House Insur

House insurance, also known as home insurance, is an essential aspect of protecting one's largest asset and ensuring financial security in the event of unforeseen circumstances. This comprehensive guide will delve into the world of house insurance, providing an expert analysis of its importance, coverage options, and the factors that influence policy choices. By understanding the intricacies of house insurance, homeowners can make informed decisions to safeguard their homes and families.

The Importance of House Insurance: Protecting Your Investment

For most individuals, purchasing a home is one of the most significant financial decisions they will make in their lifetime. House insurance acts as a safety net, offering protection against a range of risks that could potentially devastate a homeowner’s finances. From natural disasters to accidents and theft, house insurance provides the necessary coverage to rebuild, repair, and replace, ensuring that homeowners can recover from unforeseen events without facing financial ruin.

Furthermore, house insurance is often a requirement for securing a mortgage. Lenders typically mandate that borrowers maintain insurance coverage on the property throughout the duration of the loan, safeguarding their investment in the event of damage or loss. This requirement not only protects the lender's interests but also serves as an added incentive for homeowners to prioritize insurance coverage.

Understanding House Insurance Coverage

House insurance policies are designed to provide comprehensive coverage, addressing various aspects of homeownership. The specific coverage options and limits can vary depending on the policy and the insurer, but there are several key components that are commonly included:

Dwelling Coverage

This aspect of house insurance covers the physical structure of the home, including the walls, roof, and foundation. It provides protection against damages caused by perils such as fire, wind, hail, and vandalism. Dwelling coverage ensures that the homeowner can rebuild or repair their home if it sustains damage due to a covered event.

| Peril | Coverage |

|---|---|

| Fire | Full replacement cost |

| Windstorm | Actual cash value or replacement cost |

| Hail | Replacement cost |

| Vandalism | Actual cash value |

Personal Property Coverage

House insurance policies also cover the personal belongings within the home, such as furniture, electronics, clothing, and appliances. This coverage provides financial protection in the event of theft, damage, or loss due to a covered peril. It is essential to understand the limits and exclusions of personal property coverage to ensure adequate protection for valuable items.

For instance, some policies may have separate coverage limits for high-value items like jewelry, artwork, or collectibles. Homeowners should consider purchasing additional coverage or endorsements to ensure these items are adequately insured.

Liability Coverage

Liability coverage is a crucial aspect of house insurance, as it provides protection against claims and lawsuits arising from accidents or injuries that occur on the insured property. This coverage can help cover medical expenses, legal fees, and compensation for damages awarded to the injured party.

Liability coverage extends beyond the boundaries of the insured property, offering protection for the homeowner's legal obligations even when away from home. For instance, if a pet causes injury to someone while the homeowner is on vacation, liability coverage can help cover the associated costs.

Additional Living Expenses

In the event that a home becomes uninhabitable due to a covered peril, additional living expenses coverage steps in to provide financial assistance. This coverage reimburses the policyholder for the additional costs incurred while temporarily living elsewhere, such as hotel stays, meals, and other necessary expenses until the home is repaired or rebuilt.

Other Coverage Options

House insurance policies may also offer additional coverage options to cater to specific needs. These can include coverage for:

- Flood or water damage (typically requires a separate flood insurance policy)

- Earthquake damage

- Identity theft protection

- Home business operations

- Valuable items or collections (e.g., jewelry, fine art)

Homeowners should carefully review their insurance policies and consider their specific circumstances to determine if any additional coverage options are necessary.

Factors Influencing House Insurance Policy Choices

When selecting a house insurance policy, several factors come into play, each impacting the coverage, cost, and overall value of the policy. Understanding these factors is crucial for homeowners to make informed decisions and ensure they have the right coverage for their needs.

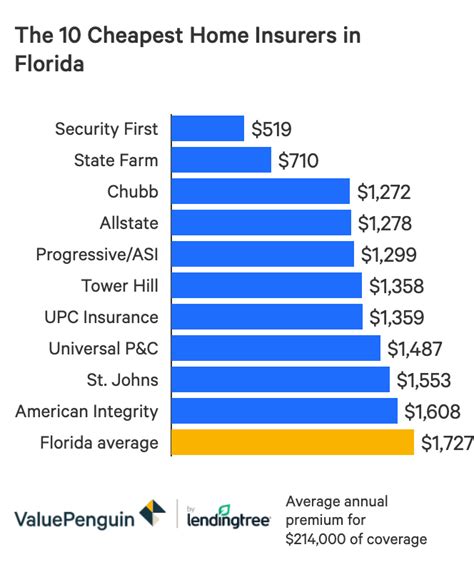

Location and Risk Factors

The location of the home is a significant determinant of house insurance rates and coverage. Areas prone to natural disasters like hurricanes, earthquakes, or wildfires typically have higher insurance premiums due to the increased risk of claims. Insurers carefully assess the likelihood of various perils in different regions to set appropriate rates.

