Indemnity Definition Insurance

The Essential Guide to Indemnity in Insurance: Understanding the Basics

In the complex world of insurance, the term "indemnity" is a cornerstone concept that underpins the very foundation of the industry. Indemnity, at its core, represents a fundamental principle of insurance contracts, serving as a vital safeguard for policyholders and a key mechanism for managing risk. This guide aims to delve into the intricacies of indemnity, exploring its definition, legal implications, and its critical role in shaping the insurance landscape.

Indemnity, derived from the Latin word "indemnificare," meaning "to make whole again," encapsulates the very essence of insurance. It is a contractual obligation that requires one party (the insurer) to compensate or reimburse another party (the insured) for any losses, damages, or liabilities incurred, provided such losses fall within the scope of the insurance policy. This concept forms the bedrock of insurance, ensuring that policyholders are protected against unforeseen events and can recover from financial setbacks.

The Legal Framework of Indemnity

Indemnity in insurance is not merely a theoretical concept; it is deeply entrenched in legal principles and regulations. Insurance policies are legally binding contracts, and indemnity is a central component of these agreements. When an insured individual or entity purchases an insurance policy, they enter into a contractual relationship with the insurer. This contract outlines the terms and conditions under which the insurer will provide financial protection and indemnity in the event of a covered loss.

The legal framework surrounding indemnity ensures that both parties have a clear understanding of their rights and obligations. Insurance contracts typically specify the types of risks covered, the limits of liability, and the conditions under which indemnity will be provided. These terms are carefully crafted to provide a balance between the insurer's need to manage risk and the insured's desire for comprehensive protection.

The Indemnity Principle in Practice

To illustrate the practical application of indemnity, let's consider a real-life scenario. Imagine a small business owner, Sarah, who purchases a comprehensive business insurance policy. This policy includes coverage for property damage, liability claims, and business interruption. One day, a fire breaks out in Sarah's warehouse, causing significant damage to her inventory and equipment. Fortunately, Sarah has taken the prudent step of insuring her business.

When Sarah files a claim with her insurance provider, the indemnity principle comes into play. The insurer assesses the extent of the damage and determines whether it falls within the scope of the policy. If the loss is covered, the insurer will compensate Sarah for the value of the damaged property, up to the policy's limits. This compensation allows Sarah to repair or replace her lost assets, effectively "making her whole" again and enabling her business to continue operating.

Key Considerations in Indemnity

While indemnity is a fundamental concept in insurance, it is not without its complexities. Here are some key considerations to understand the nuances of indemnity:

Scope of Coverage

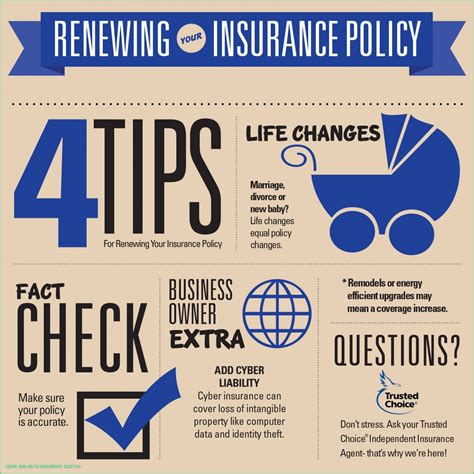

Insurance policies define the scope of coverage, specifying the types of losses or events that are covered. It is crucial for policyholders to carefully review their policies to understand the extent of their indemnity rights. Some policies may have specific exclusions or limitations, and being aware of these details is essential for effective risk management.

| Policy Type | Coverage Scope |

|---|---|

| Property Insurance | Covers damage to physical assets, such as buildings, equipment, and inventory. |

| Liability Insurance | Protects against legal claims and financial liabilities arising from accidents or negligence. |

| Health Insurance | Provides coverage for medical expenses and treatments. |

Limits of Liability

Insurance policies often impose limits on the amount of indemnity that can be claimed. These limits are typically specified in the policy and may vary depending on the type of coverage and the policyholder's needs. Understanding these limits is crucial to ensure adequate protection and to manage expectations regarding potential compensation.

