How To Apply For Insurance

Navigating the world of insurance can be a daunting task, especially when you're considering your first policy or switching providers. Understanding the process and knowing the steps to take can make the experience smoother and more efficient. This comprehensive guide will walk you through the process of applying for insurance, providing you with the knowledge and tips to make informed decisions and secure the coverage you need.

Understanding Your Insurance Needs

Before diving into the application process, it's crucial to assess your specific insurance requirements. Different types of insurance serve distinct purposes, and understanding your needs will help you choose the right coverage. Here's a breakdown of some common insurance categories and their purposes:

Health Insurance

Health insurance is a vital component of personal financial planning. It provides coverage for medical expenses, including doctor visits, hospital stays, prescription medications, and more. With the rising costs of healthcare, having adequate health insurance is essential to protect yourself and your family from unexpected medical bills.

| Key Considerations | Details |

|---|---|

| Network Providers | Choose a plan with a network of doctors and hospitals that suits your needs. |

| Coverage Limits | Understand the maximum amounts the insurance will cover for various procedures. |

| Prescription Drugs | Check if your regular medications are covered and if there are any restrictions. |

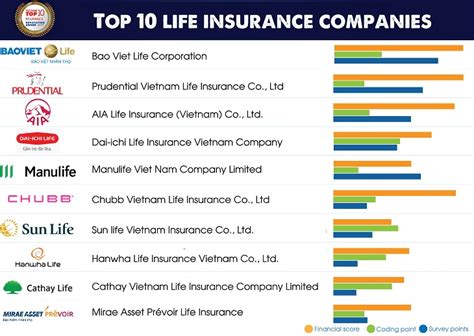

Life Insurance

Life insurance provides financial protection for your loved ones in the event of your death. It can help cover funeral expenses, pay off debts, and provide income replacement. There are two main types: term life insurance, which offers coverage for a specific period, and permanent life insurance, which provides lifelong coverage.

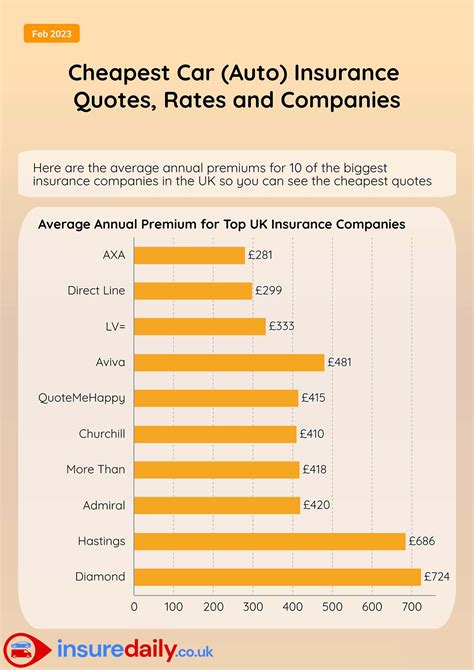

Auto Insurance

Auto insurance is mandatory in most states and is designed to protect you financially in the event of an accident. It covers a range of situations, including damage to your vehicle, injury to others, and property damage. Understanding the different coverage options is crucial to ensure you have adequate protection.

| Coverage Types | Description |

|---|---|

| Liability Coverage | Pays for damages to others in an accident caused by you. |

| Collision Coverage | Covers repairs or replacement of your vehicle after an accident. |

| Comprehensive Coverage | Protects against non-collision incidents like theft, fire, or natural disasters. |

Homeowners or Renters Insurance

Whether you own a home or rent, insurance is essential to protect your dwelling and personal belongings. Homeowners insurance covers the structure and its contents, while renters insurance covers your belongings and provides liability protection.

Additional Considerations

Beyond the basics, there are various other insurance types to consider, such as:

- Disability insurance: Provides income replacement if you're unable to work due to illness or injury.

- Long-term care insurance: Covers the cost of long-term care, such as nursing home stays or in-home care.

- Travel insurance: Offers protection for trip cancellations, medical emergencies while traveling, and lost or delayed luggage.

- Umbrella insurance: Provides additional liability coverage beyond your primary policies.

Researching Insurance Providers

Once you've identified your insurance needs, it's time to research and compare providers. Different insurance companies offer varying levels of coverage, customer service, and pricing. Here are some steps to help you find the right insurer:

Online Research

Start by searching for insurance providers online. You can use comparison websites or visit the websites of individual companies to gather information about their offerings. Look for reviews and ratings to get an idea of the company's reputation and customer satisfaction.

Referrals and Recommendations

Ask friends, family, or colleagues for recommendations. Personal referrals can provide valuable insights into the quality of service and coverage offered by specific insurers.

Agent or Broker

Consider working with an independent insurance agent or broker. They can provide unbiased advice and help you compare policies from multiple insurers. Agents can also assist with claims and provide ongoing support.

Financial Stability

Check the financial stability of the insurance company. Look for ratings from reputable agencies like AM Best or Standard & Poor's. A financially stable insurer is more likely to be able to pay out claims in the future.

Policy Details and Coverage

Review the policy details carefully. Compare coverage limits, deductibles, and exclusions across different providers. Ensure that the policy meets your specific needs and provides adequate protection.

Customer Service and Claims Handling

Consider the insurer's reputation for customer service and claims handling. Look for companies with a track record of prompt and fair claim settlements. Check online reviews and reach out to customer service to gauge their responsiveness.

Gathering Necessary Information

Before you begin the application process, ensure you have all the necessary information and documents ready. This will streamline the application and make it more efficient.

