Hmo Medical Insurance

In the ever-evolving landscape of healthcare, understanding the intricacies of different insurance plans is crucial for making informed decisions about your health coverage. Among the myriad options available, HMO (Health Maintenance Organization) plans have become a popular choice for individuals and families seeking comprehensive medical care. This article aims to delve deep into the world of HMO medical insurance, unraveling its benefits, features, and potential drawbacks, to empower readers with the knowledge needed to navigate the complex realm of healthcare.

Understanding HMO Medical Insurance

An HMO, or Health Maintenance Organization, is a type of healthcare plan that emphasizes preventative care and the coordination of various medical services. It operates on a prepaid basis, where members pay a fixed amount, typically monthly, to cover their healthcare needs. This model ensures that members have access to a network of healthcare providers, including doctors, specialists, and hospitals, all within a defined geographical area.

The core principle of an HMO is to promote efficient and cost-effective healthcare delivery. By encouraging regular check-ups and early intervention, HMOs aim to prevent the development of serious health conditions, thus reducing the need for costly treatments down the line. This approach not only benefits individual members but also contributes to a more sustainable healthcare system overall.

Key Features of HMO Plans

HMO plans offer a range of features that set them apart from other insurance options. Here are some of the key aspects:

Primary Care Physician (PCP) Requirements

One of the distinctive features of HMO plans is the requirement to choose a Primary Care Physician (PCP). This doctor serves as your primary point of contact for all your healthcare needs. They are responsible for coordinating your care, referring you to specialists when necessary, and ensuring that your medical history is maintained and accessible within the HMO network.

Having a PCP ensures that your healthcare is well-managed and tailored to your specific needs. They can provide personalized advice, monitor your overall health, and make sure that any specialists you see are informed about your medical history and current treatments.

Comprehensive Coverage

HMO plans typically offer a wide range of covered services, including but not limited to:

- Preventative Care: Routine check-ups, screenings, and vaccinations are often covered at no additional cost.

- Prescription Drugs: Many HMO plans provide coverage for a range of prescription medications.

- Specialist Visits: Referrals to specialists within the HMO network are usually included.

- Hospitalization: Coverage for inpatient care is a standard feature.

- Mental Health Services: Some plans offer coverage for counseling and therapy sessions.

- Maternity Care: Pregnant women often receive comprehensive support and coverage for prenatal care, delivery, and postnatal care.

The exact coverage details can vary depending on the specific HMO plan and the state or region it operates in.

Network of Providers

HMO plans operate within a network of healthcare providers. This network includes doctors, specialists, and hospitals that have contracted with the HMO to provide services to its members. The advantage of this network is that it allows for cost-effective care and ensures that providers are coordinated in their approach to your healthcare.

However, it's important to note that HMO plans often have a limited network compared to other insurance options. This means that members must choose their healthcare providers from within this network. Out-of-network care is typically not covered, or it may come with significant out-of-pocket expenses.

Benefits of HMO Medical Insurance

HMO plans offer several advantages that make them an appealing choice for many individuals and families:

Affordability

One of the primary draws of HMO plans is their cost-effectiveness. With a fixed monthly premium, members can access a wide range of healthcare services without incurring excessive out-of-pocket expenses. This predictability in costs can be especially beneficial for those with limited financial resources or those who prefer budgeting for their healthcare needs.

Emphasis on Preventative Care

HMOs place a strong emphasis on preventative care, which can lead to better overall health outcomes. Regular check-ups, screenings, and early interventions can help detect and manage health issues before they become more serious and costly to treat. This proactive approach not only benefits individual health but also contributes to a more sustainable healthcare system.

Coordinated Care

The coordination of care is a key strength of HMO plans. With a PCP overseeing your healthcare, you can rest assured that your medical records are centralized and easily accessible. This coordination ensures that your care is well-managed and that any specialists you see are informed about your overall health status.

Comprehensive Coverage

As mentioned earlier, HMO plans typically offer a wide array of covered services. From routine check-ups to specialist visits and prescription medications, members can access a comprehensive range of healthcare services, ensuring that their needs are met without having to navigate complex insurance networks.

