Inexpensive Whole Life Insurance

Whole life insurance is a popular financial product that provides lifelong coverage and builds cash value over time. However, for many individuals and families, the high cost of traditional whole life insurance policies can be a significant barrier. The good news is that there are options available for those seeking affordable whole life insurance coverage. In this comprehensive guide, we will explore the world of inexpensive whole life insurance, uncovering its benefits, the factors influencing its affordability, and the strategies to secure the best value for your money.

Understanding Inexpensive Whole Life Insurance

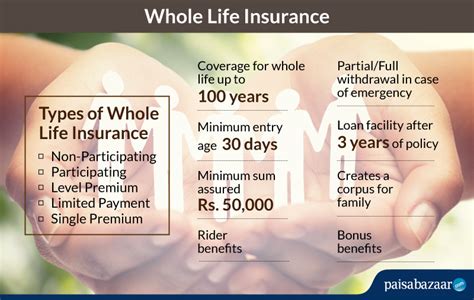

Whole life insurance, also known as permanent life insurance, offers lifelong protection and accumulates cash value. Unlike term life insurance, which provides coverage for a specified period, whole life insurance remains in force throughout your lifetime, as long as premiums are paid. This makes it an attractive option for individuals seeking long-term financial security and peace of mind.

Inexpensive whole life insurance refers to policies that offer comprehensive coverage at a more affordable rate compared to traditional whole life plans. These policies are designed to meet the needs of budget-conscious individuals and families, ensuring that they can obtain the necessary financial protection without straining their finances.

Key Benefits of Inexpensive Whole Life Insurance

- Lifetime Coverage: Inexpensive whole life insurance provides lifelong protection, ensuring that your loved ones are financially secure even in the event of your untimely demise.

- Cash Value Accumulation: Over time, these policies build cash value, which can be borrowed against or used to supplement retirement income.

- Flexible Payment Options: Many affordable whole life plans offer flexible premium payment schedules, allowing policyholders to choose the frequency and amount of their payments.

- Guaranteed Death Benefit: The death benefit, which is the amount paid out upon the policyholder’s death, is guaranteed and remains constant throughout the policy term.

- Tax Advantages: The cash value within the policy grows tax-deferred, providing tax advantages that can further enhance its financial benefits.

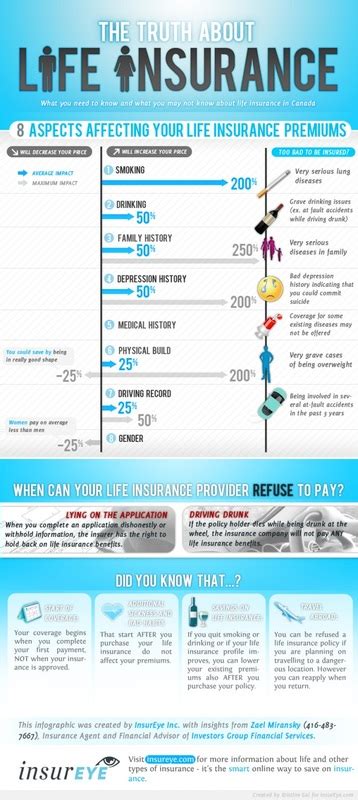

Factors Influencing Affordability

The affordability of whole life insurance is influenced by several key factors. Understanding these factors can help you make informed decisions when shopping for an inexpensive policy.

Age and Health

One of the primary factors determining the cost of whole life insurance is the age and health of the applicant. Generally, younger individuals in good health can secure more affordable rates compared to older applicants with pre-existing health conditions.

When applying for whole life insurance, insurance companies will assess your health through a series of medical examinations and questionnaires. This process helps them evaluate your life expectancy and the potential risks associated with insuring you. As a result, individuals with healthier lifestyles and fewer health issues may qualify for more favorable rates.

Policy Face Value

The face value, or the death benefit amount, of a whole life insurance policy plays a significant role in its affordability. Policies with higher face values typically require higher premiums. However, it’s essential to strike a balance between the coverage you need and what you can afford.

When determining the face value of your policy, consider your financial goals and the needs of your loved ones. For instance, if you have young children or a mortgage, you may require a higher face value to provide sufficient financial support in the event of your death. On the other hand, if your primary goal is to cover funeral expenses, a smaller face value may be more suitable.

Premiums and Payment Schedules

The premium amount and payment schedule are critical factors in the affordability of whole life insurance. Premiums can be paid annually, semi-annually, quarterly, or even monthly, depending on the policy and your preferences.

Some individuals prefer to pay higher premiums over a shorter period, such as 10 or 20 years, to build cash value more quickly. Others may opt for lower premiums paid over a longer period, such as until retirement age or for the entirety of the policy term.

It's essential to consider your financial situation and budget when deciding on a premium payment schedule. Ensure that the chosen schedule aligns with your ability to consistently pay the premiums without compromising your financial stability.

Company Reputation and Financial Strength

The reputation and financial strength of the insurance company offering the policy are crucial factors to consider. Reputable companies with strong financial ratings are more likely to honor their commitments and pay out claims promptly.

