Health Insurance Usa Cost

Understanding the cost of health insurance in the United States is crucial for individuals and families seeking comprehensive healthcare coverage. The complexity of the healthcare system, combined with varying insurance plans and policies, makes it essential to explore the factors influencing these costs. In this comprehensive guide, we delve into the intricacies of health insurance costs in the USA, shedding light on the key elements that impact premium prices and offering insights into effective strategies for managing these expenses.

The Dynamics of Health Insurance Costs in the USA

Health insurance costs in the United States are influenced by a myriad of factors, including individual characteristics, plan features, and broader healthcare market dynamics. These factors contribute to the overall complexity of determining the precise cost of health insurance for any given individual.

Individual Factors

When it comes to health insurance, the cost is personalized to an individual’s specific needs and circumstances. Key individual factors that impact insurance costs include:

- Age: Younger individuals generally pay lower premiums, as they are less likely to require extensive medical care. As individuals age, insurance costs tend to increase, reflecting the higher likelihood of health issues.

- Health Status: Pre-existing medical conditions or chronic illnesses can significantly influence insurance costs. Insurers often charge higher premiums for individuals with known health issues, as they are more likely to require frequent medical attention.

- Smoking Status: Smoking is a risk factor for various health conditions, and insurers often charge smokers higher premiums. This is due to the increased likelihood of smokers developing respiratory issues, cardiovascular diseases, and other health complications.

- Family Size: The size of an individual’s family can impact insurance costs. Family plans often provide coverage for multiple individuals, including children, which can lead to higher premiums.

- Location: The cost of living and the availability of healthcare services in a particular area can influence insurance costs. Regions with higher healthcare costs or limited provider networks may result in higher insurance premiums.

Plan Features and Coverage

The features and coverage options of a health insurance plan play a significant role in determining its cost. Here are some key considerations:

- Type of Plan: The type of insurance plan chosen can greatly affect costs. Popular plan types include Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs). Each plan type has different provider networks, coverage options, and cost structures.

- Deductibles and Copays: Plans with higher deductibles and copays often have lower monthly premiums. Conversely, plans with lower deductibles and copays tend to have higher monthly premiums. The choice between these options depends on an individual’s preference for immediate costs versus long-term financial protection.

- Prescription Drug Coverage: Prescription drug coverage is a critical component of health insurance plans. Plans that offer comprehensive prescription drug coverage typically have higher premiums, while those with limited or no drug coverage may have lower premiums.

- Out-of-Pocket Maximums: The out-of-pocket maximum is the maximum amount an individual will pay for covered services in a year. Plans with lower out-of-pocket maximums generally have higher premiums, providing greater financial protection for individuals with high healthcare needs.

- Provider Networks: The size and quality of a plan’s provider network can impact costs. Plans with narrower networks, which may include fewer doctors and hospitals, often have lower premiums. Conversely, plans with broader networks, offering more flexibility in choosing healthcare providers, typically have higher premiums.

Market Dynamics and Regulatory Influences

Beyond individual factors and plan features, broader market dynamics and regulatory influences play a significant role in shaping health insurance costs in the USA. These include:

- Healthcare Market Competition: The level of competition in the healthcare market can impact insurance costs. In markets with robust competition, insurers may offer more affordable plans to attract customers. However, in less competitive markets, insurers may have more leverage to set higher premiums.

- Government Regulations: Government regulations, such as the Affordable Care Act (ACA), play a crucial role in shaping the health insurance market. The ACA, for instance, introduced mandates for insurers, including the requirement to cover pre-existing conditions and offer essential health benefits. These regulations can influence the structure and cost of insurance plans.

- Medical Inflation: The rising cost of healthcare services, often referred to as medical inflation, can drive up insurance premiums. As the cost of medical procedures, prescription drugs, and other healthcare services increases, insurers may need to adjust their premiums to maintain adequate coverage.

- Insurance Market Risk Pools: The composition of an insurance market’s risk pool can impact costs. A risk pool refers to the group of individuals covered by a particular insurer. If a risk pool contains a higher proportion of individuals with significant health needs, insurers may need to adjust premiums upward to maintain financial stability.

Strategies for Managing Health Insurance Costs

Understanding the factors that influence health insurance costs is the first step towards effectively managing these expenses. Here are some practical strategies to help individuals and families navigate the complexities of health insurance and find affordable coverage options:

Shop Around and Compare Plans

The health insurance market in the USA is diverse, offering a range of plans from various insurers. Shopping around and comparing different plans can help individuals find the best fit for their needs and budget. Online marketplaces, such as healthcare.gov or state-specific insurance marketplaces, provide a convenient platform for comparing plan features, costs, and provider networks.

