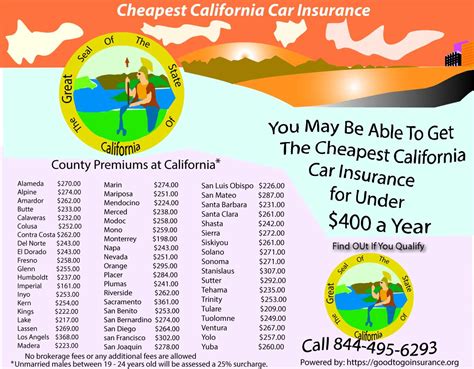

Insurance California Auto

In the bustling state of California, navigating the complex world of auto insurance is a necessary step for every driver. With a diverse range of options and regulations, understanding auto insurance in California is crucial for ensuring both legal compliance and personal protection. This comprehensive guide aims to demystify the process, providing an in-depth analysis of California's auto insurance landscape, including coverage types, policy costs, and key considerations for drivers.

Understanding California’s Auto Insurance Requirements

California is renowned for its strict regulations, and auto insurance is no exception. The state mandates that all drivers carry liability insurance as a minimum coverage. This liability insurance is designed to cover damages or injuries caused to others in an accident where the insured driver is at fault. Specifically, California requires the following minimum liability limits:

| Liability Coverage | Minimum Limits |

|---|---|

| Bodily Injury Per Person | $15,000 |

| Bodily Injury Per Accident | $30,000 |

| Property Damage | $5,000 |

While these are the legal minimums, it's important to note that many drivers opt for higher limits to provide more robust protection in the event of a serious accident. Additionally, California offers drivers the option to purchase additional coverage types to enhance their policies.

Additional Coverage Options in California

Beyond the mandatory liability insurance, California drivers can choose from a variety of optional coverage types to tailor their policies to their specific needs and financial situations. These additional coverages include:

- Collision Coverage: Pays for repairs or replacement of the insured vehicle after an accident, regardless of fault.

- Comprehensive Coverage: Covers damages to the insured vehicle due to non-collision events like theft, vandalism, fire, or natural disasters.

- Medical Payments (MedPay): Assists with medical expenses for the policyholder and passengers, regardless of who is at fault in an accident.

- Uninsured/Underinsured Motorist Coverage: Protects the policyholder in case of an accident with a driver who has no insurance or insufficient insurance.

- Rental Car Reimbursement: Provides coverage for rental car expenses if the insured vehicle is unusable due to an insured event.

Each of these coverages plays a unique role in enhancing the protection and peace of mind for California drivers. The decision to include them in a policy should be based on individual risk tolerance and financial considerations.

Factors Affecting Auto Insurance Costs in California

The cost of auto insurance in California can vary significantly based on a multitude of factors. Understanding these variables can help drivers make informed decisions when choosing a policy.

Vehicle Type and Usage

The type of vehicle being insured is a key factor in determining the cost of insurance. Sports cars and luxury vehicles, for instance, often come with higher insurance premiums due to their higher repair costs and potential for theft. Additionally, the frequency and purpose of vehicle usage can impact insurance rates. Those who drive frequently for work or pleasure may face higher premiums compared to occasional drivers.

Driver Profile and History

The profile and history of the driver are significant considerations for insurance providers. Younger drivers, particularly those under 25, often pay higher premiums due to their perceived higher risk on the road. Similarly, drivers with a history of accidents, traffic violations, or insurance claims may also face increased insurance costs. Maintaining a clean driving record and avoiding claims can help keep insurance premiums lower.

Location and Zip Code

The location where the vehicle is primarily garaged and driven can significantly influence insurance rates. Urban areas with higher population densities and traffic volumes often result in higher insurance costs due to increased accident risks. Additionally, certain zip codes may have higher rates of theft or vandalism, leading to higher insurance premiums.

Insurance Company and Policy Type

The choice of insurance company and the specific policy type can also affect the overall cost of insurance. Different insurers may offer varying levels of coverage and pricing based on their risk assessment models and target markets. It’s essential for drivers to shop around and compare policies to find the best fit for their needs and budget.

Shopping for Auto Insurance in California: A Step-by-Step Guide

Navigating the process of selecting an auto insurance policy in California can be daunting, but with a structured approach, drivers can make informed decisions. Here’s a comprehensive guide to help you through the process:

Step 1: Understand Your Coverage Needs

Start by assessing your specific needs and circumstances. Consider factors like the value of your vehicle, your daily commute, and any personal assets you wish to protect. This initial assessment will help guide your choice of coverage types and limits.

Step 2: Research Insurance Providers

California is home to numerous insurance providers, each with its own unique offerings and pricing structures. Research and compare multiple providers to find those that align with your coverage needs and budget. Online comparison tools and consumer reviews can be valuable resources during this stage.

Step 3: Obtain Quotes

Once you’ve identified potential insurance providers, request quotes from each. Be sure to provide accurate and detailed information about your vehicle, driving history, and desired coverage limits to ensure the quotes are as precise as possible. Multiple quotes will allow you to compare prices and coverage options side by side.

Step 4: Evaluate the Policies

With quotes in hand, carefully evaluate each policy’s coverage and cost. Look beyond just the premium price; consider the deductibles, coverage limits, and any additional perks or discounts offered. Assess how well each policy aligns with your specific needs and budget.

Step 5: Choose and Purchase Your Policy

After thorough evaluation, select the policy that best meets your needs and offers the most value. Ensure you understand the terms and conditions of the policy, including any exclusions or limitations. Once you’re satisfied, complete the purchase process and secure your new auto insurance coverage.

Conclusion: Empowering California Drivers

Understanding the intricacies of auto insurance in California is a powerful tool for drivers. By familiarizing themselves with the state’s requirements, coverage options, and cost factors, drivers can make informed decisions when selecting an auto insurance policy. This guide aims to provide a comprehensive resource, empowering California drivers to navigate the insurance landscape with confidence and ensure they have the coverage they need at a price they can afford.

What is the average cost of auto insurance in California?

+The average cost of auto insurance in California varies based on numerous factors, including the driver’s age, driving record, vehicle type, and location. According to recent data, the average annual premium in California is approximately 1,300, although it can range from 700 to $2,000 or more.

Are there any discounts available for auto insurance in California?

+Yes, several insurance companies in California offer discounts to help lower the cost of auto insurance. Common discounts include safe driver discounts, multi-policy discounts (for bundling auto insurance with other types of insurance), good student discounts, and discounts for vehicles equipped with safety features.

What happens if I’m involved in an accident without insurance in California?

+Driving without insurance in California is illegal and can result in serious consequences. If you’re involved in an accident without insurance, you’ll be personally responsible for all damages and injuries, which can lead to significant financial liabilities. Additionally, you may face penalties, including fines, license suspension, or even jail time.