How Much Does It Cost For Business Insurance

The cost of business insurance can vary significantly depending on a multitude of factors. Understanding these factors and the different types of insurance coverage available is crucial for any business owner seeking to protect their venture. This comprehensive guide aims to provide an in-depth analysis of the expenses associated with business insurance, offering a detailed breakdown and expert insights to help business owners make informed decisions.

Factors Influencing Business Insurance Costs

The price of business insurance is determined by a combination of elements, each playing a unique role in shaping the overall premium. These factors can be broadly categorized as follows:

Business Type and Size

The nature of your business is a primary influencer of insurance costs. High-risk industries, such as construction or manufacturing, often require more extensive coverage and thus, higher premiums. Similarly, the size of your business, measured by revenue or number of employees, can impact the scope and cost of your insurance plan.

Location and Industry

The geographical location of your business and the industry it operates in are crucial factors. Areas with higher crime rates or natural disaster risks may demand more comprehensive coverage, driving up insurance costs. Additionally, certain industries are inherently more susceptible to specific risks, which can affect insurance premiums.

Coverage Requirements

The type and extent of insurance coverage you choose will directly impact your costs. Different policies offer varying levels of protection, and businesses must assess their unique needs to determine the right balance between coverage and affordability.

Claims History

Insurance companies often consider a business’s claims history when setting premiums. Businesses with a history of frequent or costly claims may face higher insurance costs as insurers view them as a higher risk.

Deductibles and Policy Terms

The deductibles you choose for your insurance policies can affect your premium. Generally, higher deductibles result in lower premiums, as you’re taking on more financial responsibility in the event of a claim. The terms of your policy, such as the length of coverage and renewal options, can also influence the overall cost.

| Factor | Impact on Cost |

|---|---|

| Business Type | High-risk businesses often require more coverage, leading to higher premiums. |

| Business Size | Larger businesses may need more extensive coverage, affecting the overall cost. |

| Location | Areas with higher risk factors can increase insurance costs. |

| Industry | Certain industries face inherent risks, influencing insurance needs and costs. |

| Coverage | More comprehensive coverage typically means higher premiums. |

| Claims History | Frequent or costly claims can lead to increased insurance costs. |

| Deductibles | Higher deductibles may result in lower premiums. |

| Policy Terms | Longer coverage periods or specific renewal options can affect overall cost. |

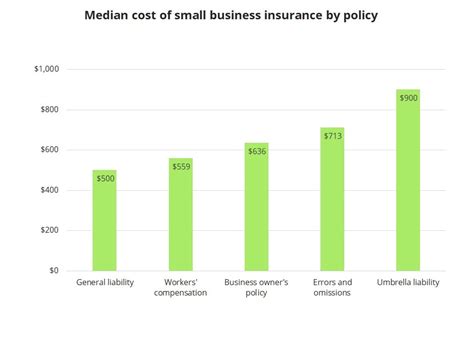

Types of Business Insurance and Their Costs

Business insurance encompasses a wide range of policies, each designed to address specific risks. Here’s an overview of some common types of business insurance and their associated costs:

General Liability Insurance

General liability insurance is a fundamental coverage for most businesses. It protects against third-party claims, including bodily injury, property damage, and personal and advertising injury. The cost of general liability insurance can vary based on factors such as business type, size, and location. On average, small businesses can expect to pay between 500 and 1,000 per year for this coverage.

Product Liability Insurance

Product liability insurance is essential for businesses that manufacture, distribute, or sell physical goods. It safeguards against claims arising from defective products, which can be particularly costly. The price of product liability insurance depends on the nature of the products, the business’s size, and its claims history. Premiums can range from a few hundred to several thousand dollars annually.

Professional Liability Insurance (E&O Insurance)

Professional liability insurance, also known as errors and omissions (E&O) insurance, is crucial for businesses providing professional services. It covers legal costs and settlements arising from client claims of negligence or errors in service. The cost of E&O insurance varies widely depending on the profession and the business’s claims history. Premiums can start from a few hundred dollars and go up to several thousand dollars per year.

Commercial Property Insurance

Commercial property insurance protects a business’s physical assets, including buildings, inventory, and equipment. The cost of this insurance depends on the value of the assets, the location of the property, and the business’s claims history. Premiums can range from a few hundred to several thousand dollars annually, depending on the scope of coverage.

