Health Insurence Quotes

In the ever-evolving landscape of healthcare, understanding the intricacies of health insurance quotes is essential for making informed decisions about your coverage. This comprehensive guide aims to delve into the world of health insurance quotes, offering expert insights, real-world examples, and practical advice to help you navigate this complex yet vital aspect of personal and family healthcare.

Understanding Health Insurance Quotes: A Deep Dive

Health insurance quotes are like personalized health plans tailored to your unique needs and circumstances. They serve as a gateway to understanding the costs and benefits associated with various insurance options. Let's explore the key components and considerations to help you make the right choice.

The Anatomy of a Health Insurance Quote

At its core, a health insurance quote comprises several critical elements, each playing a distinct role in shaping your coverage and costs. These include:

- Premium: The premium is the amount you pay regularly (usually monthly) to maintain your insurance coverage. It's the cornerstone of your insurance plan and varies based on factors like age, location, and the specific plan you choose.

- Deductible: This is the amount you must pay out of pocket before your insurance coverage kicks in. Deductibles can significantly impact your overall costs, especially if you anticipate frequent medical needs.

- Copayment (Copay): A copay is a fixed amount you pay for covered medical services, like a doctor's visit or prescription medication. It's typically a set fee, regardless of the actual cost of the service.

- Coinsurance: Coinsurance refers to the percentage of costs you share with your insurance provider after meeting your deductible. For instance, if your plan has an 80/20 coinsurance, you pay 20% of the covered services, and the insurance company covers the remaining 80%.

- Out-of-Pocket Maximum: This is the limit on how much you'll pay out of pocket for covered services in a year. Once you reach this maximum, your insurance provider covers 100% of the costs for covered services.

- Network: Insurance plans often have networks of healthcare providers and facilities. Being in-network can mean lower costs and more straightforward coverage, while out-of-network care may incur higher expenses.

Understanding these components is crucial as they collectively define the financial aspects of your insurance plan. It's essential to carefully consider each element based on your healthcare needs and budget.

Factors Influencing Health Insurance Quotes

Health insurance quotes are influenced by a myriad of factors, each playing a role in determining the cost and coverage of your plan. Here's a closer look at some of the key influences:

- Age: Age is a significant factor in health insurance quotes. Premiums generally increase with age, reflecting the higher healthcare needs associated with older individuals.

- Location: Where you live can impact your insurance costs. Healthcare expenses and the availability of providers vary across regions, influencing the overall cost of insurance.

- Plan Type: Different insurance plans offer varying levels of coverage and benefits. Platinum plans, for instance, offer comprehensive coverage but come with higher premiums, while bronze plans may have lower premiums but more limited coverage.

- Tobacco Use: Insurance providers often charge higher premiums for tobacco users due to the associated health risks and increased medical expenses.

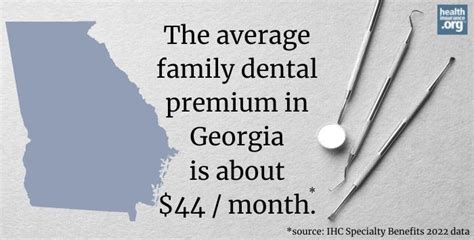

- Family Size: The size of your family impacts your insurance needs and costs. Family plans cater to the unique healthcare requirements of multiple individuals, and premiums are adjusted accordingly.

- Pre-Existing Conditions: Pre-existing conditions can influence both the availability and cost of insurance. Some plans may specifically cover certain conditions, while others might have exclusions or limitations.

- Deductible Options: The deductible you choose can significantly impact your premium. Higher deductibles often result in lower premiums, while lower deductibles can increase your monthly payments.

These factors collectively shape the landscape of health insurance quotes, offering a personalized view of your coverage options. By understanding how these elements interact, you can make more informed decisions about your healthcare.

Comparative Analysis: Finding the Right Fit

Comparing health insurance quotes is a critical step in ensuring you find a plan that aligns with your needs and budget. Here's a detailed look at how to approach this essential process:

Assessing Your Healthcare Needs

Start by evaluating your healthcare requirements. Consider factors like chronic conditions, medication needs, frequency of doctor visits, and any anticipated major medical procedures. Understanding your unique healthcare landscape is crucial for choosing the right plan.

Reviewing Plan Details

Dive deep into the specifics of each plan you're considering. Look beyond the premium and consider the deductible, copays, coinsurance, and out-of-pocket maximum. Ensure the plan covers the services and providers you need. Pay attention to any exclusions or limitations that might impact your coverage.

Network Considerations

Network coverage is a critical aspect of health insurance. Ensure the plan's network includes your preferred doctors, specialists, and hospitals. Out-of-network care can be significantly more expensive, so it's essential to understand your options.

Cost Comparison

Compare the total costs, including premiums, deductibles, and out-of-pocket expenses, for each plan. Consider your anticipated healthcare needs and choose a plan that offers the best value for your situation. Remember, the cheapest plan might not always be the best fit if it doesn't cover your essential services.

Benefits and Coverage

Beyond costs, evaluate the benefits and coverage each plan offers. Look for features like prescription drug coverage, mental health services, and preventive care. Ensure the plan aligns with your personal and family healthcare priorities.

