Monthly Auto Insurance Quotes

Welcome to an in-depth exploration of the fascinating world of monthly auto insurance quotes. This article will delve into the intricacies of this essential aspect of vehicle ownership, providing a comprehensive guide for anyone seeking to understand the factors influencing these quotes and make informed decisions when choosing auto insurance.

Understanding Monthly Auto Insurance Quotes

Monthly auto insurance quotes are an essential part of the car ownership journey. These quotes serve as a window into the potential costs associated with insuring your vehicle, offering a glimpse into the financial commitment you’ll make to keep your car on the road. In this section, we’ll unravel the complexities of these quotes, shedding light on the various elements that influence their calculation.

Factors Affecting Monthly Auto Insurance Quotes

Several key factors come into play when determining monthly auto insurance quotes. These factors can vary based on individual circumstances and the specific insurance provider. Here’s a breakdown of some of the most significant influences:

- Vehicle Type and Usage: The type of vehicle you own and how you use it can significantly impact your insurance quote. Factors such as the make, model, and age of your vehicle, as well as your annual mileage, play a crucial role. For instance, sports cars or luxury vehicles often attract higher insurance premiums due to their performance capabilities and potential repair costs.

- Driver Profile: Your personal driving history and demographics are closely scrutinized by insurance providers. This includes your age, gender, and driving record. Younger drivers, for example, are often considered higher risk due to their lack of experience, leading to potentially higher insurance quotes.

- Coverage Preferences: The level of coverage you choose for your vehicle is a key determinant of your insurance quote. Comprehensive coverage, which includes protection against a wide range of incidents, will typically result in higher premiums compared to basic liability coverage.

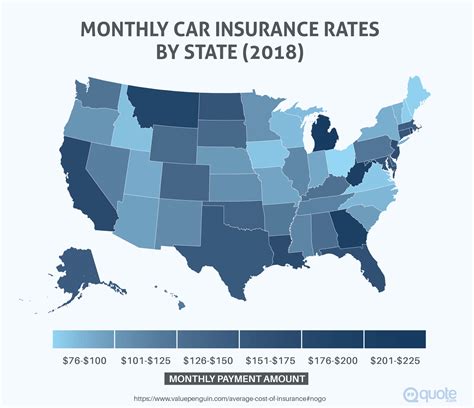

- Location and Usage: Where you live and how you use your vehicle can also affect your insurance quote. Urban areas often have higher insurance rates due to increased traffic congestion and the potential for accidents. Similarly, if you frequently drive long distances or use your vehicle for business purposes, your insurance quote may be higher.

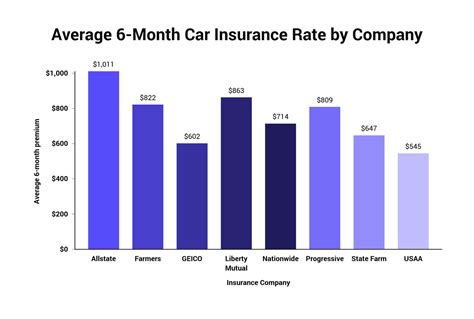

- Insurance Provider and Discounts: Different insurance providers offer varying rates and discounts. Shopping around and comparing quotes from multiple providers can help you find the best deal. Additionally, many providers offer discounts for safe driving records, multiple policy bundles, or other factors, so it's essential to explore these options.

Calculating Monthly Auto Insurance Quotes

The process of calculating monthly auto insurance quotes is complex and involves a range of mathematical models and algorithms. Insurance providers use actuarial science to assess the potential risks associated with insuring a particular vehicle and driver. These calculations consider historical data, statistical analysis, and predictive modeling to estimate the likelihood of various incidents, such as accidents, theft, or damage.

While the exact formulas used by insurance providers are often proprietary, the general principles involve assigning weights to the various factors mentioned earlier. For example, a younger driver with a history of accidents may be assigned a higher risk factor, leading to a higher insurance quote. Similarly, a vehicle with a high-performance engine or one that's frequently driven long distances may also be assigned a higher risk profile.

| Factor | Weight | Description |

|---|---|---|

| Vehicle Type | High | Make, model, and age of the vehicle |

| Driver Profile | High | Age, gender, driving record |

| Coverage Level | Medium | Comprehensive vs. liability coverage |

| Location and Usage | Medium | Urban vs. rural, annual mileage |

| Insurance Provider | Low | Provider-specific rates and discounts |

Shopping for the Best Monthly Auto Insurance Quotes

Now that we’ve explored the factors influencing monthly auto insurance quotes, let’s shift our focus to the practical aspects of shopping for the best insurance coverage. This section will provide valuable insights and strategies to help you navigate the insurance market effectively and secure the most competitive quotes.

Researching Insurance Providers

When it comes to choosing an insurance provider, conducting thorough research is essential. While insurance quotes are a significant factor, it’s important to consider other aspects as well. Here are some key considerations:

- Financial Stability: Ensure the insurance provider you choose is financially stable and reputable. This provides peace of mind, knowing that the company will be able to meet its obligations in the event of a claim.

- Coverage Options: Compare the coverage options offered by different providers. Look for policies that align with your specific needs, whether you require comprehensive coverage or more basic liability protection.

- Customer Service: The quality of customer service can greatly impact your insurance experience. Consider factors such as response time, claim handling processes, and overall customer satisfaction ratings.

