Homesite Insurance Company Progressive

In the dynamic landscape of the insurance industry, a fascinating interplay unfolds between established giants and innovative newcomers. Homesite Insurance Company, a prominent player in the home insurance sector, finds itself in an intriguing comparison with Progressive, a well-known force in the broader insurance market. This exploration aims to delve into the distinct characteristics, offerings, and market positions of both entities, offering a comprehensive understanding of their roles and relevance in the insurance arena.

Homesite Insurance Company: A Home Insurance Specialist

Homesite Insurance Company, with its roots tracing back to 1997, has carved a niche for itself in the highly competitive insurance market. Specializing in home insurance, the company has consistently ranked among the top providers, offering a comprehensive range of policies tailored to the diverse needs of homeowners.

Product Offerings and Target Market

Homesite’s product portfolio is extensive, covering standard home insurance policies that provide protection against perils like fire, theft, and natural disasters. Additionally, the company offers specialized coverage for unique circumstances, such as:

- Flood Insurance: Given the increasing frequency of flooding events, Homesite's flood insurance policies provide an essential layer of protection for homeowners in vulnerable areas.

- Earthquake Insurance: For regions prone to seismic activity, Homesite offers earthquake insurance, covering structural damage and the costs associated with rebuilding.

- Condo Insurance: Catering to condominium owners, Homesite's policies ensure coverage for personal property, liability, and additional living expenses.

- Renters Insurance: Targeting tenants, this policy covers personal belongings and provides liability protection, offering peace of mind to renters.

Furthermore, Homesite's innovative approach extends to offering coverage for specific items or collections, such as:

- Fine Arts Insurance: Protecting valuable art pieces and antiques.

- Wine Collection Insurance: Covering wine enthusiasts' valuable collections.

- Jewelry Insurance: Providing specialized coverage for high-value jewelry items.

These specialized policies showcase Homesite's commitment to catering to the unique needs of its customers, ensuring a personalized insurance experience.

Market Reach and Customer Experience

Homesite operates as a direct-to-consumer insurance company, allowing customers to purchase policies directly through its website or over the phone. This approach simplifies the insurance acquisition process, making it more accessible and convenient for homeowners. The company’s focus on digital transformation has resulted in a seamless online experience, enabling customers to manage their policies, file claims, and access resources with ease.

Additionally, Homesite's customer service is renowned for its efficiency and expertise. The company's dedicated team provides personalized support, ensuring that customers receive the guidance they need to navigate the complexities of home insurance. This commitment to customer satisfaction has been a key driver of Homesite's success and positive reputation in the market.

Progressive: A Multifaceted Insurance Powerhouse

Progressive, established in 1937, stands as a prominent force in the insurance industry, with a comprehensive suite of offerings that extend beyond its core auto insurance business. The company’s innovative spirit and customer-centric approach have positioned it as a leader in the highly competitive insurance market.

Diverse Product Portfolio

Progressive’s product offerings are extensive, covering a wide range of insurance needs. In addition to its well-known auto insurance policies, the company provides:

- Home Insurance: Progressive offers comprehensive home insurance policies, protecting homeowners against a range of perils, including fire, theft, and natural disasters. The company's policies are designed to be flexible, allowing customers to customize their coverage to meet their specific needs.

- Renters Insurance: Aimed at tenants, Progressive's renters insurance policies provide coverage for personal belongings and liability protection, offering peace of mind to renters in various living arrangements.

- Motorcycle Insurance: For motorcycle enthusiasts, Progressive offers specialized policies that cater to the unique risks associated with riding motorcycles. These policies provide comprehensive coverage, including collision, comprehensive, and liability protection.

- Boat Insurance: Progressive's boat insurance policies offer protection for various watercraft, covering liabilities, damage, and even emergency assistance while out on the water.

- Commercial Insurance: Progressive also serves the business community, offering a range of commercial insurance policies tailored to the needs of small businesses, including general liability, property, and business auto insurance.

Progressive's diverse product portfolio demonstrates its commitment to meeting the insurance needs of individuals and businesses across various sectors, solidifying its position as a trusted and versatile insurance provider.

Innovation and Customer-Centric Approach

Progressive’s success can be attributed in large part to its innovative spirit and unwavering focus on the customer experience. The company has consistently embraced technological advancements, leveraging data analytics and digital platforms to enhance its offerings and streamline the insurance process for its customers.

One of Progressive's most notable innovations is its Name Your Price tool, which empowers customers to set their own price range for auto insurance coverage. This tool allows customers to choose the coverage options that best suit their needs and budget, providing a level of flexibility and customization that is unique in the industry. Progressive's commitment to customer empowerment and choice has been a key differentiator in the competitive insurance market.

Furthermore, Progressive's customer service is renowned for its accessibility and efficiency. The company offers 24/7 customer support, ensuring that policyholders can receive assistance whenever they need it. This round-the-clock availability, coupled with Progressive's commitment to resolving customer inquiries promptly, has contributed to its positive reputation and high customer satisfaction ratings.

