Life Insurance And Term

Life insurance is a crucial financial tool that provides security and peace of mind to individuals and their families. It offers a safety net during uncertain times, ensuring that loved ones are protected and financially supported in the event of an untimely demise. Among the various types of life insurance policies, term life insurance stands out as a popular and affordable option, offering coverage for a specified period, often referred to as the "term."

Understanding Term Life Insurance

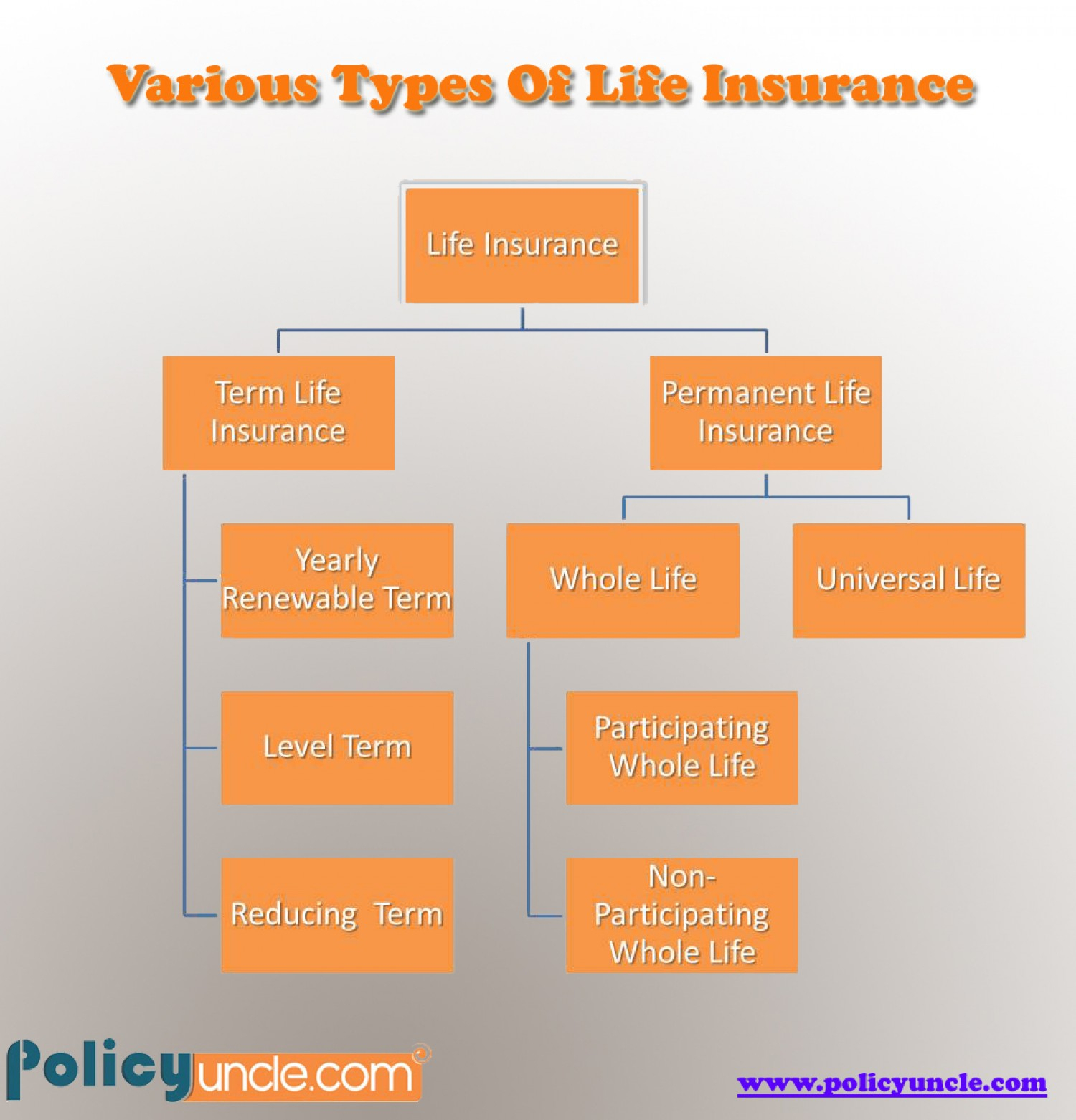

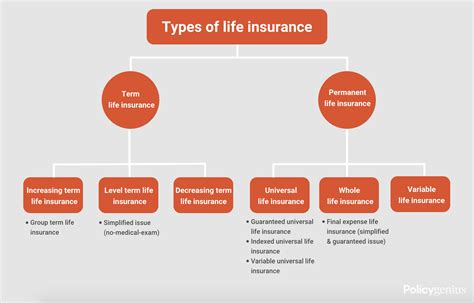

Term life insurance, as the name suggests, is a temporary form of coverage that provides financial protection for a predetermined period, typically ranging from 10 to 30 years. It is designed to meet the needs of individuals who require coverage for a specific stage of their life, such as during their working years when they have financial responsibilities like mortgages, loans, and family obligations.

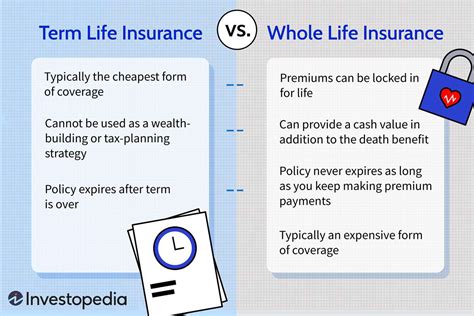

The key characteristic of term life insurance is its cost-effectiveness. Unlike permanent life insurance policies, which accumulate cash value over time, term life insurance focuses solely on providing pure protection. This means that the premiums are generally lower, making it an attractive option for those seeking a budget-friendly way to secure their family's future.

Key Features of Term Life Insurance

- Affordable Premiums: One of the primary advantages of term life insurance is its affordability. The premiums are typically fixed for the duration of the term, providing policyholders with a predictable and manageable financial commitment.

- Flexibility: Term life insurance policies offer flexibility in terms of coverage amounts and policy terms. Individuals can choose the coverage amount based on their specific needs and select a term that aligns with their financial goals and responsibilities.

- No Cash Value: Unlike whole life or universal life policies, term life insurance does not accumulate cash value. This means that the policyholder receives only the death benefit if the insured individual passes away during the policy term.

- Renewal Options: Many term life insurance policies provide the option to renew the coverage at the end of the initial term. While the premiums may increase with age, this allows individuals to extend their coverage if their financial needs or circumstances change.

