I Am Pregnant And Need Immediate Insurance

Navigating Insurance Options: A Guide for Expectant Mothers

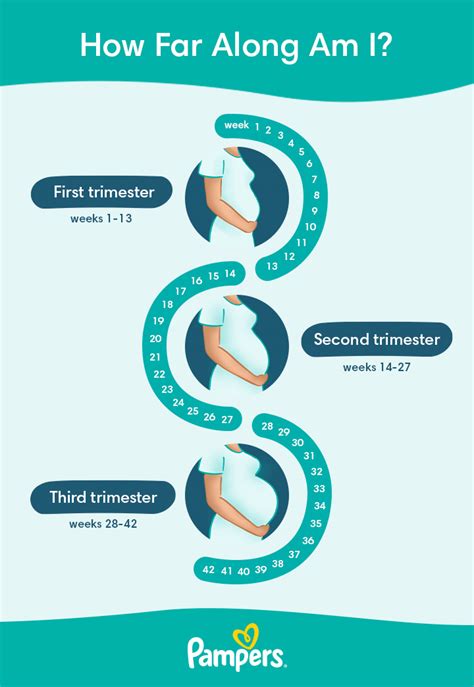

Pregnancy is an exciting journey filled with anticipation and planning, and one crucial aspect to consider is health insurance coverage. Ensuring access to quality healthcare services is paramount for both the mother and the growing baby. In this comprehensive guide, we will explore the various insurance options available to pregnant women, providing valuable insights and steps to secure immediate coverage.

Understanding Your Insurance Needs During Pregnancy

Pregnancy brings unique healthcare requirements, from prenatal care to potential complications and delivery. It's essential to evaluate your insurance needs based on your individual circumstances, such as:

- Existing Health Conditions: If you have pre-existing health issues, finding insurance that covers these conditions is vital.

- Preferred Healthcare Providers: Consider whether you want to continue seeing your current doctors or explore new options.

- Financial Considerations: Assess your budget and the cost of insurance plans, including deductibles and out-of-pocket expenses.

- Coverage Duration: Determine how long you'll need insurance, considering the pregnancy term and potential postnatal care.

Exploring Insurance Options for Pregnant Women

There are several insurance pathways to explore when you're expecting. Let's delve into each option, highlighting the benefits and considerations:

Employer-Sponsored Health Insurance

If you're employed, your workplace may offer employer-sponsored health insurance plans. These plans often provide comprehensive coverage, including prenatal care, delivery, and postnatal services. Key advantages include:

- Cost-Effectiveness: Employer contributions can significantly reduce your premium costs.

- Network Flexibility: Many plans offer a wide range of healthcare providers to choose from.

- Family Coverage: You can often add your spouse and any existing children to the plan.

- Specialized Care: Access to high-risk pregnancy specialists and maternal-fetal medicine experts.

Consider the following when evaluating employer-sponsored insurance:

- Enrollment Periods: Ensure you understand the open enrollment deadlines to avoid missing out on coverage.

- Coverage Details: Carefully review the plan's benefits, exclusions, and any limitations.

- Out-of-Pocket Costs: Assess deductibles, copayments, and coinsurance to estimate your financial responsibility.

Individual Market Insurance Plans

For those without employer-sponsored insurance, the individual market offers a range of options. These plans are purchased directly from insurance companies or through healthcare marketplaces. Key considerations include:

- Customizable Coverage: You can choose plans based on your specific needs and budget.

- Subsidies and Tax Credits: Depending on your income, you may qualify for financial assistance to lower your premiums.

- Network of Providers: Research the plan's network to ensure your preferred doctors and hospitals are included.

- Maternity Benefits: Confirm that the plan covers pregnancy-related services, including prenatal care, labor and delivery, and postnatal care.

Medicaid and CHIP

Medicaid and the Children's Health Insurance Program (CHIP) are government-funded programs offering comprehensive healthcare coverage for low-income individuals and families. During pregnancy, these programs can provide essential support:

- No-Cost Coverage: Medicaid and CHIP often cover prenatal care, delivery, and postnatal services without requiring copayments or deductibles.

- Eligibility: Income requirements vary by state, so check your state's guidelines to see if you qualify.

- Long-Term Coverage: Medicaid and CHIP can provide ongoing healthcare coverage for you and your child.

Short-Term Health Insurance

Short-term health insurance plans offer temporary coverage for those transitioning between insurance options or facing a gap in coverage. While these plans may be more affordable, they come with limitations:

- Limited Coverage: They often exclude pregnancy-related services, making them unsuitable for expectant mothers.

- Duration: Short-term plans typically last for 3-12 months, depending on your state's regulations.

- Pre-Existing Condition Exclusions: Some plans may not cover pre-existing conditions, including pregnancy-related issues.

Steps to Secure Immediate Insurance Coverage

To ensure you have immediate insurance coverage during your pregnancy, follow these steps:

- Research Insurance Options: Explore the various plans available, considering employer-sponsored, individual market, Medicaid, and CHIP options.

- Evaluate Your Needs: Assess your healthcare requirements, preferred providers, and financial capabilities.

- Compare Plans: Use online tools and resources to compare coverage, costs, and network providers across different plans.

- Apply Promptly: Submit your insurance application as soon as possible to avoid delays in coverage.

- Review Coverage Details: Once enrolled, carefully review your policy to understand the benefits, limitations, and exclusions.

- Schedule Prenatal Care: Contact your chosen healthcare provider to schedule prenatal appointments and discuss your pregnancy journey.

Maximizing Your Insurance Benefits

Once you have secured insurance coverage, it's essential to make the most of your benefits. Here are some tips to optimize your healthcare experience:

- Understand Your Network: Familiarize yourself with the healthcare providers and facilities covered by your insurance plan.

- Choose an Obstetrician or Midwife: Select a healthcare professional who aligns with your birthing preferences and provides comprehensive prenatal care.

- Utilize Preventive Services: Take advantage of free preventive services, such as prenatal vitamins, counseling, and screening tests.

- Explore Additional Benefits: Some insurance plans offer perks like breastfeeding support, birth education classes, or postpartum depression screenings.

- Stay Informed: Keep track of your insurance plan's changes, updates, and any new benefits introduced.

Frequently Asked Questions (FAQ)

Can I enroll in insurance plans at any time during my pregnancy?

+Enrollment timelines vary depending on the insurance type. For employer-sponsored plans, open enrollment periods typically occur annually, while individual market plans may offer more flexibility. Medicaid and CHIP often have year-round enrollment.

<div class="faq-item">

<div class="faq-question">

<h3>What if I have a pre-existing condition related to pregnancy?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Under the Affordable Care Act, insurance companies cannot deny coverage based on pre-existing conditions, including pregnancy-related issues. However, short-term plans may have exclusions, so choose a plan that suits your needs.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any additional costs I should expect during pregnancy and childbirth?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>While insurance covers most pregnancy-related expenses, there may be some out-of-pocket costs. These can include deductibles, copayments, and non-covered services. It's essential to understand your plan's financial obligations.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I switch insurance plans during pregnancy if I find a better option?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Switching insurance plans during pregnancy is possible, but it may depend on the type of plan and your circumstances. Some plans have restrictions on changing coverage mid-year, so review the rules carefully.</p>

</div>

</div>

</div>

Navigating insurance options during pregnancy can be complex, but with careful research and planning, you can secure the coverage you need. Remember to evaluate your specific circumstances, compare plans thoroughly, and maximize the benefits your insurance offers. Best wishes for a healthy and happy pregnancy journey!