How To Apply For State Insurance

Navigating the Process: A Comprehensive Guide to Applying for State Insurance

Securing state insurance is a crucial step towards safeguarding your health and financial well-being. While the process may seem daunting, with the right information and a systematic approach, you can navigate it efficiently. This guide will walk you through the key steps, requirements, and considerations to ensure a smooth application journey.

Understanding State Insurance Eligibility

State insurance programs are designed to provide healthcare coverage to eligible residents. Eligibility criteria vary across states and programs, but generally, they consider factors such as:

- Income Level: Most state insurance programs are means-tested, meaning your household income plays a significant role in determining eligibility. Each state sets its income thresholds, and you must fall within these limits to qualify.

- Citizenship or Immigration Status: You must be a citizen, lawful permanent resident, or have a valid immigration status that allows you to access state benefits. Specific requirements may vary, so it's essential to check your state's guidelines.

- Age and Dependency Status: State insurance often caters to specific age groups, such as children, young adults, or seniors. Some programs may also consider factors like pregnancy or disability.

- Residency: You must be a resident of the state you're applying in. Proof of residency, such as a driver's license or utility bills, may be required.

To assess your eligibility, start by researching your state's specific insurance program. Websites like Healthcare.gov or your state's official healthcare website are valuable resources. These platforms often provide eligibility calculators and detailed information on income limits and other requirements.

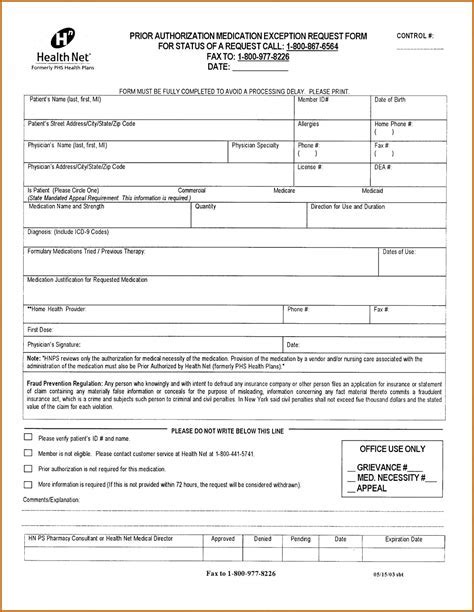

Gathering Essential Documents

To apply for state insurance, you'll need to provide various documents to support your application. Here's a checklist of common requirements:

- Proof of Identity: This can include a driver's license, passport, birth certificate, or any official document with your name, date of birth, and signature.

- Social Security Number: If you have one, provide your Social Security card or its details. Some states may accept an Individual Taxpayer Identification Number (ITIN) for those without a Social Security number.

- Proof of Citizenship or Immigration Status: Depending on your status, you may need to provide a birth certificate, passport, visa, or green card.

- Proof of Residency: As mentioned, you'll need to prove your state residency. Common documents include a driver's license, utility bills, lease agreements, or bank statements with your current address.

- Income Verification: To assess your eligibility based on income, you'll likely need to provide recent pay stubs, tax returns, or bank statements. If you're self-employed, business income statements or tax forms may be required.

- Additional Documentation: Depending on your specific circumstances, you may need to provide other documents. For example, if you're applying for insurance due to pregnancy, you might need to submit a pregnancy verification form or a letter from your healthcare provider.

Organize your documents systematically and ensure they are up-to-date. Incomplete or outdated information can delay your application process.

Choosing the Right State Insurance Program

State insurance programs come in various forms, each with its own set of benefits and limitations. It's essential to choose the program that best suits your needs and circumstances. Here are some common types of state insurance programs:

- Medicaid: Medicaid is a joint federal-state program that provides healthcare coverage to low-income individuals and families. Eligibility is primarily based on income, but it also considers factors like age, disability, and pregnancy. Medicaid covers a wide range of services, including doctor visits, hospital stays, prescription drugs, and preventive care.

- Children's Health Insurance Program (CHIP): CHIP is designed specifically for children in families with incomes too high to qualify for Medicaid but still struggling to afford private insurance. It offers comprehensive healthcare coverage for children up to a certain age, often extending into their early adulthood.

- State-Based Marketplace Plans: Many states have their own health insurance marketplaces, often in partnership with the federal government. These marketplaces offer a range of private insurance plans with varying levels of coverage and costs. You can compare plans, choose the one that suits your needs, and often receive financial assistance to make premiums more affordable.

- State-Specific Programs: Some states have unique insurance programs tailored to their residents' needs. These programs may offer coverage for specific populations, provide additional benefits, or have different eligibility criteria. It's crucial to research and understand the options available in your state.

Consider your healthcare needs, budget, and any specific requirements you may have when choosing a program. Reach out to your state's insurance agency or a healthcare navigator for guidance if needed.

