How Much For Car Insurance Per Month

Understanding Car Insurance Costs: Factors and Strategies

When it comes to car insurance, one of the most common questions that arises is, "How much does it cost?" While the answer varies greatly depending on several factors, understanding these variables can help you estimate and potentially reduce your insurance premiums.

Car insurance is a necessary expense for any vehicle owner, offering financial protection in case of accidents, theft, or other unforeseen events. The cost of this coverage can be a significant expense, so it's crucial to be informed about the factors that influence it.

Factors Affecting Car Insurance Costs

Several key factors play a role in determining the price of your car insurance policy. These include:

- Vehicle Type and Age: The make, model, and age of your car can significantly impact insurance rates. Newer, high-end vehicles or sports cars often come with higher premiums due to their replacement and repair costs.

- Location: Your geographical location plays a crucial role. Insurance rates can vary based on the state, city, or even the specific neighborhood you reside in. Areas with higher accident rates or theft occurrences often result in higher insurance costs.

- Driving History: Your past driving record is a major consideration for insurance providers. A clean driving history with no accidents or traffic violations can lead to lower premiums, while a history of accidents or claims may result in higher costs.

- Coverage Options: The level of coverage you choose directly affects your insurance cost. Comprehensive and collision coverage, which protect against damage to your vehicle, typically come with higher premiums compared to liability-only coverage.

- Driver Profile: Your age, gender, and marital status can also influence insurance rates. Young drivers, especially males, often face higher premiums due to their perceived higher risk on the road. Married individuals may enjoy lower rates, as they are statistically involved in fewer accidents.

- Usage and Mileage: The purpose and frequency of your vehicle usage can impact insurance costs. Those who use their cars for business purposes or commute long distances may pay more. Additionally, higher mileage can lead to increased wear and tear, resulting in higher premiums.

Strategies to Lower Your Car Insurance Costs

While some factors affecting insurance costs are beyond your control, there are several strategies you can employ to potentially reduce your premiums:

- Shop Around: Obtain quotes from multiple insurance providers. Rates can vary significantly between companies, so shopping around can help you find the best deal for your specific circumstances.

- Increase Deductibles: Opting for a higher deductible can lower your insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By choosing a higher deductible, you accept more financial responsibility, which can result in lower monthly payments.

- Bundle Policies: Many insurance companies offer discounts when you bundle multiple policies, such as car and home insurance. Combining policies can result in significant savings.

- Maintain a Good Driving Record: A clean driving history is crucial for keeping insurance costs down. Avoid traffic violations and accidents to prevent premium increases.

- Explore Discounts: Insurance providers offer various discounts, such as safe driver discounts, loyalty discounts, student discounts, and more. Ask your insurer about available discounts and ensure you're taking advantage of all applicable ones.

- Consider Usage-Based Insurance: Some insurance companies offer usage-based insurance programs. These programs track your driving habits and reward safe driving with lower premiums. This can be especially beneficial for low-mileage drivers or those with a history of safe driving.

Comparing Insurance Quotes: A Real-World Example

To illustrate the impact of these factors and strategies, let's consider a real-world example. Meet Sarah, a 30-year-old professional who recently purchased a new sedan.

Sarah lives in a suburban area with a relatively low crime rate and a moderate accident history. She has a clean driving record with no accidents or violations in the past five years. Her vehicle is a mid-range sedan, and she primarily uses it for commuting to work and occasional road trips.

| Insurance Provider | Coverage Type | Monthly Premium |

|---|---|---|

| Provider A | Comprehensive Coverage | $120 |

| Provider B | Liability-Only Coverage | $85 |

| Provider C | Comprehensive Coverage | $110 |

In this example, we can see the impact of different coverage types on insurance costs. Provider A offers comprehensive coverage, which includes protection against damage to Sarah's vehicle, resulting in a premium of $120 per month. Provider B, on the other hand, provides liability-only coverage, which is more affordable at $85 per month. Provider C's comprehensive coverage falls somewhere in between at $110 per month.

