How Much Is Marketplace Insurance

Marketplace insurance, also known as health insurance plans offered through the Affordable Care Act (ACA) marketplaces, provides a vital avenue for individuals and families to secure comprehensive health coverage. Understanding the cost of these plans is crucial for anyone navigating the healthcare system. The price of marketplace insurance is influenced by various factors, and while it may seem complex, we will break it down to provide a clear understanding of the financial aspects involved.

The Cost of Marketplace Insurance

The cost of marketplace insurance plans varies based on several key factors, including your age, location, tobacco use, and the specific plan you choose. These plans are designed to offer a range of options, catering to different budgets and healthcare needs.

Premium Costs

The premium is the amount you pay monthly to maintain your health insurance coverage. It’s the primary cost associated with marketplace insurance and can vary significantly based on your circumstances. Here are some factors that influence premium costs:

- Age: In general, younger individuals tend to have lower premiums, while older adults may face higher costs. This is because younger people are typically healthier and utilize healthcare services less frequently.

- Location: The cost of living and healthcare services in your area can impact insurance premiums. Urban areas with higher costs of living may have correspondingly higher insurance rates.

- Tobacco Use: If you use tobacco products, you may face a surcharge on your premiums. This is due to the higher healthcare costs associated with tobacco-related illnesses.

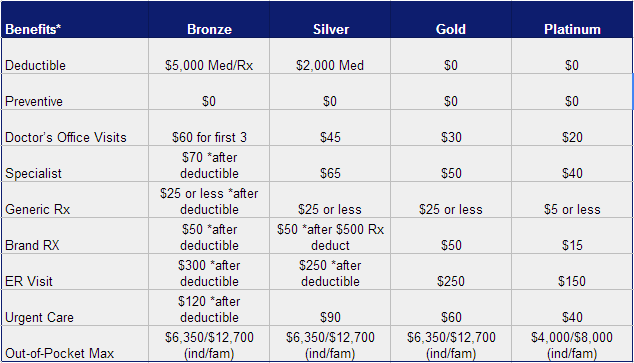

- Plan Category: Marketplace insurance plans are categorized into Metal tiers: Bronze, Silver, Gold, and Platinum. Each tier represents a different level of coverage and cost. Bronze plans typically have lower premiums but higher out-of-pocket costs, while Platinum plans offer the opposite, with higher premiums and lower out-of-pocket expenses.

| Metal Tier | Average Premium | Average Out-of-Pocket Costs |

|---|---|---|

| Bronze | $400 - $500/month | Highest |

| Silver | $450 - $600/month | Moderate |

| Gold | $550 - $750/month | Lower |

| Platinum | $700 - $900/month | Lowest |

These are approximate averages, and your specific premium will depend on your individual circumstances and the plan you choose.

Factors Affecting Premium Costs

Beyond the basic factors mentioned above, several other elements can influence the cost of your marketplace insurance premium:

- Family Size: Family plans typically cost more than individual plans, as they cover more people.

- Income: Your household income can impact your premium, especially if you qualify for premium tax credits. These credits can significantly reduce your monthly premium costs.

- Plan Network: Insurance plans have networks of providers, and out-of-network care can be more expensive. Some plans have more extensive networks, offering greater flexibility but potentially higher costs.

- Benefit Design: Plans with more comprehensive benefits, such as broader coverage for prescription drugs or mental health services, may have higher premiums.

Out-of-Pocket Costs

In addition to premiums, marketplace insurance plans also involve out-of-pocket costs. These are the expenses you pay directly for healthcare services, and they can vary depending on the plan you choose and the services you utilize.

Common Out-of-Pocket Costs

- Deductible: This is the amount you pay for covered healthcare services before your insurance plan starts to pay. Deductibles can range from a few hundred dollars to several thousand dollars, depending on your plan.

- Copayments (Copays): Copays are fixed amounts you pay for specific services, like a doctor’s office visit or a prescription. These costs are typically lower than the full price of the service.

- Coinsurance: Coinsurance is a percentage of the cost of a covered healthcare service that you pay after you’ve met your deductible. For example, if your plan has an 80⁄20 coinsurance structure, you pay 20% of the cost, and your insurance covers the remaining 80%.

Maximizing Value and Affordability

Navigating the complexities of marketplace insurance plans can be challenging, but there are strategies to ensure you find a plan that offers the best value for your needs and budget. Here are some tips to consider:

- Compare Plans: Take the time to compare the costs and benefits of different plans. Consider not just the premium, but also the out-of-pocket costs, network of providers, and specific benefits that matter to you.

- Check for Premium Tax Credits: If your income is within a certain range, you may qualify for premium tax credits. These credits can significantly reduce your monthly premium costs, making insurance more affordable.

- Understand Your Healthcare Needs: Assess your healthcare needs and choose a plan that aligns with them. If you anticipate needing more healthcare services, a plan with lower out-of-pocket costs might be a better fit. Conversely, if you expect fewer healthcare needs, a plan with a lower premium might be more suitable.

- Consider Catastrophic Plans: If you’re under 30 or have a hardship exemption, you can enroll in a catastrophic plan, which offers lower premiums but higher deductibles.

- Enroll During Open Enrollment: The open enrollment period is the annual window when you can sign up for a new plan or make changes to your existing coverage. It’s crucial to enroll during this period to avoid penalties or gaps in coverage.

The Future of Marketplace Insurance

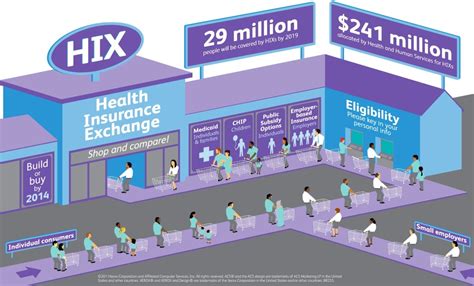

Marketplace insurance continues to evolve, and there are ongoing efforts to make it more accessible and affordable. The ACA has already made significant strides in this direction, with millions of Americans gaining health coverage since its implementation. However, challenges remain, including rising healthcare costs and varying levels of plan availability across different regions.

Looking ahead, the focus is on continuing to improve the marketplace insurance system. This includes expanding access to care, particularly in rural and underserved areas, and finding innovative ways to reduce healthcare costs while maintaining high-quality services. Additionally, efforts are being made to simplify the enrollment process and provide clearer information to consumers, making it easier for individuals and families to navigate the marketplace and choose the right insurance plan for their needs.

What is the average cost of marketplace insurance plans for a family of four?

+The average cost for a family of four can vary widely based on factors like location and plan category. As a rough estimate, you might expect to pay between 1,000 and 2,000 per month for a Silver plan, with potential premium tax credits reducing this cost.

Are there any ways to reduce the cost of marketplace insurance premiums?

+Yes, there are several strategies. Enrolling in a lower-cost Bronze plan, qualifying for premium tax credits, and choosing a plan with a narrower network can all help reduce premiums. Additionally, some states offer programs to further lower costs for certain populations.

How do I know if I qualify for premium tax credits for marketplace insurance?

+Eligibility for premium tax credits depends on your household income. Generally, if your income is between 100% and 400% of the federal poverty level, you may qualify. It’s recommended to use the HealthCare.gov income calculator to determine your eligibility.