Home And Property Insurance

Protecting your home and property is a vital aspect of safeguarding your assets and ensuring peace of mind. Home and property insurance policies play a crucial role in providing financial security and coverage for various risks and damages. In this comprehensive guide, we will delve into the world of home and property insurance, exploring the different types of policies, the coverage they offer, and the key considerations for choosing the right protection for your residence and valuables.

Understanding Home and Property Insurance

Home and property insurance, often referred to as homeowners insurance or property insurance, is a contract between a policyholder and an insurance company. It provides financial protection against a range of risks and losses associated with a residential property and its contents. These policies are designed to cover a wide spectrum of potential incidents, from natural disasters to theft and accidental damage.

Types of Home and Property Insurance

The insurance market offers various types of home and property insurance policies to cater to different needs and situations. Here are some of the common types:

- Homeowners Insurance: This is the most common type of policy for residential properties. It provides comprehensive coverage for the structure of the home, personal belongings, and liability protection. Homeowners insurance typically includes coverage for damage caused by perils such as fire, wind, hail, and theft.

- Condominium Insurance: Designed specifically for condominium owners, this policy covers the interior of the unit, personal belongings, and provides liability protection. Unlike homeowners insurance, it doesn't cover the exterior of the building, as that is usually covered by the condominium association's master policy.

- Renters Insurance: Ideal for tenants, renters insurance provides coverage for personal belongings and offers liability protection. It does not cover the structure of the rented property, as that is the responsibility of the landlord.

- Landlord Insurance: Landlords can protect their investment properties with this type of policy. It covers the structure of the rental property and provides liability protection for the owner. Landlord insurance often includes additional coverage for loss of rental income due to insured events.

- Mobile Home Insurance: Similar to homeowners insurance, this policy covers mobile or manufactured homes. It provides protection for the structure, personal belongings, and liability. Mobile home insurance may have specific coverage limits and exclusions, so it's essential to review the policy carefully.

- Vacant Property Insurance: If you own a vacant property, this type of insurance is tailored to provide coverage during the vacancy period. It offers protection against risks such as vandalism, theft, and water damage, ensuring your property is safeguarded while it remains unoccupied.

Coverage and Policy Details

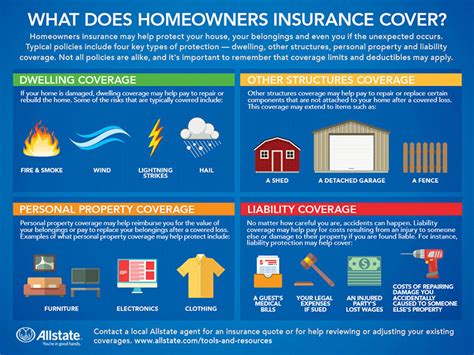

Home and property insurance policies typically include a range of coverage options. Understanding these coverages is crucial when selecting a policy that suits your needs:

- Dwelling Coverage: This covers the physical structure of your home, including the roof, walls, and foundation. It provides protection against damages caused by perils outlined in the policy.

- Personal Property Coverage: This coverage protects your personal belongings, such as furniture, electronics, and clothing. It reimburses you for the cost of replacing or repairing damaged items.

- Liability Coverage: In the event of an accident on your property that causes injury or property damage to others, liability coverage provides protection. It covers legal fees and any settlements or judgments awarded against you.

- Additional Living Expenses (ALE): If your home becomes uninhabitable due to an insured event, ALE coverage reimburses you for the additional costs of temporary housing and living expenses until your home is repaired or rebuilt.

- Personal Liability: This coverage extends beyond your property, providing protection if you or a family member are held legally responsible for bodily injury or property damage to others, even if it occurs away from your home.

- Medical Payments Coverage: If someone is injured on your property, this coverage provides reimbursement for their medical expenses, regardless of who is at fault. It can help cover costs quickly without the need for a liability claim.

- Optional Coverages: Many insurance providers offer optional add-ons to customize your policy. These may include coverage for high-value items like jewelry or art, identity theft protection, or coverage for specific risks such as earthquakes or floods (which often require separate policies).

Choosing the Right Home and Property Insurance

Selecting the appropriate home and property insurance policy involves careful consideration of various factors. Here are some key aspects to keep in mind:

Assess Your Needs

Start by evaluating your specific needs and the unique characteristics of your property. Consider factors such as the location, size, and value of your home, as well as any specific risks or hazards in your area. Are you located in a flood-prone region or an area with high crime rates? These factors will influence the type of coverage you require.

Research Insurance Providers

Take the time to research and compare different insurance providers. Look for companies with a strong financial rating and a solid reputation for customer service and claims handling. Read reviews and seek recommendations from friends and family to get a sense of their overall satisfaction with the insurer.

Understand Policy Limits and Deductibles

Policy limits refer to the maximum amount an insurance company will pay for a covered loss. Ensure that the limits align with the value of your home and possessions. Additionally, be aware of the deductibles, which are the amounts you must pay out of pocket before the insurance coverage kicks in. Higher deductibles can lower your premiums, but it's essential to choose a deductible that you can afford.

Consider Bundling Options

Many insurance providers offer bundling discounts when you combine multiple policies, such as home and auto insurance. Bundling can not only save you money but also provide added convenience by simplifying your insurance needs.

