Home Insurance Auto Insurance

Home and auto insurance are two essential types of coverage that protect homeowners and vehicle owners from financial risks and unexpected events. These insurance policies play a crucial role in providing peace of mind and financial security, covering a wide range of potential losses and damages. In this comprehensive guide, we will delve into the world of home and auto insurance, exploring their importance, coverage options, and how they can benefit individuals and families.

The Significance of Home Insurance

Home insurance is a vital component of responsible homeownership. It offers protection against various perils that could potentially lead to significant financial burdens. From natural disasters to accidental damages, home insurance provides a safety net, ensuring that homeowners can recover and rebuild with relative ease.

Coverage Options for Homes

Home insurance policies typically offer a range of coverage options, allowing homeowners to tailor their protection to their specific needs. Some key coverage types include:

- Dwelling Coverage: This is the foundation of home insurance, covering the structure of the home itself. It protects against damages caused by perils like fire, windstorms, hail, and vandalism.

- Personal Property Coverage: This aspect of home insurance safeguards the contents of the home, including furniture, electronics, and personal belongings. It provides compensation in the event of theft, fire, or other covered losses.

- Liability Coverage: Liability insurance within a home insurance policy protects homeowners from financial responsibilities arising from accidents or injuries that occur on their property. It covers medical expenses and legal fees, providing a vital layer of protection.

- Additional Living Expenses: In the event that a home becomes uninhabitable due to a covered loss, this coverage ensures that homeowners have the means to cover temporary housing and living expenses until they can return to their home.

- Optional Coverages: Homeowners can often enhance their coverage with optional add-ons. This might include coverage for high-value items, identity theft protection, or coverage for specific natural disasters like earthquakes or floods.

The specific coverage options and limits will vary depending on the insurance provider and the policy chosen. It is crucial for homeowners to carefully review and understand their policy to ensure adequate protection.

Real-Life Example: Natural Disaster Protection

Imagine a family living in an area prone to hurricanes. With a comprehensive home insurance policy, they can rest assured that their home and belongings are protected against the potential devastation caused by these natural disasters. The policy might include coverage for wind damage, storm surge, and even temporary relocation expenses, providing a much-needed safety net during challenging times.

| Coverage Type | Average Coverage Limit |

|---|---|

| Dwelling | $250,000 |

| Personal Property | $100,000 |

| Liability | $300,000 |

| Additional Living Expenses | 6 months' coverage |

Auto Insurance: Protecting Your Wheels

Auto insurance is another critical type of coverage, ensuring financial protection for vehicle owners in the event of accidents, theft, or other unforeseen circumstances. It provides peace of mind, knowing that the costs associated with vehicle-related incidents can be managed effectively.

Understanding Auto Insurance Coverage

Auto insurance policies typically offer a range of coverage options, allowing drivers to customize their protection based on their needs and the requirements of their state or province. Here are some key components of auto insurance:

- Liability Coverage: Similar to home insurance, liability coverage in auto insurance protects against financial responsibilities arising from accidents. It covers bodily injury and property damage caused to others.

- Collision Coverage: This type of coverage safeguards the insured vehicle in the event of an accident, regardless of fault. It covers repairs or the replacement cost of the vehicle, up to the policy limits.

- Comprehensive Coverage: Comprehensive insurance provides protection against damages caused by non-collision incidents, such as theft, vandalism, natural disasters, or hitting an animal. It offers a broad range of coverage for unexpected events.

- Uninsured/Underinsured Motorist Coverage: This coverage protects the insured driver in the event of an accident with a driver who has no insurance or insufficient insurance to cover the damages.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage provides compensation for medical expenses incurred by the insured driver and passengers, regardless of fault.

The specific coverage options and limits will vary depending on the insurance provider and the state or province's regulations. It is essential for vehicle owners to carefully review their policy and understand the coverage they have in place.

Real-Life Example: Collision Protection

Consider a driver involved in a fender bender. With collision coverage as part of their auto insurance policy, they can have their vehicle repaired or replaced without incurring significant out-of-pocket expenses. This coverage ensures that the financial burden of the accident is manageable.

| Coverage Type | Average Coverage Limit |

|---|---|

| Liability | $100,000 per person / $300,000 per accident |

| Collision | $5,000 deductible |

| Comprehensive | $1,000 deductible |

| Uninsured Motorist | $50,000 per person / $100,000 per accident |

| Medical Payments | $5,000 per person |

The Benefits of Bundling Home and Auto Insurance

Many insurance providers offer the option to bundle home and auto insurance policies, providing a convenient and often cost-effective solution. Bundling these policies can offer several advantages:

- Discounts: Insurance companies often provide discounts when multiple policies are bundled together. This can result in significant savings on both home and auto insurance premiums.

