How To Get Breast Pump Through Insurance

In today's fast-paced world, where many parents are navigating the challenges of balancing work and family, the demand for breast pumps has soared. Breast pumps have become an essential tool for nursing mothers, ensuring they can continue breastfeeding even when they are away from their babies. This article aims to guide you through the process of obtaining a breast pump through insurance, shedding light on the benefits and complexities involved.

Understanding the Importance of Breast Pump Coverage

The journey of motherhood is a beautiful yet demanding experience. Breastfeeding is often recommended as the optimal way to nourish and bond with your baby, offering numerous health benefits for both mother and child. However, for working mothers or those who need to be away from their infants, expressing milk becomes crucial. This is where breast pumps step in as a modern-day necessity.

Breast pumps allow mothers to express and store their milk, ensuring a continuous supply even when they are not physically with their babies. By providing coverage for breast pumps, insurance companies recognize the importance of supporting breastfeeding mothers in their efforts to maintain milk production and supply.

Breast Pump Insurance Coverage: A Comprehensive Guide

Obtaining a breast pump through insurance is a viable option for many nursing mothers. Insurance providers understand the value of promoting breastfeeding and its long-term health benefits. Here’s a step-by-step guide to help you navigate the process:

Step 1: Check Your Insurance Policy

Begin by thoroughly reviewing your insurance policy. Look for specific sections or clauses related to durable medical equipment (DME) or medical supply coverage. Breast pumps are often classified under these categories. Pay attention to any limitations, exclusions, or requirements mentioned in your policy.

| Insurance Company | Breast Pump Coverage |

|---|---|

| BlueCross BlueShield | Covers a range of pump models with prior authorization |

| Aetna | Offers coverage for hospital-grade and personal-use pumps |

| UnitedHealthcare | Provides coverage for medically necessary pumps |

Step 2: Determine Your Eligibility

Insurance companies typically have criteria for breast pump coverage. These criteria may include factors such as the age of your baby, your medical history, or your employment status. Ensure that you meet the eligibility requirements outlined in your policy.

Step 3: Obtain a Prescription

Most insurance providers require a prescription or a letter of medical necessity from a healthcare provider to authorize breast pump coverage. Schedule an appointment with your obstetrician, pediatrician, or lactation consultant. They will assess your situation and provide the necessary documentation.

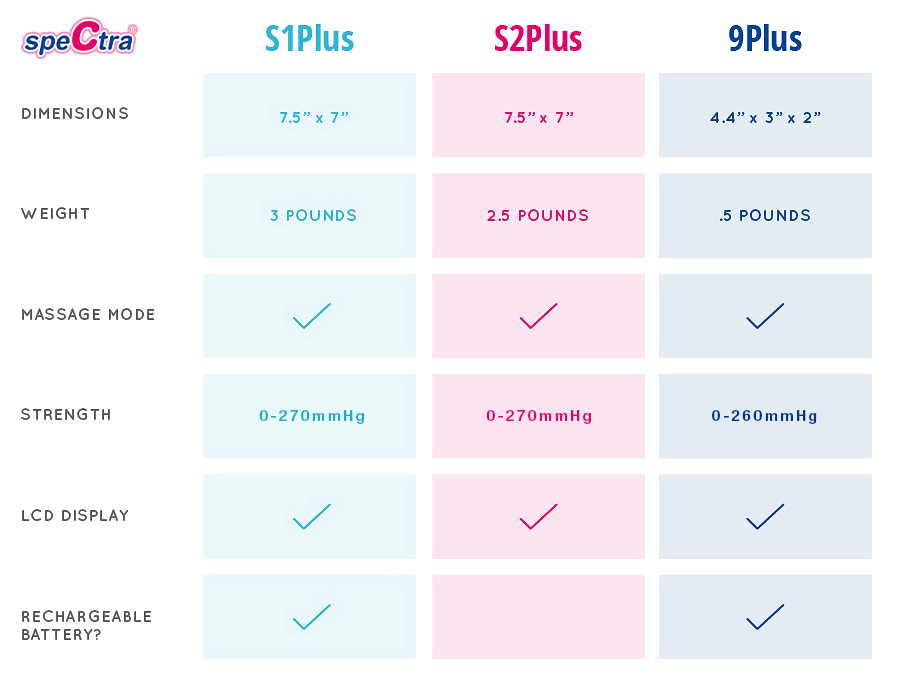

Step 4: Choose Your Breast Pump

Once you have the prescription, it’s time to select the breast pump that suits your needs. Research different types and models, considering factors like comfort, portability, and ease of use. Consult with your healthcare provider or a lactation specialist to find the best option for your lifestyle and breastfeeding goals.

