Home Fire Insurance

Home fire insurance is a crucial aspect of safeguarding your property and ensuring financial protection in the event of a devastating fire incident. This type of insurance provides coverage for damages and losses caused by fires, helping homeowners recover and rebuild. In this comprehensive article, we will delve into the intricacies of home fire insurance, exploring its coverage, benefits, and the importance of adequate protection. With the rising concerns about fire hazards and the potential for catastrophic losses, understanding the ins and outs of home fire insurance is essential for every homeowner.

Understanding Home Fire Insurance

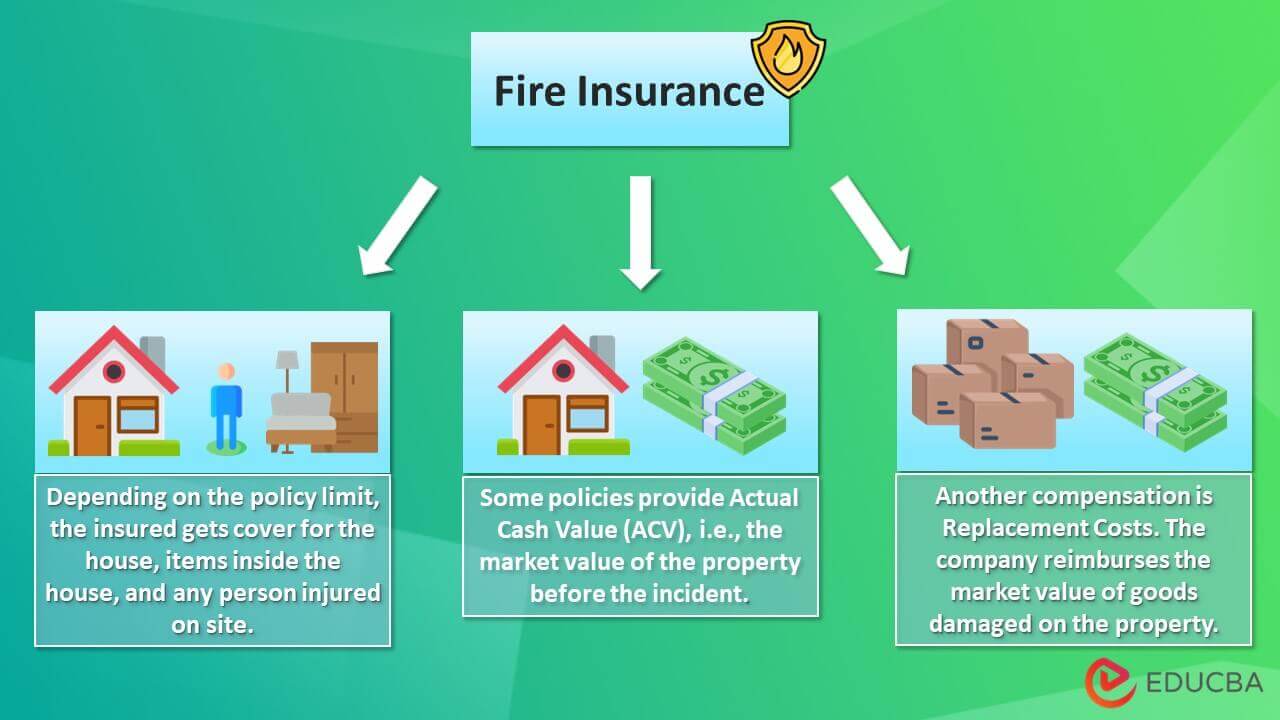

Home fire insurance is a specialized form of property insurance that focuses on covering the risks and damages associated with fires. It is designed to provide financial assistance to homeowners in the aftermath of a fire, helping them repair or rebuild their homes and replace personal belongings. This type of insurance is often included as part of a comprehensive homeowners insurance policy, but it can also be purchased as a standalone coverage.

The primary purpose of home fire insurance is to offer financial security and peace of mind to homeowners. Fires can be unpredictable and devastating, leading to extensive damage to properties and valuable possessions. By having adequate fire insurance coverage, homeowners can ensure that they have the means to recover and start afresh, even in the face of such unfortunate events.

Coverage and Benefits of Home Fire Insurance

Home fire insurance policies typically offer a range of coverage options and benefits, tailored to meet the specific needs of homeowners. Here are some key aspects of home fire insurance coverage:

Structure and Building Coverage

One of the primary benefits of home fire insurance is the protection it provides for the physical structure of your home. This coverage includes repairs or reconstruction of the building itself, ensuring that your home can be restored to its pre-fire condition. It covers damages to the walls, roof, floors, and other structural elements, as well as any necessary modifications to comply with building codes.

| Structure Coverage Highlights | Details |

|---|---|

| Rebuilding Costs | Covers the cost of rebuilding, including materials and labor. |

| Code Compliance | Ensures compliance with updated building codes during reconstruction. |

| Loss of Use | Provides temporary housing and additional living expenses if your home is uninhabitable during repairs. |

Personal Property Coverage

Home fire insurance also extends protection to your personal belongings and possessions. This coverage helps replace or repair damaged items, such as furniture, electronics, clothing, and other valuable items within your home. It is important to note that the extent of personal property coverage may vary based on the policy and your chosen coverage limits.

