Insurance Cheapest

The concept of finding the cheapest insurance is an intriguing one, as it involves a delicate balance between affordability and coverage. In today's fast-paced world, individuals and businesses alike seek the most cost-effective insurance solutions without compromising on essential protection. This comprehensive guide aims to delve into the intricacies of achieving this delicate equilibrium, providing an in-depth analysis of the cheapest insurance options available and the factors that influence their cost.

Unraveling the Complexity of Insurance Costs

Understanding the cheapest insurance options requires an exploration of the underlying factors that influence insurance premiums. These factors can vary significantly depending on the type of insurance, with each category presenting unique considerations.

Life Insurance: A Balancing Act

Life insurance is a critical financial tool, offering peace of mind to policyholders and their loved ones. The cost of life insurance is primarily influenced by the age and health of the insured. Younger individuals generally pay lower premiums, as they are statistically less likely to require a payout. Health conditions, on the other hand, can significantly impact the cost, with pre-existing conditions often leading to higher premiums or even policy denials.

Moreover, the type of life insurance policy chosen plays a pivotal role. Term life insurance, which provides coverage for a specific period, is often more affordable than permanent life insurance, which offers lifetime coverage. The duration of the term, the face value of the policy, and any additional riders can all affect the premium.

For instance, a 30-year-old healthy individual might pay an average of $200 annually for a $500,000 term life insurance policy with a 20-year term. In contrast, a similar policy with a 30-year term could cost around $250 annually. The key here is to strike a balance between coverage duration and cost, ensuring adequate protection without straining the budget.

| Age | Health Status | Policy Type | Average Annual Premium |

|---|---|---|---|

| 30 | Healthy | 20-year Term | $200 |

| 30 | Healthy | 30-year Term | $250 |

| 45 | Average Health | 20-year Term | $350 |

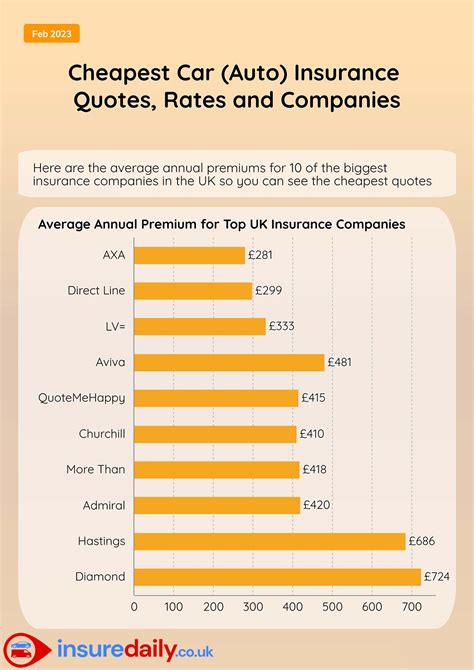

Auto Insurance: Navigating the Cost Landscape

Auto insurance is a legal requirement in most countries, making it a necessary expense for vehicle owners. The cost of auto insurance is influenced by a myriad of factors, including the make and model of the vehicle, the driver’s age and driving record, the coverage level chosen, and the geographic location.

For instance, a young driver with a clean record might pay an average of $1,200 annually for liability coverage on a mid-range sedan. In contrast, a mature driver with a history of accidents could face premiums upwards of $2,000 for the same coverage and vehicle type. Additionally, living in an area with a high rate of car theft or accidents can increase insurance costs significantly.

Understanding these factors is crucial for negotiating the best rates. Some insurance companies offer discounts for safe driving, multiple vehicles insured, or even educational qualifications. Being aware of these opportunities can help reduce the overall cost of auto insurance.

| Driver Profile | Vehicle Type | Average Annual Premium |

|---|---|---|

| Young Driver (Clean Record) | Mid-range Sedan | $1,200 |

| Mature Driver (History of Accidents) | Mid-range Sedan | $2,000 |

| High-Risk Area | Luxury SUV | $3,500 |

Health Insurance: Affordable Wellness

Health insurance is a vital component of financial planning, offering protection against the potentially devastating costs of medical care. The cost of health insurance is influenced by several factors, including age, health status, the type of plan (HMO, PPO, EPO), the coverage level (deductibles, co-pays, and out-of-pocket maximums), and the inclusion of family members.

