How Much Is Auto Insurance For 1 Year

When it comes to auto insurance, the cost for a one-year policy can vary significantly based on numerous factors. Understanding these factors is crucial for anyone looking to obtain accurate estimates and make informed decisions about their vehicle insurance coverage.

In this comprehensive guide, we will delve into the key elements that influence the cost of a one-year auto insurance policy. By exploring real-world examples and providing industry insights, we aim to offer a clear understanding of how insurance rates are determined and how you can navigate the process to find the best coverage at a competitive price.

Factors Influencing Auto Insurance Rates

The cost of auto insurance is a reflection of the perceived risk associated with insuring a particular driver and vehicle. Insurance companies use a range of criteria to assess this risk and determine premiums. Here are some of the primary factors that influence auto insurance rates for a one-year policy:

- Location: Where you live and drive plays a significant role in insurance rates. Urban areas generally have higher premiums due to increased traffic congestion, higher accident rates, and a greater likelihood of vehicle theft.

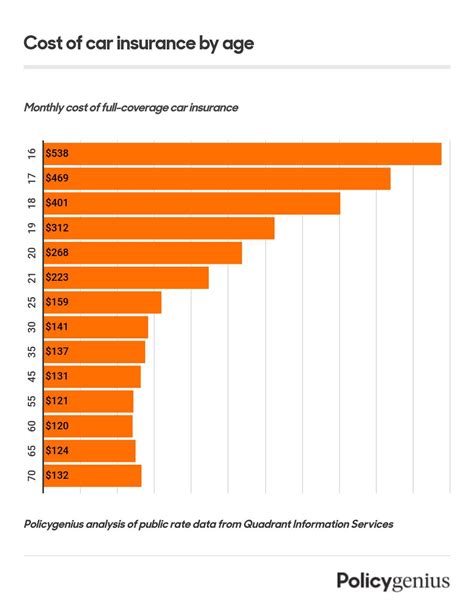

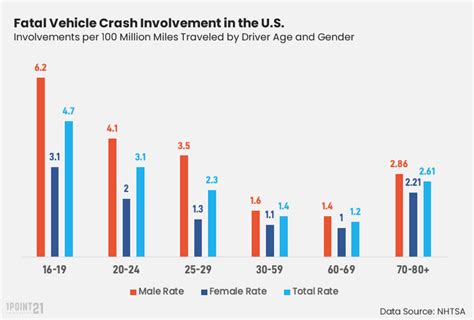

- Age and Driving Experience: Younger drivers, especially those under 25, often pay higher premiums due to their lack of driving experience and the higher risk they pose on the roads. As drivers gain experience and reach their mid-20s, insurance rates typically decrease.

- Vehicle Type and Usage: The make, model, and age of your vehicle impact insurance costs. Sports cars and luxury vehicles generally have higher premiums due to their higher repair costs and theft risks. Additionally, how you use your vehicle matters; personal use typically incurs lower rates compared to commercial or business use.

- Driving Record: A clean driving record with no accidents or violations is ideal for keeping insurance rates low. Conversely, a history of accidents, especially those deemed at-fault, can significantly increase premiums. Even minor traffic violations like speeding or running a red light can lead to higher rates.

- Insurance Coverage Options: The type and extent of coverage you choose impact your insurance costs. Comprehensive and collision coverage, which cover damage to your vehicle from accidents or non-accident-related events, can increase premiums. Conversely, liability-only coverage, which is legally required in most states, is generally more affordable.

- Insurance Company and Policy Type: Different insurance companies offer varying rates and policy options. It's important to shop around and compare quotes from multiple insurers to find the best coverage at the most competitive price. Additionally, policy types (e.g., six-month vs. annual policies) can impact rates.

Real-World Examples of Auto Insurance Rates

To provide a clearer picture of how these factors influence insurance rates, let's examine some real-world examples of auto insurance costs for a one-year policy:

Example 1: Urban Driver with a Clean Record

Consider a 30-year-old driver living in a major city like New York City. They have a clean driving record with no accidents or violations. Their vehicle is a 2018 Toyota Corolla, a popular choice for its reliability and affordability. With comprehensive and collision coverage, their annual insurance premium might range from $1,200 to $1,500.

| Coverage Type | Premium (Annual) |

|---|---|

| Liability Only | $800 |

| Comprehensive & Collision | $1,350 |

While this example highlights the impact of location and coverage choices, it's important to note that individual rates can vary based on the specific insurer and the driver's unique circumstances.