Potential Drawbacks

While HMO plans offer numerous benefits, it’s essential to consider some potential drawbacks:

Limited Network of Providers

One of the most significant drawbacks of HMO plans is the limited network of providers. If you have a preferred doctor or specialist who is not within the HMO network, you may need to switch providers or pay out-of-pocket for their services. This can be especially challenging for those with established relationships with specific healthcare professionals.

Preauthorization Requirements

HMO plans often require preauthorization for certain services or procedures. This means that your PCP or the HMO’s administrative staff must approve the treatment before it can be carried out. While this process ensures that unnecessary or duplicate treatments are avoided, it can also lead to delays in receiving care, particularly for complex or urgent situations.

Out-of-Pocket Costs

While HMO plans are generally more affordable than other insurance options, they still come with certain out-of-pocket costs. These can include deductibles, copayments, and coinsurance. It’s essential to review the specific plan’s details to understand these costs and how they might impact your overall healthcare expenses.

Performance Analysis and Future Implications

The performance of HMO plans has been a subject of ongoing research and analysis. Studies have shown that HMOs can effectively reduce healthcare costs while maintaining high-quality care, particularly for routine and preventative services. However, the effectiveness of HMOs in managing complex or chronic conditions remains a topic of debate.

Looking ahead, the future of HMO medical insurance appears promising. With the ongoing emphasis on value-based care and the shift towards preventative healthcare, HMOs are well-positioned to play a significant role in the evolving healthcare landscape. As technology advances, HMOs can leverage digital tools and telemedicine to enhance coordination and access to care, further improving their efficiency and patient satisfaction.

Furthermore, the increasing focus on patient-centered care and personalized medicine aligns with the core principles of HMOs. By emphasizing preventative care and the coordination of services, HMOs can contribute to a more patient-centric healthcare system, where individual needs and preferences are at the forefront of decision-making.

Conclusion

HMO medical insurance plans offer a unique and appealing approach to healthcare coverage. With their focus on preventative care, coordinated services, and comprehensive coverage, HMOs provide an efficient and cost-effective option for individuals and families. While there are certain limitations, such as a limited network of providers and preauthorization requirements, the overall benefits of HMO plans make them a viable choice for those seeking accessible and affordable healthcare.

As the healthcare industry continues to evolve, it's essential for consumers to stay informed about their insurance options. By understanding the features, benefits, and potential drawbacks of HMO plans, individuals can make empowered decisions about their healthcare and ensure they have the coverage they need to maintain their well-being.

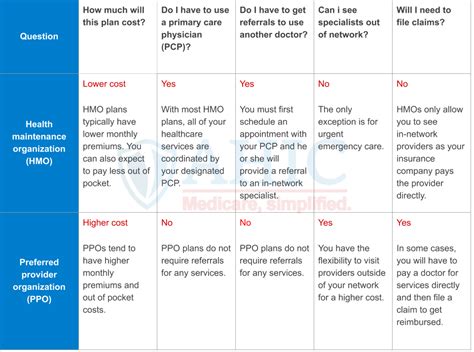

What is the difference between an HMO and a PPO plan?

+HMO plans typically have a more restricted network of providers and require members to choose a primary care physician. PPO plans, on the other hand, offer a larger network of providers and allow members to see any provider within the network without a referral. PPOs generally have higher premiums and out-of-pocket costs compared to HMOs.

Do HMO plans cover emergency care?

+Yes, HMO plans typically cover emergency care, regardless of whether the emergency occurs within or outside the HMO network. However, it’s important to review your specific plan’s details to understand any potential limitations or requirements.

How do I choose the right HMO plan for me?

+When selecting an HMO plan, consider factors such as the network of providers, the cost of premiums and out-of-pocket expenses, the range of covered services, and the plan’s reputation for quality of care. It’s also crucial to review your personal healthcare needs and preferences to ensure the plan aligns with your requirements.