For instance, a young, healthy individual might pay an average of $300 monthly for a PPO plan with a $2,000 deductible and a $5,000 out-of-pocket maximum. In contrast, a family plan for a similar coverage level could cost upwards of $1,000 per month. The inclusion of children, spouses, and elderly family members can significantly impact the premium, as these individuals often require more medical care.

Additionally, health insurance costs can be influenced by the state or country's healthcare system and the specific insurance provider's policies. Some states offer government-subsidized health insurance plans, which can significantly reduce the cost for low-income individuals and families.

| Profile | Plan Type | Average Monthly Premium |

|---|---|---|

| Young Individual (Healthy) | PPO | $300 |

| Family | PPO | $1,000 |

| Senior Citizen | HMO | $550 |

Home Insurance: Protecting Your Assets

Home insurance is a critical safeguard for homeowners, protecting against a range of potential risks. The cost of home insurance is influenced by factors such as the location of the property, the value of the home and its contents, the coverage level chosen, and any additional features or endorsements added to the policy.

For instance, a homeowner in a low-risk area might pay an average of $1,000 annually for a policy that covers the structure and its contents, with a $1,000 deductible. In contrast, a homeowner in a high-risk area, such as a flood zone, might pay significantly more, upwards of $2,500 annually, for similar coverage. The inclusion of additional features, such as earthquake or flood insurance, can also increase the premium.

Understanding the risks specific to your area and the value of your home and possessions is crucial in determining the right level of coverage and keeping costs manageable.

| Location | Coverage Level | Average Annual Premium |

|---|---|---|

| Low-Risk Area | Standard Coverage | $1,000 |

| High-Risk Area (Flood Zone) | Standard Coverage | $2,500 |

| High-Value Property | Enhanced Coverage | $3,000 |

The Future of Affordable Insurance

As the insurance industry evolves, new technologies and approaches are emerging to make insurance more accessible and affordable. Telemedicine, for instance, is transforming the way healthcare is delivered, often reducing the need for in-person visits and thus lowering healthcare costs, which can have a positive impact on health insurance premiums.

Furthermore, the rise of InsurTech startups is introducing innovative solutions, such as usage-based insurance models for auto insurance. These models, often powered by telematics, offer personalized premiums based on actual driving behavior, rewarding safe drivers with lower rates.

In the realm of life insurance, the integration of health and wellness tracking devices is gaining traction. Some insurers are offering discounted premiums or additional benefits to policyholders who actively monitor and improve their health, fostering a culture of prevention and cost-effectiveness.

The future of insurance is bright, with a focus on customization and affordability. As consumers, staying informed about these advancements can empower us to make smarter choices, ensuring we get the best value for our insurance needs.

Key Takeaways

- Understanding the factors influencing insurance costs is crucial for finding the cheapest options.

- Life, auto, health, and home insurance each have unique considerations that impact their premiums.

- Balancing coverage with affordability is key to ensuring you’re adequately protected without overspending.

- The insurance industry is evolving, offering new technologies and approaches to make insurance more accessible and affordable.

- Staying informed about these advancements can help consumers make smarter insurance choices.

Conclusion: Empowering Affordable Protection

The quest for the cheapest insurance is not just about saving money; it’s about understanding the intricate dance between coverage and cost. By delving into the factors that influence insurance premiums and staying abreast of industry innovations, we can make informed decisions that protect our assets and loved ones without breaking the bank. It’s a delicate balance, but with knowledge and vigilance, it’s a balance we can achieve.

How can I find the cheapest insurance rates for my needs?

+Finding the cheapest insurance rates involves a careful evaluation of your specific needs and circumstances. Consider the factors that influence insurance costs, such as age, health status, driving record, property location, and coverage level. Shop around and compare quotes from multiple providers to ensure you’re getting the best value for your money. Additionally, keep an eye out for discounts and special offers that can further reduce your premiums.

Are there any government programs that offer affordable insurance options?

+Yes, many governments offer programs to make insurance more affordable, particularly for low-income individuals and families. For example, the United States has the Affordable Care Act, which provides subsidies for health insurance premiums based on income. Similarly, some countries offer government-subsidized home insurance or auto insurance programs for specific groups, such as senior citizens or low-income homeowners.

How can I reduce my auto insurance costs as a young driver?

+As a young driver, auto insurance can be particularly expensive due to the higher risk associated with younger age groups. However, there are strategies to reduce these costs. Maintain a clean driving record by avoiding accidents and traffic violations. Consider enrolling in a defensive driving course, as some insurers offer discounts for completing such courses. Additionally, compare quotes from multiple insurers, as rates can vary significantly.