Applying for State Insurance: Step-by-Step Guide

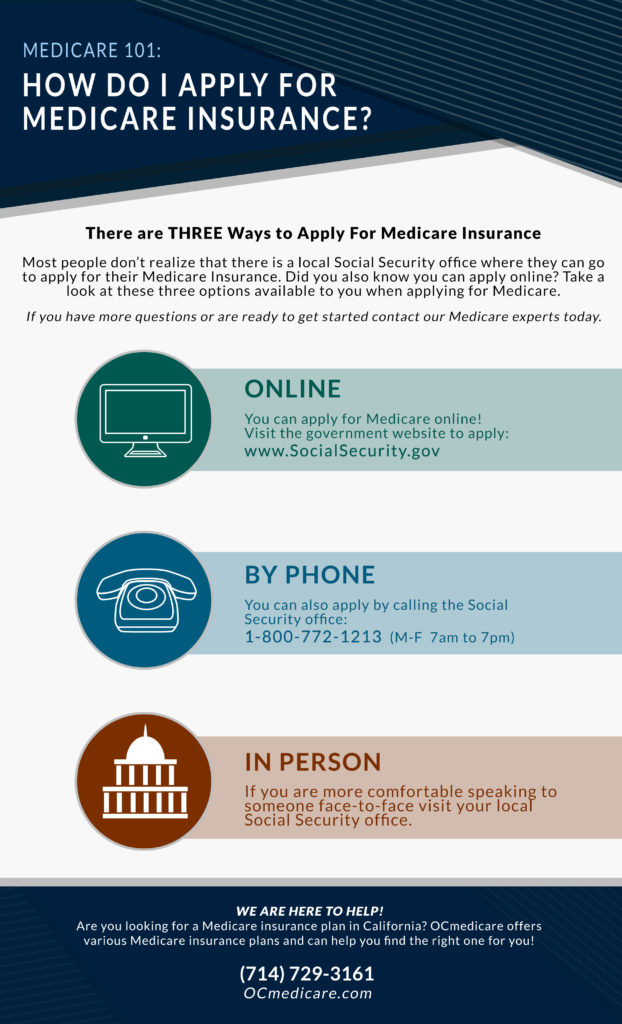

- Choose Your Application Method: Most states offer multiple ways to apply for insurance. You can apply online through the official state insurance website or the federal Healthcare.gov platform. Alternatively, you can apply by phone, mail, or in-person at your local Department of Health or social services office.

- Create an Account: If applying online, you'll need to create an account. This allows you to save your progress, track your application status, and receive important updates. Ensure you use a secure and unique password for your account.

- Complete the Application: The application process typically involves providing personal information, household details, income verification, and any other required documentation. Be as accurate and thorough as possible to avoid delays.

- Review and Submit: Carefully review your application for errors or omissions. Double-check your personal details, income information, and any supporting documents you've attached. Once satisfied, submit your application.

- Wait for a Decision: After submitting your application, you'll receive a confirmation. The processing time varies depending on the state and program. Keep an eye on your account or check the status online or by phone. If approved, you'll receive information on your coverage and any required payments.

If your application is denied, you have the right to appeal the decision. The appeal process varies by state, but you'll typically receive instructions on how to proceed.

Understanding Your State Insurance Coverage

Once you've secured state insurance coverage, it's essential to understand what it entails. Here are some key considerations:

- Benefit Packages: Different insurance programs offer varying benefit packages. Review the covered services, such as doctor visits, hospital stays, prescription drugs, mental health services, and preventive care. Understand any limitations or exclusions in your plan.

- Cost-Sharing: State insurance plans often have cost-sharing components, such as premiums, deductibles, copayments, and coinsurance. Understand how these costs work and how they may impact your out-of-pocket expenses.

- Provider Networks: Most state insurance plans have networks of healthcare providers. Ensure your preferred doctors, specialists, and hospitals are in-network to avoid higher out-of-network costs. If not, research alternative providers or consider a different plan.

- Renewal and Changes: State insurance coverage is typically valid for a set period, often a year. Be aware of renewal deadlines and any changes to your eligibility or coverage. Keep your contact information updated to receive important notices.

- Using Your Insurance: Familiarize yourself with the process of using your insurance. Understand how to access services, make appointments, and submit claims. Reach out to your insurance provider or a healthcare advocate if you have any questions or need assistance.

Tips for a Successful State Insurance Application

Here are some additional tips to enhance your state insurance application experience:

- Start early: Don't wait until the last minute to apply. Give yourself ample time to gather documents and understand the process.

- Stay organized: Keep a file or digital folder with all your application-related documents. This makes it easier to access and submit information.

- Be accurate: Double-check your application for errors. Inaccurate information can lead to delays or denials.

- Seek assistance: If you're unsure or need help, reach out to a healthcare navigator, your local Department of Health, or a trusted healthcare advocate.

- Stay informed: Keep up-to-date with changes in state insurance programs and eligibility requirements. This ensures you can take advantage of any new opportunities or benefits.

Applying for state insurance is a significant step towards better healthcare access and financial security. By understanding the process, gathering the right documents, and choosing the appropriate program, you can navigate the journey with confidence. Remember, state insurance programs are designed to support eligible residents, so don't hesitate to reach out for assistance if needed.

What documents are typically required for a state insurance application?

+Commonly required documents include proof of identity (driver’s license, passport), Social Security number or ITIN, proof of citizenship or immigration status, proof of residency (utility bills, lease), and income verification (pay stubs, tax returns). Additional documents may be needed depending on your circumstances.

How can I find out if I’m eligible for state insurance?

+Start by researching your state’s specific insurance program on websites like Healthcare.gov or your state’s official healthcare website. These platforms often provide eligibility calculators and detailed information on income limits and other requirements.

Can I apply for state insurance if I’m not a U.S. citizen or lawful permanent resident?

+Eligibility for state insurance programs depends on your immigration status. Some programs may allow certain categories of non-citizens to apply, while others may have more restrictive requirements. Check your state’s guidelines for specific information.

What happens if my state insurance application is denied?

+If your application is denied, you have the right to appeal the decision. The appeal process varies by state, but you’ll typically receive instructions on how to proceed. It’s essential to understand the reasons for the denial and address any issues to increase your chances of success on appeal.