Insurance License Lookup Fl

Welcome to the comprehensive guide on conducting an insurance license lookup in the Sunshine State! This article will provide you with a detailed step-by-step process, along with valuable insights and real-world examples to help you navigate the world of insurance regulation in Florida. Whether you're an insurance professional, a consumer, or simply curious about the process, this guide will offer an in-depth understanding of how to verify insurance licenses in Florida.

Understanding the Importance of Insurance License Verification

In the realm of insurance, trust and transparency are paramount. Verifying the legitimacy of an insurance agent’s license is a crucial step in ensuring that you, as a consumer, are dealing with a qualified and licensed professional. This process not only protects your interests but also upholds the integrity of the insurance industry in Florida.

Florida, with its diverse population and vibrant economy, is home to a multitude of insurance providers and agents. With such a competitive market, it's essential to have a robust system in place to maintain trust and ensure compliance with state regulations. This is where the insurance license lookup process comes into play.

The Step-by-Step Guide to Insurance License Lookup in Florida

Conducting an insurance license lookup in Florida is a straightforward process, thanks to the efficient online systems and tools provided by the state’s regulatory bodies. Here’s a detailed breakdown of the steps you need to follow:

Step 1: Access the Official Florida Insurance Portal

Begin your journey by visiting the official website of the Florida Office of Insurance Regulation. This portal serves as the primary gateway for all insurance-related inquiries and services in the state. You can find it at https://www.floir.com. Once on the website, navigate to the “Consumer Resources” section, where you’ll find a dedicated page for license lookup.

Step 2: Choose Your License Lookup Option

The Florida Office of Insurance Regulation offers multiple ways to conduct a license lookup. You can choose to search by individual name, business name, or license number. Each option has its advantages, depending on the information you have at hand. For instance, if you’ve been provided with a license number by an insurance agent, you can directly input it to verify their credentials.

Step 3: Enter the Required Details

Depending on your chosen lookup method, you’ll need to provide specific details. For a name search, you’ll need to enter the agent’s first and last name, along with their Social Security Number (SSN) or date of birth. This helps ensure that you’re getting accurate results for the right individual. For a business name search, simply enter the name of the insurance agency or company.

Step 4: Submit Your Request

After entering the necessary details, click on the “Submit” or “Search” button to initiate your license lookup. The system will then process your request and display the results, typically within a few seconds.