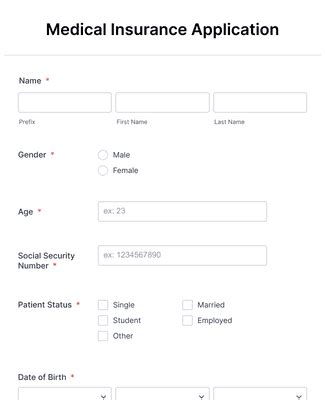

Personal Information

Collect the following personal details:

- Full name, date of birth, and contact information.

- Social Security number (for identity verification).

- Employment status and income details.

- Marital status and information about any dependents.

- Any existing insurance policies and their details.

Vehicle Information (for Auto Insurance)

If applying for auto insurance, gather the following:

- Vehicle make, model, year, and VIN number.

- Current mileage and any modifications.

- Driving history, including accidents and violations.

- Details of any current auto insurance policy.

Property Information (for Homeowners or Renters Insurance)

For homeowners or renters insurance, you'll need:

- Property address and details (e.g., square footage, construction type).

- List of valuable items and their estimated values.

- Any security features or home improvements that may impact coverage.

- Details of any existing homeowners or renters insurance policy.

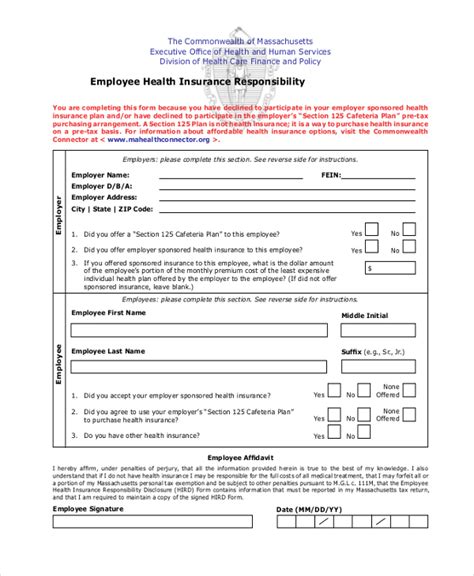

Completing the Application

With your research complete and necessary information gathered, you're ready to apply for insurance. Here's a step-by-step guide to the application process:

Online Application

Many insurance companies offer online applications, which can be convenient and efficient. Follow these steps:

- Visit the insurer's website and locate the application form.

- Fill out the form accurately and completely. Provide all the required information and ensure it matches your official documents.

- Review the policy details and terms carefully before submitting.

- Submit the application and wait for a response. The insurer will review your application and provide a quote or approval.

In-Person or Over the Phone

If you prefer a more personalized approach, you can apply for insurance in-person at the insurer's office or over the phone. Here's what to expect:

- Schedule an appointment or call the insurer's customer service line.

- Have all your necessary documents and information ready.

- An insurance agent or representative will guide you through the application process. They can answer any questions you have and provide personalized advice.

- Once the application is complete, the insurer will process it and provide a quote or approval.

Understanding the Quote

After submitting your application, you'll receive a quote from the insurer. The quote will outline the coverage, premiums, and any additional fees or charges. Take the time to review the quote carefully and ask questions if needed.

Reviewing and Accepting the Policy

Once you've received a quote and are satisfied with the coverage and pricing, it's time to review and accept the insurance policy. Here's what to consider:

Policy Documents

Read through the policy documents thoroughly. Ensure that the coverage, limits, and exclusions match your expectations. Pay attention to any fine print or exclusions that could impact your coverage.

Premiums and Payment Options

Understand the premium amount and the payment options available. Some insurers offer discounts for paying the full premium upfront or for enrolling in automatic payment plans.

Effective Date

Note the effective date of the policy. This is the date from which your coverage begins. Ensure that the coverage starts when you need it.

Policy Term

Understand the term of the policy. Some policies are for a specific period, while others are renewable annually. Know when your policy expires and when you'll need to renew.

Maintaining and Updating Your Insurance

Insurance is not a one-time process; it requires ongoing management and updates. Here's what you should do to ensure your insurance remains up-to-date and effective:

Regular Reviews

Periodically review your insurance policies to ensure they still meet your needs. Life changes, such as getting married, having children, or purchasing a new home, may require adjustments to your coverage.

Updates and Changes

Inform your insurer of any significant life changes or updates to your personal or property information. This ensures that your coverage remains accurate and relevant.

Claims and Adjustments

If you need to file a claim, follow the insurer's claim process carefully. Keep records of all communications and provide any necessary documentation. After a claim, review your policy to ensure it still provides adequate coverage.

Renewal and Reevaluation

When it's time to renew your policy, reevaluate your needs and compare options. You may find better rates or coverage with another insurer, or your current insurer may offer adjustments to meet your changing needs.

Frequently Asked Questions

What if I have pre-existing medical conditions?

+Some health insurance providers offer coverage for pre-existing conditions, but it may impact your premium. Be transparent about your medical history during the application process.

Can I get insurance if I have a poor driving record?

+Yes, but it may result in higher premiums or restrictions on your coverage. Some insurers offer programs to help improve your driving record and reduce costs over time.

How do I choose between term and permanent life insurance?

+Term life insurance is more affordable and provides coverage for a specific period. Permanent life insurance offers lifelong coverage but is more expensive. Consider your financial goals and the duration of coverage you require.

Applying for insurance is a critical step in protecting your financial well-being and the well-being of your loved ones. By understanding your needs, researching providers, and following the application process, you can secure the coverage you need with confidence. Remember, insurance is a long-term commitment, so take the time to make informed decisions and regularly review your policies to ensure they continue to meet your evolving needs.