic violations and accidents, as they can lead to increased premiums or even policy cancellations. If you have a history of violations, consider taking defensive driving courses, which can help improve your driving skills and potentially reduce your insurance costs.

Choose a Higher Deductible

Opting for a higher deductible can result in lower premiums. While this means you’ll pay more out of pocket if you need to file a claim, it can be a worthwhile trade-off if you’re confident in your ability to manage unexpected expenses. Just ensure you choose a deductible amount that aligns with your financial capabilities.

Explore Discounts

Insurance companies often offer a variety of discounts to attract and retain customers. Common discounts include safe driver discounts, multi-policy discounts, good student discounts, and loyalty discounts for long-term customers. Ask your insurance provider about the discounts they offer and ensure you’re taking advantage of any that apply to you.

Understanding Your Car Insurance Policy

To ensure you’re getting the right coverage at a fair price, it’s crucial to understand your car insurance policy and the components that make it up. Here’s a breakdown of the key elements to help you navigate your policy.

Liability Coverage

Liability coverage is a fundamental component of car insurance, providing protection if you’re found at fault in an accident. It covers the costs associated with bodily injury and property damage caused to others. State laws typically set minimum liability requirements, but it’s often advisable to opt for higher limits to ensure adequate protection.

Collision and Comprehensive Coverage

Collision coverage pays for repairs or replacements if your vehicle is damaged in an accident, regardless of fault. Comprehensive coverage, on the other hand, covers damage caused by events other than collisions, such as theft, vandalism, natural disasters, or hitting an animal. While these coverages can add to your premium, they provide valuable protection for your vehicle.

Medical Payments and Personal Injury Protection

Medical payments coverage, also known as MedPay, covers medical expenses for you and your passengers if you’re involved in an accident, regardless of fault. Personal Injury Protection (PIP) is a similar coverage, but it may also include wage loss and other related expenses. These coverages can provide essential financial support in the event of an accident.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you if you’re involved in an accident with a driver who doesn’t have sufficient insurance coverage. It ensures you’re not left financially burdened if the at-fault driver is unable to cover the costs of the accident. This coverage is particularly important given the number of uninsured drivers on the road.

Additional Coverages and Add-ons

Depending on your needs and preferences, you may opt for additional coverages or add-ons to your policy. These can include rental car reimbursement, gap insurance, roadside assistance, or custom parts and equipment coverage. While these coverages may increase your premium, they provide added peace of mind and protection.

Future Trends and Considerations

As technology advances and the insurance industry evolves, several trends and considerations are shaping the future of car insurance.

Telematics and Usage-Based Insurance

Telematics and usage-based insurance are gaining traction, allowing insurance companies to track driving behavior and offer personalized premiums. With telematics, insurance providers can monitor driving habits, such as acceleration, braking, and mileage, to assess risk and adjust premiums accordingly. This approach can benefit safe drivers by rewarding them with lower rates.

Automated Vehicles and Insurance

The rise of automated vehicles is expected to have a significant impact on car insurance. As self-driving cars become more prevalent, the focus of insurance coverage may shift from driver liability to vehicle and system liability. This transition could lead to changes in how insurance premiums are calculated and who is held responsible in accidents involving automated vehicles.

Environmental Factors and Climate Change

Climate change and extreme weather events are increasingly influencing insurance rates. As natural disasters become more frequent and severe, insurance companies are adjusting their risk assessments and premiums accordingly. This trend is likely to continue, making it important for drivers to be aware of the potential impact on their insurance costs.

Digital Transformation and Insurtech

The insurance industry is undergoing a digital transformation, with the rise of Insurtech companies offering innovative solutions. These companies are leveraging technology to streamline processes, enhance customer experiences, and provide personalized insurance products. As this trend continues, drivers can expect more efficient and tailored insurance options.

How often should I review my car insurance policy?

+It’s advisable to review your car insurance policy annually or whenever your circumstances change significantly. This ensures you’re always getting the best coverage and value. Regular reviews can help you stay updated on any changes in your driving habits, vehicle usage, or personal circumstances that may impact your insurance needs.

Can I switch insurance providers to save money?

+Absolutely! Switching insurance providers is a common way to save money on car insurance. As mentioned earlier, insurance rates can vary significantly between companies, so shopping around for the best deal is always a good idea. However, ensure you thoroughly compare policies and understand the coverage details before making a switch.

What factors can I control to lower my car insurance costs?

+You have control over several factors that can impact your car insurance costs. Maintaining a clean driving record, choosing a higher deductible, and exploring discounts are some of the strategies you can employ. Additionally, regularly reviewing your coverage needs and ensuring you’re not over-insured or under-insured can help you optimize your policy and keep costs down.