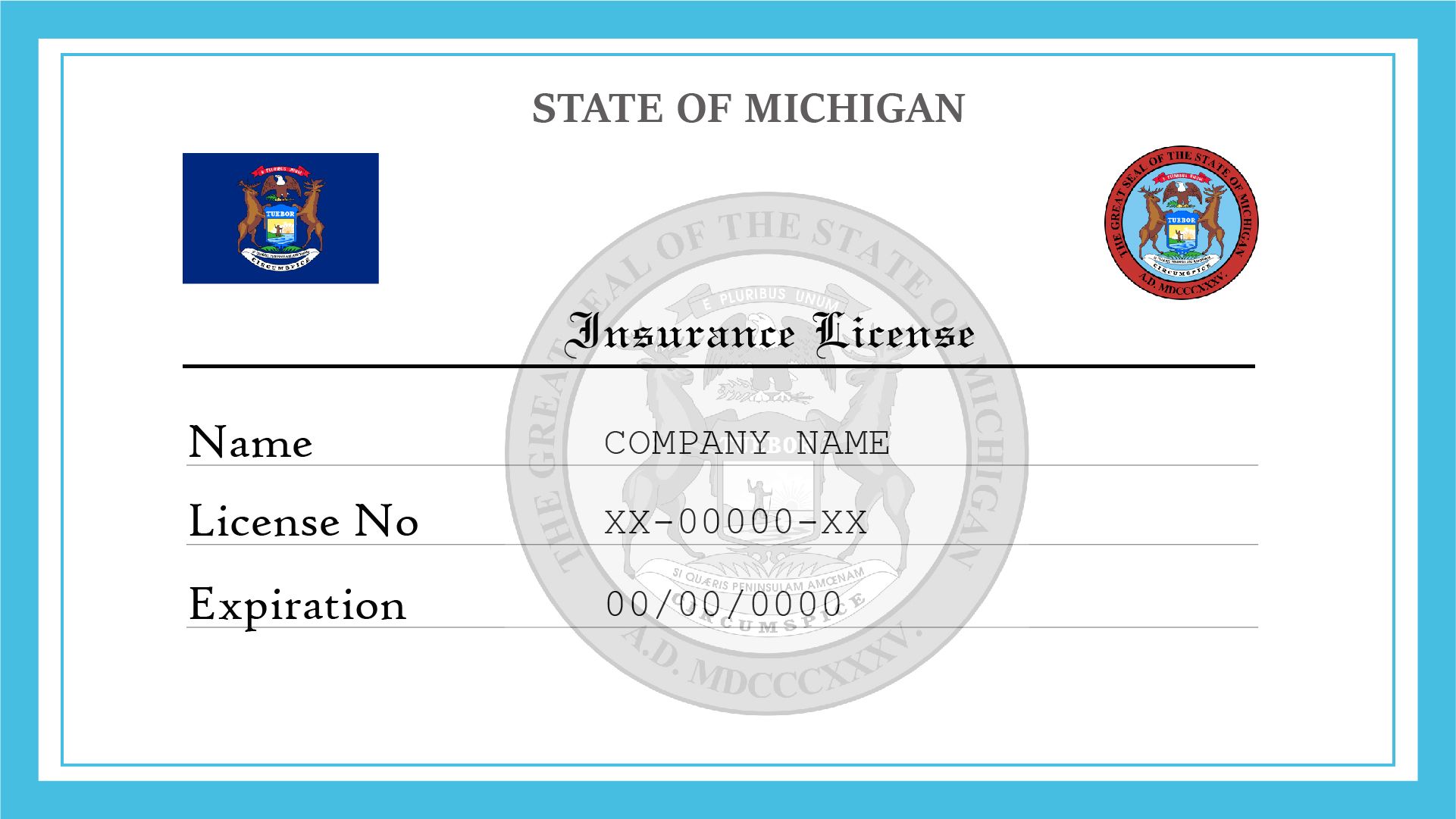

Step 5: Review the License Information

Once your request is processed, you’ll be presented with a detailed report on the insurance license. This report will include crucial information such as the agent’s full name, license number, license type (e.g., Life, Health, Property, and Casualty), and the issuing state. Additionally, you’ll find details about the license status, including whether it’s active, expired, or under suspension.

Step 6: Verify Additional Details (Optional)

If you wish to delve deeper into the agent’s credentials, you can explore additional resources provided by the Florida Office of Insurance Regulation. These resources may include information on the agent’s educational background, any disciplinary actions taken against them, and their professional affiliations.

Real-World Example: Verifying an Insurance Agent’s License

Let’s walk through a hypothetical scenario to illustrate the insurance license lookup process in Florida. Imagine you’ve recently received an insurance quote from an agent named John Smith. You want to ensure that he’s a licensed professional before proceeding with the policy.

Step 1: You visit the Florida Office of Insurance Regulation's website at https://www.floir.com and navigate to the "License Lookup" page.

Step 2: Since you have John Smith's full name, you choose the "Name Search" option.

Step 3: You enter his name, "John Smith," along with his date of birth (e.g., 01/01/1980) in the provided fields.

Step 4: After submitting your request, the system processes your query and displays the results.

Step 5: The license lookup report reveals that John Smith holds an active license for Life, Health, and Annuities in Florida. The report also includes his license number (e.g., 2345678) and the date of issuance.

Step 6: Satisfied with the results, you can proceed with confidence, knowing that John Smith is a licensed insurance agent in Florida.

The Benefits of Conducting an Insurance License Lookup

Conducting an insurance license lookup offers several advantages, both for consumers and the insurance industry itself. Here are some key benefits:

- Consumer Protection: By verifying an agent's license, consumers can ensure they're dealing with a legitimate professional, reducing the risk of fraud or unauthorized practices.

- Transparency: License lookup promotes transparency in the insurance industry, allowing consumers to make informed decisions about their insurance providers.

- Compliance: Insurance agents and companies are held accountable, as their licenses can be easily verified, ensuring they adhere to state regulations.

- Peace of Mind: Knowing that your insurance agent is licensed and regulated provides peace of mind, especially when making significant financial decisions.

The Future of Insurance License Verification

As technology continues to advance, the process of insurance license verification is likely to become even more streamlined and efficient. With the increasing adoption of digital platforms and online services, we can expect the following trends and developments:

- Real-Time Verification: License lookup systems may integrate with real-time data, providing instant verification results, similar to credit card transactions.

- Blockchain Technology: The use of blockchain could enhance security and transparency, ensuring the integrity of license data across multiple systems.

- AI-Assisted Search: Artificial Intelligence could be employed to analyze and match license information, improving accuracy and reducing human error.

- Mobile Apps: The development of dedicated mobile apps could make license verification more accessible and convenient for consumers on the go.

Conclusion

In the dynamic world of insurance, staying informed and vigilant is essential. The insurance license lookup process in Florida empowers consumers to make educated choices and ensures a fair and regulated insurance landscape. By following the step-by-step guide outlined above, you can confidently verify the licenses of insurance agents and companies, contributing to a robust and trustworthy insurance ecosystem in the Sunshine State.

Frequently Asked Questions

What happens if an insurance agent’s license is expired or suspended during the lookup process?

+If an insurance agent’s license is found to be expired or under suspension during the lookup process, it indicates that they may no longer be authorized to conduct insurance business in Florida. It is crucial to avoid doing business with such agents and instead seek licensed professionals with active and valid licenses.

Can I verify the licenses of multiple agents at once using the online system?

+The Florida Office of Insurance Regulation’s online system is designed for individual license lookups. However, you can conduct multiple searches by repeating the process for each agent’s name or license number. This ensures accurate and up-to-date information for each professional you wish to verify.

Are there any fees associated with conducting an insurance license lookup in Florida?

+The good news is that conducting an insurance license lookup in Florida is a free service provided by the state. You won’t incur any fees or charges when using the official website to verify an agent’s license. This accessibility ensures that consumers can easily protect their interests without any financial barriers.