Vehicle Insurance Charges

Vehicle insurance is a crucial aspect of owning a car, motorcycle, or any other motorized vehicle. It provides financial protection and peace of mind to vehicle owners by covering various risks and liabilities associated with road accidents, theft, and other unforeseen events. The cost of vehicle insurance, often referred to as the premium, can vary significantly based on numerous factors, making it an essential topic for anyone seeking to understand their insurance options and make informed choices.

Understanding the Factors that Influence Vehicle Insurance Charges

The price of vehicle insurance is determined by a complex interplay of variables, each contributing to the overall risk profile assessed by insurance providers. These factors can be broadly categorized into personal, vehicle-specific, and environmental considerations.

Personal Factors

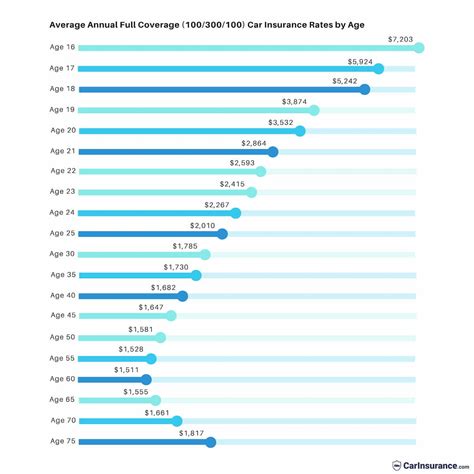

Insurance companies assess the risk associated with an individual’s driving history, demographics, and personal circumstances. For instance, young drivers under the age of 25 are often considered high-risk due to their limited driving experience, leading to higher insurance premiums. Similarly, individuals with a history of accidents or traffic violations may face increased charges. Insurance providers also take into account the number of years a person has held a valid driver’s license, with longer periods generally resulting in lower premiums.

| Personal Factor | Impact on Premium |

|---|---|

| Age | Younger drivers often pay more due to higher risk. |

| Driving History | Accidents and violations can increase insurance costs. |

| Years of Driving Experience | Longer experience can lead to lower premiums. |

Vehicle-Specific Factors

The type, make, and model of a vehicle significantly influence insurance charges. High-performance sports cars, for example, are generally more expensive to insure due to their potential for higher speeds and increased accident risk. Similarly, vehicles with advanced safety features may qualify for discounts, as they are statistically less likely to be involved in accidents. The value of the vehicle also plays a role; more expensive cars typically require higher insurance coverage, resulting in higher premiums.

| Vehicle Factor | Impact on Premium |

|---|---|

| Vehicle Type | Sports cars and luxury vehicles often have higher premiums. |

| Safety Features | Vehicles with advanced safety systems may qualify for discounts. |

| Vehicle Value | More expensive vehicles generally require higher insurance coverage. |

Environmental Factors

The geographic location where a vehicle is primarily driven and stored can impact insurance charges. Areas with high rates of car theft or frequent natural disasters may result in higher premiums. Additionally, the type of neighborhood or community can also be a factor; densely populated urban areas often have higher insurance costs due to increased traffic and potential for accidents.

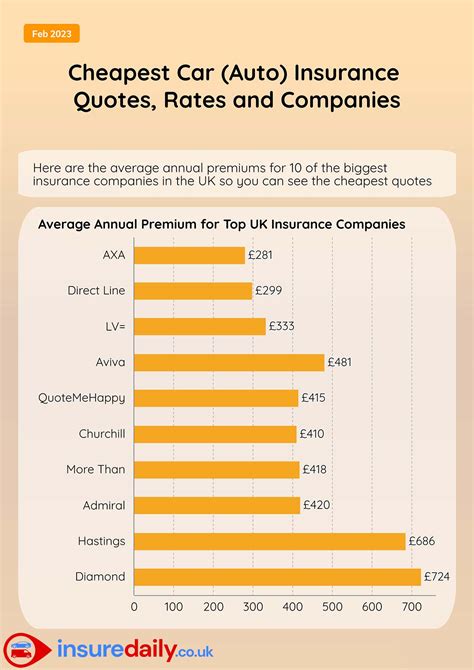

Comparative Analysis of Insurance Providers and Coverage Options

When seeking vehicle insurance, it’s crucial to compare quotes from multiple providers to find the best coverage at the most competitive price. Each insurance company has its own methodology for assessing risk and setting premiums, so quotes can vary significantly. Online comparison tools can be a valuable resource for quickly gathering quotes from various insurers.