Example 2: Suburban Driver with an At-Fault Accident

Imagine a 22-year-old driver living in a suburban area who was recently involved in an at-fault accident. Their vehicle is a 2016 Honda Civic. With a history of an at-fault accident, their insurance rates will likely increase significantly. Even with liability-only coverage, their annual premium might range from $1,500 to $2,000.

| Coverage Type | Premium (Annual) |

|---|---|

| Liability Only | $1,650 |

| Comprehensive & Collision | $2,100 |

This example illustrates how a single accident can dramatically impact insurance rates, especially for younger drivers.

Example 3: Rural Driver with a New Vehicle

Let's consider a 45-year-old driver living in a rural area who recently purchased a new Tesla Model 3. With their age and clean driving record, they might expect lower insurance rates. However, the high cost of repairing electric vehicles and the increased risk of theft associated with luxury cars can drive up insurance costs. With comprehensive and collision coverage, their annual premium might be around $2,500.

| Coverage Type | Premium (Annual) |

|---|---|

| Liability Only | $1,800 |

| Comprehensive & Collision | $2,550 |

This example showcases how vehicle type and usage can significantly impact insurance rates, even for experienced drivers with a clean record.

Tips for Finding Affordable Auto Insurance

If you're seeking to minimize the cost of your auto insurance, here are some strategies to consider:

- Shop Around: Compare quotes from multiple insurance companies to find the best rates for your specific circumstances. Online quote comparison tools can be particularly helpful for this.

- Review Coverage Options: Assess your coverage needs and consider dropping unnecessary coverage types to lower your premiums. However, ensure you maintain the legally required minimum coverage levels for your state.

- Explore Discounts: Many insurance companies offer discounts for various factors, such as good driving records, safe vehicle features, multiple policy bundles (e.g., auto and home insurance), and loyalty rewards for long-term customers.

- Maintain a Clean Driving Record: Avoiding accidents and violations is crucial for keeping insurance rates low. Safe driving practices and regular vehicle maintenance can help prevent accidents and reduce repair costs.

- Consider Usage-Based Insurance: Some insurance companies offer usage-based insurance policies that track your driving behavior and reward safe driving with lower rates. These policies can be a good option for drivers with clean records who want more control over their insurance costs.

The Future of Auto Insurance Rates

As the auto insurance industry continues to evolve, several trends and advancements are shaping the future of insurance rates:

- Telematics and Usage-Based Insurance: The increasing adoption of telematics and usage-based insurance policies is expected to drive more personalized and data-driven insurance rates. These policies use real-time driving data to assess risk and offer more accurate premiums.

- Autonomous Vehicles: The emergence of autonomous vehicles is likely to revolutionize auto insurance. While fully autonomous vehicles are expected to significantly reduce accident rates, the transition period could lead to increased liability concerns and potentially higher insurance costs.

- Electric Vehicles: The growing popularity of electric vehicles (EVs) is also impacting insurance rates. As the repair and maintenance costs of EVs differ from traditional vehicles, insurance rates for EVs may fluctuate until the market stabilizes.

- Data Analytics and Machine Learning: Insurance companies are leveraging advanced data analytics and machine learning to more accurately assess risk and price insurance policies. This trend is expected to continue, leading to more precise and competitive insurance rates.

Conclusion

Understanding the factors that influence auto insurance rates is essential for making informed decisions about your coverage and finding the best value. By considering your location, driving record, vehicle type, and coverage needs, you can navigate the insurance market and secure a competitive one-year auto insurance policy that provides the protection you need at a price you can afford.

What is the average cost of auto insurance for a one-year policy?

+

The average cost of auto insurance for a one-year policy varies widely based on individual factors. However, as a rough estimate, you can expect annual premiums to range from 800 to 2,500 or more, depending on your specific circumstances and coverage choices.

Are there ways to lower my auto insurance rates?

+

Yes, there are several strategies to reduce your auto insurance rates. These include shopping around for quotes, reviewing and adjusting your coverage options, exploring discounts, maintaining a clean driving record, and considering usage-based insurance policies.

How do insurance companies determine rates for a one-year policy?

+

Insurance companies assess various factors, including location, age and driving experience, vehicle type and usage, driving record, and coverage options, to determine rates for a one-year policy. They use this data to calculate the perceived risk associated with insuring a particular driver and vehicle.

What is the difference between comprehensive and liability-only coverage?

+

Comprehensive coverage provides protection for damage to your vehicle caused by accidents, theft, or non-accident-related events like natural disasters. Liability-only coverage, on the other hand, only covers damage you cause to others and their property. It is the legally required minimum coverage in most states.

How can I find the best auto insurance company for my needs?

+

To find the best auto insurance company for your needs, consider factors such as the range of coverage options, pricing, customer service reputation, financial stability, and any additional perks or benefits they offer. Reading reviews and comparing quotes from multiple insurers can also help you make an informed decision.