Consider High-Deductible Health Plans (HDHPs)

High-deductible health plans (HDHPs) are a cost-effective option for individuals who are generally healthy and have minimal healthcare needs. These plans have lower monthly premiums compared to traditional plans but higher deductibles. HDHPs are often paired with health savings accounts (HSAs), allowing individuals to save money tax-free for future medical expenses.

Explore Employer-Sponsored Plans

Many employers offer health insurance plans as part of their employee benefits package. These plans can provide significant cost savings, as employers often contribute a portion of the premium. Additionally, employer-sponsored plans may offer a wider range of coverage options and lower out-of-pocket costs compared to individual plans.

Evaluate Government-Sponsored Programs

Government-sponsored health insurance programs, such as Medicaid and Medicare, offer affordable coverage options for specific populations. Medicaid provides coverage for low-income individuals and families, while Medicare is designed for individuals aged 65 and older or those with certain disabilities. Understanding eligibility criteria and applying for these programs can provide essential healthcare coverage at a reduced cost.

Optimize Deductibles and Out-of-Pocket Costs

When choosing a health insurance plan, carefully consider the balance between monthly premiums and out-of-pocket costs. While plans with lower premiums may seem more affordable upfront, they often come with higher deductibles and out-of-pocket maximums. Conversely, plans with higher premiums may offer more comprehensive coverage and lower out-of-pocket costs in the long run. Evaluate your healthcare needs and financial situation to make an informed decision.

Utilize Preventive Care Services

Preventive care services, such as vaccinations, screenings, and wellness check-ups, are often covered at no cost under most health insurance plans. Taking advantage of these services can help identify potential health issues early on, leading to more effective treatment and potentially reducing long-term healthcare costs. Regular preventive care can also contribute to overall well-being and reduce the likelihood of developing more serious health conditions.

Negotiate Medical Bills and Explore Discounts

Medical bills can sometimes be negotiable, especially if you are paying out of pocket or have a high-deductible plan. Contacting healthcare providers and insurers to discuss potential discounts or payment plans can help reduce the financial burden. Additionally, many healthcare providers offer discounts for prompt payment or for individuals who meet certain income criteria. Researching and inquiring about these discounts can lead to significant savings.

Consider Telehealth and Virtual Care Options

Telehealth and virtual care services have become increasingly popular and accessible, offering convenient and cost-effective healthcare options. These services allow individuals to consult with healthcare professionals remotely, often at a lower cost compared to in-person visits. Telehealth can be particularly beneficial for routine check-ups, minor illnesses, and mental health support.

Conclusion: Navigating the Complexities of Health Insurance Costs

Understanding the intricacies of health insurance costs in the USA is essential for making informed decisions about healthcare coverage. By considering individual factors, plan features, and broader market dynamics, individuals can navigate the complexities of the health insurance landscape and find affordable, comprehensive coverage. Remember, managing health insurance costs is an ongoing process, and staying informed about changing regulations, market trends, and personal healthcare needs is crucial for maintaining effective coverage.

What is the average cost of health insurance in the USA?

+

The average cost of health insurance in the USA varies widely based on individual factors, plan types, and geographic location. As of [most recent data available], the average monthly premium for employer-sponsored health insurance was approximately [average cost], with significant variations based on the level of coverage and employee contributions. Individual market plans can range from [low-cost plans] to [high-cost plans], depending on the level of coverage and deductibles.

How can I reduce my health insurance costs?

+

There are several strategies to reduce health insurance costs. Shopping around and comparing plans, considering high-deductible health plans, exploring employer-sponsored options, and evaluating government-sponsored programs can all lead to cost savings. Additionally, optimizing deductibles and out-of-pocket costs, utilizing preventive care services, negotiating medical bills, and exploring discounts can further reduce expenses.

Are there any government programs to assist with health insurance costs?

+

Yes, the US government offers several programs to assist with health insurance costs. Medicaid provides coverage for low-income individuals and families, while Medicare is designed for individuals aged 65 and older or those with certain disabilities. The Affordable Care Act (ACA) also provides subsidies and tax credits to help individuals and families purchase health insurance through the individual marketplace.

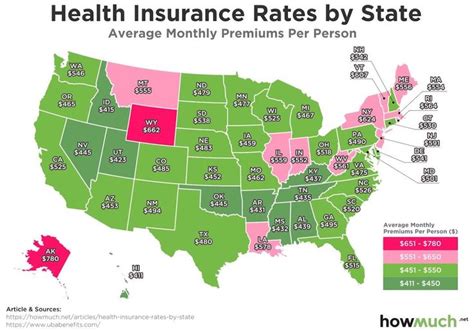

How do health insurance costs vary by state?

+

Health insurance costs can vary significantly by state due to differences in healthcare market competition, regulatory environments, and the cost of living. States with robust competition and lower healthcare costs may offer more affordable insurance options. Additionally, state-specific programs and regulations can impact the availability and cost of insurance plans.