Coverage Options and Their Impact on Charges

The level of coverage an individual chooses also greatly affects the overall insurance premium. Basic liability coverage, which is the minimum legally required in most states, will generally have lower premiums compared to comprehensive coverage, which includes protection for a wider range of incidents, such as theft, vandalism, and natural disasters.

| Coverage Type | Description | Impact on Premium |

|---|---|---|

| Liability Coverage | Covers damages caused to others in an accident. | Lower premiums compared to comprehensive coverage. |

| Comprehensive Coverage | Covers a wide range of incidents, including theft and natural disasters. | Higher premiums but provides more extensive protection. |

Discounts and Bundle Options

Insurance providers often offer discounts to attract customers and reward safe driving practices. These discounts can be based on various factors, such as the installation of anti-theft devices, taking defensive driving courses, or maintaining a clean driving record. Additionally, many insurers offer bundle discounts when multiple insurance policies (e.g., auto, home, or life insurance) are purchased from the same provider.

The Future of Vehicle Insurance: Technological Advancements and Changing Dynamics

The vehicle insurance industry is experiencing significant transformations due to technological advancements and changing consumer behaviors. The rise of connected vehicles and the Internet of Things (IoT) is enabling insurers to gather more precise data on driving behavior, which can lead to more tailored and accurate pricing. Additionally, the development of autonomous vehicles is expected to drastically reduce the number of accidents, potentially leading to lower insurance premiums in the long term.

The Role of Telematics and Usage-Based Insurance

Telematics is a technology that allows insurers to monitor driving behavior in real-time. By installing a small device in a vehicle or using a smartphone app, insurers can track factors such as speed, acceleration, braking, and time of day driven. This data is then used to calculate insurance premiums, often resulting in lower charges for safe drivers. Usage-Based Insurance (UBI) programs, which utilize telematics, are becoming increasingly popular, offering drivers the opportunity to save money by demonstrating responsible driving habits.

| Telematics Feature | Description |

|---|---|

| Real-time Driving Monitoring | Insurers track driving behavior to assess risk and set premiums. |

| Usage-Based Insurance (UBI) | Programs that reward safe driving with lower premiums. |

The Impact of Autonomous Vehicles on Insurance

The widespread adoption of autonomous vehicles is expected to revolutionize the insurance industry. With self-driving cars, the number of accidents caused by human error is anticipated to decrease significantly. This reduction in accidents could lead to lower insurance premiums, as the risk profile for vehicle owners would shift from human error to mechanical and software failures, which are generally less frequent and more predictable.

Conclusion: Making Informed Decisions for Optimal Insurance Coverage

Understanding the factors that influence vehicle insurance charges and the various coverage options available is essential for making informed decisions. By comparing quotes, exploring discount opportunities, and staying informed about industry trends, individuals can find the best insurance coverage at a competitive price. With the rapid advancements in technology and the potential benefits of autonomous vehicles, the future of vehicle insurance looks promising, offering increased safety and potential cost savings for vehicle owners.

How do insurance companies determine my insurance premium?

+Insurance companies use a complex algorithm that takes into account various factors, including your age, driving history, the type of vehicle you drive, and your location. This risk assessment helps determine the likelihood of you making an insurance claim, which directly influences your premium.

Are there any ways to reduce my insurance premium?

+Yes, there are several strategies to reduce your insurance premium. These include maintaining a clean driving record, taking advantage of insurance discounts (such as for safe driving or anti-theft devices), and exploring bundle options where you can combine multiple insurance policies (e.g., auto and home insurance) with the same provider.

What is the difference between liability and comprehensive coverage?

+Liability coverage is the minimum legally required insurance and covers damages you cause to others in an accident. Comprehensive coverage, on the other hand, is more extensive and covers a wider range of incidents, including theft, vandalism, and natural disasters. While comprehensive coverage offers more protection, it also typically comes with a higher premium.