Flexibility and Customization

Some plans offer flexibility and customization options, allowing you to tailor the coverage to your needs. Consider these options if they provide a better fit for your circumstances.

Reputation and Reliability

Research the reputation and reliability of the insurance provider. Look for customer reviews and ratings to ensure the company has a track record of prompt claim processing and customer satisfaction.

Renewal and Long-Term Considerations

Consider the long-term implications of your choice. Some plans may have renewal limitations or changes in coverage over time. Ensure the plan provides the stability and continuity you need for your healthcare journey.

The Impact of Technology on Health Insurance Quotes

The digital age has revolutionized the way we access and interact with health insurance quotes. Here's how technology is shaping this landscape:

- Online Comparison Tools: Digital platforms offer robust comparison tools, making it easier than ever to compare quotes from multiple providers. These tools provide detailed breakdowns of plan features and costs, streamlining the decision-making process.

- Real-Time Quotes: Technology enables real-time generation of quotes, allowing you to get instant estimates based on your personal information and preferences. This instant feedback can expedite the decision-making process.

- Personalized Recommendations: Advanced algorithms can analyze your healthcare needs and provide personalized plan recommendations. These suggestions take into account your unique circumstances, offering tailored guidance.

- Mobile Accessibility: With the rise of mobile apps, accessing and managing your health insurance quotes is now more convenient than ever. You can compare plans, track expenses, and manage your coverage directly from your smartphone.

- Data-Driven Insights: Technology allows for the collection and analysis of vast amounts of healthcare data. This data-driven approach can lead to more accurate quotes and improved coverage options, benefiting both consumers and providers.

Future Implications and Industry Trends

The world of health insurance is continually evolving, and several trends are shaping the future of this industry:

- Telehealth Expansion: The COVID-19 pandemic accelerated the adoption of telehealth services, and this trend is expected to continue. Insurance providers are increasingly covering virtual healthcare services, offering convenience and accessibility to policyholders.

- Value-Based Care: The focus is shifting from volume-based care to value-based care, emphasizing quality over quantity. This approach aims to improve patient outcomes while controlling costs, potentially impacting insurance plan designs.

- Artificial Intelligence (AI) Integration: AI is poised to play a significant role in the health insurance industry. From predictive analytics to automated claim processing, AI can enhance efficiency and accuracy in various aspects of insurance operations.

- Consumer-Centric Approach: Insurance providers are increasingly adopting a consumer-centric mindset, focusing on individual needs and preferences. This shift may lead to more personalized and flexible insurance plans, empowering consumers to make choices that align with their unique healthcare journeys.

Expert Insights and Practical Tips

Navigating the world of health insurance quotes can be complex, but with the right guidance, you can make informed choices. Here are some expert tips to enhance your understanding and decision-making process:

- Seek Professional Advice: Consider consulting an insurance broker or agent who can provide personalized guidance based on your specific needs. They can help you navigate the complexities of insurance plans and ensure you make the best choice.

- Understand Exclusions: Carefully review the exclusions and limitations of each plan. Knowing what's not covered can prevent unexpected expenses and ensure you choose a plan that aligns with your healthcare requirements.

- Review Your Coverage Annually: Health insurance needs can change over time. Review your coverage annually to ensure it still meets your needs. This proactive approach can help you identify any gaps or changes that might require a plan adjustment.

- Consider Short-Term Plans: If you're between jobs or transitioning to a new plan, short-term health insurance plans can provide temporary coverage. These plans offer flexibility and can bridge the gap until you find a more permanent solution.

- Explore Government Programs: Depending on your income and circumstances, you may qualify for government-sponsored health insurance programs like Medicaid or the Children's Health Insurance Program (CHIP). These programs offer affordable coverage and are worth exploring if you meet the eligibility criteria.

Frequently Asked Questions (FAQ)

How do I know if I'm getting a good health insurance quote?

+A good health insurance quote offers a balance between comprehensive coverage and affordable costs. It should align with your healthcare needs, provide access to your preferred healthcare providers, and offer clear terms and conditions. Compare quotes from multiple providers to ensure you're getting a competitive rate.

<div class="faq-item">

<div class="faq-question">

<h3>What factors can influence the cost of my health insurance quote?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Several factors can impact the cost of your health insurance quote, including your age, location, plan type, tobacco use, family size, and pre-existing conditions. Additionally, the deductible and other out-of-pocket expenses you choose can significantly affect your premium.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How can I reduce my health insurance costs without compromising coverage?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>To reduce costs while maintaining coverage, consider plans with higher deductibles and lower premiums. Additionally, review your coverage annually and choose plans that offer the benefits you need without unnecessary extras. Exploring government programs like Medicaid or CHIP can also provide cost-effective coverage options.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What should I do if I have a pre-existing condition?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>If you have a pre-existing condition, it's essential to carefully review insurance plans to ensure they cover your specific condition. Some plans may have exclusions or limitations, so understanding the fine print is crucial. Government-sponsored programs like Medicaid or state-specific high-risk pools can also provide coverage for individuals with pre-existing conditions.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How can I stay informed about changes in health insurance policies and plans?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Staying informed about health insurance changes is crucial. Regularly check reliable news sources, government websites, and insurance provider websites for updates. Consider signing up for newsletters or alerts from reputable organizations to receive timely information about changes that may impact your coverage.</p>

</div>

</div>