- Convenience: Managing multiple policies with a single provider simplifies the insurance process. It streamlines billing, claims, and policy updates, making it easier to keep your coverage up-to-date.

- Enhanced Coverage: Some insurance companies offer additional benefits or extended coverage options when policies are bundled. This might include discounts on specific add-ons or enhanced liability protection.

Real-Life Scenario: Bundle Benefits

Imagine a family with a home and multiple vehicles. By bundling their home and auto insurance policies, they can take advantage of multi-policy discounts, potentially saving hundreds of dollars annually. Additionally, they can streamline their insurance management, making it more efficient and less time-consuming.

The Future of Home and Auto Insurance

The insurance industry is constantly evolving, and technology is playing a significant role in shaping the future of home and auto insurance. Here are some trends and developments to watch:

- Telematics and Usage-Based Insurance: Telematics technology allows insurance companies to track driving behavior and offer usage-based insurance policies. These policies reward safe drivers with lower premiums, providing a more personalized and fair insurance experience.

- Artificial Intelligence and Data Analytics: AI and data analytics are being utilized to improve risk assessment and claims processing. This technology can help insurance companies offer more accurate and tailored coverage, benefiting both insurers and policyholders.

- Smart Home Technology Integration: As smart home technology becomes more prevalent, insurance companies are exploring ways to integrate it into home insurance policies. This could include discounts for homes with advanced security systems or fire prevention measures.

- Digital Claims Processing: The insurance industry is increasingly embracing digital claims processing, making it faster and more efficient for policyholders to submit and manage claims. This technology can reduce delays and provide a more seamless experience.

Conclusion

Home and auto insurance are essential aspects of financial planning and risk management. By understanding the coverage options available and staying informed about industry developments, individuals can make informed decisions to protect their homes, vehicles, and financial well-being. Whether it’s safeguarding against natural disasters or ensuring peace of mind on the road, these insurance policies provide a vital safety net for homeowners and vehicle owners alike.

How do I choose the right home insurance coverage for my needs?

+When selecting home insurance coverage, consider the value of your home, the cost of rebuilding, and the replacement value of your personal belongings. Assess the risks in your area, such as natural disasters or crime rates, and choose a policy that provides adequate coverage for those risks. Don’t forget to include liability coverage to protect against accidents or injuries that may occur on your property.

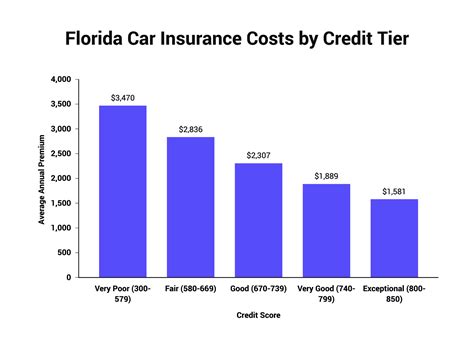

What factors determine auto insurance rates?

+Auto insurance rates are influenced by various factors, including your driving record, the make and model of your vehicle, your age and gender, the coverage limits you choose, and your location. Insurance companies also consider your credit score and claims history. It’s important to shop around and compare quotes from different insurers to find the best rate for your specific circumstances.

Are there any discounts available for home and auto insurance?

+Yes, insurance companies often offer a range of discounts to policyholders. These can include multi-policy discounts when you bundle home and auto insurance, as well as discounts for safety features like burglar alarms, smoke detectors, and anti-theft devices in your home or vehicle. Safe driver discounts, good student discounts, and loyalty discounts are also common. It’s worth inquiring with your insurance provider to see what discounts you may be eligible for.

How do I file a claim for home or auto insurance?

+To file a claim, contact your insurance provider as soon as possible after an incident occurs. They will guide you through the claims process, which typically involves providing details of the incident, any supporting documentation, and, in some cases, an inspection by an insurance adjuster. It’s important to cooperate fully with the claims process and provide accurate information to ensure a smooth and timely resolution.