Homeowners Insurance Cost

Homeowners insurance is a vital aspect of protecting one's most significant investment - their home. It provides financial security and peace of mind, covering various risks and perils that homeowners may face. However, the cost of homeowners insurance can vary significantly depending on several factors. In this comprehensive guide, we will delve into the intricacies of homeowners insurance costs, exploring the key determinants, offering valuable insights, and providing practical tips to help you navigate this essential aspect of homeownership.

Understanding the Factors that Influence Homeowners Insurance Costs

The cost of homeowners insurance is influenced by a multitude of factors, each playing a crucial role in determining the premium you pay. By understanding these factors, you can make informed decisions and potentially save on your insurance expenses.

1. Location and Risk Factors

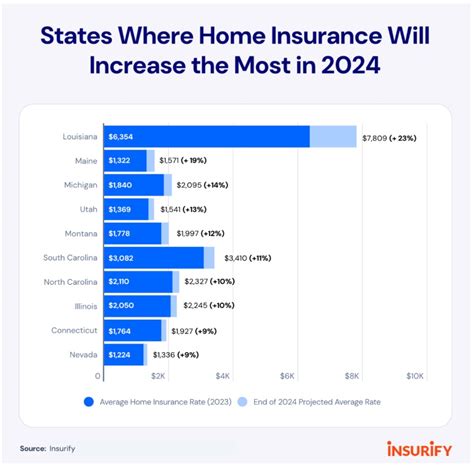

One of the primary determinants of homeowners insurance costs is the location of your property. Insurance companies carefully assess the risks associated with different areas, considering factors such as crime rates, natural disasters, and proximity to fire stations. High-risk areas, prone to frequent claims, often result in higher insurance premiums.

For instance, if you live in a region susceptible to hurricanes or earthquakes, your insurance rates will likely be higher due to the increased likelihood of claims. Similarly, urban areas with higher crime rates may attract higher premiums compared to rural or suburban locations.

| Location Risk Factors | Impact on Premium |

|---|---|

| Natural Disaster Prone Areas | Higher Premiums |

| High Crime Rate Regions | Increased Premiums |

| Proximity to Fire Hazards | Varying Premiums |

2. Coverage and Policy Limits

The extent of coverage and the policy limits you choose have a direct impact on your homeowners insurance costs. Insurance policies offer varying levels of protection, and selecting a comprehensive plan with higher coverage limits will generally result in higher premiums.

It’s essential to strike a balance between adequate coverage and affordability. Assess your specific needs, including the replacement cost of your home, the value of your personal belongings, and any unique risks you want to insure against. Choosing the right coverage ensures you’re protected without overpaying.

| Coverage Type | Description | Impact on Premium |

|---|---|---|

| Dwelling Coverage | Protects the structure of your home | Higher Limits = Higher Premiums |

| Personal Property Coverage | Covers belongings inside your home | Increased Coverage = Higher Costs |

| Liability Coverage | Protects against legal claims | Higher Limits = Increased Premiums |

3. Home’s Age, Construction, and Features

The age and construction of your home are significant factors in determining insurance costs. Older homes may require more maintenance and are susceptible to specific risks, such as outdated electrical wiring or plumbing, which can increase insurance premiums.

Additionally, the construction materials and design of your home play a role. Homes built with fire-resistant materials or featuring advanced safety systems may attract lower insurance rates. On the other hand, homes with older, outdated construction may face higher premiums due to increased repair costs.

| Home Characteristics | Impact on Premium |

|---|---|

| Age of the Home | Older Homes = Higher Premiums |

| Construction Materials | Fire-Resistant Materials = Lower Premiums |

| Safety Features | Advanced Safety Systems = Potential Savings |

4. Claims History and Credit Score

Your insurance claims history and credit score are vital factors in determining homeowners insurance costs. Insurance companies carefully evaluate these aspects to assess the level of risk you pose as a policyholder.

A history of frequent claims or large claims may lead to higher insurance premiums. Insurance companies view frequent claims as an indication of higher risk and may adjust your premium accordingly. Similarly, a poor credit score can impact your insurance rates, as it is often used as an indicator of financial responsibility.

| Factor | Impact on Premium |

|---|---|

| Claims History | Frequent Claims = Higher Premiums |

| Credit Score | Lower Credit Score = Higher Premiums |

Tips to Save on Homeowners Insurance Costs

While homeowners insurance is an essential investment, there are strategies you can employ to potentially reduce your insurance costs without compromising on protection.

