Insurance Claim On Iphone

Smartphones have become an integral part of our lives, and for many, the iPhone stands out as a preferred choice. With its sleek design, user-friendly interface, and innovative features, it has gained a dedicated following worldwide. However, accidents happen, and when they involve our beloved iPhones, it can be a stressful and costly affair. That's where insurance comes into play, offering a safety net to protect your investment. In this comprehensive guide, we will delve into the process of making an insurance claim for your iPhone, exploring the steps, requirements, and considerations to ensure a smooth and successful claim process.

Understanding iPhone Insurance

iPhone insurance is a type of protection plan that safeguards your device against unexpected damage or theft. It provides peace of mind, knowing that you are financially covered in case of unfortunate events. While iPhones are built with durability in mind, accidents like screen cracks, water damage, or even loss due to theft can occur, and insurance steps in to mitigate the financial impact.

The Benefits of iPhone Insurance

Having iPhone insurance offers several advantages:

- Financial Protection: Insurance covers the cost of repairs or replacement, saving you from unexpected expenses.

- Peace of Mind: Knowing your iPhone is insured gives you the freedom to enjoy your device without constant worry.

- Comprehensive Coverage: Most insurance plans cover a wide range of incidents, including accidental damage, liquid damage, and theft.

- Quick Turnaround: With insurance, you can often receive swift repairs or replacements, minimizing downtime.

Assessing Your Insurance Options

Before making a claim, it’s crucial to understand the different insurance options available and the specific coverage they provide. iPhone insurance can be obtained through various channels, each with its own set of terms and conditions.

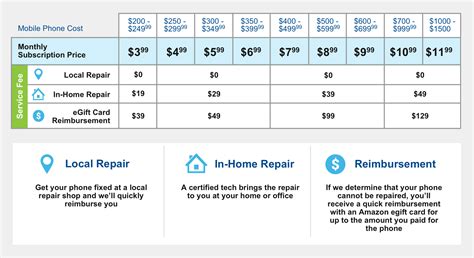

Carrier-Provided Insurance

Many cellular carriers offer insurance plans for iPhones. These plans typically cover accidental damage, theft, and sometimes even loss. The coverage and cost can vary depending on the carrier and the specific plan you choose. It’s essential to review the fine print to understand the exclusions and limitations.

Manufacturer’s Warranty

Apple, the manufacturer of iPhones, provides a limited warranty for its devices. This warranty covers manufacturing defects and certain hardware issues. While it doesn’t offer protection against accidental damage, it can be a starting point for repairs or replacements in specific cases. However, it’s important to note that the warranty period is limited, usually lasting a year from the purchase date.

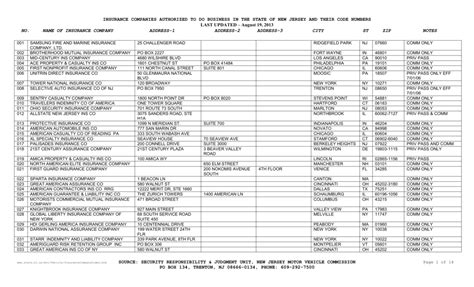

Third-Party Insurance Providers

Apart from carrier-provided insurance, there are numerous third-party insurance companies that specialize in device protection. These providers often offer flexible plans with customizable coverage options. Some even provide additional benefits like accidental damage coverage for other devices or discounted rates for multiple device plans. Researching and comparing these options can help you find the best fit for your needs.

| Insurance Type | Pros | Cons |

|---|---|---|

| Carrier Insurance | Convenient, often includes device protection plans | Limited coverage, may be more expensive |

| Manufacturer's Warranty | Covers manufacturing defects, cost-effective | Short duration, no accidental damage coverage |

| Third-Party Insurance | Customizable plans, competitive pricing | Research required to find the right provider |

Making an Insurance Claim

Now that you’ve assessed your insurance options and chosen a suitable plan, it’s time to navigate the claim process. Here’s a step-by-step guide to ensure a smooth and successful claim.

Step 1: Assess the Damage

Before initiating a claim, carefully examine your iPhone for any signs of damage. Take clear and detailed photos of the affected areas. This documentation will be crucial when submitting your claim.

Step 2: Contact Your Insurance Provider

Reach out to your insurance provider and inform them about the incident. Provide them with the necessary details, including the nature of the damage, the date and time of the occurrence, and any relevant documentation. Be prepared to answer questions about the circumstances surrounding the damage.

Step 3: Gather Supporting Documents

Insurance claims often require supporting documentation to validate your case. Gather the following documents:

- Proof of purchase: This could be your original receipt, invoice, or a copy of the purchase confirmation email.

- Insurance policy details: Have your insurance policy number and any other relevant information readily available.

- Photos of the damage: The photos you took during the assessment step will be essential in supporting your claim.

Step 4: Submit Your Claim

Once you have all the necessary information and documentation, it’s time to submit your claim. Most insurance providers offer online claim submission, making the process convenient and efficient. Follow the instructions provided by your insurer and ensure that all required fields are completed accurately.

Step 5: Wait for Approval

After submitting your claim, your insurance provider will review the details and assess the validity of your request. This process can take a few days to a week, depending on the provider and the complexity of your claim. During this time, it’s essential to remain patient and avoid rushing the insurer.

