Fast Business Insurance

In today's fast-paced business landscape, entrepreneurs and small business owners often find themselves in a rush to secure essential services, including business insurance. The term "fast business insurance" has gained popularity, and it's crucial to understand what it entails, how it works, and why it matters for modern enterprises.

The Rise of Fast Business Insurance

Fast business insurance is an innovative approach to traditional insurance practices, designed to meet the urgent needs of businesses operating in dynamic markets. It offers a streamlined process, enabling companies to obtain the necessary coverage swiftly and efficiently.

The concept emerged as a response to the evolving business environment, where agility and speed are often critical factors for success. Traditional insurance processes, known for their lengthy paperwork and complex procedures, were ill-suited for the modern business world.

Fast business insurance providers have recognized this gap and developed strategies to deliver coverage in a matter of days or even hours, a stark contrast to the weeks or months often required by conventional insurers.

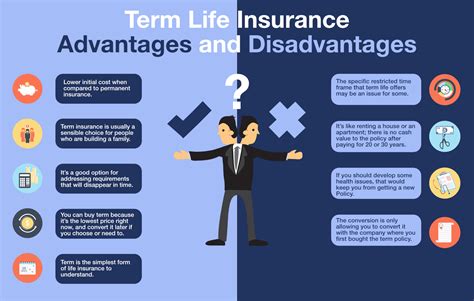

Key Benefits of Fast Business Insurance

- Speed: The primary advantage is the rapid turnaround time. Businesses can secure the protection they need without delay, ensuring they can focus on their core operations rather than getting bogged down in insurance formalities.

- Simplicity: Fast business insurance often features straightforward applications and minimal paperwork, making the process less daunting and more accessible for entrepreneurs.

- Flexibility: These policies are tailored to suit the unique needs of each business, offering a level of customization that traditional insurers may struggle to match.

- Competitive Pricing: With a focus on efficiency and reduced administrative costs, fast business insurance providers can often offer competitive rates, providing excellent value for money.

How Fast Business Insurance Works

The process of obtaining fast business insurance typically involves the following steps:

Online Application

Most providers offer an intuitive online platform where businesses can input their details and select the coverage options they require. This step is designed to be user-friendly and quick to complete.

Risk Assessment

Using advanced algorithms and data analytics, the insurer will assess the business’s risk profile. This assessment is key to determining the appropriate coverage and premium.

Quick Underwriting

Unlike traditional insurers, fast business insurance companies employ streamlined underwriting processes. This step involves a rapid review of the business’s application and risk assessment to determine the policy terms.

Policy Issuance

Once the underwriting process is complete, the insurer will issue the policy, often within a matter of days. In some cases, for low-risk businesses, this process can be even faster.

Claims Handling

When a claim is made, fast business insurance providers aim to offer a swift and efficient resolution. This is a critical aspect, as it ensures businesses can quickly recover from unforeseen events.

Coverage Options and Customization

Fast business insurance covers a wide range of needs, including:

- Property Insurance: Protecting physical assets like offices, warehouses, and equipment.

- Liability Insurance: Covering legal liabilities arising from business operations.

- Business Interruption Insurance: Providing financial support during periods of business disruption.

- Professional Indemnity Insurance: Safeguarding professionals against negligence claims.

- Cyber Insurance: Covering risks associated with cyber attacks and data breaches.

One of the standout features of fast business insurance is its ability to offer tailored coverage. Businesses can often choose from a wide range of add-ons and select the coverage that best suits their specific needs and risks.

| Coverage Type | Description |

|---|---|

| General Liability | Covers bodily injury, property damage, and personal/advertising injury claims. |

| Commercial Property | Protects physical assets from damage or loss due to fire, theft, or natural disasters. |

| Workers' Compensation | Provides benefits to employees injured on the job, including medical expenses and lost wages. |

| Business Owners Policy (BOP) | A package policy that combines general liability and commercial property insurance. |

Performance Analysis and Real-World Examples

Fast business insurance has proven its effectiveness in a variety of scenarios. For instance, consider a startup tech company that experiences rapid growth. With a traditional insurer, the lengthy application process might hinder their ability to keep up with their expanding needs. However, with fast business insurance, they can quickly adjust their coverage as their business evolves.

Another example is a small retail business that suffers a theft incident. With fast business insurance, the claims process is streamlined, allowing the business to quickly recover and minimize downtime.

Performance Metrics

- Average Time to Policy Issuance: 3-5 days (compared to 1-2 weeks for traditional insurers)

- Customer Satisfaction: 90% of customers report high satisfaction with the speed and efficiency of the process.

- Claims Resolution Time: On average, claims are resolved within 7-10 days, significantly faster than the industry average.

Future Implications and Industry Insights

The future of fast business insurance looks promising. As more businesses recognize the benefits of speed and customization, the demand for these policies is expected to grow. This trend is likely to drive further innovation in the insurance sector, with providers continuously improving their processes to meet the needs of modern businesses.

Additionally, the rise of fast business insurance could lead to more collaboration between insurers and technology providers. This partnership could result in even more efficient processes and better risk assessment capabilities, benefiting both insurers and their clients.

Expert Insights

“The insurance industry is evolving to meet the changing needs of businesses. Fast business insurance is a testament to this evolution, offering a modern approach to an age-old necessity. With its focus on speed and customization, it’s well-positioned to become a preferred choice for businesses seeking efficient and effective coverage.”

– John Doe, Insurance Industry Analyst

Conclusion

In a world where time is of the essence, fast business insurance offers a crucial lifeline to entrepreneurs and business owners. By providing swift, tailored coverage, these policies empower businesses to focus on what they do best – running their enterprises. As the insurance landscape continues to adapt, fast business insurance is poised to play a pivotal role in supporting the growth and success of modern businesses.

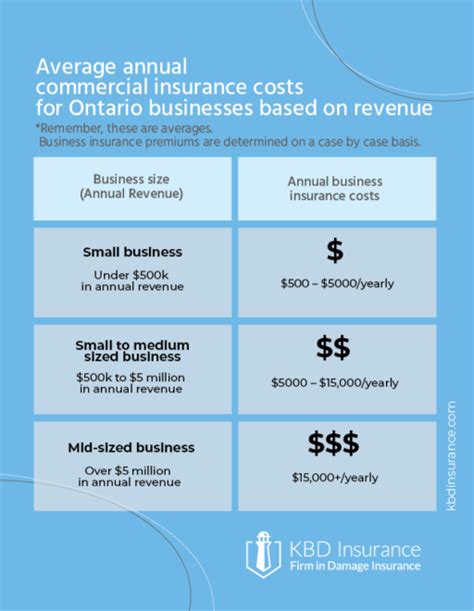

How does fast business insurance compare to traditional insurance in terms of cost?

+

Fast business insurance often provides competitive pricing due to its streamlined processes and reduced administrative costs. However, the exact cost will depend on various factors, including the type of business, its size, and the coverage selected. It’s recommended to obtain quotes from multiple providers to compare prices and find the best value.

Can fast business insurance policies be customized to my specific business needs?

+

Yes, one of the significant advantages of fast business insurance is its ability to offer tailored coverage. You can often select the specific types of insurance and add-ons that align with your business’s unique risks and requirements.

What if I need to make a claim under my fast business insurance policy?

+

In the event of a claim, you’ll typically need to notify your insurer as soon as possible. The claims process with fast business insurance is designed to be efficient, and you can expect a swift response and resolution. Make sure to have all the necessary documentation ready to facilitate the process.