Conditions Precedent

Insurance policies may include specific conditions or requirements that must be met for indemnity to be provided. These conditions can include timely notice of a claim, cooperation with the insurer during investigations, and adherence to policy terms. Failure to meet these conditions could result in the denial of indemnity, emphasizing the importance of policyholder compliance.

The Role of Indemnity in Risk Management

Indemnity is a critical component of risk management in the insurance industry. By providing financial protection and compensation for covered losses, indemnity helps policyholders mitigate the potential financial impact of unforeseen events. This risk transfer mechanism allows individuals and businesses to focus on their core operations and plan for the future with greater confidence.

For insurers, indemnity serves as a tool for managing their exposure to risk. By carefully underwriting policies and assessing the risks associated with each policyholder, insurers can set appropriate premiums and manage their liabilities. This process ensures that the insurance market remains stable and that policyholders receive fair and reasonable indemnity when needed.

Indemnity vs. Reimbursement

It is important to distinguish between indemnity and reimbursement. While both concepts involve compensation, they differ in their approaches. Indemnity typically involves a direct payment from the insurer to the insured, covering the actual loss incurred. In contrast, reimbursement requires the insured to incur the expense first and then seek compensation from the insurer.

For example, if a policyholder suffers a loss and is entitled to indemnity, the insurer may provide a direct payment to cover the cost of repairs or replacements. In a reimbursement scenario, the policyholder would pay for the repairs themselves and then submit a claim to the insurer for reimbursement of the expenses.

Future Implications and Innovations

As the insurance industry continues to evolve, the concept of indemnity is likely to adapt and innovate. Technological advancements, such as the integration of artificial intelligence and data analytics, are transforming the way insurers assess risk and provide indemnity. These innovations enhance efficiency, accuracy, and personalized risk management solutions.

Additionally, the rise of parametric insurance, which triggers payouts based on predefined parameters rather than individual losses, offers a new approach to indemnity. This innovative model provides faster and more predictable compensation, particularly in cases of natural disasters or catastrophic events. Parametric insurance has the potential to revolutionize the way indemnity is delivered, especially in regions vulnerable to extreme weather conditions.

Indemnity in a Digital Age

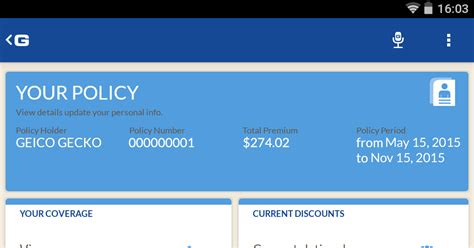

The digital transformation of the insurance industry brings new opportunities and challenges for indemnity. Digital platforms and online services are streamlining the insurance experience, making it more accessible and convenient for policyholders. However, it also introduces new risks and complexities, such as cyber threats and data privacy concerns.

Insurer investments in cybersecurity measures and data protection protocols are essential to ensure that indemnity remains a reliable safeguard in the digital age. By adapting to emerging technologies and addressing digital risks, the insurance industry can continue to provide effective indemnity solutions while meeting the evolving needs of policyholders.

How does indemnity differ from compensation in insurance policies?

+Indemnity and compensation are closely related concepts, but they have distinct nuances. Indemnity refers to the legal obligation of the insurer to reimburse the insured for covered losses, aiming to restore them to their pre-loss financial position. Compensation, on the other hand, is a broader term that encompasses any form of payment or relief provided to the insured, including indemnity, but also potentially covering non-financial aspects such as emotional support or other benefits.

Can indemnity be applied to all types of insurance policies?

+Yes, indemnity is a fundamental principle that applies to a wide range of insurance policies, including property, liability, health, and life insurance. However, the specific terms and conditions of indemnity may vary depending on the type of policy and the insurer’s underwriting practices. It is crucial for policyholders to carefully review their policies to understand the scope and limits of their indemnity rights.

What happens if an insurance claim exceeds the policy’s limits of liability?

+If an insurance claim exceeds the policy’s limits of liability, the insurer may provide indemnity up to the maximum amount specified in the policy. In such cases, the insured may be responsible for any additional expenses or losses that fall outside the scope of the policy’s coverage. It is essential for policyholders to carefully assess their insurance needs and choose policies with adequate limits to ensure sufficient protection.