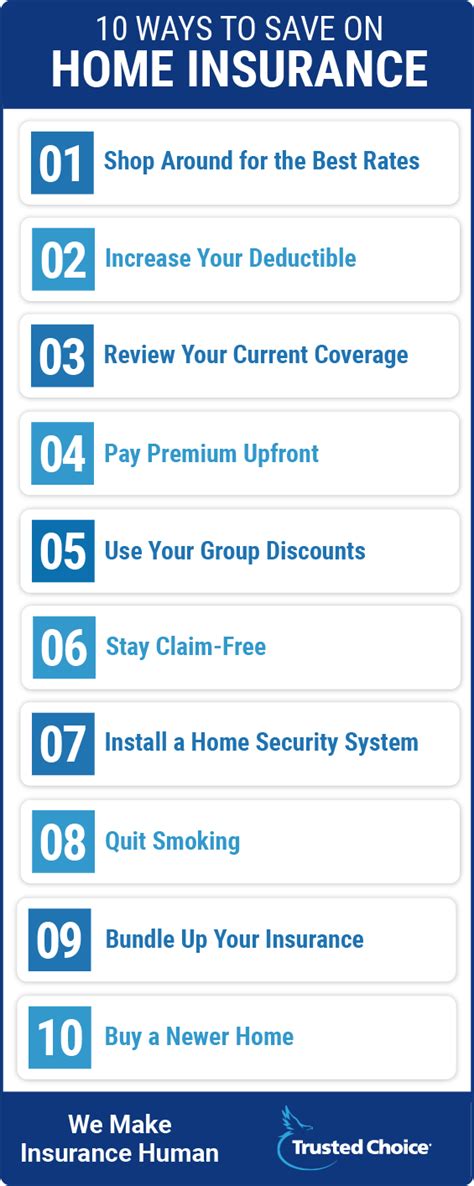

1. Shop Around and Compare Quotes

One of the most effective ways to save on homeowners insurance is by shopping around and comparing quotes from multiple insurance providers. Insurance rates can vary significantly between companies, so obtaining quotes from at least three providers is recommended.

Online insurance comparison platforms can be a valuable tool in this process. These platforms allow you to enter your information once and receive multiple quotes, making it easier to identify the most competitive rates.

Additionally, consider reaching out to local insurance agents or brokers who can provide personalized recommendations and help you navigate the various policy options available.

2. Bundle Your Policies

Many insurance companies offer discounts when you bundle multiple policies with them. By combining your homeowners insurance with other policies, such as auto insurance or life insurance, you can often secure significant savings.

Bundling policies not only saves you money but also simplifies your insurance management. You’ll have a single provider for all your insurance needs, making it more convenient to handle claims and policy updates.

3. Improve Your Home’s Security

Investing in home security measures can not only enhance your peace of mind but also potentially reduce your homeowners insurance costs. Insurance companies often offer discounts for homes equipped with advanced security systems.

Consider installing monitored security systems, smoke detectors, fire sprinklers, or even smart home devices that can detect and prevent potential hazards. These improvements demonstrate your commitment to preventing losses and can lead to lower insurance premiums.

4. Increase Your Deductible

Your deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Increasing your deductible can result in lower insurance premiums, as you’re assuming a larger portion of the financial responsibility in the event of a claim.

However, it’s essential to choose a deductible that aligns with your financial capacity. While a higher deductible can save you money in the long run, ensure you can afford the out-of-pocket expenses associated with it.

5. Maintain a Good Credit Score

Your credit score plays a significant role in determining your insurance rates. Insurance companies view a good credit score as an indicator of financial responsibility and stability. Maintaining a strong credit score can lead to lower insurance premiums and provide you with more negotiating power when shopping for insurance.

Take steps to improve your credit score by paying your bills on time, reducing your debt, and regularly monitoring your credit report for any errors or discrepancies.

Conclusion

Homeowners insurance is a vital investment that provides financial protection and peace of mind. By understanding the factors that influence insurance costs and implementing strategic approaches, you can potentially save on your insurance expenses without compromising on coverage.

Remember to shop around, bundle your policies, enhance your home’s security, consider increasing your deductible, and maintain a good credit score. These steps, combined with a thorough understanding of your specific needs and risks, will empower you to make informed decisions and secure the best homeowners insurance coverage for your unique situation.

How often should I review my homeowners insurance policy?

+It’s recommended to review your homeowners insurance policy annually or whenever significant changes occur in your life or home. This ensures that your coverage remains up-to-date and aligned with your needs.

What are some common discounts offered by insurance companies for homeowners insurance?

+Insurance companies often provide discounts for various reasons, such as having a good claims history, installing security systems, being a loyal customer, or even being a member of certain organizations. It’s worth exploring these discounts when shopping for insurance.

Can I negotiate my homeowners insurance rates with my insurance provider?

+While insurance rates are primarily based on risk assessments, it doesn’t hurt to negotiate with your insurance provider. They may be able to offer you a better rate or provide additional discounts based on your specific circumstances.