Additional Living Expenses

In the event that a fire renders your home uninhabitable, home fire insurance often includes coverage for additional living expenses. This provision assists homeowners in covering the costs of temporary housing, meals, and other necessary expenses while their home is being repaired or rebuilt. It provides financial support during a challenging time, ensuring that homeowners can maintain their daily routines.

Liability Coverage

Home fire insurance policies typically include liability coverage, which protects homeowners from legal and financial liabilities arising from fire-related incidents. This coverage can be particularly crucial if a fire spreads to neighboring properties or if someone is injured on your property due to the fire. It provides a safety net, ensuring that homeowners are not held personally responsible for such damages or injuries.

Debris Removal and Clean-up

After a fire, the cleanup and removal of debris can be a daunting task. Home fire insurance policies often include coverage for debris removal and clean-up costs. This provision assists homeowners in safely and efficiently removing damaged materials and ensuring that the property is restored to a habitable state.

Other Perils and Endorsements

Home fire insurance policies may also provide coverage for additional perils that are often associated with fires. These can include smoke damage, water damage from firefighting efforts, and even vandalism that occurs during or after the fire. Additionally, homeowners can opt for endorsements or riders to customize their coverage further, ensuring that their specific needs and concerns are addressed.

The Importance of Adequate Coverage

Having adequate home fire insurance coverage is crucial for several reasons. Firstly, fires can cause extensive damage, and the costs of repairs and rebuilding can be significant. Without sufficient insurance, homeowners may find themselves facing financial burdens that can be challenging to overcome. Adequate coverage ensures that homeowners have the means to fully restore their homes and replace their belongings, avoiding long-term financial strain.

Additionally, home fire insurance provides peace of mind and emotional support during a difficult time. The process of recovering from a fire can be emotionally taxing, and having insurance coverage in place can help alleviate some of the stress and uncertainty. It allows homeowners to focus on their well-being and the well-being of their loved ones, knowing that their financial stability is protected.

Tips for Choosing the Right Home Fire Insurance

When selecting a home fire insurance policy, it is essential to consider your specific needs and circumstances. Here are some tips to help you choose the right coverage:

- Assess Your Risks: Evaluate the potential fire hazards in your area and the likelihood of fire-related incidents. Consider factors such as proximity to wildfire-prone areas, electrical systems, and other fire risks.

- Understand Your Policy: Read your insurance policy carefully, paying close attention to the coverage limits, exclusions, and any specific conditions or requirements. Ensure that you understand the terms and conditions before committing to a policy.

- Customized Coverage: Discuss your specific needs and concerns with your insurance provider. They can help tailor your policy to address any unique circumstances, such as valuable possessions, home-based businesses, or specific fire prevention measures.

- Consider Additional Riders: Explore the option of adding riders or endorsements to your policy to enhance your coverage. For example, you may want to consider additional coverage for valuable items, such as jewelry or fine art.

- Regularly Review and Update: Fire hazards and your personal circumstances can change over time. Regularly review your insurance policy to ensure that your coverage remains adequate and aligned with your current needs. Update your policy as necessary to reflect any changes in your home or possessions.

Frequently Asked Questions (FAQ)

What is the difference between home fire insurance and homeowners insurance?

+Home fire insurance is typically a component of a comprehensive homeowners insurance policy. While homeowners insurance provides coverage for various risks, including fire, home fire insurance focuses specifically on fire-related damages and losses. It offers detailed coverage for the structure, personal belongings, and additional expenses associated with fires.

How much home fire insurance coverage do I need?

+The amount of home fire insurance coverage you need depends on several factors, including the value of your home, the cost of rebuilding in your area, and the value of your personal belongings. It’s recommended to work with an insurance professional to assess your specific needs and determine an appropriate coverage limit.

Does home fire insurance cover smoke damage?

+Yes, home fire insurance policies often include coverage for smoke damage. Smoke damage can be a significant concern after a fire, as it can affect walls, ceilings, furniture, and other surfaces. It’s important to review your policy to understand the extent of smoke damage coverage and any potential exclusions.

What happens if a fire spreads to neighboring properties?

+If a fire originating from your property spreads to neighboring properties, your home fire insurance policy’s liability coverage may come into play. This coverage can help protect you from legal and financial liabilities arising from damage to neighboring properties or injuries sustained by others due to the fire.

Can I get home fire insurance if I live in a high-risk area for wildfires?

+Obtaining home fire insurance in high-risk areas for wildfires may be more challenging, but it is not impossible. Insurance companies often consider the specific circumstances and take measures to manage the risks. It’s advisable to work with a knowledgeable insurance agent who specializes in high-risk areas to find suitable coverage options.