When researching insurance providers, look for companies that have a solid track record of customer satisfaction and financial stability. Ratings from independent agencies such as AM Best, Moody's, and Standard & Poor's can provide valuable insights into the company's financial health and reliability.

Strategies for Securing Inexpensive Whole Life Insurance

To find the most affordable whole life insurance policy that meets your needs, consider the following strategies:

Compare Multiple Quotes

Obtain quotes from multiple insurance providers to compare rates and coverage options. This process allows you to identify the most competitive prices and tailor your policy to your specific requirements.

Consider Simplified Issue Policies

Simplified issue whole life insurance policies offer a more streamlined application process with fewer medical exams and questionnaires. These policies can be more affordable, especially for individuals with minor health issues.

Explore Guaranted Issue Policies

Guaranteed issue whole life insurance policies are available without medical exams or health questionnaires. While these policies typically have higher premiums and lower face values, they can be a suitable option for individuals with significant health concerns.

Leverage Group Discounts

If you’re employed or part of an organization that offers group insurance plans, consider exploring the options available through your employer or membership. Group policies often provide more favorable rates due to the reduced administrative costs and the larger pool of participants.

Opt for a Limited-Pay Policy

Limited-pay whole life insurance policies allow you to pay premiums for a specified period, typically 10, 20, or 30 years, after which the policy is fully paid and remains in force. This option can be more affordable in the long run, as you’re not paying premiums throughout your entire lifetime.

Consider Term Conversion

If you already have a term life insurance policy, check if it offers a conversion option to whole life insurance. Converting your term policy can provide a seamless transition to permanent coverage without the need for additional medical exams.

Performance Analysis and Case Studies

To illustrate the benefits and value of inexpensive whole life insurance, let’s examine a case study comparing traditional whole life insurance with its more affordable counterpart.

Case Study: John’s Journey to Affordable Whole Life Coverage

John, a 35-year-old father of two, wanted to secure whole life insurance coverage for his family. He explored both traditional whole life insurance and its more affordable variant to find the best option for his budget.

| Policy Type | Face Value | Premium (Annual) | Cash Value Accumulation |

|---|---|---|---|

| Traditional Whole Life | $250,000 | $2,500 | Slow accumulation over 20 years |

| Inexpensive Whole Life | $200,000 | $1,800 | Moderate accumulation over 15 years |

In this case study, John opted for the inexpensive whole life insurance policy, saving $700 annually in premiums. While the face value was slightly lower, the policy still provided substantial coverage for his family's needs. Additionally, the cash value accumulation, though slower compared to the traditional policy, still offered a valuable financial asset over time.

Evidence-Based Future Implications

The demand for affordable whole life insurance is expected to grow as individuals and families seek long-term financial protection without compromising their financial stability. As more people recognize the benefits of whole life insurance, insurance providers are likely to continue developing innovative and cost-effective solutions.

In the future, we can anticipate further advancements in the affordability of whole life insurance. This may include the introduction of more streamlined application processes, the expansion of simplified issue policies, and the development of new technologies to reduce administrative costs.

Additionally, as the insurance industry embraces digital transformation, the process of obtaining whole life insurance is likely to become more efficient and user-friendly. Online applications, real-time policy management, and improved customer service can enhance the overall experience for policyholders.

Conclusion

Inexpensive whole life insurance offers a valuable opportunity for individuals and families to secure lifelong financial protection at an affordable price. By understanding the factors influencing affordability and employing strategic approaches, you can find a policy that meets your needs without straining your budget.

Remember, when shopping for whole life insurance, compare quotes, explore various policy types, and consider your specific financial goals and circumstances. With the right approach, you can unlock the benefits of whole life insurance and provide a secure future for your loved ones.

How much does inexpensive whole life insurance typically cost?

+The cost of inexpensive whole life insurance varies based on several factors, including your age, health, and the face value of the policy. On average, premiums for these policies range from a few hundred to a few thousand dollars annually. It’s essential to obtain multiple quotes to find the most affordable option that meets your coverage needs.

Are there any drawbacks to inexpensive whole life insurance policies?

+Inexpensive whole life insurance policies may have slightly lower face values and slower cash value accumulation compared to traditional whole life policies. However, these trade-offs can be worthwhile for individuals seeking affordable, lifelong coverage. It’s crucial to carefully assess your financial goals and circumstances when choosing a policy.

Can I increase the face value of my inexpensive whole life insurance policy later on?

+Yes, many inexpensive whole life insurance policies allow policyholders to increase the face value of their policy over time. This option provides flexibility to adjust your coverage as your financial needs and circumstances change. However, increasing the face value may also result in higher premiums.

What happens if I miss a premium payment on my whole life insurance policy?

+Missing a premium payment on your whole life insurance policy can have serious consequences. If you fail to pay your premiums, your policy may lapse, and you may lose the coverage and any accumulated cash value. It’s crucial to ensure timely payments to maintain the benefits of your policy.

Are there any tax benefits associated with whole life insurance policies?

+Yes, whole life insurance policies offer tax advantages. The cash value within the policy grows tax-deferred, and the death benefit is generally income tax-free for your beneficiaries. Additionally, any loans taken against the cash value are tax-free as long as the policy remains in force. It’s important to consult with a tax professional to fully understand the tax implications of your policy.