Review and Update Regularly

Home and property insurance policies should be reviewed annually to ensure they still meet your needs. Life changes, such as renovations, additions to your home, or acquiring new possessions, may require adjustments to your coverage. Regularly updating your policy ensures that you have adequate protection as your circumstances evolve.

Understand Exclusions

Every insurance policy has exclusions, which are specific events or circumstances that are not covered. Familiarize yourself with the exclusions in your policy to avoid any surprises. For example, many standard policies exclude coverage for earthquakes and floods, so you may need to purchase separate policies for these risks.

Performance Analysis and Real-World Examples

To gain a deeper understanding of home and property insurance, let's examine some real-world scenarios and analyze how different policies perform:

Scenario: Natural Disaster

Imagine a homeowner living in a hurricane-prone area. They have a standard homeowners insurance policy with dwelling coverage, personal property coverage, and liability protection. During a severe hurricane, their home sustains significant damage, including roof damage, water intrusion, and damage to personal belongings. In this case, the insurance policy would cover the cost of repairing the roof, replacing damaged appliances and furniture, and providing temporary housing until the home is habitable again. The liability coverage would also protect the homeowner if any neighbors or passersby were injured during the storm due to falling debris from their property.

Scenario: Theft and Burglary

Consider a renter who has a renters insurance policy. While away on vacation, their apartment is burglarized, and valuable electronics and jewelry are stolen. With renters insurance, they can file a claim to receive reimbursement for the stolen items, as long as they have maintained an up-to-date inventory of their possessions. The policy's personal property coverage would cover the cost of replacing the stolen items, providing financial relief during a stressful situation.

Scenario: Water Damage

A homeowner discovers a burst pipe in their basement, causing extensive water damage to the flooring, walls, and personal belongings stored in the basement. Their homeowners insurance policy includes coverage for water damage, so they can file a claim to cover the cost of repairing the damage and replacing any ruined items. Additionally, the policy's additional living expenses coverage would reimburse them for any necessary temporary housing costs while the repairs are underway.

Future Implications and Industry Insights

The home and property insurance industry is constantly evolving, and keeping up with emerging trends and challenges is essential. Here are some key insights and future considerations:

Climate Change and Natural Disasters

As climate change continues to impact weather patterns, the frequency and severity of natural disasters are expected to increase. Insurance providers are adapting their policies and risk assessments to account for these changes. Some insurers are developing innovative solutions, such as parametric insurance, which pays out based on predefined triggers like wind speed or rainfall amounts, providing quicker payouts to policyholders.

Technology and Smart Home Integration

The rise of smart home technology offers new opportunities for insurance providers. Smart home devices can enhance security, provide early detection of potential hazards, and even prevent losses. Insurers are exploring partnerships with smart home manufacturers to offer discounts or incentives for policyholders who incorporate these technologies into their homes.

Data Analytics and Risk Assessment

Advanced data analytics and machine learning are transforming the way insurance companies assess risk. By analyzing vast amounts of data, insurers can more accurately predict and manage risks, leading to more tailored and cost-effective insurance products. This also enables insurers to offer personalized rates based on individual risk profiles.

Digital Transformation and Customer Experience

The insurance industry is embracing digital transformation to enhance the customer experience. Online portals, mobile apps, and chatbots are making it easier for policyholders to manage their policies, file claims, and receive support. This shift towards digital interactions improves efficiency and provides customers with greater control over their insurance needs.

Emerging Risks and Coverage Gaps

As technology advances, new risks emerge. For example, the rise of cyber threats and cyber insurance is an area of focus for many insurers. Additionally, the increasing prevalence of remote work and the associated risks highlight the need for comprehensive liability coverage for home-based businesses. Insurers are working to address these emerging risks and fill coverage gaps to protect policyholders adequately.

Frequently Asked Questions (FAQ)

How much does home and property insurance typically cost?

+The cost of home and property insurance can vary significantly based on factors such as location, the value of your home, the level of coverage chosen, and any additional endorsements or riders. On average, homeowners insurance premiums range from 500 to 2,000 per year, but this can be higher or lower depending on individual circumstances.

What is the difference between actual cash value and replacement cost coverage for personal property?

+Actual cash value (ACV) coverage reimburses you for the current value of your belongings, taking into account depreciation. This means you may receive less than the original purchase price. Replacement cost coverage, on the other hand, pays the full cost of replacing your items with new ones of similar quality, without deducting for depreciation.

Do I need to insure my home for its full replacement cost?

+Insuring your home for its full replacement cost is generally recommended to ensure adequate coverage in the event of a total loss. Underinsuring your home may leave you financially vulnerable, as you may not have sufficient funds to rebuild or repair your property.

Can I customize my home and property insurance policy to include specific coverages for valuable items like jewelry or artwork?

+Yes, many insurance providers offer optional endorsements or riders that allow you to add coverage for high-value items. These endorsements typically provide broader coverage and higher limits than standard personal property coverage. It’s essential to discuss your specific needs with your insurance agent to ensure adequate protection.

How often should I review and update my home and property insurance policy?

+It is recommended to review your insurance policy annually, or whenever significant changes occur in your life or home. This ensures that your coverage remains up-to-date and aligned with your needs. Life events such as marriage, home renovations, or the acquisition of valuable possessions may require adjustments to your policy.