Healthcare Insurance In Florida

Healthcare insurance is a vital aspect of life in Florida, a state known for its diverse population and unique healthcare landscape. With a large number of residents and a significant influx of tourists and seasonal residents, Florida presents a complex healthcare environment. Understanding the intricacies of healthcare insurance in this sunny state is crucial for both residents and visitors.

The Importance of Healthcare Insurance in Florida

Florida’s healthcare system is diverse and caters to a wide range of needs. From renowned medical centers to specialized clinics, the state offers a plethora of healthcare services. However, accessing these services without adequate insurance coverage can be financially challenging. Healthcare insurance plays a pivotal role in ensuring that individuals and families have access to quality healthcare without facing crippling financial burdens.

The cost of healthcare in Florida, as in many other states, can be exorbitant. A simple emergency room visit can result in thousands of dollars in medical bills, and specialized treatments or procedures can quickly escalate costs. Healthcare insurance acts as a financial safeguard, providing coverage for a wide range of medical expenses, including doctor visits, hospital stays, prescription medications, and preventive care.

Understanding Florida’s Healthcare Insurance Market

Florida’s healthcare insurance market is regulated by the state government and is influenced by various factors, including federal policies, demographics, and the state’s unique healthcare needs. The market offers a variety of insurance plans, each with its own set of benefits, coverage limits, and premium costs.

Types of Healthcare Insurance in Florida

In Florida, there are several types of healthcare insurance plans available, catering to different demographics and needs. These include:

- Individual and Family Plans: These plans are tailored for individuals and families, offering comprehensive coverage for routine care, hospitalizations, and prescription medications. Insurance providers often offer a range of plans with varying deductibles and out-of-pocket maximums to suit different budgets.

- Employer-Sponsored Plans: Many employers in Florida offer healthcare insurance as part of their benefits package. These plans are typically more cost-effective as the employer often contributes a significant portion of the premium. The coverage and benefits may vary depending on the employer and the plan chosen.

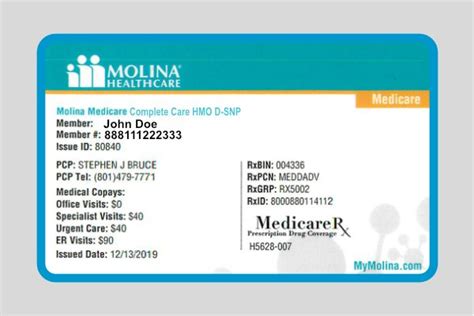

- Medicaid and Medicare: Florida's Medicaid program provides healthcare coverage to eligible low-income individuals and families. Medicare, on the other hand, is a federal program that primarily serves individuals aged 65 and older, as well as those with certain disabilities. Both programs play a crucial role in ensuring access to healthcare for vulnerable populations in Florida.

- Short-Term Health Insurance: For those who are between jobs, transitioning to a new plan, or require temporary coverage, short-term health insurance plans offer a more affordable and flexible option. However, these plans often come with limitations and may not provide the same level of coverage as long-term plans.

Key Considerations When Choosing a Healthcare Insurance Plan

Selecting the right healthcare insurance plan in Florida requires careful consideration of several factors. These include:

- Network of Providers: Ensure that your preferred doctors, hospitals, and specialists are included in the plan's network. Out-of-network care can result in higher costs.

- Coverage Limits: Understand the plan's coverage limits, including deductibles, co-pays, and out-of-pocket maximums. These can significantly impact your financial responsibility.

- Prescription Drug Coverage: If you require regular medications, ensure that your plan covers the cost of these drugs and that your preferred pharmacy is in-network.

- Preventive Care: Many insurance plans offer coverage for preventive services, such as vaccinations, screenings, and wellness visits. Opt for a plan that encourages preventive care to maintain your health and potentially reduce future costs.

- Flexibility and Customization: Some insurance plans offer flexible options, allowing you to tailor your coverage to your specific needs. This can include adding dental or vision coverage, or choosing a plan with a higher premium but lower out-of-pocket costs.

Navigating Florida’s Healthcare Insurance Landscape

Understanding the nuances of Florida’s healthcare insurance market can be complex. Here are some key insights and strategies to help you navigate this landscape effectively:

Shopping for Insurance

When shopping for healthcare insurance in Florida, it’s important to compare plans and providers. The Florida Health Insurance Marketplace, often referred to as the “Health Insurance Marketplace,” is a valuable resource. It offers a range of insurance plans from various providers, allowing you to compare costs, coverage, and benefits side by side. Additionally, the Marketplace provides information on eligibility for subsidies and tax credits, which can significantly reduce the cost of insurance premiums.