Additionally, the specific features of the home's location can impact insurance coverage. For instance, homes located in flood-prone areas may require separate flood insurance, as standard house insurance policies typically do not cover flood damage. Similarly, homes with a higher risk of theft or vandalism may face higher premiums or have specific coverage exclusions.

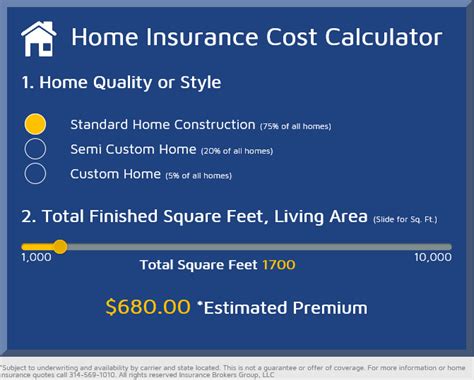

Home Value and Replacement Cost

The value of the home is a critical factor in determining house insurance coverage and premiums. Insurers typically base policies on the replacement cost of the home, which is the estimated cost to rebuild the home from the ground up using similar materials and construction methods.

It is essential for homeowners to ensure that their insurance coverage reflects the current replacement cost of their home. Undervalued policies may leave homeowners underinsured, resulting in financial strain if they need to rebuild after a covered loss. Regularly reviewing and updating the home's value with the insurer is recommended to maintain adequate coverage.

Policy Deductibles and Limits

House insurance policies typically include deductibles, which are the amount the policyholder must pay out of pocket before the insurance coverage kicks in. Deductibles can vary widely, and choosing a higher deductible can often result in lower premiums. However, it’s important to strike a balance, as a higher deductible may make it more difficult to cover the costs of smaller claims.

Policy limits, on the other hand, define the maximum amount an insurer will pay for a covered loss. These limits apply to various aspects of the policy, including dwelling coverage, personal property coverage, and liability coverage. Homeowners should carefully review these limits to ensure they align with their needs and the potential risks they face.

Discounts and Bundling Options

Insurers often offer discounts to policyholders who take steps to reduce their risk exposure. These discounts can be significant and may include:

- Multi-policy discounts: Bundling house insurance with other policies, such as auto insurance or umbrella liability insurance, can result in substantial savings.

- Safety features discounts: Homes equipped with security systems, fire alarms, or other safety features may qualify for discounts.

- Loyalty discounts: Insurers may offer reduced rates to long-term policyholders as a reward for their loyalty.

- Claim-free discounts: Policyholders who maintain a clean claims history may be eligible for lower premiums.

Exploring these discount options and considering bundling multiple policies with the same insurer can help homeowners save money on their house insurance premiums.

Navigating the House Insurance Landscape: Tips and Considerations

Understanding the intricacies of house insurance is the first step towards making informed decisions. Here are some additional tips and considerations to keep in mind when navigating the house insurance landscape:

Review Policies Regularly

House insurance policies should be reviewed periodically to ensure they remain up-to-date and aligned with the homeowner’s needs. Life changes, such as renovations, additions, or the acquisition of valuable items, may necessitate adjustments to the policy.

Regular reviews also provide an opportunity to assess whether the policy's coverage limits and deductibles are still appropriate. As the value of the home and personal belongings may increase over time, it's crucial to ensure that the insurance coverage keeps pace.

Understand Exclusions and Limitations

While house insurance policies provide comprehensive coverage, they also come with exclusions and limitations. It’s essential for homeowners to carefully review these aspects of their policies to understand what perils and damages are not covered.

For instance, standard house insurance policies typically do not cover flood damage, requiring a separate flood insurance policy. Other common exclusions may include damage caused by earthquakes, nuclear accidents, or acts of war.

Consider Additional Coverage for High-Value Items

House insurance policies often have coverage limits for high-value items, such as jewelry, fine art, or collectibles. If these items exceed the policy’s limits, homeowners may want to consider purchasing additional coverage or endorsements to ensure they are adequately insured.

For example, a homeowner with a valuable diamond engagement ring may want to obtain a separate rider or floater on their house insurance policy to ensure full coverage in the event of loss or damage.

Explore Options for High-Risk Homes

Homeowners residing in areas prone to natural disasters or facing other high-risk factors may find it challenging to obtain standard house insurance policies. In such cases, it’s essential to explore alternative options, such as:

- Specialized insurers: There are insurers that specialize in providing coverage for high-risk homes. These insurers may offer tailored policies to meet the unique needs of homeowners in these situations.