Choosing the Right Term Length

When selecting a term life insurance policy, one of the crucial decisions is determining the appropriate term length. The choice of term length depends on various factors, including the policyholder’s age, financial responsibilities, and long-term goals.

For younger individuals starting their careers and building a family, a shorter term of 10 to 15 years may be sufficient. This period often covers critical financial responsibilities such as paying off student loans, establishing an emergency fund, or ensuring that young children are provided for until they reach adulthood.

On the other hand, individuals with long-term financial obligations, such as a mortgage or significant business loans, may opt for a longer term of 20 to 30 years. This ensures that their loved ones are protected and can continue to meet their financial commitments even in the absence of the policyholder.

Factors Influencing Term Length

- Age and Health: Younger and healthier individuals may opt for shorter terms, as they are less likely to require coverage for an extended period. As individuals age and their health status changes, they may consider longer terms to maintain coverage.

- Financial Responsibilities: The nature and extent of an individual’s financial obligations play a significant role in determining the term length. Those with significant debts or long-term financial commitments may benefit from longer terms to provide continuous protection.

- Retirement Planning: For individuals nearing retirement, term life insurance can serve as a bridge to ensure financial security until other retirement plans come into effect. In such cases, a shorter term aligned with the retirement timeline may be suitable.

The Benefits of Term Life Insurance

Term life insurance offers several advantages that make it a popular choice among individuals seeking financial protection. Here are some key benefits:

Cost-Effectiveness

The most significant advantage of term life insurance is its affordability. The premiums for term policies are often much lower compared to permanent life insurance, making it accessible to a wider range of individuals. This cost-effectiveness allows policyholders to secure substantial coverage without straining their finances.