Understanding Premiums and Costs

Healthcare insurance premiums in Florida can vary significantly based on several factors, including age, location, tobacco use, and the chosen plan’s benefits and coverage limits. It’s essential to understand these costs and consider them within your overall financial planning. Some plans may have lower premiums but higher out-of-pocket costs, while others may offer more comprehensive coverage with higher premiums.

| Factor | Impact on Premium |

|---|---|

| Age | Premiums generally increase with age, as older individuals tend to require more healthcare services. |

| Location | Premiums can vary based on the cost of living and healthcare services in different regions of Florida. |

| Tobacco Use | Insurance providers often charge higher premiums for individuals who use tobacco products, as they are at a higher risk for certain health conditions. |

Utilizing Insurance Benefits

Once you have selected a healthcare insurance plan, it’s crucial to understand how to maximize its benefits. This includes familiarizing yourself with the plan’s network of providers, understanding your coverage limits, and taking advantage of preventive care services. Many insurance plans offer online portals or mobile apps that provide real-time access to your coverage details, claims history, and preferred provider networks.

Managing Out-of-Pocket Costs

Out-of-pocket costs, including deductibles, co-pays, and co-insurance, can quickly add up, especially for those with ongoing medical needs. To manage these costs effectively, consider the following strategies:

- Review your Explanation of Benefits (EOB) statements regularly to understand the costs associated with your medical services.

- Take advantage of generic medications, which are often significantly more affordable than brand-name drugs.

- Consider using in-network pharmacies and healthcare providers to minimize out-of-pocket expenses.

- If you anticipate high medical expenses, explore the option of a Health Savings Account (HSA) or Flexible Spending Account (FSA) to set aside pre-tax dollars for healthcare costs.

The Future of Healthcare Insurance in Florida

Florida’s healthcare insurance landscape is continually evolving, influenced by changing demographics, advancements in medical technology, and shifts in government policies. As the state’s population continues to grow and diversify, the demand for accessible and affordable healthcare insurance is expected to increase. Here are some key trends and potential developments to watch for in the future:

Expanding Coverage Options

Efforts to expand healthcare insurance coverage in Florida are ongoing. This includes initiatives to increase access to Medicaid, improve affordability for individuals and families, and enhance the quality of care. The state is also exploring ways to attract more insurance providers and encourage competition, which could lead to more affordable and comprehensive plans.

Focus on Preventive Care

The importance of preventive care is gaining recognition in Florida’s healthcare insurance market. Insurance providers are increasingly offering incentives and discounts for individuals who maintain healthy lifestyles and prioritize preventive services. This shift towards a more proactive approach to healthcare is expected to continue, potentially reducing overall healthcare costs and improving long-term health outcomes.

Technology and Digital Innovations

The integration of technology into healthcare insurance is transforming the way Floridians access and manage their coverage. Online portals, mobile apps, and telemedicine services are becoming more prevalent, offering convenience and efficiency. Additionally, the use of data analytics and artificial intelligence is expected to further enhance the accuracy and personalization of healthcare insurance plans, leading to more targeted and cost-effective coverage.

Addressing Unique Healthcare Needs

Florida’s diverse population includes a significant proportion of individuals with unique healthcare needs, such as seniors, individuals with disabilities, and those with chronic conditions. The state is working to develop specialized insurance plans and programs to address these needs, ensuring that all Floridians have access to the care they require.

How do I know if I’m eligible for Medicaid in Florida?

+

Eligibility for Medicaid in Florida is based on several factors, including income, family size, pregnancy status, and disability. You can check your eligibility by visiting the Florida Department of Children and Families website or by contacting a local Medicaid office.

What are some tips for reducing healthcare insurance costs in Florida?

+

To reduce healthcare insurance costs in Florida, consider shopping around for plans during the open enrollment period, exploring employer-sponsored options, utilizing preventive care services, and taking advantage of generic medications. Additionally, consider setting up a Health Savings Account (HSA) if eligible, which can help reduce taxable income and provide tax-free savings for healthcare expenses.

Are there any resources for individuals struggling to afford healthcare insurance in Florida?

+

Yes, there are several resources available for individuals struggling to afford healthcare insurance in Florida. These include the Florida Health Insurance Marketplace, which offers subsidized plans for eligible individuals, as well as community health centers and local health departments that may provide low-cost or free healthcare services.