Workers’ Compensation Insurance

Workers’ compensation insurance is a legal requirement in most states and provides coverage for employees injured on the job. The cost of this insurance is typically based on the business’s payroll and the nature of the work performed. Premiums can vary significantly, with some businesses paying a few hundred dollars per year, while others may pay several thousand.

Business Interruption Insurance

Business interruption insurance covers a business’s income and operating expenses if it has to suspend operations due to a covered event, such as a fire or natural disaster. The cost of this insurance depends on the business’s revenue, location, and the likelihood of such events. Premiums can range from a few hundred to several thousand dollars annually.

| Insurance Type | Average Annual Cost | Key Factors Affecting Cost |

|---|---|---|

| General Liability | $500 - $1,000 | Business type, size, location |

| Product Liability | $300 - $5,000 | Nature of products, business size, claims history |

| Professional Liability (E&O) | $300 - $5,000 | Profession, claims history |

| Commercial Property | $500 - $5,000 | Value of assets, location, claims history |

| Workers' Compensation | $300 - $5,000 | Payroll, nature of work |

| Business Interruption | $300 - $5,000 | Business revenue, location, likelihood of events |

Strategies to Reduce Business Insurance Costs

While the cost of business insurance can be significant, there are strategies business owners can employ to potentially reduce their insurance expenses. Here are some effective approaches:

Bundle Your Insurance Policies

Bundling multiple insurance policies with the same insurer can often result in cost savings. Insurance companies typically offer discounts when you purchase multiple policies, as it simplifies their administrative processes and reduces the risk of multiple claims.

Increase Your Deductibles

Opting for higher deductibles can lower your insurance premiums. While this means you’ll pay more out-of-pocket in the event of a claim, it can be a cost-effective strategy for businesses with a low likelihood of claims.

Implement Risk Management Strategies

By actively managing risks, businesses can reduce the likelihood of claims and thus, lower their insurance costs. This can involve implementing safety protocols, employee training programs, and regular maintenance of equipment and facilities.

Review Your Coverage Regularly

Regularly reviewing your insurance coverage ensures that you’re not overinsured or underinsured. As your business grows and changes, your insurance needs may evolve. Periodically reassessing your coverage can help you identify areas where you might be able to save on premiums.

Shop Around and Negotiate

Don’t be afraid to shop around for insurance quotes. Different insurers may offer varying premiums for the same coverage. Additionally, negotiating with your insurance provider can sometimes result in better rates, especially if you have a long-standing relationship with the insurer.

Utilize Insurance Brokers

Insurance brokers can be a valuable resource for businesses seeking the most cost-effective insurance solutions. Brokers have access to multiple insurers and can help you compare policies and prices, ensuring you get the best coverage at the most competitive rates.

Conclusion: Making Informed Decisions

Understanding the cost of business insurance is a critical aspect of financial planning for any business. By recognizing the factors that influence insurance costs and the different types of coverage available, business owners can make informed decisions about their insurance needs. While the costs can be significant, there are strategies to mitigate these expenses without compromising on essential coverage.

Regularly reviewing insurance policies, staying informed about industry trends, and consulting with insurance professionals can help businesses navigate the complex world of business insurance with confidence. Ultimately, the right insurance coverage can provide the peace of mind that comes with knowing your business is protected, allowing you to focus on growth and success.

FAQ

What is the average cost of business insurance for a small business?

+

The average cost of business insurance for a small business can vary widely depending on several factors. However, as a rough estimate, small businesses can expect to pay anywhere from 500 to 2,000 per year for a basic package of general liability, professional liability, and property insurance.

Are there any tax benefits associated with business insurance premiums?

+

Yes, business insurance premiums are generally tax-deductible as a business expense. This means that the cost of your insurance can reduce your taxable income, potentially resulting in significant tax savings.

Can I get business insurance if I work from home?

+

Absolutely! Many insurance providers offer specific policies tailored for home-based businesses. These policies typically cover your business operations and any equipment or inventory you have at home. However, it’s important to review your existing homeowners or renters insurance policy, as it might already provide some level of coverage for your home-based business.

What happens if I can’t afford the insurance premiums for my business?

+

If you’re struggling to afford insurance premiums, it’s important to explore your options. Consider shopping around for more affordable policies, negotiating with your current insurer, or adjusting your coverage to reduce costs while still maintaining adequate protection. It’s also advisable to seek guidance from insurance professionals or financial advisors who can provide tailored advice based on your specific circumstances.