How Do I Find Out What Medical Insurance I Have

Knowing what medical insurance you have and understanding its coverage is essential to ensure you receive the necessary healthcare services without unexpected financial burdens. This comprehensive guide will walk you through the process of discovering your medical insurance details, from checking employer-provided plans to exploring government-sponsored options and utilizing online resources. We'll also delve into reading and interpreting insurance cards and policies to ensure you're fully informed about your coverage.

Employer-Provided Health Insurance

Many individuals obtain their medical insurance through their employers as part of their benefits package. If you’re employed, your first step should be to contact your Human Resources (HR) department or benefits coordinator. They can provide you with detailed information about the insurance plan offered by your employer, including the insurer’s name, the specific plan type, and any associated policy numbers.

During your inquiry, it's beneficial to ask about the following aspects of your coverage:

- Network Providers: Inquire about the insurance network, which includes healthcare providers (doctors, hospitals, and specialists) that have contracted with your insurance company. Using in-network providers typically results in lower out-of-pocket costs.

- Deductibles and Copays: Understand the financial responsibilities associated with your plan. Deductibles are the amounts you must pay out of pocket before your insurance coverage begins, while copays are fixed amounts you pay for specific services or prescriptions.

- Coverage Limits: Ask about any annual or lifetime limits on specific services or total healthcare expenses. Knowing these limits is crucial to ensure you're not caught off guard by unexpected expenses.

- Pre-Authorization Requirements: Some procedures or treatments may require pre-authorization from your insurance company. Being aware of these requirements can prevent delays in receiving necessary care.

- Coverage Exclusions: Inquire about any services or treatments that are not covered by your plan. This information will help you make informed decisions about your healthcare and budget accordingly.

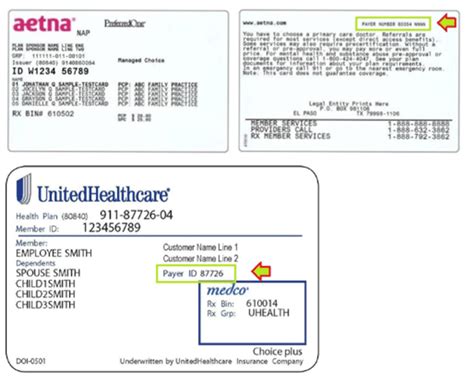

Understanding Your Insurance Card

Your insurance card serves as a quick reference for essential plan details. Here’s a breakdown of the information typically found on an insurance card:

| Field | Description |

|---|---|

| Insurer's Name | The name of the insurance company providing your coverage. |

| Plan Type | The specific type of insurance plan, such as PPO, HMO, or EPO. |

| Member ID | A unique identification number assigned to you as a plan member. |

| Group Number | The number assigned to your employer's group plan. |

| Effective Dates | The dates your coverage is active. |

| Contact Information | Details for reaching customer service or member services. |

Government-Sponsored Health Insurance

If you’re not employed or your employer doesn’t offer health insurance, you may be eligible for government-sponsored health insurance programs. Here are some options to consider:

Medicare

Medicare is a federal health insurance program primarily for individuals aged 65 and older, although some younger individuals with disabilities or specific medical conditions may also qualify. To find out if you’re eligible for Medicare, visit the official Medicare website or contact the Social Security Administration.

Medicaid

Medicaid is a state-administered program that provides health coverage to eligible low-income adults, children, pregnant women, elderly adults, and people with disabilities. Eligibility and coverage details vary by state. You can visit your state’s Medicaid website or use the official Medicaid website’s Find Coverage tool to determine your eligibility and explore your options.

The Health Insurance Marketplace

The Health Insurance Marketplace, also known as the Health Insurance Exchange, is a platform created by the Affordable Care Act (ACA) to help individuals and small businesses find and purchase health insurance plans. You can use the Health Insurance Marketplace website to browse and compare plans, calculate costs, and determine if you’re eligible for financial assistance.

Online Resources and Tools

Several online resources can assist you in finding and understanding your medical insurance options. Here are a few reputable sources:

- Healthcare.gov: The official website for the Health Insurance Marketplace provides comprehensive information about healthcare plans, eligibility, and enrollment.

- Medicare.gov: This website offers detailed information about Medicare coverage, eligibility, and benefits.

- State Medicaid Websites: Each state has its own Medicaid website, where you can find specific information about your state's Medicaid program.

- Insurers' Websites: Major insurance companies often provide online tools and resources to help you understand your coverage and navigate the claims process.

Reading and Interpreting Insurance Policies

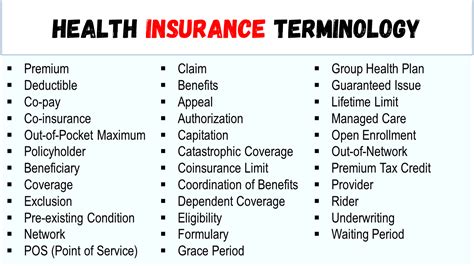

Insurance policies can be complex documents, but understanding key terms and provisions is essential. Here are some tips for interpreting your insurance policy:

- Definitions: Review the definitions section to understand the meaning of specific terms used in the policy.

- Covered Services: Identify the types of medical services and treatments covered by your plan.

- Exclusions: Familiarize yourself with any services or treatments that are not covered by your insurance.

- Pre-Existing Conditions: Understand how your plan handles pre-existing conditions, which are health issues that existed before your coverage began.

- Claim Process: Learn about the steps you need to take to file a claim and receive reimbursement for covered services.

What if I can't afford the insurance plan offered by my employer?

+If the cost of your employer-provided insurance plan is a concern, explore the options available through the Health Insurance Marketplace. You may be eligible for subsidies or tax credits that can make coverage more affordable. Additionally, consider comparing the costs and benefits of different plans to find the best fit for your budget and healthcare needs.

How often should I review my insurance coverage?

+It's a good practice to review your insurance coverage annually, especially during open enrollment periods. This allows you to assess whether your current plan still meets your needs and to explore any new options or changes to your existing plan. Regular reviews ensure you stay informed and make the most of your healthcare coverage.

Can I switch insurance plans during the year?

+Switching insurance plans outside of the open enrollment period is typically limited to qualifying life events, such as marriage, divorce, birth or adoption of a child, or loss of other coverage. Check with your insurer or the Health Insurance Marketplace to understand the specific rules and requirements for changing plans.

Understanding your medical insurance coverage is a crucial step towards ensuring you receive the healthcare you need without financial strain. By following the steps outlined in this guide and utilizing the provided resources, you’ll be well-equipped to navigate the world of medical insurance and make informed decisions about your healthcare.