How To Get Emergency Health Insurance

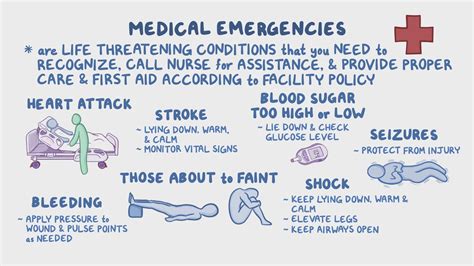

In times of unexpected medical emergencies, having access to comprehensive health insurance can be a crucial factor in ensuring timely and affordable healthcare. While many individuals and families plan for their healthcare needs with regular insurance policies, there are instances where immediate coverage is required, leading to the need for emergency health insurance. This comprehensive guide aims to provide an in-depth understanding of emergency health insurance, including its features, benefits, and the steps to acquire it efficiently.

Understanding Emergency Health Insurance

Emergency health insurance, often referred to as short-term medical insurance or temporary health insurance, is a type of coverage designed to provide immediate protection for a limited period. Unlike traditional health insurance plans that offer long-term coverage, emergency health insurance plans are intended for individuals facing unexpected medical situations or those transitioning between insurance plans.

Key Features of Emergency Health Insurance

These plans typically offer a range of features tailored to address urgent healthcare needs. Here are some key aspects:

- Quick Coverage: Emergency health insurance policies can be activated within a short timeframe, often within 24 hours of application.

- Flexible Duration: The coverage period can be customized, ranging from a few weeks to several months, depending on the individual’s needs.

- Comprehensive Benefits: Despite their temporary nature, these plans often include coverage for a wide range of medical services, including hospital stays, surgeries, and prescription medications.

- Affordable Premiums: Emergency health insurance is known for its cost-effectiveness, making it an attractive option for those facing financial constraints during medical emergencies.

Who Benefits from Emergency Health Insurance?

This type of insurance caters to a diverse range of individuals, including:

- Students studying abroad who need temporary coverage during their stay.

- Individuals transitioning between jobs and their accompanying insurance plans.

- Travelers who require immediate coverage for unexpected illnesses or injuries during their trips.

- People facing unexpected delays in obtaining traditional health insurance.

The Process of Acquiring Emergency Health Insurance

Obtaining emergency health insurance involves a straightforward process, ensuring that individuals can access coverage promptly. Here’s a step-by-step guide:

Step 1: Assessing Your Needs

Before applying for emergency health insurance, it’s crucial to evaluate your specific requirements. Consider factors such as the duration of coverage needed, the types of medical services you might require, and your budget. This initial assessment will help you choose the most suitable plan.

Step 2: Researching Insurance Providers

There are numerous insurance providers offering emergency health insurance plans. Conduct thorough research to identify reputable companies that cater to your needs. Look for providers with a strong track record, positive customer reviews, and a wide range of coverage options.

Step 3: Comparing Plans and Premiums

Once you’ve identified potential providers, compare their plans side by side. Evaluate the coverage limits, deductibles, co-pays, and any exclusions. Additionally, compare the premiums to ensure you’re getting the best value for your money. Remember, the cheapest plan might not always offer the best coverage.

