Homeowners Insurance Policy Quote

Securing a homeowners insurance policy is a crucial step for any homeowner to protect their biggest asset and ensure peace of mind. This comprehensive guide will walk you through the process of obtaining a homeowners insurance policy quote, highlighting the key factors that impact your premium, and offering valuable insights to help you navigate the world of insurance with confidence.

Understanding Homeowners Insurance and Its Importance

Homeowners insurance is a contract that provides financial protection for homeowners against a variety of risks and liabilities. It is designed to cover the structure of your home, its contents, and the personal liability associated with owning a home. Understanding the coverage options and the factors that influence your premium is essential to finding the right policy for your needs.

Here's a breakdown of the typical coverage provided by a standard homeowners insurance policy:

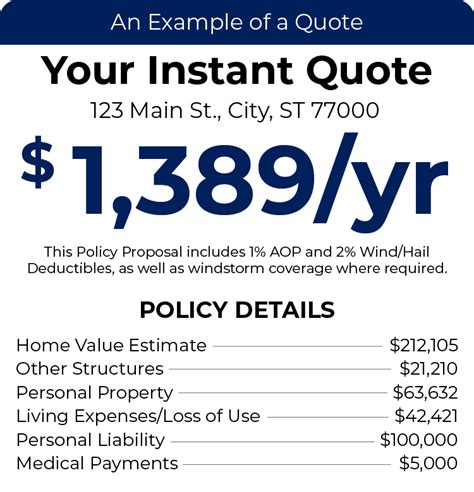

- Dwelling Coverage: This covers the physical structure of your home, including the walls, roof, and permanent fixtures. It ensures that if your home is damaged or destroyed, you can rebuild or repair it.

- Personal Property Coverage: This coverage protects your belongings, such as furniture, electronics, and clothing, in case of theft, damage, or loss. It typically covers both on-premises and off-premises incidents.

- Liability Coverage: One of the most critical aspects of homeowners insurance is liability coverage. It provides protection if someone is injured on your property or if you are held responsible for causing property damage or bodily injury to others.

- Additional Living Expenses: In the event that your home becomes uninhabitable due to a covered loss, this coverage will reimburse you for additional living expenses, such as hotel stays or restaurant meals, until you can return to your home.

- Medical Payments: This coverage provides for the medical expenses of individuals who are injured on your property, regardless of liability. It is often used for minor injuries and can help avoid costly lawsuits.

Homeowners insurance is a vital component of your financial security, providing protection against unforeseen events and potential liabilities. However, the cost of this protection can vary significantly based on a multitude of factors.

Factors Influencing Your Homeowners Insurance Quote

When requesting a homeowners insurance policy quote, it's essential to understand the key factors that insurance companies consider. These factors help insurers assess the level of risk associated with your property and determine your premium.

Location and Geographic Risk Factors

One of the primary considerations in homeowners insurance is your location. Different areas face varying levels of risk due to natural disasters, crime rates, and other factors. For example, homes in regions prone to hurricanes, tornadoes, or earthquakes may face higher premiums due to the increased risk of catastrophic damage.

Additionally, the specific characteristics of your neighborhood, such as the proximity to fire stations, the local crime rate, and the quality of local emergency services, can all influence your insurance rates. Insurance companies carefully analyze these geographic risk factors to assess the potential for claims in your area.

| Geographic Risk Factor | Impact on Premium |

|---|---|

| Natural Disaster Zones | Higher Premiums |

| Crime Rate | Varies by Location |

| Proximity to Fire Stations | Lower Premiums |

| Emergency Services Quality | Varies by Location |

Home Value and Replacement Cost

The value of your home and its replacement cost are significant factors in determining your insurance premium. A higher home value generally leads to a higher premium, as it indicates a greater financial risk for the insurance company.

Insurance companies typically use a formula to calculate the replacement cost of your home, which considers factors like the size of your home, the quality of construction materials, and the cost of labor in your area. The replacement cost is essential for ensuring that your policy provides adequate coverage in the event of a total loss.

Personal Information and Claims History

Your personal information, including your age, occupation, and credit score, can influence your homeowners insurance premium. Insurance companies may view certain occupations or credit scores as indicators of higher risk, which could lead to higher premiums.

Your claims history is another critical factor. Insurance companies use this information to assess your past behavior and the likelihood of future claims. A history of frequent claims may result in higher premiums or even non-renewal of your policy.

Home Construction and Maintenance

The age, construction, and maintenance of your home play a significant role in determining your insurance premium. Older homes may be at higher risk for certain types of damage, such as water leaks or electrical fires, which can increase your premium.