- Discounts and Bundles: Many insurance providers offer discounts for various reasons, such as safe driving records, multiple policy bundles, or loyalty programs. Exploring these options can help you reduce your insurance costs.

- Online Reviews and Testimonials: Reading online reviews and testimonials from other customers can provide valuable insights into the insurance provider's reputation and customer experience.

Obtaining Multiple Quotes

One of the most effective strategies for securing the best monthly auto insurance quotes is to obtain multiple quotes from different providers. This allows you to compare rates and coverage options, ensuring you find the most suitable and cost-effective insurance solution. Here’s a step-by-step guide to obtaining multiple quotes:

- Identify Reputable Providers: Start by creating a list of reputable insurance providers in your area. You can use online resources, recommendations from friends and family, or industry rankings to identify potential options.

- Request Quotes: Contact each insurance provider on your list and request a quote. Be prepared to provide detailed information about your vehicle, driving history, and coverage preferences. Ensure you're consistent in the information you provide to each provider for an accurate comparison.

- Compare Quotes: Once you have a collection of quotes, carefully compare them. Look at the coverage levels, deductibles, and any additional features or discounts offered. Consider not only the premium amounts but also the overall value and suitability of the policy.

- Negotiate and Ask Questions: Don't be afraid to negotiate with insurance providers. If you find a quote that seems particularly competitive, reach out to the provider and inquire about potential discounts or additional coverage options. They may be willing to adjust their quote to secure your business.

- Read the Fine Print: When comparing quotes, it's essential to read the fine print. Understand the terms and conditions, including any exclusions or limitations, to ensure you're fully aware of what's covered and what's not.

Managing Your Monthly Auto Insurance Costs

While securing the best monthly auto insurance quotes is a crucial step, it’s also important to consider strategies for managing your insurance costs over the long term. Here are some tips to help you keep your insurance premiums under control:

- Maintain a Clean Driving Record: Insurance providers reward safe driving with lower premiums. Strive to maintain a clean driving record by practicing defensive driving and adhering to traffic laws. This can significantly reduce your insurance costs over time.

- Choose Higher Deductibles: Opting for higher deductibles can lead to lower monthly premiums. However, it's essential to ensure you can afford the higher deductible amount if you need to make a claim. It's a trade-off between immediate savings and potential future costs.

- Explore Discounts: Many insurance providers offer a range of discounts. These can include safe driver discounts, multi-policy discounts (bundling your auto insurance with other policies like home or life insurance), and loyalty discounts for long-term customers. Inquire about these discounts when obtaining quotes.

- Review Your Coverage Annually: Insurance needs can change over time. Review your coverage annually to ensure it still aligns with your requirements. This allows you to adjust your coverage levels, add or remove unnecessary features, and potentially reduce your insurance costs.

- Consider Usage-Based Insurance: Some insurance providers offer usage-based insurance programs. These programs track your driving behavior and reward safe driving habits with lower premiums. If you're a cautious and responsible driver, this could be a cost-effective option.

The Future of Monthly Auto Insurance Quotes

As technology continues to advance and the insurance industry evolves, the future of monthly auto insurance quotes looks promising. Here are some trends and developments that are shaping the future of auto insurance and its quotes:

Technology and Data-Driven Insurance

The integration of technology and data analytics is revolutionizing the insurance industry. Insurance providers are leveraging advanced analytics and machine learning algorithms to assess risk and calculate insurance quotes more accurately. This shift towards data-driven insurance allows for more precise risk assessments, potentially leading to more competitive and tailored insurance quotes.

Telematics and Usage-Based Insurance

Telematics refers to the use of technology to track and analyze vehicle data. Usage-based insurance programs, which utilize telematics, are becoming increasingly popular. These programs offer a more dynamic approach to insurance, where premiums are based on actual driving behavior rather than generalized risk assessments. This trend empowers drivers to take control of their insurance costs by adopting safer driving habits.

Personalized Insurance

The insurance industry is moving towards a more personalized approach, recognizing that each driver and vehicle is unique. Personalized insurance policies are tailored to individual needs and circumstances, taking into account factors such as driving habits, vehicle usage, and even lifestyle choices. This shift towards personalized insurance offers the potential for more accurate and cost-effective coverage.

Regulatory Changes and Market Competition

Regulatory changes and increased market competition are also shaping the future of auto insurance quotes. As regulations evolve to promote transparency and consumer protection, insurance providers are adapting their business models. This competitive landscape encourages innovation and the development of more efficient and consumer-friendly insurance products, potentially benefiting consumers with more competitive quotes.

What is the average monthly cost of auto insurance?

+The average monthly cost of auto insurance can vary significantly depending on various factors, including your location, driving record, vehicle type, and coverage preferences. As of [current year], the national average monthly cost for auto insurance is approximately 150 to 200. However, it’s important to note that this is just an average, and your specific quote may be higher or lower based on your individual circumstances.

How often should I review my auto insurance policy?

+It’s generally recommended to review your auto insurance policy at least once a year. This allows you to ensure that your coverage still aligns with your needs and that you’re not paying for unnecessary features. Additionally, reviewing your policy annually provides an opportunity to explore potential discounts or coverage adjustments, which can help reduce your insurance costs.

Can I get auto insurance quotes online?

+Yes, obtaining auto insurance quotes online has become increasingly convenient and efficient. Many insurance providers offer online quote tools on their websites, allowing you to input your information and receive personalized quotes within minutes. This makes it easier than ever to compare quotes and find the best insurance coverage for your needs.