Comparative Analysis: Homesite vs. Progressive

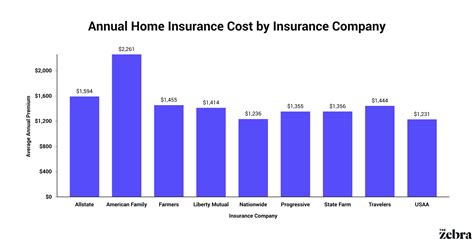

When comparing Homesite Insurance Company and Progressive, it becomes evident that both entities have carved distinct niches within the insurance industry. Homesite’s specialization in home insurance and its focus on personalized coverage for unique circumstances sets it apart as a go-to provider for homeowners seeking tailored protection.

On the other hand, Progressive's multifaceted approach and extensive product portfolio position it as a versatile insurance powerhouse. From auto insurance to home, renters, motorcycle, boat, and commercial insurance, Progressive offers a comprehensive suite of policies to meet the diverse needs of individuals and businesses. Its innovative tools and customer-centric approach have solidified its reputation as a trusted and forward-thinking insurance provider.

Key Differences and Similarities

While Homesite and Progressive share the common goal of providing insurance protection to their customers, their approaches and target markets differ significantly:

- Specialization vs. Versatility: Homesite's specialization in home insurance allows it to offer highly tailored policies for unique circumstances, such as flood, earthquake, and fine arts insurance. Progressive, on the other hand, takes a more versatile approach, offering a wide range of insurance products to cater to a broader customer base.

- Target Market: Homesite primarily targets homeowners, offering them specialized coverage tailored to their specific needs. Progressive, with its diverse product portfolio, caters to a wider audience, including homeowners, renters, motorcycle and boat owners, and businesses.

- Innovation: Both companies embrace innovation, but their focus differs. Homesite's innovations tend to be more niche-specific, developing specialized policies for unique scenarios. Progressive, with its broader scope, innovates across various insurance sectors, introducing tools like Name Your Price to empower customers with choice and flexibility.

- Customer Experience: Both companies prioritize customer satisfaction and have earned reputations for their efficient and accessible customer service. Homesite's focus on digital transformation has resulted in a seamless online experience, while Progressive's 24/7 customer support ensures round-the-clock assistance for policyholders.

Performance and Market Position

Homesite’s specialization has enabled it to establish a strong presence in the home insurance market, consistently ranking among the top providers. Its commitment to personalized coverage and customer satisfaction has contributed to its positive reputation and market success.

Progressive, with its extensive product offerings and innovative approach, has solidified its position as a leading insurance provider. Its ability to cater to a diverse range of customers and its commitment to customer empowerment have been key drivers of its success and market dominance.

Future Implications and Market Trends

Looking ahead, both Homesite and Progressive are well-positioned to navigate the evolving insurance landscape. Homesite’s specialization in home insurance and its focus on personalized coverage align with the growing demand for tailored insurance solutions. As climate change continues to impact home insurance, Homesite’s specialized policies for natural disasters and unique circumstances will likely remain in high demand.

Progressive, with its versatile approach and innovative spirit, is well-equipped to adapt to changing market dynamics. Its ability to offer a wide range of insurance products and its commitment to customer-centric innovation position it as a leader in the evolving insurance industry. As technology continues to shape the insurance sector, Progressive's digital initiatives and data-driven strategies will likely enhance its competitive advantage.

Conclusion

In the intricate world of insurance, Homesite Insurance Company and Progressive stand as distinct yet formidable entities. Homesite’s specialization in home insurance and its focus on personalized coverage have solidified its position as a trusted provider in this niche market. Progressive, with its multifaceted approach and innovative spirit, has established itself as a leading force across various insurance sectors, catering to a diverse range of customers.

As the insurance landscape continues to evolve, both companies are poised to adapt and thrive. Homesite's specialized offerings and Progressive's versatile product portfolio, coupled with their shared commitment to customer satisfaction and innovation, ensure their relevance and success in the dynamic insurance industry.

FAQ

How does Homesite Insurance Company compare to other home insurance providers in terms of coverage and pricing?

+Homesite Insurance Company stands out for its comprehensive coverage options, including specialized policies for unique circumstances like flood, earthquake, and fine arts insurance. In terms of pricing, Homesite offers competitive rates, and its online purchasing process provides customers with transparency and convenience.

What sets Progressive apart from other insurance companies in terms of customer service and innovation?

+Progressive is known for its innovative approach, particularly with tools like Name Your Price, which empowers customers to choose their auto insurance coverage. Additionally, Progressive’s 24⁄7 customer support and commitment to resolving inquiries promptly have contributed to its positive reputation for customer service.

How do Homesite and Progressive handle claims and customer support in comparison to their competitors?

+Both Homesite and Progressive prioritize customer satisfaction and have efficient claims processes. Homesite’s focus on digital transformation has streamlined its claims handling, while Progressive’s 24⁄7 customer support ensures prompt assistance. Both companies consistently receive positive feedback for their customer support and claims handling.