Insurance Car Nj

In the bustling state of New Jersey, where roads buzz with activity and the iconic Jersey Shore sees its fair share of vacationers, understanding the intricacies of car insurance is paramount. With a diverse range of drivers, from daily commuters navigating the busy turnpikes to those seeking peaceful drives along the scenic Garden State Parkway, the Garden State presents a unique landscape for automotive coverage. This comprehensive guide delves into the specifics of car insurance in New Jersey, offering an in-depth analysis to help residents and visitors alike navigate the complex world of automotive protection.

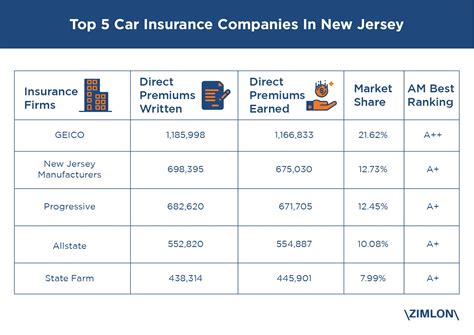

Unraveling the Complexities of New Jersey’s Car Insurance Scene

New Jersey, often referred to as the “Crossroads of the East Coast,” presents a dynamic environment for drivers and their insurance needs. With a population that values both urban convenience and suburban tranquility, the state’s car insurance requirements and options reflect this diversity. As we delve into the specifics, we’ll explore how New Jersey’s unique characteristics influence the automotive insurance landscape.

Understanding New Jersey’s Mandatory Coverage

In New Jersey, the state mandates that all drivers carry a minimum amount of liability insurance. This includes bodily injury liability coverage with a limit of 15,000 per person and 30,000 per accident, as well as property damage liability coverage with a limit of $5,000. These requirements are in place to ensure that drivers can provide compensation for injuries and damages caused in accidents.

| Mandatory Coverage | Limits |

|---|---|

| Bodily Injury Liability (per person) | $15,000 |

| Bodily Injury Liability (per accident) | $30,000 |

| Property Damage Liability | $5,000 |

However, many drivers opt for higher limits to provide more comprehensive protection. The state also requires uninsured and underinsured motorist coverage, which protects drivers in case of accidents with individuals who lack sufficient insurance coverage. This is a crucial aspect, given the state's diverse driving population.

Navigating the Unique Challenges of New Jersey’s Driving Environment

New Jersey’s roads present a unique set of challenges. From the densely populated cities like Newark and Jersey City to the more rural areas, drivers face a variety of traffic conditions. The state’s notorious rush-hour traffic and the presence of multiple major highways can lead to an increased risk of accidents. Additionally, the varying weather conditions, from heavy snow in the north to coastal storms in the south, further complicate driving scenarios.

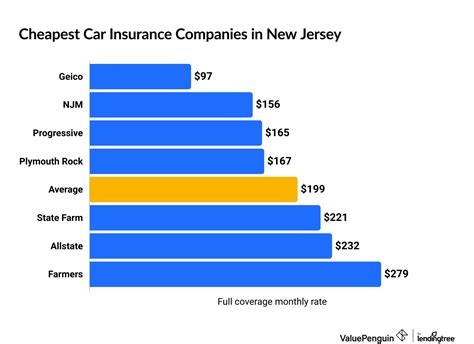

These factors often influence the cost and availability of car insurance. Insurance companies carefully assess these risks when determining premiums, which can vary significantly across the state.

Tailoring Insurance Policies to Individual Needs

Given the diverse nature of New Jersey’s driving environment, it’s essential for drivers to carefully consider their insurance needs. Factors such as the type of vehicle, the driver’s age and experience, and the intended use of the vehicle all play a role in determining the best insurance coverage.

For instance, a young driver in a highly populated city may benefit from comprehensive coverage that includes collision and comprehensive protection, as well as additional liability coverage. On the other hand, a mature driver with a clean record in a suburban area might prioritize cost-effectiveness and opt for state-mandated coverage with higher deductibles.

The availability of various discounts can also significantly impact the overall cost of insurance. Many insurers offer discounts for safe driving records, vehicle safety features, and even educational achievements. These discounts can make insurance more affordable and accessible for a wide range of drivers.

Exploring the Future of Car Insurance in New Jersey

As technology advances and driving habits evolve, the landscape of car insurance is also changing. In New Jersey, the adoption of telematics and usage-based insurance is gaining traction. This innovative approach to insurance pricing allows drivers to link their driving behavior directly to their insurance rates, potentially leading to significant savings for safe drivers.

Additionally, with the rise of electric vehicles and autonomous driving technologies, the insurance industry is adapting to cover these new risks. As these technologies become more prevalent, insurance policies will need to keep pace to provide adequate protection.

The Role of Technology in Enhancing Safety and Insurance

Technology is not only shaping the future of driving but also influencing the insurance industry. Advanced driver-assistance systems (ADAS), for instance, are becoming more common in vehicles, offering features like automatic emergency braking and lane-keeping assist. These technologies not only enhance safety but also have the potential to reduce the frequency and severity of accidents.

| Advanced Driver-Assistance Systems (ADAS) | Benefits |

|---|---|

| Automatic Emergency Braking | Reduces collision risk |

| Lane Departure Warning | Prevents accidental lane departures |

| Adaptive Cruise Control | Maintains safe following distances |

Insurance companies are recognizing the impact of these technologies and offering discounts or incentives for vehicles equipped with ADAS. This trend is expected to continue, further encouraging the adoption of safety features and potentially leading to a safer driving environment.

Conclusion: Navigating the Road Ahead

The world of car insurance in New Jersey is dynamic and ever-evolving. From understanding the state’s mandatory coverage to exploring the latest technological advancements, drivers have a wealth of options to consider. By staying informed and tailoring insurance policies to individual needs, New Jersey residents can ensure they are adequately protected on the state’s diverse roads.

FAQs

What are the penalties for driving without insurance in New Jersey?

+Driving without insurance in New Jersey can result in severe penalties. This includes a fine of up to $500 for the first offense, potential suspension of your driver’s license and registration, and even imprisonment for repeat offenses. It’s crucial to maintain adequate insurance coverage to avoid these consequences.

Are there any discounts available for car insurance in New Jersey?

+Yes, there are several discounts available that can significantly reduce the cost of car insurance in New Jersey. These include safe driver discounts, multi-policy discounts, and even discounts for vehicle safety features. It’s worth exploring these options with your insurance provider to potentially save on your premiums.

How does my driving record impact my car insurance rates in New Jersey?

+Your driving record plays a significant role in determining your car insurance rates in New Jersey. A clean driving record with no accidents or traffic violations can lead to lower premiums. On the other hand, a history of accidents or moving violations can increase your rates. It’s important to maintain a safe driving record to keep your insurance costs down.