What Does Out Of Pocket Max Mean In Health Insurance

Understanding health insurance terminology is crucial when navigating the complex world of medical coverage. One term that often arises is the "Out-of-Pocket Maximum," which plays a significant role in defining the financial responsibilities of policyholders. In this comprehensive guide, we'll delve into the intricacies of the Out-of-Pocket Maximum, exploring its definition, how it works, and its impact on healthcare expenses. By the end, you'll have a clear understanding of this essential insurance concept.

The Out-of-Pocket Maximum: Unraveling the Concept

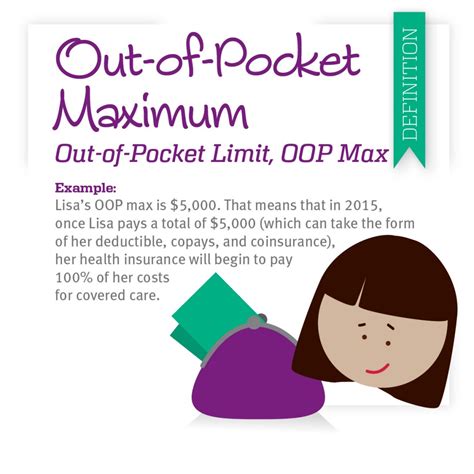

The Out-of-Pocket Maximum, often referred to as OOPM, is a specified dollar amount outlined in your health insurance plan. It represents the maximum amount you, as the policyholder, are responsible for paying out of your own pocket for covered medical services in a given benefit year. This limit includes expenses like deductibles, copayments, and coinsurance.

How the Out-of-Pocket Maximum Works

To illustrate the functionality of the OOPM, let’s consider an example. Imagine you have a health insurance plan with an annual deductible of 2,000 and an Out-of-Pocket Maximum of 5,000. This means that, in the worst-case scenario, you would be responsible for paying the first 2,000 of your medical expenses through your deductible. However, once your total out-of-pocket expenses reach 5,000, your insurance provider will cover 100% of eligible medical costs for the remainder of the benefit year.

Here's a breakdown of how it works:

- Deductible: This is the amount you pay before your insurance coverage kicks in. In our example, it's $2,000.

- Copayments: These are fixed amounts you pay for specific services, like a doctor's visit or prescription medication. For instance, you might pay a $30 copay for a specialist visit.

- Coinsurance: This is a percentage of the cost of a service that you're responsible for paying. For example, your insurance might cover 80% of a hospital stay, leaving you to pay the remaining 20% as coinsurance.

- Out-of-Pocket Maximum: Once your total out-of-pocket expenses, including deductibles, copayments, and coinsurance, reach the OOPM limit ($5,000 in our case), your insurance provider takes over and covers the rest of your eligible medical costs for the year.

It's important to note that the Out-of-Pocket Maximum doesn't include all healthcare expenses. Some services, like cosmetic procedures or treatments for certain pre-existing conditions, may not be covered by your insurance plan. Additionally, the OOPM typically resets annually, meaning you'll start counting towards the limit again each year.

The Impact of the Out-of-Pocket Maximum

The Out-of-Pocket Maximum is a critical component of health insurance plans as it provides a financial safety net for policyholders. By capping the amount you’re responsible for paying, it ensures that your healthcare expenses remain manageable, even in the event of a serious illness or injury.

Moreover, the OOPM encourages preventive care and early detection of health issues. With the knowledge that your expenses are limited, you're more likely to seek regular check-ups, screenings, and necessary treatments without worrying about excessive financial burden.

Comparing Out-of-Pocket Maximums: A Real-World Example

To demonstrate the practical application of the Out-of-Pocket Maximum, let’s explore a hypothetical scenario involving two individuals, John and Sarah, who have different health insurance plans.

| Plan Feature | John's Plan | Sarah's Plan |

|---|---|---|

| Annual Deductible | $1,500 | $2,500 |

| Out-of-Pocket Maximum | $3,000 | $6,000 |

| Copayment for Specialist Visit | $40 | $50 |

| Coinsurance for Hospital Stay | 20% | 30% |

In this scenario, John's plan has a lower deductible and Out-of-Pocket Maximum compared to Sarah's. While John's plan may have slightly higher copayments and coinsurance rates, his overall financial responsibility is capped at $3,000. This means that even if he requires extensive medical care, his out-of-pocket expenses won't exceed this limit.

On the other hand, Sarah's plan has a higher deductible and Out-of-Pocket Maximum. While her plan might offer lower copayments and coinsurance rates, she could potentially face higher out-of-pocket expenses if she requires extensive medical treatment. Her OOPM of $6,000 represents the maximum she'll pay for covered services in a year.

Frequently Asked Questions

What happens if I exceed my Out-of-Pocket Maximum during the benefit year?

+Once you reach your Out-of-Pocket Maximum, your insurance provider will cover 100% of eligible medical costs for the remainder of the benefit year. This means you won’t have to pay any additional out-of-pocket expenses for covered services.

Are there any expenses that aren’t included in the Out-of-Pocket Maximum calculation?

+Yes, some expenses are typically excluded from the OOPM calculation. These may include non-covered services, such as cosmetic procedures or certain pre-existing conditions. Additionally, some plans may exclude certain prescription medications or durable medical equipment from the OOPM limit.

Do Out-of-Pocket Maximums apply to all types of health insurance plans?

+Out-of-Pocket Maximums are a standard feature of most health insurance plans, including employer-sponsored plans, individual plans purchased through the marketplace, and Medicare Advantage plans. However, the specific OOPM limit and other plan details may vary depending on the type of insurance and the provider.

How often does the Out-of-Pocket Maximum reset?

+The Out-of-Pocket Maximum typically resets annually, meaning you start counting towards the limit again at the beginning of each new benefit year. Some plans may offer a family Out-of-Pocket Maximum, which applies to all covered family members, while others have individual OOPM limits for each person on the plan.

In conclusion, the Out-of-Pocket Maximum is a vital aspect of health insurance plans, providing policyholders with a clear understanding of their financial responsibilities. By capping out-of-pocket expenses, it offers a sense of security and encourages proactive healthcare management. When choosing a health insurance plan, carefully consider the Out-of-Pocket Maximum, along with other factors like deductibles and coverage terms, to ensure you have the right level of protection for your needs.