Additionally, the materials used in your home's construction can impact your premium. Homes built with fire-resistant materials or reinforced against natural disasters may qualify for lower rates. Regular maintenance and updates to your home's systems, such as plumbing and electrical, can also reduce the risk of claims and lower your premium.

Security and Safety Features

Installing security and safety features in your home can be a great way to reduce your homeowners insurance premium. These features demonstrate a commitment to preventing losses and can be attractive to insurance companies.

Common security and safety features include:

- Smoke detectors

- Carbon monoxide detectors

- Fire extinguishers

- Burglar alarms

- Security cameras

- Deadbolt locks

- Reinforced doors and windows

By investing in these features, you not only enhance the safety of your home but also potentially lower your insurance costs.

The Homeowners Insurance Quote Process

Now that we've covered the key factors influencing your homeowners insurance quote, let's delve into the process of obtaining a quote.

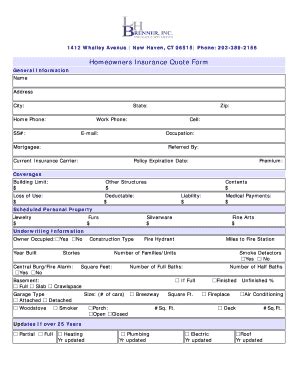

Gathering Information

Before requesting a quote, it's essential to have certain information readily available. This includes details about your home, such as its size, construction type, and any recent improvements or renovations. Additionally, having your personal information, including your date of birth, occupation, and credit score, can streamline the quote process.

Comparing Quotes

Once you've gathered the necessary information, it's time to compare quotes from different insurance providers. Online quote comparison tools can be a convenient way to quickly view multiple options. However, it's crucial to understand that these tools may not provide the most accurate quotes, as they often rely on standard assumptions that may not apply to your specific situation.

For a more precise quote, consider contacting insurance agents directly. They can provide personalized quotes based on your unique circumstances and offer valuable insights into the coverage options available to you.

Customizing Your Policy

When you receive a quote, it's important to review the coverage limits and deductibles to ensure they align with your needs. Remember that the lowest premium may not always offer the best value if it leaves you underinsured. Consider the potential costs of a total loss or significant damage to your home when choosing your coverage limits.

Additionally, discuss with your insurance agent any potential discounts you may qualify for. Many insurance companies offer discounts for bundling policies (e.g., combining homeowners and auto insurance), installing security systems, or being claim-free for a certain period.

Tips for Getting the Best Homeowners Insurance Quote

To ensure you're getting the best homeowners insurance quote, consider these expert tips:

- Shop Around: Don't settle for the first quote you receive. Compare quotes from multiple insurers to find the best combination of coverage and price.

- Understand Your Needs: Take the time to assess your specific needs and risks. This will help you choose a policy that provides adequate coverage without unnecessary expenses.

- Bundle Policies: If you have multiple insurance needs, such as auto and homeowners insurance, consider bundling them with the same insurer. This can often result in significant savings.

- Review Your Policy Annually: Your circumstances and insurance needs may change over time. Regularly review your policy to ensure it still meets your needs and to take advantage of any new discounts or coverage options.

- Consider Higher Deductibles: Opting for a higher deductible can lower your premium. However, be sure you can afford the deductible in the event of a claim.

- Improve Your Home's Safety: Investing in safety and security features can not only protect your home but also potentially lower your insurance costs.

The Bottom Line

Obtaining a homeowners insurance policy quote is a critical step in protecting your home and your financial well-being. By understanding the factors that influence your premium and taking proactive steps to mitigate risks, you can find a policy that provides comprehensive coverage at a competitive price.

Remember, your home is one of your most valuable assets, and homeowners insurance is an essential tool to protect it. Take the time to shop around, compare quotes, and customize your policy to ensure you have the right coverage for your needs.

Frequently Asked Questions

What is the difference between replacement cost and actual cash value coverage?

+Replacement cost coverage reimburses you for the full cost of rebuilding your home, while actual cash value coverage considers depreciation and provides a lower payout.

How often should I review my homeowners insurance policy?

+It’s recommended to review your policy annually to ensure it still meets your needs and to take advantage of any new discounts or coverage options.

Can I get homeowners insurance if I have a poor credit score?

+Yes, but a poor credit score may result in higher premiums. It’s worth shopping around as different insurers have varying policies regarding credit scores.

What is the average cost of homeowners insurance in the United States?

+The average cost of homeowners insurance in the U.S. varies widely depending on factors like location, home value, and coverage limits. However, the national average premium is around $1,300 per year.

Are there any discounts available for homeowners insurance?

+Yes, many insurers offer discounts for bundling policies, installing security systems, or being claim-free for a certain period. It’s worth discussing potential discounts with your insurance agent.