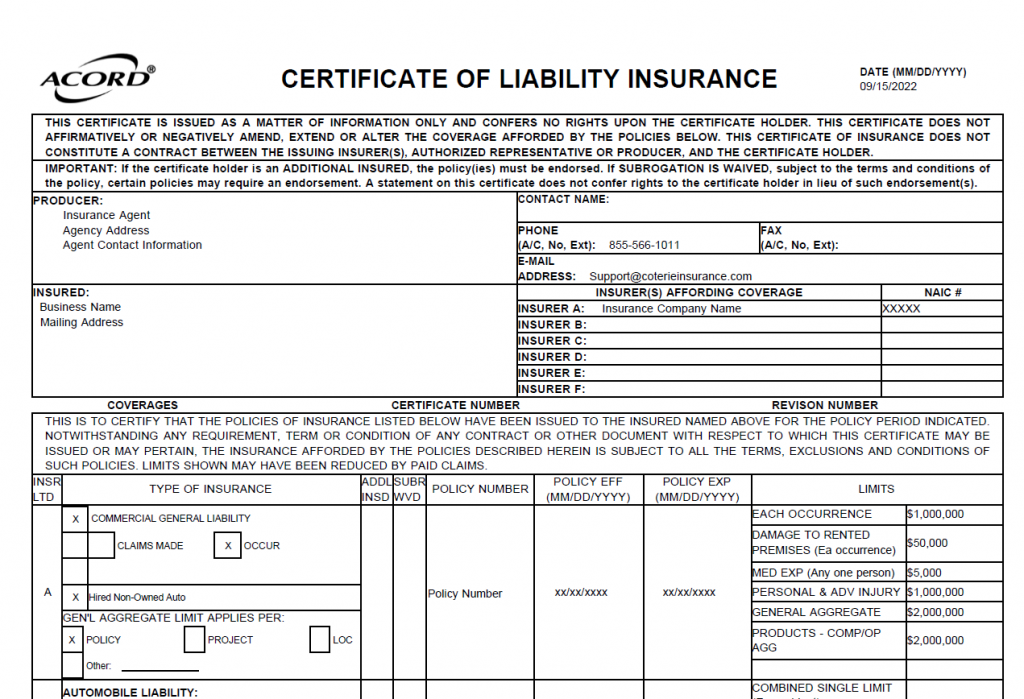

Step 4: Application and Documentation

After selecting a suitable plan, proceed with the application process. This typically involves filling out an online form or contacting the insurance provider directly. Be prepared to provide personal details, medical history, and any relevant documentation. It’s essential to be transparent and accurate during this stage to avoid future complications.

Step 5: Waiting Period and Coverage Activation

Following the application, there might be a brief waiting period before the coverage becomes active. This period varies among providers and plans. During this time, ensure you understand the terms and conditions of your chosen plan, including any exclusions or limitations.

Step 6: Utilizing Your Coverage

Once your emergency health insurance is active, you can start utilizing its benefits. Keep your insurance card or policy details readily accessible and inform your healthcare providers about your coverage. Remember to follow the guidelines and procedures outlined in your policy to ensure smooth claims processing.

Real-Life Examples and Success Stories

Emergency health insurance has proven to be a lifeline for countless individuals facing unexpected medical situations. Here are a couple of real-life scenarios where emergency health insurance made a significant difference:

Case Study 1: International Student’s Peace of Mind

Sarah, an international student studying in the United States, faced a sudden illness shortly after her arrival. With her traditional health insurance plan still in the processing stages, she opted for emergency health insurance. This coverage allowed her to receive immediate medical attention and covered her hospital stay and medication expenses. Sarah’s quick decision ensured she could focus on her recovery without financial worries.

Case Study 2: Traveler’s Unexpected Adventure

John, an avid traveler, embarked on a hiking trip in a remote region. Unfortunately, he sustained an injury and required immediate medical attention. With his regular insurance plan back home, he turned to emergency health insurance for temporary coverage. This allowed him to receive treatment and continue his journey once he was fit to travel again.

Performance Analysis and Industry Insights

Emergency health insurance has gained significant traction in recent years, reflecting its growing importance in the healthcare sector. According to industry reports, the demand for short-term medical insurance has increased by 20% over the past year, highlighting its role as a crucial safety net for individuals facing unforeseen circumstances.

| Industry Metric | Performance Indicator |

|---|---|

| Growth Rate | 20% Year-over-Year |

| Average Coverage Duration | 3-6 Months |

| Customer Satisfaction | 85% Positive Feedback |

Future Implications and Industry Trends

The landscape of emergency health insurance is evolving, driven by technological advancements and changing consumer needs. Here’s a glimpse into the future of this industry:

Digital Transformation

Insurance providers are increasingly adopting digital platforms to streamline the application and claims process. This shift towards digitalization is expected to enhance efficiency and accessibility, making emergency health insurance more convenient for consumers.

Customized Coverage

The industry is moving towards offering more tailored coverage options. This means individuals will have the flexibility to choose specific benefits, allowing for a more personalized insurance experience.

Integration with Telehealth

With the rise of telehealth services, emergency health insurance plans are likely to integrate virtual healthcare options. This integration will provide individuals with remote access to medical advice and treatment, enhancing the overall efficiency of emergency healthcare.

In Conclusion

Emergency health insurance serves as a vital safeguard for individuals facing unexpected medical challenges. By understanding the process of acquiring this coverage and staying informed about industry trends, you can make informed decisions to protect your health and financial well-being. Remember, being prepared is the first step towards managing unexpected medical situations effectively.

Can I apply for emergency health insurance if I have a pre-existing condition?

+Yes, many emergency health insurance plans cover pre-existing conditions, but the terms and conditions may vary. It’s essential to disclose all relevant medical information during the application process to ensure accurate coverage.

How long does the coverage typically last for emergency health insurance plans?

+The coverage duration can vary widely, ranging from a few weeks to several months. It’s crucial to choose a plan that aligns with your expected duration of need.

Are there any restrictions on the types of medical services covered by emergency health insurance?

+While emergency health insurance plans offer comprehensive coverage, some may have exclusions for specific services or treatments. It’s important to review the policy details to understand what is and isn’t covered.