Flexibility and Customization

Term life insurance policies provide flexibility in terms of coverage amounts and term lengths. Policyholders can tailor their coverage to meet their specific needs, ensuring that they have adequate protection for their unique circumstances. This customization allows for a more precise and efficient use of financial resources.

Renewal and Conversion Options

Many term life insurance policies offer renewal options, allowing policyholders to extend their coverage beyond the initial term. While renewal may result in higher premiums due to aging, it provides an opportunity to maintain protection for a longer duration. Additionally, some term policies offer conversion privileges, enabling policyholders to convert their term policy into a permanent life insurance policy without undergoing a new medical exam.

Peace of Mind

Term life insurance provides peace of mind, knowing that one’s loved ones are financially secured in the event of an untimely demise. It ensures that families can maintain their standard of living, pay off debts, and continue pursuing their financial goals without the added burden of financial strain.

Performance Analysis and Real-World Examples

To illustrate the effectiveness of term life insurance, let’s examine a real-world scenario. Consider a 35-year-old individual with a spouse and two young children. This individual has a mortgage, student loans, and other financial obligations. By opting for a 20-year term life insurance policy with a coverage amount of $500,000, they can ensure that their family is protected during a critical period of their lives.

In the unfortunate event of the policyholder's death within the 20-year term, the death benefit of $500,000 would be paid to the beneficiaries. This substantial sum can be used to pay off debts, cover funeral expenses, and provide a financial cushion for the surviving spouse and children. The policy's affordable premiums, tailored to the individual's budget, ensure that this protection is maintained without financial strain.

| Term Length | Coverage Amount | Estimated Premiums |

|---|---|---|

| 10 years | $250,000 | $15/month |

| 15 years | $350,000 | $20/month |

| 20 years | $500,000 | $25/month |

The above table provides an estimate of premiums for different term lengths and coverage amounts. These premiums are based on a healthy 35-year-old individual and serve as a general guide. Actual premiums may vary depending on individual circumstances and the insurance provider.

Evidence-Based Future Implications

Term life insurance continues to be a valuable tool for individuals seeking financial protection. As life expectancy increases and financial responsibilities evolve, the demand for term life insurance is likely to remain strong. Here are some future implications based on current trends and industry insights:

- Growing Awareness: With increasing financial literacy and a focus on long-term planning, more individuals are likely to recognize the importance of life insurance. This awareness will drive the demand for term life insurance as a cost-effective and flexible solution.

- Digital Innovation: The insurance industry is embracing digital technologies, making it easier for individuals to compare policies, obtain quotes, and purchase term life insurance online. This convenience will further enhance the accessibility and popularity of term life insurance.

- Tailored Solutions: Insurance providers are increasingly offering customized term life insurance policies that cater to specific needs. This trend will continue, allowing individuals to find policies that align perfectly with their financial goals and responsibilities.

- Renewal and Conversion Strategies: Insurance companies may focus on providing attractive renewal and conversion options to retain customers. This could include simplified renewal processes and competitive pricing to encourage policyholders to extend their coverage beyond the initial term.

What happens if I outlive my term life insurance policy?

+If you outlive your term life insurance policy, the coverage expires, and you will no longer have insurance protection. However, many policies offer renewal options, allowing you to extend the coverage for an additional term. Renewal terms may come with higher premiums due to aging, but they provide an opportunity to maintain protection.

Can I convert my term life insurance policy into a permanent policy?

+Yes, many term life insurance policies offer conversion privileges. This means you can convert your term policy into a permanent life insurance policy, such as whole life or universal life, without undergoing a new medical exam. Conversion typically needs to be done within a specified time frame and may have certain requirements or restrictions.

How do I determine the right coverage amount for my term life insurance policy?

+Determining the right coverage amount involves assessing your financial obligations and goals. Consider factors such as outstanding debts, mortgage, future education expenses for your children, and any other financial responsibilities. You can also consult with a financial advisor or insurance agent to help you calculate the appropriate coverage amount based on your unique circumstances.