Individuals Health Insurance

Health insurance is a crucial aspect of our lives, ensuring access to essential medical care and financial protection. For individuals and families, understanding the intricacies of health insurance and choosing the right plan can be a complex task. This comprehensive guide aims to provide an in-depth analysis of individuals' health insurance, offering valuable insights, tips, and strategies to navigate the healthcare system effectively.

The Landscape of Individuals’ Health Insurance

The health insurance market for individuals has evolved significantly over the years, offering a diverse range of options tailored to meet different needs. From traditional fee-for-service plans to managed care models like health maintenance organizations (HMOs) and preferred provider organizations (PPOs), individuals now have a multitude of choices when it comes to securing their healthcare coverage.

Moreover, the introduction of the Affordable Care Act (ACA) in the United States has brought about a paradigm shift in the insurance landscape. The ACA mandates that individuals have health insurance, providing subsidies and tax credits to make coverage more affordable. It also expands coverage options, prohibits discrimination based on pre-existing conditions, and introduces essential health benefits that must be included in all plans.

For individuals, understanding the various types of plans and their unique features is essential. Let's delve into the specifics of each plan type and explore how they cater to different healthcare needs.

Fee-for-Service Plans

Fee-for-service plans, also known as indemnity plans, offer individuals the flexibility to choose their own doctors and hospitals. These plans typically require individuals to pay a premium, a deductible, and a coinsurance percentage for each service. The deductible is the amount an individual must pay out of pocket before the insurance coverage kicks in, while coinsurance refers to the percentage of the cost that the individual shares with the insurance company after the deductible is met.

| Fee-for-Service Plan Metrics | Description |

|---|---|

| Premium | Monthly cost of the plan |

| Deductible | Annual out-of-pocket expense before coverage begins |

| Coinsurance | Percentage of covered medical expenses paid by the individual |

One of the key advantages of fee-for-service plans is the freedom they offer. Individuals can visit any healthcare provider without needing a referral or prior authorization. However, the trade-off is often higher costs, as these plans tend to be more expensive than managed care options.

Health Maintenance Organizations (HMOs)

HMOs are a type of managed care plan that provides comprehensive healthcare services through a network of contracted providers. Under an HMO, individuals must select a primary care physician (PCP) who acts as a gatekeeper for their healthcare needs. The PCP coordinates all medical care, including referrals to specialists within the HMO network.

| HMO Plan Metrics | Description |

|---|---|

| Premium | Monthly payment for coverage |

| Deductible | Low or no deductible for in-network services |

| Copayment | Fixed amount paid for each service, such as office visits or prescriptions |

HMOs typically have lower premiums and out-of-pocket costs compared to fee-for-service plans. However, individuals are restricted to using in-network providers, and out-of-network services may not be covered or may require higher out-of-pocket expenses. HMOs are an excellent option for those who prioritize cost-effectiveness and prefer a more structured approach to their healthcare.

Preferred Provider Organizations (PPOs)

PPOs offer a more flexible approach than HMOs, allowing individuals to choose from a network of preferred providers. Unlike HMOs, PPOs do not require a primary care physician, and individuals can directly access specialists without a referral. PPOs provide coverage for both in-network and out-of-network services, although using in-network providers often results in lower costs.

| PPO Plan Metrics | Description |

|---|---|

| Premium | Monthly payment for coverage |

| Deductible | Annual out-of-pocket expense before coverage begins |

| Coinsurance | Percentage of covered medical expenses paid by the individual |

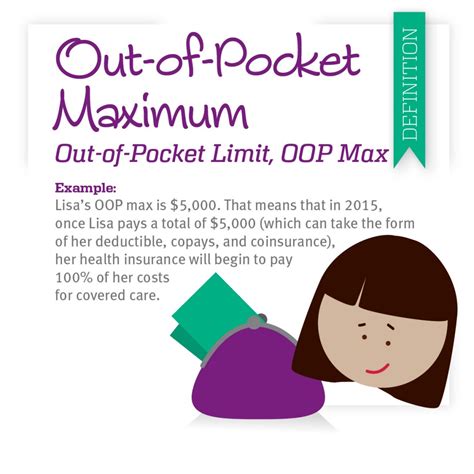

| Out-of-Pocket Maximum | The maximum amount an individual pays in a year for covered services |

PPOs strike a balance between the flexibility of fee-for-service plans and the cost-effectiveness of HMOs. They offer individuals the freedom to choose their providers while still benefiting from lower costs when using in-network services. PPOs are a popular choice for those seeking a more customized healthcare experience.

Navigating the Health Insurance Market

With a vast array of health insurance options available, navigating the market can be daunting. Here are some essential tips and strategies to help individuals make informed decisions when choosing their health insurance plan.

Assessing Individual Needs

The first step in selecting a health insurance plan is to assess your unique healthcare needs. Consider factors such as your current health status, any pre-existing conditions, and your healthcare preferences. Do you require frequent specialist visits or have a preference for a specific healthcare provider or hospital? Understanding your needs will help narrow down the plan options that best suit your circumstances.

Comparing Plan Features

Once you have a clear understanding of your needs, it’s time to compare the features of different plans. Look beyond the premiums and consider factors like deductibles, coinsurance, and out-of-pocket maximums. Evaluate the network of providers and hospitals associated with each plan to ensure they align with your preferences. Additionally, review the list of covered services and benefits to ensure they meet your healthcare requirements.