Step 5: Contact Your Insurance Provider

Reach out to your insurance company’s customer service or claims department. Provide them with the necessary details, including your prescription, to initiate the coverage process. They will guide you through the steps and inform you of any specific procedures or forms required.

Step 6: Select a Supplier

Insurance companies often have a network of preferred suppliers or durable medical equipment (DME) providers. Choose a supplier from this network to ensure seamless coverage. The supplier will work with your insurance company to process the claim and deliver the breast pump.

Step 7: Track Your Claim

Keep track of the claim process by regularly checking your insurance account or contacting the supplier. Ensure that all the necessary documentation has been submitted and that the claim is being processed accurately. This proactive approach can help identify and resolve any potential issues promptly.

Maximizing Your Breast Pump Insurance Benefits

To make the most of your breast pump insurance coverage, consider the following strategies:

- Compare different breast pump models and brands to find the one that aligns with your needs and preferences.

- Review the coverage limits and any associated costs, such as co-pays or deductibles, to understand your financial responsibilities.

- Explore additional benefits or discounts offered by your insurance provider, such as extended warranties or accessory packages.

- Consider the long-term value of your breast pump. Some insurance plans offer coverage for hospital-grade pumps, which can be beneficial if you plan to breastfeed multiple children or have specific medical needs.

Common Challenges and Solutions

While obtaining a breast pump through insurance can be straightforward, certain challenges may arise. Here are some common issues and potential solutions:

Prescription Denial

If your insurance company denies your breast pump prescription, don’t lose hope. Review the denial letter carefully to understand the reasons for the denial. Contact your healthcare provider to discuss the denial and explore options for resubmitting the prescription with additional supporting documentation.

Limited Coverage Options

Some insurance policies may have limited coverage for breast pumps, offering only basic models. In such cases, consider exploring alternative funding options. You can explore employer-provided benefits, such as flexible spending accounts (FSAs) or health savings accounts (HSAs), which may cover the cost of a breast pump.

Long Wait Times

Processing insurance claims can sometimes take longer than expected. To avoid delays, ensure that all necessary documentation is complete and accurate when submitting your claim. Stay in touch with your insurance provider and supplier to monitor the progress and address any potential bottlenecks.

Future Trends and Developments

The landscape of breast pump insurance coverage is evolving. As more research highlights the long-term health benefits of breastfeeding, insurance companies are increasingly recognizing the value of supporting nursing mothers. Here are some potential future developments:

- Expanded coverage options, including more advanced pump models and accessory packages.

- Improved access to lactation support services, such as virtual consultations or in-person support groups, to enhance breastfeeding success.

- Integration of breast pump coverage with other maternal and infant health initiatives, promoting a holistic approach to women's healthcare.

Conclusion: Empowering Breastfeeding Mothers

Obtaining a breast pump through insurance is a valuable opportunity for nursing mothers. By understanding the process and maximizing your insurance benefits, you can ensure a seamless and positive breastfeeding experience. Remember, insurance coverage for breast pumps is a step towards empowering mothers and supporting their journey of nourishing and bonding with their little ones.

Can I use my insurance coverage for a breast pump if I am not working?

+Yes, insurance coverage for breast pumps is not limited to working mothers. Many insurance policies cover breast pumps based on medical necessity and the age of the baby, regardless of employment status.

Are there any additional costs associated with breast pump insurance coverage?

+Insurance coverage for breast pumps may involve co-pays, deductibles, or other out-of-pocket expenses. Review your insurance policy and consult with your insurance provider to understand the exact costs associated with your coverage.

Can I choose any breast pump brand or model through insurance coverage?

+Insurance coverage often comes with a list of approved brands and models. However, some insurance providers may offer flexibility, allowing you to choose from a range of options within certain parameters. Consult with your insurance company to explore your choices.