The Future of Car Insurance: Technological Innovations

The car insurance industry is constantly evolving, and technological advancements are playing a significant role in shaping the future of coverage. Here's a glimpse into some key innovations and their potential impact on insurance costs:

Telematics and Usage-Based Insurance

Telematics technology, which involves the use of devices or apps to track driving behavior, is gaining popularity in the insurance industry. Usage-based insurance programs leverage telematics to monitor factors such as driving speed, acceleration, braking, and mileage. By rewarding safe driving habits with lower premiums, these programs offer a more personalized and fair pricing model.

Artificial Intelligence and Data Analytics

Artificial Intelligence (AI) and data analytics are revolutionizing the way insurance companies assess risk and price policies. Advanced algorithms can analyze vast amounts of data, including historical claims data, driving behavior, and even social media activity, to predict potential risks more accurately. This enhanced risk assessment can lead to more precise pricing and potentially lower premiums for low-risk drivers.

Connected Car Technology

The rise of connected car technology, which enables vehicles to communicate with each other and their surroundings, has significant implications for insurance. This technology can provide real-time data on driving behavior, vehicle diagnostics, and even traffic conditions. By integrating this data with insurance policies, providers can offer more dynamic and tailored coverage, potentially reducing costs for safe drivers.

Autonomous Vehicles and Insurance

The advent of autonomous vehicles (AVs) is expected to revolutionize the insurance industry. As AVs become more prevalent, insurance providers will need to adapt their policies and pricing models. While AVs may reduce the number of accidents caused by human error, they may also introduce new risks, such as software failures or cyber attacks. Insurance companies will need to navigate these challenges and potentially offer specialized coverage for AV owners.

Conclusion: Empowering Consumers

Understanding the factors that influence car insurance costs and the strategies available to potentially reduce premiums is essential for consumers. By being informed and proactive, individuals can make more confident decisions when choosing insurance coverage. Additionally, staying up-to-date with technological advancements in the industry can provide insights into future pricing trends and coverage options.

Remember, while car insurance is a necessary expense, it doesn't have to break the bank. By shopping around, maintaining a good driving record, and exploring innovative coverage options, you can find the right balance between protection and affordability.

What is the average monthly cost of car insurance?

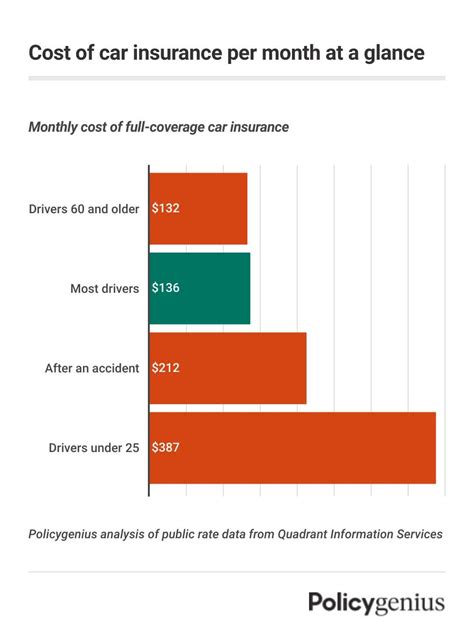

+The average monthly cost of car insurance varies greatly depending on factors such as location, vehicle type, driving history, and coverage options. It can range from 50 to 200 per month, with the national average being around $150.

Can I negotiate my car insurance rates?

+Yes, you can negotiate your car insurance rates by shopping around and comparing quotes from multiple providers. Additionally, discussing your specific circumstances and driving record with your insurer may lead to potential discounts or lower premiums.

How do insurance companies determine my rates?

+Insurance companies use a variety of factors to determine rates, including your driving history, vehicle type, location, and coverage options. They also consider statistical data and actuarial tables to assess the risk associated with insuring you.