For instance, if you have a chronic condition that requires regular medication, a plan with a comprehensive prescription drug benefit might be more advantageous. Similarly, if you frequently travel or live in an area with limited healthcare options, a plan with a robust out-of-network coverage policy could be beneficial.

Utilizing Subsidies and Tax Credits

If you are eligible for health insurance subsidies or tax credits under the Affordable Care Act, it’s essential to factor these into your plan selection process. These financial aids can significantly reduce the cost of your health insurance premiums, making coverage more affordable. By comparing plans and considering the impact of subsidies, you can find the most cost-effective option that provides adequate coverage.

Exploring Alternative Options

In addition to traditional health insurance plans, individuals may also explore alternative options such as short-term health insurance or limited benefit plans. These options are often more affordable but may have limited coverage and may not comply with the ACA’s requirements. It’s crucial to carefully review the terms and conditions of such plans to ensure they meet your healthcare needs and legal obligations.

Maximizing Your Health Insurance Benefits

Once you have selected your health insurance plan, it’s essential to make the most of your coverage. Here are some strategies to help you optimize your benefits and navigate the healthcare system efficiently.

Understanding Your Coverage

Take the time to thoroughly understand your health insurance plan’s coverage and benefits. Familiarize yourself with the network of providers, the list of covered services, and any limitations or exclusions. By understanding your coverage, you can make informed decisions about your healthcare and avoid unexpected costs.

Utilizing Preventive Care

Most health insurance plans offer preventive care services at little to no cost. These services, such as annual check-ups, immunizations, and screenings, are designed to help individuals maintain their health and prevent future medical issues. By taking advantage of preventive care, you can proactively manage your health and potentially reduce the need for more costly medical interventions in the future.

Managing Chronic Conditions

If you have a chronic condition, your health insurance plan may offer specialized programs or resources to help you manage your condition effectively. These programs often provide access to dedicated healthcare professionals, educational resources, and support groups. By actively participating in these programs, you can improve your health outcomes and potentially reduce the cost of managing your condition.

Navigating the Claims Process

Understanding how to navigate the claims process is essential to ensure you receive the coverage you are entitled to. Familiarize yourself with the steps involved in filing a claim, including any necessary forms or documentation. Keep records of all your healthcare expenses and communicate regularly with your insurance provider to address any concerns or questions.

The Future of Individuals’ Health Insurance

The landscape of individuals’ health insurance is continually evolving, influenced by technological advancements, changing healthcare trends, and policy reforms. As we look to the future, several key trends and developments are shaping the industry.

Digital Transformation

The integration of digital technologies is revolutionizing the health insurance industry. From online enrollment and claim submission to telemedicine and wearable health tracking devices, digital tools are enhancing the efficiency and accessibility of healthcare services. Insurance providers are leveraging data analytics to offer personalized plans and predictive healthcare solutions, further improving the overall healthcare experience.

Value-Based Care Models

Value-based care models, which focus on the quality and outcomes of healthcare services, are gaining traction in the industry. These models incentivize healthcare providers to deliver high-quality, cost-effective care by linking payments to patient health outcomes. By shifting the focus from volume-based care to value-based care, insurance providers aim to improve patient satisfaction and reduce overall healthcare costs.

Expansion of Telehealth Services

The COVID-19 pandemic accelerated the adoption of telehealth services, and this trend is expected to continue. Telehealth allows individuals to access healthcare services remotely, providing convenience and accessibility, especially for those in rural or underserved areas. Insurance providers are increasingly covering telehealth services, recognizing their potential to improve patient engagement and reduce healthcare costs.

Emphasis on Preventive Care

The industry is placing a growing emphasis on preventive care as a means to improve overall population health and reduce healthcare costs. Insurance providers are investing in preventive care initiatives, such as wellness programs and disease prevention strategies, to promote healthy lifestyles and reduce the burden of chronic diseases. By prioritizing preventive care, the industry aims to shift from reactive to proactive healthcare management.

Conclusion

Navigating the world of individuals’ health insurance requires a comprehensive understanding of the various plan options, an assessment of personal needs, and a strategic approach to maximizing benefits. With the ever-evolving landscape of healthcare and insurance, staying informed and adaptable is key. By embracing digital technologies, value-based care models, and preventive care initiatives, individuals can take control of their healthcare journey and make informed choices that align with their unique circumstances.

What is the difference between fee-for-service and managed care plans like HMOs and PPOs?

+Fee-for-service plans offer flexibility in provider choice but tend to be more expensive. Managed care plans, such as HMOs and PPOs, provide cost-effective coverage by limiting provider options and using a network of preferred providers. HMOs require a primary care physician and have more restricted networks, while PPOs offer more flexibility and cover both in-network and out-of-network services.

How can I determine which health insurance plan is best suited for my needs?

+To choose the right plan, assess your healthcare needs, consider your preferred providers, and evaluate the coverage and benefits offered by each plan. Compare premiums, deductibles, and out-of-pocket costs, and review the network of providers and covered services. Consider any subsidies or tax credits you may be eligible for to further reduce costs.

What are some alternative health insurance options, and when might they be suitable?

+Alternative options include short-term health insurance and limited benefit plans. These plans are typically more affordable but may have limited coverage and may not comply with the Affordable Care Act’s requirements. They can be suitable for those who are temporarily uninsured or have specific, limited healthcare needs.

How can I maximize the benefits of my health insurance plan?

+To maximize your benefits, thoroughly understand your plan’s coverage and benefits. Utilize preventive care services, take advantage of specialized programs for chronic conditions, and actively manage your healthcare by staying informed about the claims process and any necessary documentation.