- FAIR plans: Some states have established FAIR (Fair Access to Insurance Requirements) plans, which are designed to provide insurance coverage for properties that are considered high-risk and may be difficult to insure through standard markets.

- Federal programs: In the case of flood insurance, the National Flood Insurance Program (NFIP) offers coverage to homeowners who may not be able to obtain it through private insurers.

Utilize Technology for Claims Management

Many insurers now offer digital tools and mobile apps to streamline the claims process. These technologies can make it easier for homeowners to report claims, track their progress, and receive updates. Utilizing these tools can help expedite the claims process and ensure a smoother experience during a stressful time.

Future Implications and Emerging Trends in House Insurance

The house insurance industry is constantly evolving, with new technologies, risk factors, and consumer expectations shaping the landscape. As we look ahead, several emerging trends and considerations are worth noting:

Climate Change and Extreme Weather Events

The increasing frequency and severity of extreme weather events, such as hurricanes, wildfires, and floods, are placing greater strain on the house insurance industry. Insurers are adapting their risk assessment models and policies to account for these changing conditions, which may result in higher premiums for homeowners in vulnerable areas.

Additionally, the growing awareness of climate change is leading to a shift in consumer expectations. Homeowners are increasingly seeking insurance providers that not only offer comprehensive coverage but also demonstrate a commitment to sustainability and climate resilience.

Technology-Driven Risk Assessment and Claims Management

Advancements in technology are transforming the way house insurance is assessed and managed. Insurers are leveraging data analytics, artificial intelligence, and satellite imaging to more accurately assess risk and underwrite policies. This enables them to offer more precise coverage and pricing, tailored to the specific characteristics of each home.

In the realm of claims management, technology is streamlining the process, making it faster and more efficient. Mobile apps and digital tools allow policyholders to report claims, upload damage documentation, and track the progress of their claims in real-time, reducing the overall time and effort required to resolve a claim.

Telematics and Usage-Based Insurance

Telematics, the technology that allows the collection and transmission of data from vehicles, is being explored in the house insurance industry. This technology could enable insurers to offer usage-based insurance, where premiums are calculated based on actual usage and risk factors, rather than solely on static variables like location and home value.

Usage-based insurance has the potential to reward homeowners who take proactive steps to reduce their risk exposure, such as implementing smart home security systems or adopting energy-efficient practices. This could lead to more personalized and fair insurance rates, as well as incentivize homeowners to adopt more sustainable practices.

Collaborative Risk Management and Shared Responsibility

The house insurance industry is recognizing the importance of collaborative risk management and shared responsibility between insurers, homeowners, and communities. This approach involves insurers working closely with homeowners to identify and mitigate risks, as well as encouraging communities to take collective action to reduce the overall risk exposure.

For instance, insurers may offer incentives or discounts to homeowners who participate in community-wide initiatives to improve fire safety or implement flood mitigation measures. By fostering a culture of shared responsibility, insurers can help reduce the overall risk profile of communities, leading to more stable insurance markets and potentially lower premiums for homeowners.

FAQ

What is the difference between replacement cost and actual cash value coverage in house insurance?

+

Replacement cost coverage reimburses the policyholder for the cost to rebuild or repair the home and its contents to their pre-loss condition, without deducting for depreciation. Actual cash value coverage, on the other hand, takes into account depreciation and pays the policyholder the current value of the damaged property, which is typically lower than the replacement cost.

How often should I review my house insurance policy?

+

It is recommended to review your house insurance policy annually or whenever there are significant changes to your home, such as renovations, additions, or the acquisition of high-value items. Regular reviews ensure that your coverage remains up-to-date and aligned with your needs.

Can I bundle my house insurance with other policies to save money?

+

Yes, many insurers offer multi-policy discounts when you bundle your house insurance with other policies, such as auto insurance or umbrella liability insurance. Bundling can result in substantial savings, so it’s worth exploring this option to maximize your insurance value.

What should I do if my home is located in a high-risk area for natural disasters?

+

If your home is located in a high-risk area for natural disasters, it’s important to explore specialized insurers or FAIR plans (Fair Access to Insurance Requirements) that cater to high-risk properties. These options can provide the necessary coverage, even in challenging circumstances.

How can I reduce my house insurance premiums?

+

To reduce your house insurance premiums, consider increasing your deductible (but ensure it’s a manageable amount), bundling policies with the same insurer, exploring safety feature discounts, and maintaining a clean claims history. Additionally, stay informed about emerging trends and technologies that can lead to more personalized and cost-effective insurance options.