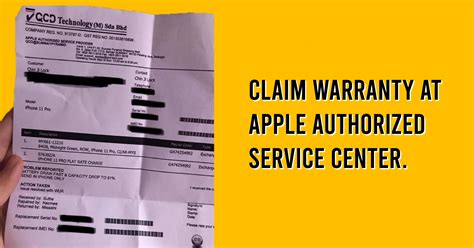

Step 6: Repair or Replacement

If your claim is approved, your insurance provider will guide you through the next steps. Depending on the nature of the damage and the terms of your policy, you may have the option to repair or replace your iPhone. Repair options often involve sending your device to an authorized service center or utilizing mail-in repair services.

Step 7: Post-Claim Considerations

After your iPhone is repaired or replaced, it’s crucial to take steps to prevent future incidents. Consider investing in a sturdy case and screen protector to enhance your iPhone’s protection. Additionally, regularly back up your data to ensure you don’t lose valuable information in case of future accidents.

Common Insurance Claim Scenarios

iPhone insurance claims can arise from various situations. Understanding these common scenarios can help you prepare and navigate the claim process more effectively.

Accidental Damage

Accidents happen, and your iPhone might suffer from cracked screens, liquid damage, or internal malfunctions due to accidental drops or spills. In such cases, insurance can provide coverage, ensuring your device is repaired or replaced without significant financial burden.

Theft or Loss

Unfortunately, theft and loss are common occurrences, and iPhones are often targeted. If your iPhone is stolen or lost, insurance can offer a replacement, allowing you to stay connected without incurring the full cost of a new device.

Manufacturer’s Defects

In rare cases, iPhones might have manufacturing defects that manifest over time. These defects can range from hardware issues to software glitches. If your iPhone experiences such problems within the warranty period, you can leverage the manufacturer’s warranty for repairs or replacements.

Tips for a Successful Insurance Claim

To maximize your chances of a successful insurance claim, keep the following tips in mind:

- Read Your Policy: Familiarize yourself with the terms and conditions of your insurance policy. Understand the coverage, exclusions, and any specific requirements for claims.

- Document Everything: Take detailed notes and photos of the damage. This documentation will be invaluable when submitting your claim.

- Be Honest: Provide accurate and truthful information to your insurance provider. Misrepresenting facts can lead to claim denials or legal consequences.

- Act Promptly: Report the incident and initiate your claim as soon as possible. Delays can impact the success of your claim.

- Stay Organized: Keep all relevant documents, receipts, and correspondence related to your claim in one place for easy reference.

The Future of iPhone Insurance

As technology advances and smartphones become increasingly integral to our lives, the demand for reliable insurance coverage will continue to grow. Insurance providers are expected to enhance their offerings, providing more comprehensive and flexible plans to meet the evolving needs of iPhone users.

Emerging Trends

- Extended Warranty Options: Manufacturers and insurers may introduce extended warranty plans, offering longer coverage periods beyond the standard one-year warranty.

- Enhanced Coverage: Insurance providers may expand their coverage to include more incidents, such as coverage for cosmetic damage or accidental loss.

- Digital Claim Processes: The claim process is likely to become even more streamlined and efficient, with the use of digital tools and artificial intelligence for faster assessment and approval.

Frequently Asked Questions

What should I do if my iPhone is stolen or lost while traveling internationally?

+If your iPhone is stolen or lost while traveling internationally, it’s crucial to report the incident to the local authorities and obtain a police report. Contact your insurance provider and provide them with the necessary details, including the police report and any other relevant documentation. Some insurance policies may have specific requirements for international claims, so be sure to review your policy and follow the instructions provided.

Can I claim for multiple incidents within the same insurance policy period?

+The ability to claim for multiple incidents within the same policy period depends on your specific insurance policy. Some providers offer policies with multiple claims allowance, while others may have limitations or deductibles. It’s essential to review your policy terms and conditions to understand the claim limits and any potential additional charges.

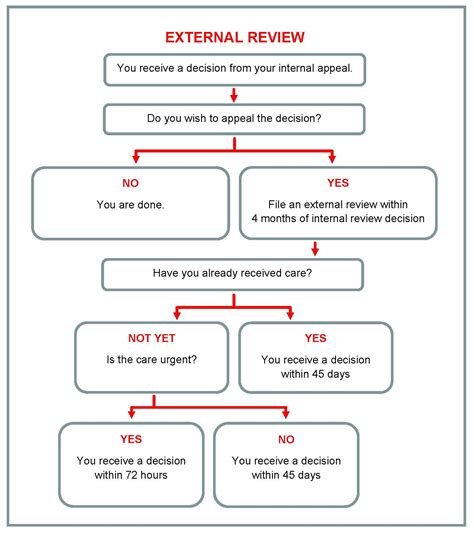

What happens if my claim is denied by the insurance provider?

+If your insurance claim is denied, your provider will typically provide a reason for the denial. Common reasons for claim denials include policy exclusions, lack of proper documentation, or misrepresented information. In such cases, carefully review the denial letter and assess if there are any valid grounds for appeal. If you believe the denial was unjustified, you can contact your insurance provider to discuss your options and provide additional information if necessary.

Can I cancel my iPhone insurance policy before the term ends?

+Canceling an iPhone insurance policy before the term ends is generally possible, but it may incur cancellation fees or penalties. Review your policy terms and conditions to understand the cancellation process and any associated charges. It’s important to carefully consider your options and potential financial implications before canceling your insurance.